- 1. What x1000 is: Product and Live Features

- 2. Roadmap: What’s Coming

- 3. Token Utility & Tokenomics

- 4. Why x1000 Stands Out (My Analysis)

- 5. A Quick Benchmark: Adoption & Market Cap

- 6. Fund Interest, Traction and Go-to-Market

- 7. Risks & What Would Derail the Thesis

- 8. My Recommendation

- 9. Final Take on x1000

x1000 is building an AI-first decision hub for crypto investors, combining real-time on-chain analytics, sentiment signals and an AI assistant that already talks (text/audio/video). Given what’s live today, a practical roadmap and tight tokenomics, I believe the project has every structural ingredient to grow strongly, and a case can be made for a sub-to-mid-nine-figure market-cap in the medium term if execution and fund adoption continue.

Below, I walk through what I looked at, what’s live now on the platform, what’s coming, why x1000 stands out versus peers, the token model, risks, and my recommendation.

What x1000 is: Product and Live Features

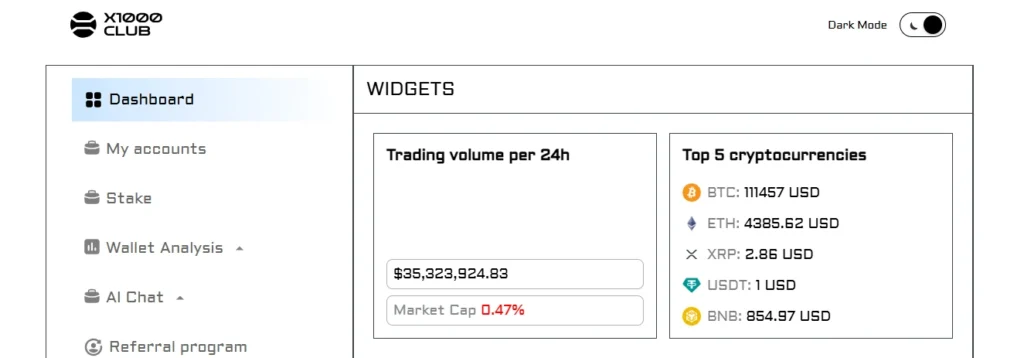

At its core, x1000 positions itself as an AI cockpit for crypto investors. They call it a single place that blends early signals, real-time on-chain analytics and an AI model trained specifically on crypto/finance to help users make decisions faster. The features already live today are meaningful and product-grade:

1. AI assistant: It is available via text, audio and video chat. It’s geared to help investors navigate markets with answers and actionable commentary.

2. Real-time on-chain analytics: It has dashboard tools that surface token movements, wallet activity, and AI-generated commentary on those flows. The dashboard lists balance/history analysis, token analysis, mass wallet search and AI-powered wallet discovery.

3. AI model trained on crypto/finance: The model is tuned to market specifics rather than a generalist assistant, which helps reduce hallucinations on market facts.

4. AI video generation: The site shows automated analytics videos and a virtual avatar host for Q&A and digest content.

Put plainly, x1000 already combines three pieces that many projects sell separately. There is an AI conversational layer, live on-chain telemetry, and automated content/video, and it has those available to users today.

Roadmap: What’s Coming

The site and white paper outline a staged build:

Short Term/Next Few Months

- The single AI cockpit: unify signals, analytics and decision tools in one hub.

- Multi-agent AI: orchestrate multiple specialized models to improve accuracy.

- AI portfolio analyst: wallet PnL, forecasts and “what-if” simulations.

- AI Social Radar: automated tracking of Twitter/Telegram/Reddit/media, summarized into simple signals and anomalies.

- Automated alerts: push notifications on token pumps, whale moves and news spikes.

Strategic (2026 and Beyond)

- AI trader twin: a deeply personalized assistant that knows your portfolio, goals and risk profile and gives live advice.

- Web3 integration: AI agents that can interact with smart contracts, assess liquidity, read contracts and (eventually) execute actions.

