- 1. What is Crypto Earn Withdrawal?

- 2. How Does the Staking Process Work?

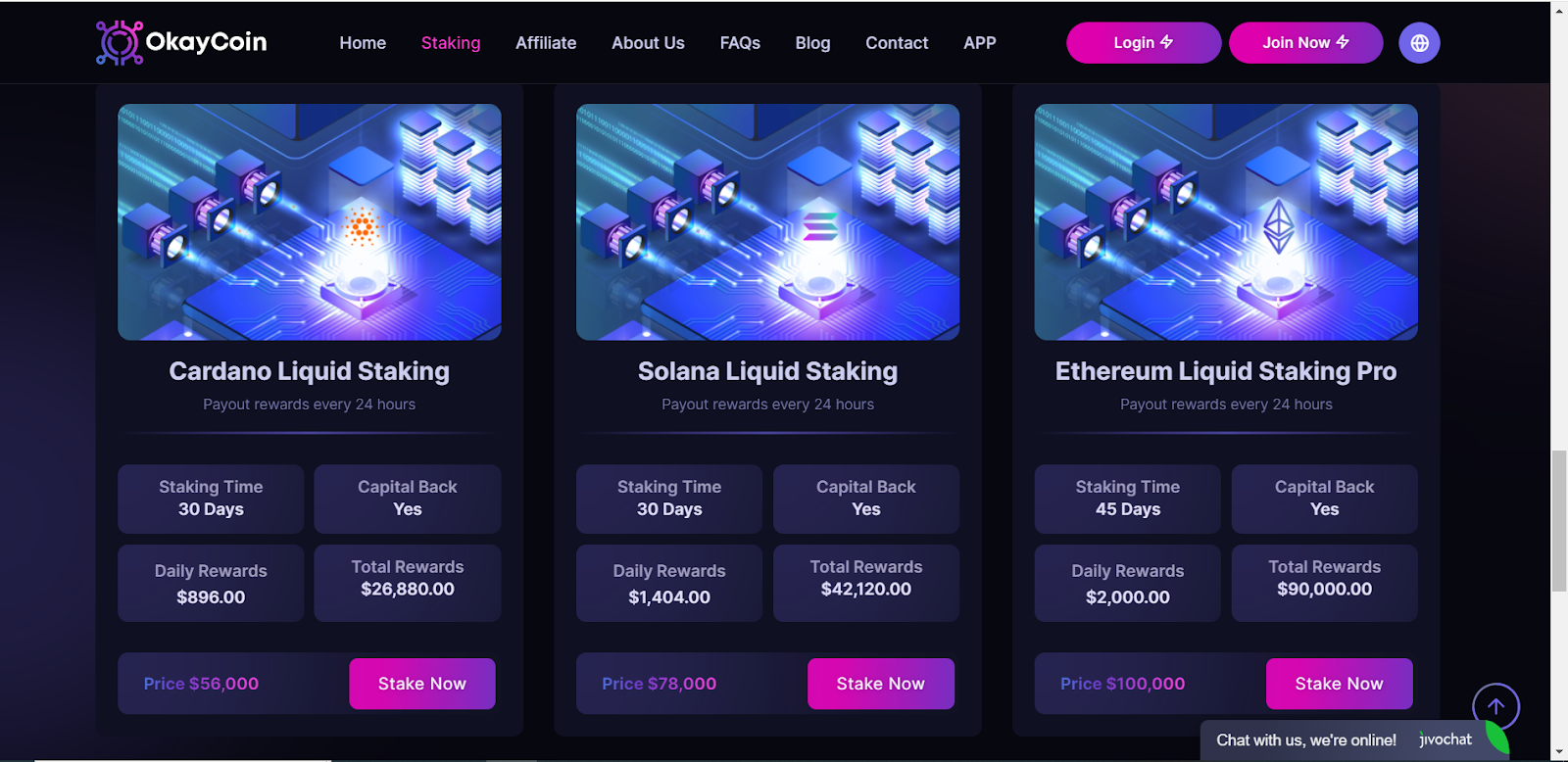

- 3. Staking Plans Available on OkayCoin

- 4. How to Sign Up and Start Staking on OkayCoin

- 5. Conclusion

Cryptocurrency staking has grown as an integral part of passive income generation within the digital asset space. In return, by staking their crypto assets, investors can generate some reward that, in turn, fosters greater security and better returns towards the development of the network. However, one of the most important question areas of staking involves withdrawal, and precisely, “Crypto Earn Withdrawal.” This article looks at what crypto earn withdrawal is, how it works with the platform OkayCoin, and any other important details one needs to know about withdrawing their staking rewards.

What is Crypto Earn Withdrawal?

