CryptoQuant’s latest report sheds light on Bitcoin’s current precarious position and its implications for the market. This article delves into the key findings of the report and what they signify for the future of Bitcoin.

Price Predictions and Current Standings

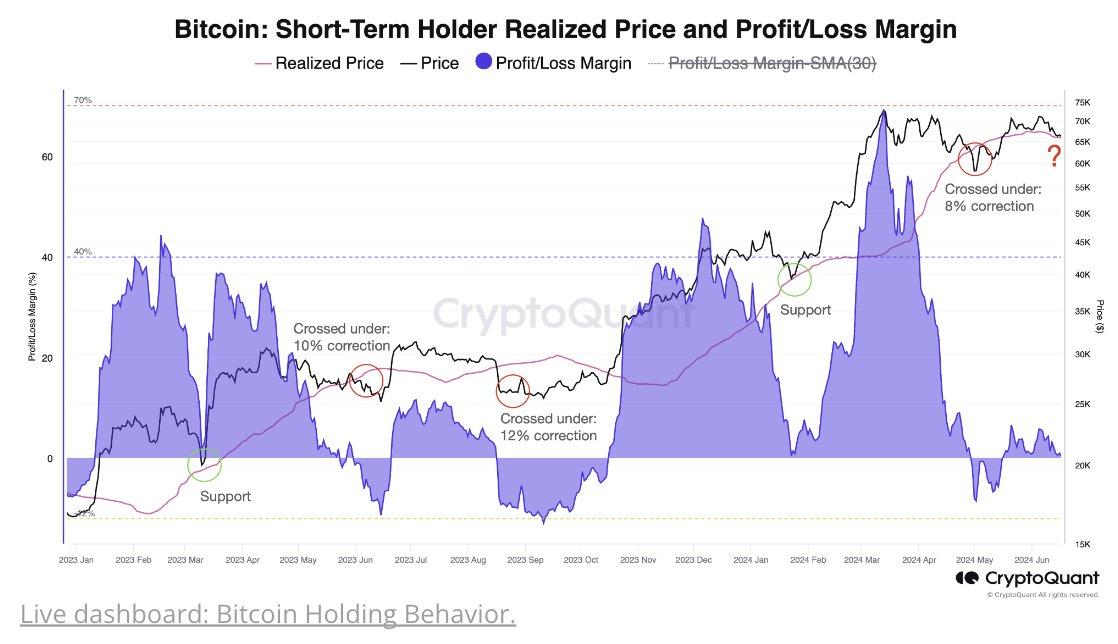

Bitcoin’s recent dip below the significant $65.8K support level marks a critical moment for the cryptocurrency, currently trading under $64K. This threshold historically signals potential market corrections, with predictions now pointing towards an 8%-12% decline, potentially bottoming out near $60K.

This price movement is crucial as it aligns with the trader’s on-chain realized price, a reliable indicator that has previously acted as both support and resistance.

Source: CryptoQuant

While Bitcoin remains tethered to key support levels, trader behavior and stablecoin supply – two of the most important determinants of market sentiment – both signal investor wariness. For example, very few whales – or large Bitcoin holders whose actions can move markets – seem to be buying much.

In addition to that stablecoin liquidity, which is a major driver behind price rallies, has registered the smallest increase it has seen since November 2023. This slowdown marks a sharp contrast with the earlier quarters, where strong demand from U.S. investors, who are now shying away from making more investments, powered the market.

Indicators and Long-term Outlook

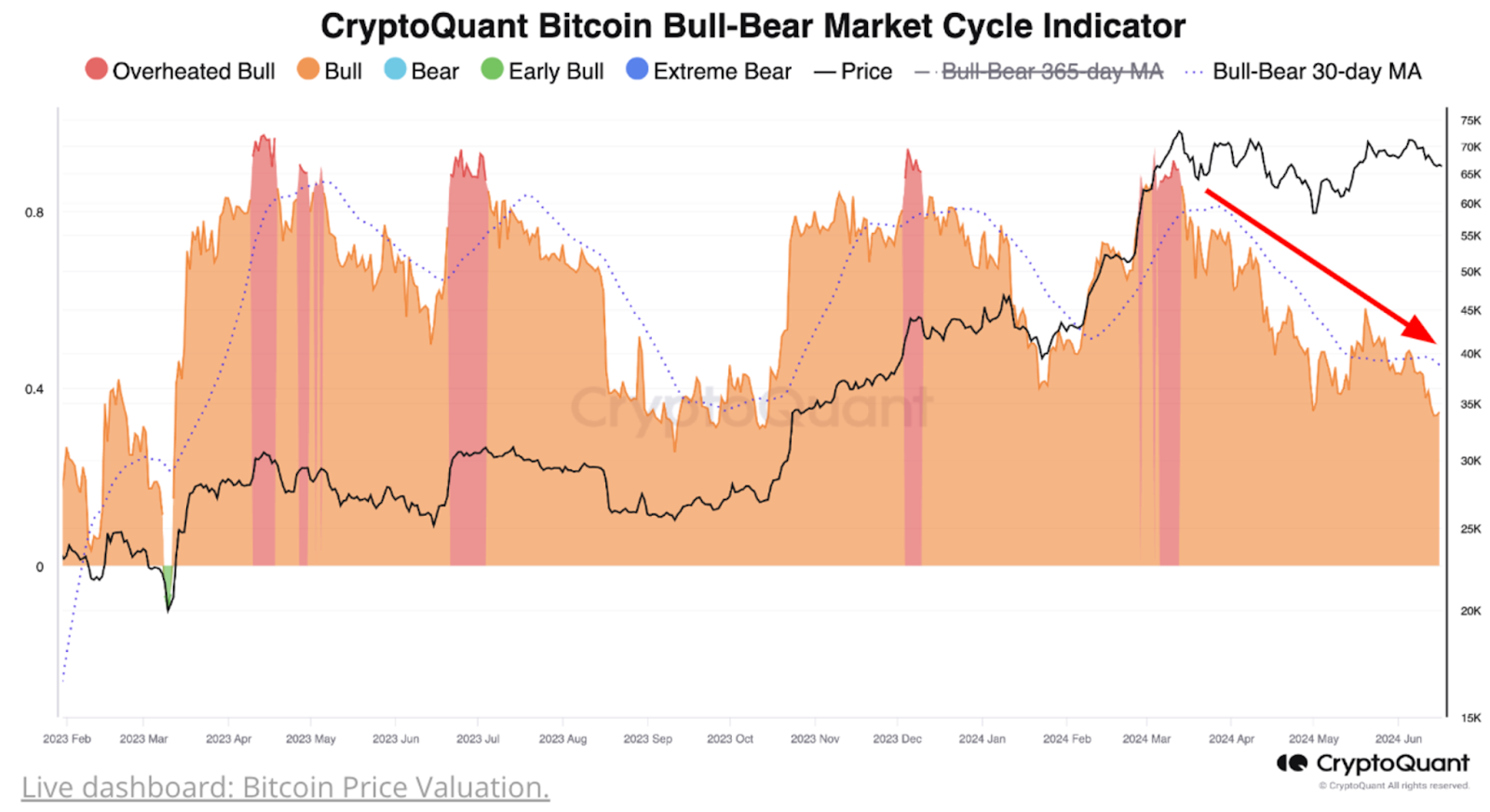

On the brighter side, despite declining in the short term, the CryptoQuant’s full Bull-seven stages Bear Market Cycle indicate that Bitcoin remains in a long-term Bull market cycle, just that it lacks momentum for now and would need impactful news to get bullish.

Source: CryptoQuant

For example, this indicator is the lowest level since October 2023 and should exceed its 30-day moving average to indicate a strong bullish momentum.