- Next-gen social trading and broader ambitions like quantum-resistant AI and global AI networks.

The roadmap is appropriately ambitious yet staged: immediate utility for traders now, and progressive automation and on-chain agency over a multi-year timeline.

Token Utility & Tokenomics

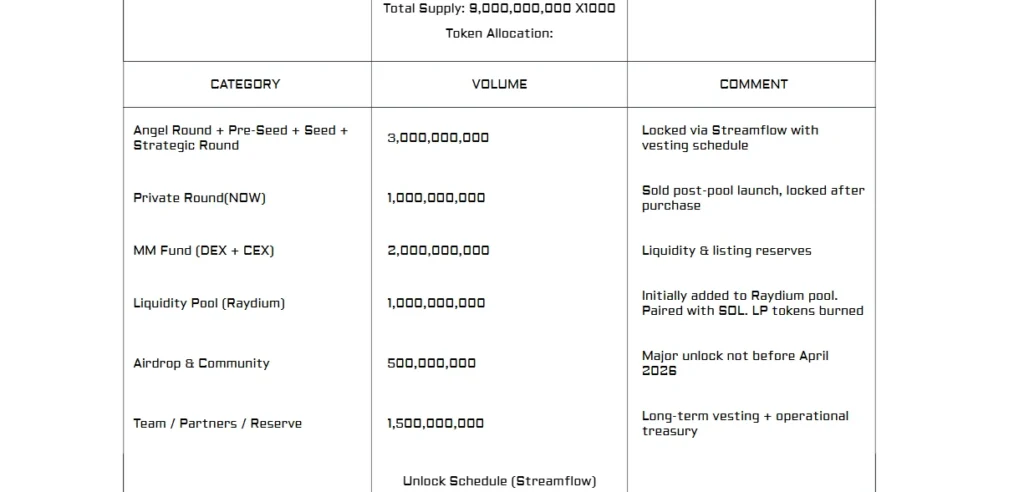

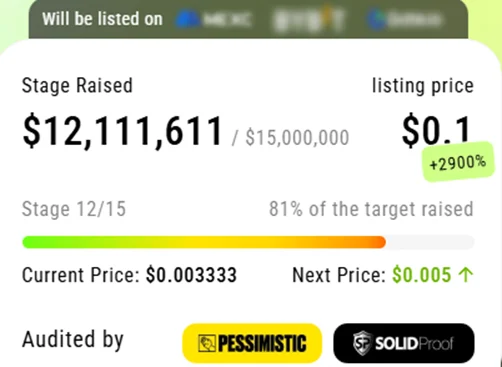

The $X1000 token is the platform’s utility fuel: it unlocks access tiers, private clubs, analytics tools and future NFT utilities. The tokenomics page documents total supply (9 billion tokens), allocation and vesting; importantly, the project emphasizes minimal free tokens that could flood markets (allocations are largely locked/vested per the public tokenomics).

That design reduces immediate dump risk and aligns incentives toward long-term platform adoption. Staking and locked staking (with USDT rewards) are live features, which helps create token demand from active users and community members. In sum, token is tied to product access and engagement rather than being purely speculative.

Why x1000 Stands Out (My Analysis)

There are plenty of analytics and signal projects in crypto (Nansen, Dune, Glassnode, Santiment, and signal clubs), and now several AI integrations are springing up across exchanges and apps. What makes x1000 notable:

- AI-first + on-chain in one UX. Many analytics firms are data-first; others add chat on top. x1000 designed the experience around an AI cockpit that expects to take user queries and return a mix of analytics, signals and generated video. It is a product mindset, not a marketing retrofit.

- Crypto-specialized AI model. Instead of a vanilla LLM, x1000 claims a model trained on crypto and finance. This specialization reduces misinterpretation of domain terms and allows automated commentary rooted in market nuance. That matters for trust.

- Video + avatar delivery. Short, auto-generated video digests are an underrated distribution hook. BingX’s AI example shows how fast users can adopt simple AI features on top of exchange functionality (BingX AI reached 2M users in ~100 days). That’s a market signal: users will flock to interfaces that feel fast and helpful.

