- 1. Uniswap: A Quick Introduction

- 2. Uniswap: Working Module

- 3. Uniswap Price Prediction: Price History

- 4. UNI Token Price: Technical Analysis

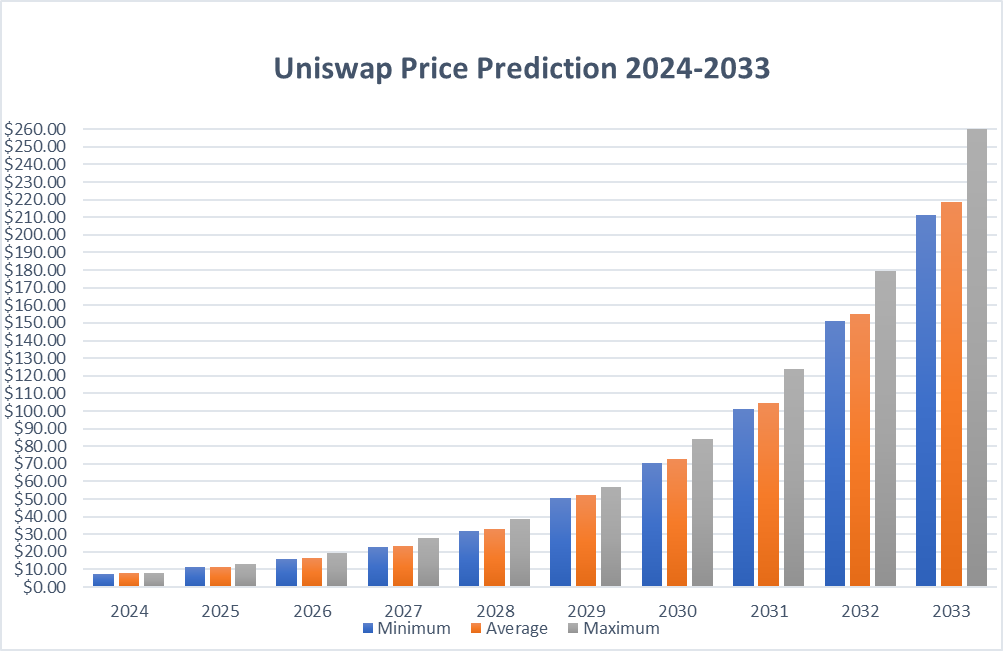

- 5. Uniswap Price Prediction By Blockchain Reporter

- 5.1. Uniswap Price Prediction 2024

- 5.2. Uniswap Price Prediction 2025

- 5.3. UNI Price Forecast for 2026

- 5.4. Uniswap (UNI) Price Prediction 2027

- 5.5. Uniswap Price Prediction 2028

- 5.6. Uniswap Price Prediction 2029

- 5.7. Uniswap (UNI) Price Prediction 2030

- 5.8. Uniswap Price Forecast 2031

- 5.9. Uniswap (UNI) Price Prediction 2032

- 5.10. Uniswap Price Prediction 2033

- 6. Uniswap Price Prediction: By Experts

- 7. Is Uniswap A Good Investment? When To Buy?

- 8. Conclusion

- Uniswap: A Quick Introduction

- Uniswap: Working Module

- Uniswap Price Prediction: Price History

- UNI Token Price: Technical Analysis

- Uniswap Price Prediction By Blockchain Reporter

- Uniswap Price Prediction 2023

- Uniswap Price Prediction 2024

- UNI Price Forecast for 2025

- Uniswap (UNI) Price Prediction 2026

- Uniswap Price Prediction 2027

- Uniswap Price Prediction 2028

- Uniswap (UNI) Price Prediction 2029

- Uniswap Price Forecast 2030

- Uniswap (UNI) Price Prediction 2031

- Uniswap Price Prediction 2032

- Uniswap Price Forecast: By Experts

- Is Uniswap A Good Investment? When To Buy?

