- 1. Trident India Limited: A Quick Introduction

- 2. Trident India: Offerings

- 3. Trident Share: Price History

- 4. Trident Share Price: Technical Analysis

- 5. Trident Share Price Prediction By Blockchain Reporter

- 5.1. Trident Share Price Prediction 2023

- 5.2. Trident Share Price Prediction 2024

- 5.3. Trident Share Price Prediction 2025

- 5.4. Trident Share Price Prediction 2026

- 5.5. Trident Share Price Prediction 2027

- 5.6. Trident Share Price Prediction 2028

- 5.7. Trident Share Price Prediction 2029

- 5.8. Trident Share Price Prediction 2030

- 6. Trident Share Price Forecast: Experts’ Opinions

- 7. Trident’s Income Declined By 10% In FY24: Financial Report

- 8. Conclusion

India’s textile industry is a blend of rich tradition and modern innovation, making it one of the most emerging sectors of the Indian economy. With its roots tracing back to ancient civilizations, the textile sector has been leading India’s economic and cultural identity. Over the years, the industry has undergone significant changes, adapting to global trends and technological advancements. Today, it stands as a statue of India’s ability to balance age-old craftsmanship with robust technology. In recent times, the Indian textile industry has witnessed remarkable growth, driven by increasing domestic consumption and a surge in export demand. The sector’s recovery, even in the face of global economic challenges, speaks volumes about its potential and the opportunities it presents for investors and stakeholders. Amidst this surge of growth and transformation, one name that stands out is Trident India Limited. Being a messiah in the textile world, Trident has developed a niche for itself, not just within India but on the international stage. As a part of the illustrious Trident Group, this company draws the spirit of innovation, quality, and sustainability that the Indian textile industry is renowned for. In this article, we will dive deep into the journey of Trident India Limited, exploring its share price history and future market trajectory with Trident share price prediction and vision. Furthermore, for those looking at lucrative investment opportunities now, we will also shed light on the current movement of Trident share price, offering insights into its potential with in-depth technical analysis.

Trident India Limited: A Quick Introduction

Trident India Limited stands as a prominent entity in the Indian textile and apparel sector. With its headquarters nestled in Ludhiana, Punjab, this company serves as the crown jewel of the Trident Group, showcasing a diverse array of business ventures. Globally recognized as the premier manufacturer of terry towels and wheat straw-based paper, Trident operates primarily within two key business domains: Textiles and Paper, both anchored in Punjab.

Its global footprint extends across over 75 nations spanning six continents, collaborating with renowned retail giants such as Ralph Lauren, Calvin Klein, JCPenney, IKEA, Target, Wal-Mart, Macy’s, Kohl’s, Sears, Sam’s Club, Burlington, and more. At its core, Trident Limited is committed to upholding superior product quality, ensuring unparalleled customer satisfaction.

In 1990, Trident India Limited started its journey in Punjab, initially producing yarn and paper. Today, it stands as a premier textile and apparel manufacturer in India and represents the Trident Group. Guided by a strong ethical foundation and a vision for transformative impact, the company has evolved from its initial focus on yarn and paper. Now, it’s recognized as one of the world’s foremost integrated home textile producers. With a presence spanning six continents, Trident India Limited has made its mark in over 100 countries worldwide.

Mr. Rajinder Gupta laid the foundation for Trident India Limited, marking the beginning of the Indian industrial landscape. An esteemed industrialist, Mr. Gupta currently holds the position of Chairman of the company. His educational background is notable, having completed the Advanced Management Program at Harvard Business School.

In recognition of his outstanding contributions to Trade and Industry, Mr. Gupta was honored with the Padma Shri Award in 2007. This prestigious accolade is one of the highest civilian awards conferred by the Government of India. Under his visionary leadership, Mr. Gupta continues to set new benchmarks and create opportunities that bring growth to society at large.

Trident India: Offerings

In the global industries, Trident stands tall with its quality and sustainability. Established with a vision to excel, the company has consistently pushed the boundaries, venturing into diverse sectors and setting benchmarks along the way. Let’s understand the multifaceted world of Trident and explore its diverse product offerings:

- Bed and Bath Collections: Trident has firmly established itself as a global leader in the sector of bed and bath textiles. Their expertise spans the entire spectrum of terry towel and bed sheet production. With an extensive palette of fibers and yarns, they offer a myriad of colors in both piece-dyed and yarn-dyed varieties. From the simplicity of plains to the intricacy of jacquards, Trident’s collection is growing, ensuring they serve the distinct preferences of their clientele.