- Tighter token mechanics. The token’s locked allocations and staking options reduce open sell pressure compared with tokens that have large unlocked free supplies. This structural difference helps price stability if product adoption follows.

- Pipeline of pragmatic features. The near-term tools (alerts, portfolio analyst, social radar) are directly monetizable and easy to package into tiers. This gives the team straightforward revenue paths well before the advanced AI trader twin is built.

In short, x1000 combines design, domain-tuned AI, product hooks (video/alerts) and token mechanics in a compact, monetizable stack.

A Quick Benchmark: Adoption & Market Cap

Two quick comparators I used to sanity-check a valuation narrative:

- BingX AI: It was launched as an AI assistant that hit ~2 million users and 20 million queries in ~100 days. That pace shows the appetite for crypto-native AI features and is exactly the kind of adoption x1000 hopes to capture in its niche of analytics + assistant.

- Alchemist AI (ALCH): It is a project whose market cap sits in millions (CoinMarketCap showed ALCH’s market cap in the ~$77M range at the time I checked). ALCH’s product breadth is weaker by x1000’s own product checklist, which makes the case that a better product + fund interest could reasonably push x1000 toward a similar cap if traction accelerates. (This is a directional analogy, not a promise.)

Using those comparisons and assuming continued product launches, good retention for the AI assistant, monetized tiers and at least one or two institutional/fund listings, the forecast of a sub-$100M market cap within 12 months is plausible, but that depends heavily on execution and market conditions (see risks below).

Fund Interest, Traction and Go-to-Market

Negotiations with investment funds and the outcomes will appear on those funds’ sites soon. If x1000 secures institutional backing or featured listings, that will materially increase visibility and trust. The product already has the right early signs: a working assistant, analytics dashboards and token mechanics to capture revenue. If the team converts fund interest into partnerships or custodial integrations, customer acquisition will accelerate.

Risks & What Would Derail the Thesis

I don’t want to sugarcoat the risk profile; crypto product success isn’t guaranteed. Here are some things to consider:

- Model accuracy & trust: Crypto is a small-signal, high-noise market. If the AI assistant frequently gives incorrect or low-value advice, user churn will spike. A crypto-trained model helps, but live reliability matters.

- Competition: Big players (exchanges adding AI, analytics incumbents) can replicate parts of the stack quickly. Being a first-mover helps, but the window can be narrow.

- Execution risk: Roadmap items like on-chain actuating agents and AI trader twins are nontrivial and require heavy engineering, audits and security. Missteps here are costly.

- Macro & regulatory risk: Crypto market downturns or unfavorable regulation can slow adoption even for strong products.

My Recommendation

If you’re researching x1000 from an editorial/investment perspective:

- For everyday users: x1000 is worth watching and testing. Try the live assistant and dashboard. Early product experience is the best signal.

- For investors: The token has structural upside if the product keeps shipping and funds formalize interest. A disciplined allocation (small position scaled with milestones e.g., cockpit launch, multi-agent release, first institutional partnership) balances upside with execution risk.

- For product partners: consider integrations around alerts and institutional dashboards; these are the highest-leverage hooks for adoption.

Final Take on x1000

x1000 isn’t vaporware, it already offers an AI that talks, a live set of on-chain analytics and an accessible dashboard. Those are useful today. What elevates the project is the product focus, designing around an AI cockpit rather than bolting chat onto analytics, and sensible token mechanics that reduce immediate sell pressure.

The BingX precedent shows the market will embrace AI features quickly; x1000’s more specialized approach (crypto-trained models + on-chain agency) gives it a realistic runway to reach the kind of market recognition that translates into a sizable market cap if execution and fund interest continue.

I’d classify x1000 as high-reward/moderate-to-high risk: the upside is real and grounded in product, the downside is execution and macro. For anyone exploring this project, test the live assistant, watch the next product releases (cockpit + multi-agent) and track fund announcements. These events will be the clearest inflection points.