- Conclusion

Uniswap stands out as a prominent decentralized cryptocurrency exchange, functioning on the Ethereum blockchain. In contrast to the model where crypto trading predominantly occurs on centralized platforms like Coinbase and Binance, Uniswap offers a unique approach. Centralized exchanges are typically under the jurisdiction of a single organization, requiring users to entrust their funds to the platform and employing a conventional order book system for trade execution. Uniswap, however, diverges from this norm by being fully decentralized – not under the control of any single entity. It also introduces a novel trading mechanism known as an automated liquidity protocol, distinguishing itself from traditional exchange models. Automated Market Makers (AMMs) tackle the challenge of insufficient liquidity, which can make converting assets on an exchange into cash difficult. They do this by creating liquidity pools and encouraging liquidity providers to contribute assets to these pools.

The greater the liquidity in a pool, the easier it becomes to execute trades. Uniswap is designed to be permissionless, offering its services to everyone without any restrictions or controls over who can use them. The Uniswap network utilizes UNI as its utility and governance token. Holders of UNI have the ability to participate in voting on different proposals or can delegate their voting rights to others. Additionally, they can earn rewards through staking their tokens. As the overall crypto market has been on an upward trend recently following Bitcoin’s surge above $38,000, Uniswap token broke above its multi-year resistance, aiming to head toward its ATH. In this article, we’ll explore Uniswap price prediction, its current market sentiment with in-depth technical analysis and future market performance.

Uniswap: A Quick Introduction

Uniswap functions as a decentralized exchange facilitating peer-to-peer market making and operates under the cryptocurrency symbol ‘UNI’. It allows users to engage in trading without the involvement of a centralized intermediary.

Running on the Ethereum blockchain, Uniswap is controlled by its UNI token holders. The platform characterizes its blockchain as a public good and maintains an open-source nature, allowing anyone to view and contribute to its code. Uniswap supports the trading of digital tokens complying with the Ethereum ERC-20 technical standard.

It relies on smart contracts, a feature of blockchain technology, to operate as an automated market maker, enabling users to create liquidity pools, contribute liquidity, and swap various digital assets securely.

Hayden Adams, who previously worked as a mechanical engineer at Siemens, founded Uniswap on November 2, 2018. Uniswap’s design is permissionless, making its protocol accessible to all without any selective access restrictions. Thus, anyone can utilize Uniswap for trading digital assets, adding liquidity, or establishing new markets for trading different digital asset pairs.

The platform leverages smart contracts not only to streamline asset trading but also to circumvent the liquidity challenges often faced by centralized exchanges. By eliminating intermediary parties like centralized exchanges or financial institutions, Uniswap potentially reduces transaction fees, further enhancing its efficiency and appeal.

Uniswap: Working Module

The Uniswap platform employs smart contracts based on blockchain technology to enable decentralized trading of various digital assets. It operates through liquidity pools, where pairs of digital assets are exchanged. These pools use smart contracts that automatically readjust after each trade. The Uniswap blockchain, similar to an electronic ledger, is constantly updated to mirror the trading activities of its users. As it operates without the need for a central authority, Uniswap acts as an automated market maker.

Uniswap operates on the Ethereum platform, which has adopted the proof-of-stake method since transitioning from proof of work in 2022.

There are several ways users can engage with the Uniswap decentralized exchange:

- Creating New Markets: Users can leverage smart contracts on Uniswap to establish markets for trading new pairs of digital assets.

- Swapping Assets in Existing Markets: Uniswap allows users to exchange digital assets through already established decentralized markets.

- Providing Liquidity and Earning Rewards: Users can contribute liquidity by staking their digital assets, i.e., committing not to trade or sell them. In return, they receive rewards in the form of UNI tokens.

- Participating in Governance: Holders of UNI tokens have governance rights over the Uniswap platform, with their voting power proportional to their UNI holdings.

To participate in the Uniswap network, users must connect a compatible digital wallet. Additionally, since the Ethereum platform incurs fees for processing transactions, Uniswap users need to have Ether (ETH) to cover any transaction fees.

In its technical documentation, or whitepaper, Uniswap calls itself as a “noncustodial automated market maker”. In other words, it is a decentralized exchange. It goes on to say that it offers flexible fees, a convenient way to check on price changes, and more efficient liquidity.