Crypto earn withdrawal is a process wherein one withdraws the rewards gained in the staking of cryptocurrency through any platform, in this case, OkayCoin. Staking cryptocurrencies refers to locking funds in a staking pool for some time-a period in which the money is used to confirm transactions on the blockchain network. In the event of staking in cryptocurrencies, you generally get rewards in the form of the same cryptocurrency staked. The Crypto Earn withdrawal, in this case, refers to the process involved in withdrawing accrued rewards from the balance of the staking wallet and transferring the funds either into their main crypto wallet or their exchange account.

How Does the Staking Process Work?

The very first step toward staking involves choosing a trustworthy and renowned platform, such as OkayCoin, that offers many staking options including Ethereum, Polygon, and Tron among others. Once you have chosen any staking platform, you need to lock your cryptocurrency in that particular staking pool. A staking pool pools assets from different investors for transaction validation across the network. As the staked assets become active in the validation process, you start earning rewards. These generally are proportional to the amount of cryptocurrency you have staked, and the duration for which you have been staking the assets.

Staking Period is a lock-up period in which your asset remains in the pool. The staking period generally depends on the type of cryptocurrency and special staking terms offered by the platform. Once you have accrued some rewards, you will need to trigger a crypto earn withdrawal to transfer those rewards from the balance of staking into your main account or cryptocurrency wallet.

Staking Plans Available on OkayCoin

OkayCoin provides everything from large to small staking platforms that offer staking various cryptocurrencies and, therefore, earning rewards. At the moment you sign up, you have the chance to get a free $100 staking bonus.

Ethereum (ETH): Given its position as one of the largest and best-known digital assets, Ethereum is a great place to stake.

Polygon-MATIC: Low network congestion fees and speedier transaction times have also made the network a favorite for stake-to-earn.

TRON: It is the unique staking option in light of the hard focus that it has on decentralized creation and application.

Polkadot: Its multi-chain technology brings the latest and highly rewarding stakings. The staking of DOT on OkayCoin provides an avenue for investors to reap some profits, which in turn supports interoperability between different blockchains.

Celestia: It is a relatively new blockchain project that focuses on developing a modular, scalable solution. Staking TIA via OkayCoin gives an opportunity to gain interest by virtue of the network’s growth.

Aptos: Aptos is designed with simplicity in mind and a focus on high throughput. By staking APT on OkayCoin, users will be able to receive rewards while contributing to maintaining a network that tries to further develop the ease of blockchain use.

SUI: Sui provides high-throughput staking, particularly towards DeFi applications. Staking SUI on OkayCoin is available with rewards while contributing to the high-speed operations of the network.

Avalanche: It is very well-known for fast and cheap transactions. Staking AVAX on the chain through OkayCoin opens an avenue for earning passive rewards by contributing to a network that’s built for speed and efficiency.

Cardano (ADA): Cardano is one of the more research-oriented blockchains out there. Staking ADA through OkayCoin rewards users for supporting a network focused on scientific and peer-reviewed development.

Solana (SOL): High throughput, combined with low transaction fees, makes Solana an attractive staking option. With OkayCoin, users who stake the SOL token are allowed to earn rewards while keeping the performance of the network maintained.

How to Sign Up and Start Staking on OkayCoin

Staking at the OkayCoin web platform and withdrawing your rewards is quite an easy process; it basically consists of the next steps:

Create an Account at OkayCoin: You just create an account on the website of OkayCoin using your email address. Do all verifications if required.

Deposit Crypto: Open your account and deposit the cryptocurrency you want to stake into an OkayCoin wallet. These include Ethereum, Polygon, Tron, and more.

Select a Staking Pool: Go to the staking page on the OkayCoin website and choose the appropriate staking pool fitting your needs. You may base your choices on the yields at hand, lock-up period, or even on the potential of the network in general.

Stake Your Asset: After having selected an appropriate pool, it is time to lock up the assets into the chosen pool. One can trace their staking progress and rewards through the dashboard of OkayCoin.

Crypto Earn Withdrawal: Staking allows the receiving of rewards that can be withdrawn through a crypto-earn withdrawal process. You are able to go into the withdrawal section, select the reward amount to be withdrawn, and confirm it. It gets transferred into your main OkayCoin wallet or any other crypto wallet of your choice.

Conclusion

Crypto Earn withdrawal is a main function of the staking process whereby users are allowed to withdraw some of the accumulated reward that is on their stakings across various platforms like OkayCoin. OkayCoin provides the simplest, most accessible staking options for new and experienced crypto investors alike with many staking options such as Ethereum, Polygon, Tron, among others. Being aware of how to leverage this process through an extensive range of withdrawal options will benefit you in further maximizing your staking strategy and ultimately making the most out of one’s investments in cryptocurrencies.