- Yarn Selections: Trident takes pride in presenting a premium assortment of yarns, offering a diverse range to choose from. Their product mix is vast, encompassing 100% Cotton, Blended Yarn, Special Open-End Yarn, and Organic Cotton, to name a few. Additionally, they have introduced value-added yarns such as Melanges, Package Dyed, Gassed Mercerized Yarn, and many more, ensuring they meet the varied needs of the textile industry.

- Paper Products: Choosing Trident’s agro-based paper means opting for an eco-conscious choice. Every sheet bearing the Trident Group name showcases its commitment to reducing ecological footprints. Their value-added paper not only guarantees top-notch quality but also champions the cause of sustainability. Trident’s eco-friendly copier and print papers are crafted to international standards, ensuring customers get the best value while contributing to a greener planet.

- Chemical Offerings: Trident’s chemical division offers a range of products, with Sulphuric acid, often referred to as the “oil of vitriol,” being a standout. This viscous, corrosive liquid is a fundamental chemical commodity. Trident’s expertise lies in producing three distinct grades of Sulphuric Acid, each tailored to cater to specific applications.

- Energy Solutions: Understanding the growing energy demands of its expansive operations, Trident has ventured into captive power generation. In line with their commitment to energy conservation and environmental sustainability, they produce steam and power using processes that are not only efficient but also eco-friendly.

In 1999, Trident’s second unit, Unit II, with an installed capacity of 43,392 spindles, began producing a diverse range of yarns, from dyed cotton mélange to carded and combed cotton yarn. This expansion was financed through term loans, rights issues, and internal accruals, amounting to Rs 95 crores. By 2000, Trident had achieved the status of a Government Recognized Trading House, with its products gaining international acclaim.

In 2014, the amalgamation of Trident Corporation Limited with Trident was approved, leading to the commissioning of the world’s largest integrated terry towel unit in Budni, Madhya Pradesh. By 2015, Trident was implementing a composite textile project in the Home Textiles Segment, expected to be completed by 2016.

By 2019, Trident initiated various modernization efforts, expanded its Yarn Segment, and integrated eight companies with Lotus Hometextiles Limited. In 2021-22, the company introduced ‘Detergent Powder’ in its Chemical Segment, broadened its Yarn operations, and set up a 7.6 MW Solar Power Plant in Budni.

Trident Share: Price History

In the early years of its presence on the stock market, Trident’s share price mirrored the company’s consistent growth and adeptness in navigating the intricate textile industry. Early investors who identified Trident’s potential were rewarded with steady returns.

On June 6, 2001, Trident shares debuted on the exchanges, opening at a price of ₹0.5. Despite this, the price remained stagnant for several years, rarely exceeding ₹1. From 2005 to 2008, the share price saw a significant rise, touching the ₹3 mark. However, it couldn’t maintain this momentum due to a lack of investor confidence.

For the subsequent years leading up to 2014, Trident’s price largely hovered around the ₹1 mark. Yet, 2014 marked a renewed investor interest, leading many to add Trident to their portfolios. By August 21, 2015, the share price had reached ₹4.18 and continued its ascent. As Trident diversified its offerings and entered new markets, its share price saw a remarkable increase. This positive trend persisted until it peaked at ₹9.8 in mid-2017, after which a bearish phase began.

Like all companies, Trident faced its set of challenges. Market fluctuations, global economic downturns, and industry-specific hurdles occasionally affected its share price. In early 2018, the share price took a significant hit, plummeting past several support levels to a low of ₹6. The decline was further accelerated by the Covid pandemic in 2020, pushing the price to a low of ₹3.5.

Nevertheless, the subsequent years witnessed a robust rally in Trident’s price. By early 2022, it reached an impressive ₹65, backed by a strong financial performance. This gain, however, was short-lived as the price soon entered another bearish phase, decreasing by over 50% within 2022. In 2023, the price bounced back from ₹28 and is now poised to reach new heights by year-end.

Trident Share Price: Technical Analysis

Recently, the Trident share price witnessed a solid bearish trend in the last few days, which has brought a selling sentiment among traders in the market. The market is heavily influenced due to declining demand in the textile industry; however, Trident maintains a bullish momentum above the key support level and continues to hold its price stability. Despite facing critical support levels in the past, Trident’s shares have managed to display a surprising recovery and are now above the bearish region. A thorough technical analysis of Trident share price reveals minor bullish indicators with bearish domination, which may soon send the price to increased volatility. Investors should exercise caution as the short-term movement for Trident appears volatile.