In the summer of 2023, the Uniswap decentralized exchange (DEX) experienced unforeseen success. This surge in popularity occurred following a security breach at Curve DAO (CRV), one of its primary competitors, which resulted in a loss exceeding $50 million in cryptocurrency. This incident led to an influx of traders turning to Uniswap. Additionally, following the release of the latest upgrade to Uniswap’s platform in June, there was a noticeable increase in the value of its token, UNI. Top of Form

Uniswap Price Prediction: Price History

Let’s dive into the price history of the UNI token. While historical performance isn’t a reliable indicator of future trends, understanding its past movements can provide valuable context for interpreting or formulating Uniswap price predictions.

UNI entered the open market in September 2020, initially trading at around $6.50. However, it experienced a significant drop, closing at $2.80 on October 7 and reaching a daily low of $1.89 on November 4, 2020 — a 70% decrease from its September prices. It ended the year at $5.17.

2021 was a significant year for UNI. It participated in a burgeoning market, escalating from $5.25 on January 11 to $29.14 on February 20, marking a 455% increase in just over a month. The momentum continued, with the token reaching an all-time high of $44.97 on May 3, 2021. The price then fluctuated, dropping to $14.60 on July 20 but recovering to $31.30 on September 1, before closing the year at $17.07.

2022 presented challenges for many cryptocurrencies, including UNI, amidst fears of a ‘crypto winter’ and market crashes. UNI’s price decreased from $17.81 on January 16 to $3.37 on June 18, an 81% fall. Some positive developments followed, such as the acquisition of Genie and listing on Robinhood, which boosted its price to $6 on June 26 and $9.74 on July 28, respectively.

However, the price again declined, influenced by market dynamics and events like the collapse of FTX. By November 9, UNI had fallen to $4.77. A slight recovery followed, with the token valued at about $5.33 on December 22. At this time, there were 762.2 million UNI in circulation out of a total supply of 1 billion.

2023 saw further fluctuations for UNI. After briefly rising above $7 in February, it dropped again. On June 10, amid news about Crypto.com, it traded at $3.75 but recovered to $5.50 on June 26, only to fall to approximately $4.79 on June 28. Nevertheless, by August 1, 2023, UNI had climbed to around $6.45. However, since October, UNI price regained its momentum and surged above $6, maintaining robust buying pressure.

In March 2024 , the price of Uniswap surged above $15. However, it later declined toward $6.

UNI Token Price: Technical Analysis

Uniswap’s recent movements have formed a bullish pattern as buyers successfully pushed the price above immediate resistance channels. Buyers broke the prolonged bearish consolidation around $6.5 as the Uniswap price formed a high near the $7 mark. As of writing, Uniswap price trades at $6., surging over 0.68% in the last 24 hours.

The price has surged above 23.6% Fib level and is holding well above the EMA20 trend line, aiming to meet bullish goals. The current level is crucial for the bulls to hold, as falling below it could lead to the retest of $6 support level.

As the RSI level now hovers above the midline at level 55, UNI coin price might soon trigger a minor upward correction.

If the price continues to hold above the 20-day EMA, it could set the stage for a push above $7.2. Such a move might initiate a recovery toward $7.5 and potentially extend to $8.

Uniswap Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | $7.46 | $7.73 | $8.15 |

| 2025 | $11.29 | $11.67 | $13.02 |

| 2026 | $16.17 | $16.64 | $19.42 |

| 2027 | $22.81 | $23.48 | $27.81 |

| 2028 | $31.96 | $33.14 | $38.90 |

| 2029 | $50.71 | $52.04 | $57.08 |

| 2030 | $70.65 | $72.74 | $83.92 |

| 2031 | $101.04 | $104.67 | $123.68 |

| 2032 | $150.89 | $155.07 | $179.33 |

| 2033 | $211.10 | $218.85 | $260.54 |

Uniswap Price Prediction 2024

The Bitcoin Halving is set to occur in 2024, but its effects are not expected to materialize until 2025. Despite this, 2024 is shaping up to be an exciting year for the cryptocurrency markets. Additionally, global crypto regulations are being rolled out, providing investors and developers with more clarity when investing or launching tokens.

These developments bode well for Uniswap’s price outlook. The combination of increased regulatory clarity and growing investor exposure to cryptocurrencies encourages greater participation in DeFi. Uniswap, being the top decentralized exchange across all blockchains, stands to benefit significantly.

In 2024, Uniswap’s price is expected to have a minimum value of $7.46. The price may reach a maximum of $8.15, with an average trading price of $7.73 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $6.96 | $7.23 | $7.65 |

| February | $7.01 | $7.28 | $7.70 |

| March | $7.05 | $7.32 | $7.74 |

| April | $7.10 | $7.37 | $7.79 |

| May | $7.14 | $7.41 | $7.83 |

| June | $7.19 | $7.46 | $7.88 |

| July | $7.23 | $7.50 | $7.92 |

| August | $7.28 | $7.55 | $7.97 |

| September | $7.32 | $7.59 | $8.01 |

| October | $7.37 | $7.64 | $8.06 |

| November | $7.41 | $7.68 | $8.10 |

| December | $7.46 | $7.73 | $8.15 |

Uniswap Price Prediction 2025

As we look further into the future, predicting the Uniswap coin price becomes increasingly uncertain. However, certain events and shifts in market sentiment can help provide insight into the long-term outlook for Uniswap.

In particular, 2025 is expected to be the year when the effects of the 2024 Bitcoin Halving are fully realized, with analysts forecasting new all-time highs for Bitcoin. Historically, the altcoin market tends to follow Bitcoin’s movements, and many altcoins could also reach new highs.

Additionally, with the growing adoption of cryptocurrencies and increased exposure of retail and institutional investors to DeFi, Uniswap, as a leading player in the DeFi space, is well-positioned for a strong 2025.

By 2025, Uniswap is projected to hit a minimum value of $11.29. The maximum price could rise to $13.02, with the average price forecasted at $11.67.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $9.79 | $10.17 | $11.52 |

| February | $9.93 | $10.31 | $11.66 |

| March | $10.06 | $10.44 | $11.79 |

| April | $10.20 | $10.58 | $11.93 |

| May | $10.34 | $10.72 | $12.07 |

| June | $10.47 | $10.85 | $12.20 |

| July | $10.61 | $10.99 | $12.34 |

| August | $10.74 | $11.12 | $12.47 |

| September | $10.88 | $11.26 | $12.61 |

| October | $11.02 | $11.40 | $12.75 |

| November | $11.15 | $11.53 | $12.88 |

| December | $11.29 | $11.67 | $13.02 |

UNI Price Forecast for 2026

In 2026, the price of Uniswap is anticipated to reach a minimum level of $16.17. It could go up to a maximum of $19.42, with an average price of $16.64 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $13.67 | $14.14 | $16.92 |

| February | $13.90 | $14.37 | $17.15 |

| March | $14.12 | $14.59 | $17.37 |

| April | $14.35 | $14.82 | $17.60 |

| May | $14.58 | $15.05 | $17.83 |

| June | $14.81 | $15.28 | $18.06 |

| July | $15.03 | $15.50 | $18.28 |

| August | $15.26 | $15.73 | $18.51 |

| September | $15.49 | $15.96 | $18.74 |

| October | $15.72 | $16.19 | $18.97 |

| November | $15.94 | $16.41 | $19.19 |

| December | $16.17 | $16.64 | $19.42 |

Uniswap (UNI) Price Prediction 2027

According to technical analysis, Uniswap’s price in 2027 is expected to have a minimum value of $22.81, a maximum of $27.81, and an average value of $23.48.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $19.31 | $19.98 | $24.31 |

