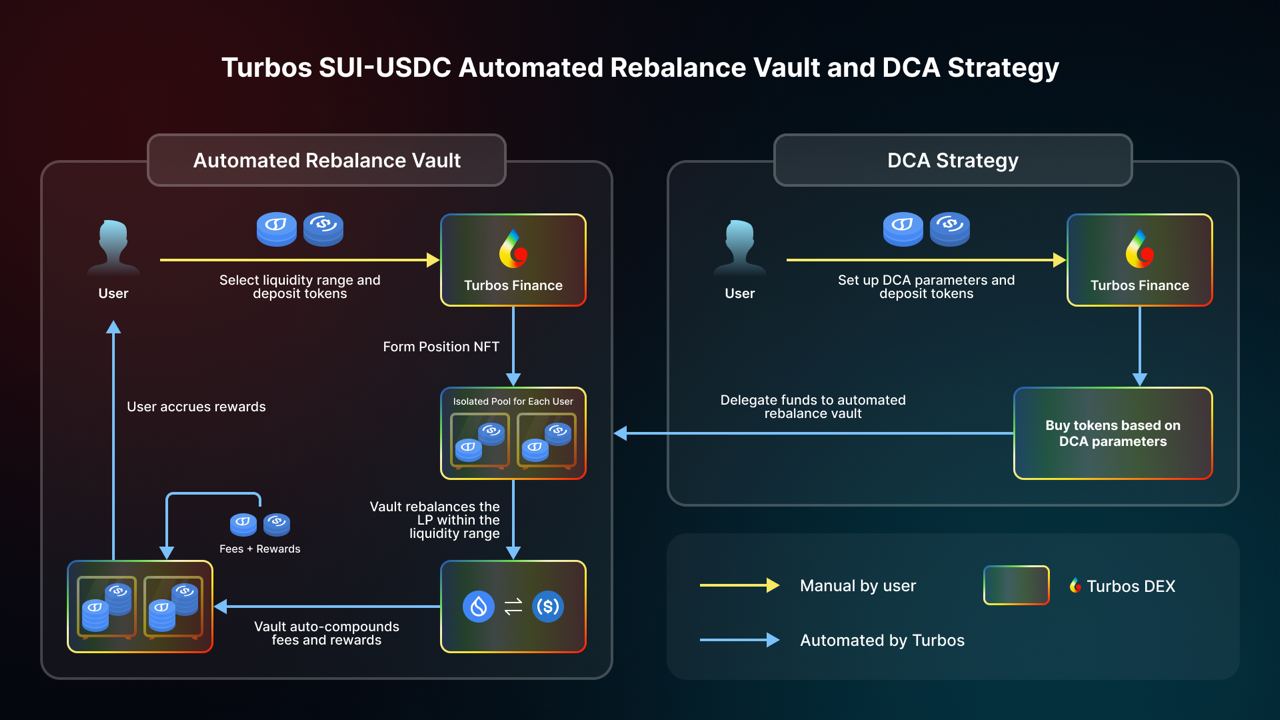

Decentralized exchange Turbos Finance has unveiled two groundbreaking liquidity strategies within the Sui ecosystem. These strategies comprise a Sui network-centric automated liquidity management vault tailored for CLMM positions on the Turbos DEX, alongside an inventive Auto-swap feature integrated with Dollar-Cost Averaging (DCA) strategies to streamline liquidity provision.

These strategies not only promise to streamline liquidity provision but also introduce novel concepts to enhance returns for liquidity providers (LPs) and investors alike. LPs can now capitalize on automated rebalancing to optimize their returns with minimal effort, while retail investors and professional strategy managers can leverage advanced products to enhance their strategies and yield.

Next-Gen Liquidity Management

A notable feature of Turbos’ automated rebalance vault is the Isolated Position Model, a departure from the conventional share pool model susceptible to price manipulation. This model offers individual fund management for LPs, harnessing Sui’s exceptional gas efficiency and scalability. By providing a secure and efficient asset management solution, Turbos sets a new benchmark for DeFi asset management.

Furthermore, the introduction of Auto-compound Fee and Rewards streamlines LP pair formation by enabling single-token deposits for automatic pairing. This feature aims to attract a wider user base, bolster Total Value Locked (TVL), and introduce systematic investment through DCA LP functionality, mitigating the impact of price volatility.

To incentivize user participation, Turbos will launch a referral program alongside the new liquidity strategies, offering fee waivers to reward active users. These initiatives are poised to drive user engagement and foster a vibrant community within the Turbos ecosystem. The rollout of these liquidity strategies is scheduled for May 3rd, with ongoing updates and optimizations planned to further enhance efficiency and user experience. Additionally, the launch of DCA strategies is slated for the third quarter, promising further innovation and value for users.

Commenting on the significance of these developments, Ted, Co-founder of Turbos Finance, emphasized the transformative potential of their rebalance vault, stating, “Our rebalance vault leverages the unique capabilities of Sui to transform user interaction with DeFi. Users precisely manage their assets individually, adapting to market shifts with real-time, high-frequency adjustments. Our vault simplifies asset management through rebalancing and compounding to maximize returns with minimal effort.”

Adeniyi Abiodun, Co-founder and Chief Product Officer (CPO) at Mysten Labs, an investor in Turbos Finance, expressed excitement about the innovative strategies facilitated by Sui’s architecture, saying, “I’m thrilled to see the innovative digital asset management strategies introduced by Turbos Finance. It’s always fulfilling to see new possibilities offered to builders with Sui’s object data model, exceptional gas efficiency, and scalable architecture.”

Turbos Finance is a beacon of efficiency in the decentralized crypto marketplace, leveraging the Sui blockchain to offer cutting-edge liquidity strategies and asset management solutions. With a track record including an all-time TVL of $28 million and cumulative trading volume of $1.5 billion, Turbos is the leading DEX operating on Sui, driving the evolution of DeFi liquidity management. Its latest liquidity strategies represent a paradigm shift in DeFi, promising enhanced efficiency, security, and returns for users within the Sui ecosystem and beyond.