According to TradingView, the Trident share price is currently trading at ₹32.4, reflecting a decrease of over 0.77% in the last 24 hours. Our technical evaluation of Trident’s price indicates that the bearish momentum may soon intensify as bulls fail to make a comeback to prevent the price from dropping. Examining the daily price chart, Trident share price has found support near the ₹31.5 level, which is a crucial monthly support level, and bulls are trying hard to hold the trend above this level. As the Trident price continues to face bearish domination to surge above the ascending channel pattern, bears may soon gain confidence and open short positions, pushing the price to lower levels in the coming days. The Balance of Power (BoP) indicator is currently trading in a bearish region zone at 0.43, hinting at a downward correction ahead.

To thoroughly analyze the price of Trident shares, it is crucial to take a look at the RSI-14 indicator. The RSI indicator recently experienced a solid decline as Trident’s price made a declining trend from ₹34 after failing to gain buying pressure near higher levels. The RSI trend line is dropping below the midline as it currently trades at level 46, and there’s an increased selling pressure building up to begin a downward correction for the Trident price. It is anticipated that Trident shares will soon attempt to break below its 38.6% Fibonacci level to achieve its short-term bearish goals. If it fails to decline below this Fibonacci region, an uptrend might be on the horizon.

As the SMA-14 continues its upward swing toward the 52 level, it trades slightly below the RSI line, potentially holding promises of the stock’s upward correction on the price chart. If Trident shares rebound from the support line, it can pave the way to resistance at ₹34. A breakout above will drive the share price toward the upper limit of the Bollinger band at ₹36.9.

Conversely, if the Trident fails to hold above the critical support level of ₹31.5, a sudden collapse may occur, resulting in further price declines and causing the Trident share to trade near the Bollinger band’s lower limit of ₹29.7. If the price fails to continue a trade above ₹29.2, it might trigger a more significant bearish downtrend toward ₹25.

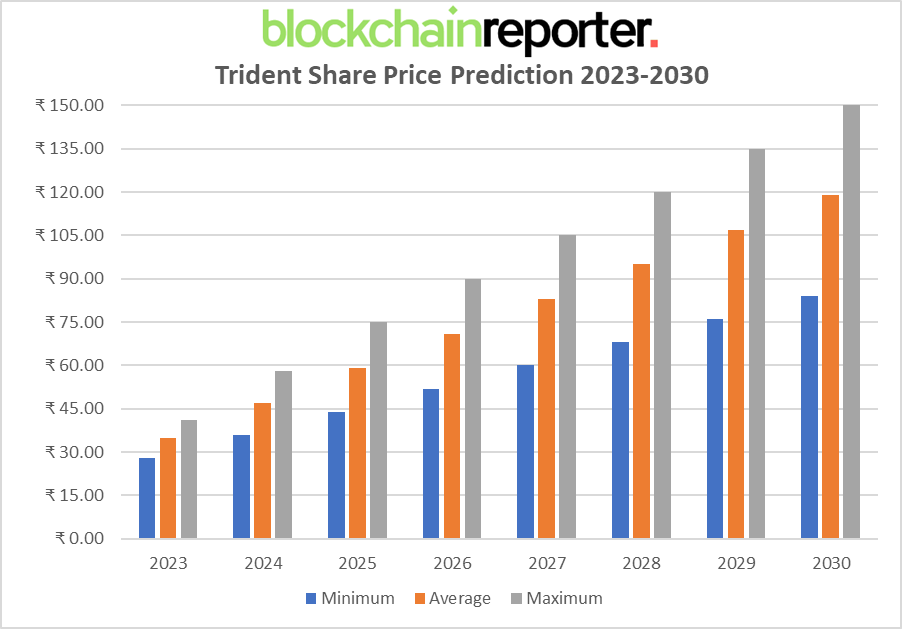

Trident Share Price Prediction By Blockchain Reporter

Trident Share Price Prediction 2023

In 2023, the average price for Trident India Limited shares is predicted to be around ₹35. The minimum price could potentially drop to ₹28, while the maximum price could rise to ₹41. As a leading Indian textile company, Trident’s consistent growth and strategic initiatives to expand its market presence in the textile sector play a significant role in this prediction.