| February | $19.63 | $20.30 | $24.63 |

| March | $19.95 | $20.62 | $24.95 |

| April | $20.26 | $20.93 | $25.26 |

| May | $20.58 | $21.25 | $25.58 |

| June | $20.90 | $21.57 | $25.90 |

| July | $21.22 | $21.89 | $26.22 |

| August | $21.54 | $22.21 | $26.54 |

| September | $21.86 | $22.53 | $26.86 |

| October | $22.17 | $22.84 | $27.17 |

| November | $22.49 | $23.16 | $27.49 |

| December | $22.81 | $23.48 | $27.81 |

Uniswap Price Prediction 2028

Based on past price data, Uniswap is forecasted to reach a minimum of $31.96 in 2028. The maximum price might be $38.90, with an average price of $33.14.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $26.96 | $28.14 | $33.90 |

| February | $27.41 | $28.59 | $34.35 |

| March | $27.87 | $29.05 | $34.81 |

| April | $28.32 | $29.50 | $35.26 |

| May | $28.78 | $29.96 | $35.72 |

| June | $29.23 | $30.41 | $36.17 |

| July | $29.69 | $30.87 | $36.63 |

| August | $30.14 | $31.32 | $37.08 |

| September | $30.60 | $31.78 | $37.54 |

| October | $31.05 | $32.23 | $37.99 |

| November | $31.51 | $32.69 | $38.45 |

| December | $31.96 | $33.14 | $38.90 |

Uniswap Price Prediction 2029

By 2029, Uniswap’s price could reach a minimum of $50.71. The maximum value is predicted to be $57.08, with an average trading price of $52.04.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $42.71 | $44.04 | $49.08 |

| February | $43.44 | $44.77 | $49.81 |

| March | $44.16 | $45.49 | $50.53 |

| April | $44.89 | $46.22 | $51.26 |

| May | $45.62 | $46.95 | $51.99 |

| June | $46.35 | $47.68 | $52.72 |

| July | $47.07 | $48.40 | $53.44 |

| August | $47.80 | $49.13 | $54.17 |

| September | $48.53 | $49.86 | $54.90 |

| October | $49.26 | $50.59 | $55.63 |

| November | $49.98 | $51.31 | $56.35 |

| December | $50.71 | $52.04 | $57.08 |

Uniswap (UNI) Price Prediction 2030

In 2030, Uniswap is expected to reach a minimum price of $70.65. The maximum forecast is $83.92, with an average price of $72.74.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $60.65 | $62.74 | $73.92 |

| February | $61.56 | $63.65 | $74.83 |

| March | $62.47 | $64.56 | $75.74 |

| April | $63.38 | $65.47 | $76.65 |

| May | $64.29 | $66.38 | $77.56 |

| June | $65.20 | $67.29 | $78.47 |

| July | $66.10 | $68.19 | $79.37 |

| August | $67.01 | $69.10 | $80.28 |

| September | $67.92 | $70.01 | $81.19 |

| October | $68.83 | $70.92 | $82.10 |

| November | $69.74 | $71.83 | $83.01 |

| December | $70.65 | $72.74 | $83.92 |

Uniswap Price Forecast 2031

For 2031, Uniswap’s price is projected to reach a minimum value of $101.04, with a maximum of $123.68, and an average price of $104.67.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $86.04 | $89.67 | $108.68 |

| February | $87.40 | $91.03 | $110.04 |

| March | $88.77 | $92.40 | $111.41 |

| April | $90.13 | $93.76 | $112.77 |

| May | $91.49 | $95.12 | $114.13 |

| June | $92.86 | $96.49 | $115.50 |

| July | $94.22 | $97.85 | $116.86 |

| August | $95.59 | $99.22 | $118.23 |

| September | $96.95 | $100.58 | $119.59 |

| October | $98.31 | $101.94 | $120.95 |

| November | $99.68 | $103.31 | $122.32 |

| December | $101.04 | $104.67 | $123.68 |

Uniswap (UNI) Price Prediction 2032

In 2032, Uniswap’s price is forecasted to reach a minimum value of $150.89. The maximum could be $179.33, with an average trading price of $155.07.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $130.89 | $135.07 | $159.33 |

