- 1. Trump's Victory Sparks Crypto Chaos: $XYZ Meme Coin Ready to Deliver a 99,900% Knockout

- 2. $XYZ Breaks into the Ring to Knockout Meme Coin Legends

- 3. $XYZ Already Delivers Even Before Hitting the Market

- 4. TRON and TRX: Recent Price Movements and Outlook

- 5. Sui (SUI)

- 6. Toncoin and (TON)

- 7. Uniswap (UNI) Faces Critical Price Levels

- 8. Conclusion

Turning a modest investment into substantial wealth within two years is no longer a distant dream. Certain cryptocurrencies are on the cusp of explosive growth, with the potential to increase investments a hundredfold by mid-2025. This article uncovers the top five digital currencies set for remarkable gains, offering insights into opportunities that could transform financial futures.

Trump’s Victory Sparks Crypto Chaos: $XYZ Meme Coin Ready to Deliver a 99,900% Knockout

Donald Trump’s election victory has triggered a seismic shift in the crypto market, setting the stage for a bull run like no other. As the dust settles, major coins limp forward with uninspiring double-digit gains, while meme coins are stealing the show.

PNUT’s recent 4,500% surge? FRED’s 6,000% explosion? Ancient history, buried in the ashes of short-lived hype. These coins buckled under selling pressure, leaving FOMO-ridden investors licking their wounds. But the crypto battlefield doesn’t wait for the weak — a new titan has emerged with plans to obliterate profit records and deliver an earth-shaking 99,900% surge.

Take the XYZ Side – The Undisputed Champion of Meme Coins

$XYZ Breaks into the Ring to Knockout Meme Coin Legends

Meet $XYZ – the first-ever all-sports memecoins for true crypto degens hungry for 1000X profits. This is the token for those who thrive on the thrill of competition.

As Trump takes the reins, the crypto market is set to erupt so the competition is getting fierce. Only the strongest tokens can survive in this no-mercy arena. Here comes the dawn of a crypto era for those with balls of steel — the guys like Joe Rogan and Dana White — who’d proudly rally behind Trump’s team. With such true men of business on board, there is no place for old pussy meme coins, it’s time for real brutal coins.

Fueled by the sports mentality, the $XYZ token has emerged as the ultimate contender ready to crush competitors and rocket to the moon on Elon Musk’s mission. $XYZ is on its way to the winner’s podium to become a badge of honor for those who live and breathe sports and crypto.

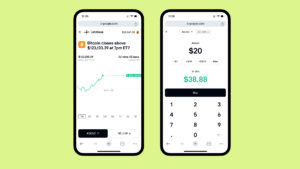

$XYZ Already Delivers Even Before Hitting the Market

The $XYZ presale is underway, providing access to the token at a special pre-listing price.

Launch Price: $0.0001

Price Now: $0.001333

In just a couple of months, $XYZ already soared over 1330%!

Next Stage: $0.002 (+66% jump incoming)

Final Knockout Target: $0.1

From launch to the token generation event, $XYZ is targeting a mind-blowing 99,900% surge!

If you’re not in, you’re out. The $XYZ presale is already smashing through stages with the speed of a champion’s knockout blow.

Join $XYZ Presale Now and See Your Pennies Grow Into Millions!

TRON and TRX: Recent Price Movements and Outlook

TRON (TRX) is currently trading between $0.25 and $0.27. Over the past week, its price has dropped by 5.41%. In the last month, it has decreased by 7.91%. Despite these declines, TRX has seen a significant rise of 76.36% over the past six months.

Technical indicators show mixed signals. The Relative Strength Index is at 29.91, suggesting TRX might be oversold. The Stochastic indicator reads 16.76, pointing to a similar conclusion. The MACD level is -0.0022, indicating a bearish trend in the short term. The 10-day simple moving average is $0.24, which is below the 100-day average of $0.26.

If TRX moves above the nearest resistance level at $0.28, it could target the next resistance at $0.31, an increase of about 15%. On the downside, if it falls below the support at $0.23, it might test the next support at $0.21, a drop of roughly 16%. These levels could be key in determining TRX’s next direction.

Sui (SUI)

Sui (SUI) has seen strong growth recently. Over the past 6 months, its price jumped by 503%. In the last month, it went up by 17.59%, and in the past week, it increased by 5.54%. This shows that SUI has been performing well in the market.

Currently, SUI trades between $4.34 and $5.75. The next resistance is at $6.26. Above that, it could reach $7.67. On the downside, support levels are at $3.43 and $2.02. The 10-day moving average is $4.65, and the 100-day average is $4.95, suggesting recent stability.

Technical indicators are mixed. The RSI is 33.97, nearing oversold territory, which might indicate a potential price increase. However, the MACD is negative at -0.0412, and the Stochastic is low at 10.25, possibly pointing to continued downward momentum. Monitoring these signals could help anticipate SUI’s next move.

Toncoin and (TON)

Toncoin (TON) has seen significant price fluctuations in recent months. Over the past week, its value dropped by 6.45%, adding to a 10.68% decline in the last month and a substantial 29.67% decrease over six months. These figures indicate a downward trend that has caught the attention of market watchers.

Currently, Toncoin is trading between $5.47 and $5.91. The nearest support level is at $5.22; if the price dips below this point, it could next find support at $4.78. On the upside, the closest resistance level is $6.09. Surpassing this could see the coin aiming for the second resistance at $6.53, representing potential gains from the current range.

Technical indicators offer mixed signals. The Relative Strength Index (RSI) stands at 34.39, suggesting Toncoin is approaching oversold territory, which might precede a price rebound. The Stochastic indicator is at 19.43, reinforcing the oversold perspective. However, the Moving Average Convergence Divergence (MACD) level is negative at -0.0321, pointing to bearish momentum. The 10-day Simple Moving Average (SMA) is $5.24, slightly below the current price range, while the 100-day SMA is $5.51. These factors combined imply that while there may be short-term challenges, shifts in momentum could influence Toncoin’s trajectory in the near future.

Uniswap (UNI) Faces Critical Price Levels

Uniswap’s token, UNI, has experienced notable price movements recently. Over the past week, its price has dropped by 7.22%. In the last month, it decreased by 20.92%. Despite these declines, UNI’s price is up by 55.70% over the past six months. Currently, it is trading between $13.48 and $16.13.

Technical indicators suggest that UNI might be oversold. The Relative Strength Index is at 31.03, close to the oversold threshold. The Stochastic indicator stands at 13.14, also indicating oversold conditions. The 10-day Simple Moving Average is $12.88, while the 100-day average is $14.23. The MACD level is -0.1745, showing bearish momentum.

UNI is approaching key support and resistance levels. The nearest resistance is at $17.09. If the price breaks above this, it could rise toward the second resistance at $19.75, representing a potential increase of around 22%. On the downside, the nearest support is at $11.78. Falling below this could lead to a drop toward the second support at $9.13, a decrease of about 20%. Traders are watching these levels closely to gauge UNI’s next move.

Conclusion

TRX, SUI, TON, and UNI offer promise, but XYZVerse (XYZ), blending sports and meme culture and targeting 20,000% growth, could redefine crypto success by mid-2025.

You can find more information about XYZVerse (XYZ) here: