Amid the ongoing price consolidation across the wider crypto market, a Fartcoin whale has shifted his focus to Solana (SOL).

Today, July 8, 2025, market analyst Onchain Lens reported a post on X, revealing that a Fartcoin’s major investor made a significant move as he sold 1.459 million FARTCOIN tokens for 10,509 SOL worth $1.57 million.

The Whale Cashes Out Fartcoin Profit

This trading showcases a substantial cash-out event by the major investor in the Fartcoin (FARTCOIN) meme coin market.

According to the data, the prominent trader placed a sale of 1.459 million FARTCOIN tokens for 10,509 SOL worth $1.57 million. The investor went ahead and deposited the profit (in Solana tokens) into Binance, hinting at an intention to either cash out the SOL coins into fiat money or engage in further investment activities on-chain.

The investor had bought these FARTCOIN tokens three months ago at a price of $606,000, as reported by the data. Today’s sales enabled him to earn a whopping profit of $963,000, showing efficient market timing and Fartcoin’s incredible profit capability.

While the sales of these massive Fartcoin tokens earned the whale significant profits, this dumping activity is likely to cause the asset’s price to fall. Such a huge selling event could cause anxiety among Fartcoin small investors, triggering further selling pressure as they consider it as a sign of decreasing confidence in the meme coin.

FARTCOIN Price Updates

The investor’s sale was strategic as it happened at a time when Fartcoin is experiencing price consolidations noted over the past week. Its price has been down 8.6% and 2.5% over the last 24 hours and seven days, respectively, placing its value currently at $1.08.

The meme coin is currently trading in a symmetrical triangle pattern, indicating the asset is witnessing a correction period where both sellers and buyers are in equilibrium, leading to a pause in the asset’s particular movement.

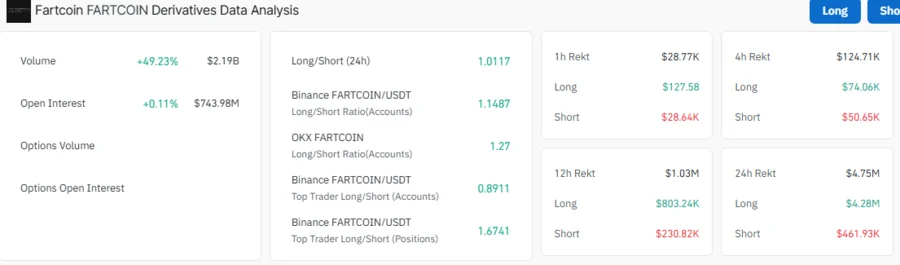

Despite the pause, Open Interest (OI) metrics from Coinglass show Fartcoin is preparing for a looming bullish momentum soon. Over the past 24 hours, the asset’s OI recorded a 0.11% increase, indicating derivatives traders are bullish on the asset and are currently buying premiums, positioning themselves for a potential price rise in the coming days.