Trident Share Price Prediction 2024

By 2024, the average price for Trident India Limited shares is projected to be around ₹47. The minimum price could be around ₹36, while the maximum price could soar to ₹58. The anticipated growth is attributed to Trident’s continued improvement in quality and innovation in the textile industry.

Trident Share Price Prediction 2025

In 2025, the average price for Trident India Limited shares is expected to be around ₹59. The minimum price could potentially plunge to ₹44, while the maximum price could climb to ₹75. Trident’s commitment to sustainable textile practices and its efforts to tap into global markets are key factors in this projection.

Trident Share Price Prediction 2026

By 2026, the average price for Trident India Limited shares is estimated to be around ₹71. The minimum price could be around ₹52, while the maximum price could reach ₹90. The company’s focus on expanding its product range and serving the rising demands of the textile market drives this prediction.

Trident Share Price Prediction 2027

In 2027, the average price for Trident India Limited shares is predicted to be around ₹83. The minimum price could potentially drop to ₹60, while the maximum price could be ₹105. This prediction takes into account Trident’s strategic partnerships in the textile sector and its dedication to enhancing customer experience.

Trident Share Price Prediction 2028

By 2028, the average price for Trident India Limited shares is projected to be around ₹95. The minimum price could be around ₹68, while the maximum price could hover around ₹120. Trident’s robust financial performance in the textile industry and its initiatives to strengthen its brand presence are significant contributors to this forecast.

Trident Share Price Prediction 2029

In 2029, the average price for Trident India Limited shares is expected to be around ₹107. The minimum price is predicted to be around ₹76, while the maximum price could climb to ₹135.

Trident Share Price Prediction 2030

By 2030, the average price for Trident India Limited shares is estimated to be around ₹119. The minimum price could be around ₹84, while the maximum price could reach ₹150. Trident’s vision to be a market leader in the textile sector and its growth on sustainable strategies are central to this prediction.

Trident Share Price Forecast: Experts’ Opinions

JM Financial recommends a “buy” on Trident with a target price set at Rs 40. Currently, Trident’s market price stands at Rs 32.4. The analyst predicts that Trident could achieve this target within a 12-month timeframe.

According to Wallet Investor, the forecast for Trident Ltd is bullish. Their forecasts suggest a long-term upward trend, predicting that the stock price for “Trident Ltd” will reach 68.593 INR by 2028-08-14. If one were to invest for a 5-year period, the anticipated revenue growth would be approximately +111.51%. Thus, an initial investment of $100 by an individual could potentially grow to $211.51 by 2028.

Trident’s Income Declined By 10% In FY24: Financial Report

According to Trident’s financial performance, in the first quarter of the current fiscal year (Q1FY24), Trident Group reported a standalone profit after tax (PAT) of Rs 90.3 crore. This is a 27% decrease from Rs 123.8 crore in the same period last year (YoY). When compared to the previous quarter’s Rs 116.4 crore, the profit dropped by 22%.

The total income for Q1FY24 was Rs 1,550 crore, marking a 10.65% YoY decline from Rs 1,685 crore. This income is less than 5% lower than the previous quarter’s Rs 1,580 crore.

For the 2023-24 financial year, the board of directors announced and disbursed the first interim dividend of 36% (Rs 0.36 for each Rs 1 equity share). The revenue from operations for the quarter ending June 30, 2022, was Rs 19.58 crore, and for the year ending March 31, 2023, it was Rs 22.86 crore.

Conclusion

Investing in Trident shares can be a profitable option as the price has grown significantly since 2021. However, its declining market and financial performance have been concerning, which may halt investment opportunities in this stock.

However, Trident India Limited is a diversified company with a significant presence in the textile and paper sectors. The company has been proactive in presenting its financial and business highlights to investors, showcasing its commitment to transparency and growth.

The global textile and apparel trade market is projected to reach a value of $1,000 billion by 2025. In comparison, India’s domestic textile and apparel market is expected to grow at a Compound Annual Growth Rate (CAGR) of 10% to reach $190 billion.

Trident Limited has shown strong domination in its business operations, with notable market capitalization and a history of compounding its sales and profit after tax (PAT) over the years. The company’s financial risk profile is sound, and its credit-related measures have shown consistent improvement. Furthermore, Trident Group offers a wide range of products and services in home textiles, paper, chemicals, and yarn, emphasizing its diversified portfolio and global presence.

In conclusion, Trident India Limited stands as a robust and growing company in the textile and paper industry, with a promising future backed by its strong financials and strategic market positioning. However, you should conduct your own research before investing in the stock market.