| February | $132.71 | $136.89 | $161.15 |

| March | $134.53 | $138.71 | $162.97 |

| April | $136.34 | $140.52 | $164.78 |

| May | $138.16 | $142.34 | $166.60 |

| June | $139.98 | $144.16 | $168.42 |

| July | $141.80 | $145.98 | $170.24 |

| August | $143.62 | $147.80 | $172.06 |

| September | $145.44 | $149.62 | $173.88 |

| October | $147.25 | $151.43 | $175.69 |

| November | $149.07 | $153.25 | $177.51 |

| December | $150.89 | $155.07 | $179.33 |

Uniswap Price Prediction 2033

By 2033, Uniswap is predicted to have a minimum price of $211.10, a maximum of $260.54, and an average trading price of $218.85.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $186.10 | $193.85 | $235.54 |

| February | $188.37 | $196.12 | $237.81 |

| March | $190.65 | $198.40 | $240.09 |

| April | $192.92 | $200.67 | $242.36 |

| May | $195.19 | $202.94 | $244.63 |

| June | $197.46 | $205.21 | $246.90 |

| July | $199.74 | $207.49 | $249.18 |

| August | $202.01 | $209.76 | $251.45 |

| September | $204.28 | $212.03 | $253.72 |

| October | $206.55 | $214.30 | $255.99 |

| November | $208.83 | $216.58 | $258.27 |

| December | $211.10 | $218.85 | $260.54 |

Uniswap Price Prediction: By Experts

According to Coincodex’s current Uniswap price prediction, the price of Uniswap is expected to decrease by -14.74%, reaching $5.74 by October 18, 2024. Their technical indicators show a Neutral sentiment, while the Fear & Greed Index is at 45 (Fear). Over the past 30 days, Uniswap recorded 16 out of 30 (53%) green days, with a 5.80% price volatility. Based on this forecast, Coincodex suggests it may be a good time to buy Uniswap.

Considering Uniswap’s historical price movements and Bitcoin’s halving cycles, the projected yearly low for 2025 is estimated at $5.32, while the price could rise to as high as $22.24 next year.

According to Digital Coin Price, market analysts and experts predict that by 2026, Uniswap (UNI) will start the year at $20.15 and trade around $24.75, marking a substantial increase compared to the previous year. This is considered a significant and acceptable rise for Uniswap.

By early 2030, their Uniswap price prediction and technical analysis forecast that the token will reach $50.27, with the same price expected by the year’s end. Additionally, UNI could hit a high of $46.11. The period from 2024 to 2030 is projected to be pivotal for Uniswap’s growth.

Is Uniswap A Good Investment? When To Buy?

Following a hack at Curve DAO, Uniswap found itself in an advantageous position to benefit. Consequently, its price has maintained an upward trajectory and is currently in a better state than it was a few months prior.

In June, UNI unveiled the code for its latest update. This development coincided with a rise in the token’s price, illustrating how new advancements can stimulate interest. It remains to be seen if this momentum can be sustained.

Recently, the growing optimism surrounding Uniswap is evident in UNI’s daily trading volume, which recently reached $497 million. The notable rise in UNI’s price has substantially boosted its market capitalization, adding over $750 million to approach a total of nearly $5 billion.

This increased interest is also mirrored in the Uniswap Protocol’s monthly trading volume, which has hit $14.25 billion in November to date. This is the highest volume since June, when the protocol experienced a record $16.20 billion in trades—a record that could potentially be surpassed by the end of the month.

Hence, Uniswap can be a profitable investment option ahead of the 2024 bull run. An investment at $5.5 can be lucrative in the long-term. As with any cryptocurrency investment, it’s crucial to conduct thorough research before deciding to invest in UNI.

Conclusion

Uniswap’s Version 3 (v3) was recently launched on the Boba Network with approval from its DAO community, backed by organizations like ConsenSys and FranklinDAO. This move allows Uniswap to potentially attract more users from the Boba Network, which could boost its transaction volume and the value of its token.

Despite the overall downturn in the decentralized finance (DeFi) sector, Uniswap remains a significant player. Its UNI token has experienced volatility but has started to stabilize thanks to new updates and features. Uniswap is aiming high, with ambitions to become the leading DeFi platform in the next few years.