- 1. XRP Gains Institutional Edge With RLUSD Integration

- 2. Why This Matters for XRP's Market Position

- 3. BullZilla Presale Gains Traction With Massive ROI Potential

- 4. Conclusion: XRP Leads Institutions, BullZilla Powers Retail

- 5. Frequently Asked Questions About XRP’s Institutional Growth and BullZilla’s Presale

- 5.1. What is BlackRock’s BUIDL fund?

- 5.2. How does RLUSD strengthen XRP’s ecosystem?

- 5.3. What is the current outlook for the XRP price?

- 5.4. What stage is BullZilla’s presale in?

- 5.5. How much ROI can BullZilla investors expect?

- 5.6. How do XRP and BullZilla differ?

- 5.7. How can investors join the BullZilla presale?

- 5.8. Glossary of Key Terms

- 5.9. Article Summary

- 5.10. Disclaimer

The XRP Ledger (XRPL) is rapidly becoming a cornerstone for institutional tokenization. Ripple has also reported that its enterprise stablecoin, RLUSD, is being implemented with the tokenization platform of Securitize, which allows the fund in 24/7 redemptions of the BlackRock 2 billion BUIDL fund and VanEck 2 billion VBILL shares into stable assets.

This innovation positions the XRP in the centre of a financial revolution, spanning both traditional assets such as U.S Treasuries with blockchain-based liquidity. To traders, the development adds legitimacy to the network and contributes to the bigger picture optimism regarding XRP price action. Meanwhile, retail traders have been gaining some attention with massive presale offerings, such as BullZilla ($BZIL), and are demonstrating that institutional power and grassroots support are redefining crypto jointly.

XRP Gains Institutional Edge With RLUSD Integration

BlackRock’s BUIDL is the largest tokenized money market fund in the industry, and its expansion to XRPL through RLUSD represents a milestone in blockchain finance. Token holders can now redeem shares instantly for RLUSD, unlocking constant liquidity, stable on-chain transfers, and access to DeFi applications.

Ripple President Monica Long highlighted the speed of adoption: “DBS and Franklin Templeton are already using RLUSD for tokenized asset trading and lending. Now, with BlackRock and VanEck in the mix, we’re pushing RLUSD toward becoming a global standard for institutional liquidity.”

Backed 1:1 with high-quality liquid assets and regulated under New York’s DFS charter, RLUSD strengthens Ripple’s compliance-first approach. With XRP price analysis showing resilience around key support levels, this institutional pipeline reinforces long-term bullish sentiment.

Why This Matters for XRP’s Market Position

Ripple has positioned XRPL as more than just a payments ledger. Recent adoption by Guggenheim, VERT, and Dubai Land Registry underscores its growing role in real-world asset (RWA) tokenization. Now, with BlackRock and VanEck tapping its rails, XRPL ranks among the top blockchains for RWA activity.

The ability to move seamlessly between tokenized funds and RLUSD unlocks a new wave of capital efficiency. For XRP, it validates the ledger’s infrastructure in ripple xrp news 2025 narratives and fuels investor confidence. Analysts argue that if institutional flows continue, XRP could reclaim higher price zones faster than expected.

For investors comparing XRP vs BullZilla, the difference lies in scale: XRP provides institutional-grade exposure, while BullZilla is carving out high-growth potential in meme-driven retail markets.

BullZilla Presale Gains Traction With Massive ROI Potential

While XRP builds institutional bridges, retail investors are fueling momentum into BullZilla ($BZIL). The project is now in Stage 4 (Red Candle Buffet), marking strong demand and rapid community growth.

At the current presale price of $0.00008574, more than 28 billion tokens have been sold, raising over $630,000 and attracting 2,000+ holders. Early adopters from Stage 4A already sit on nearly 1,400% ROI, while current buyers could lock in a 6,048% upside to the confirmed listing price of $0.00527. With the next price surge of 7.77% to $0.00009241 imminent in Stage 4B, momentum is only intensifying.

BullZilla ($BZIL) Presale Snapshot

| Metric | Value |

| Current Stage | 4th – Red Candle Buffet |

| Current Price | $0.00008574 |

| Tokens Sold | 28 Billion+ |

| Presale Raised | $630,000+ |

| Token Holders | 2,000+ |

| ROI to Listing | 6,048.13% |

| ROI for Early Joiners | 1,391.13% |

| Upcoming Price Surge | +7.77% to $0.00009241 |

For those eyeing BullZilla presale stages or seeking BullZilla whitelist entry 2025, the project continues to shine as one of the year’s top high-growth meme coins.

Conclusion: XRP Leads Institutions, BullZilla Powers Retail

Ripple’s integration of RLUSD with Securitize and BlackRock’s BUIDL marks a transformative step for institutional tokenization. With real-world asset adoption accelerating, XRP strengthens its role as a bridge between traditional finance and blockchain liquidity.

At the same time, retail energy thrives in projects like Bull Zilla, where massive ROI projections and phased presale growth offer unique opportunities for individual investors. Together, XRP and BullZilla embody the dual growth story of 2025 , institutional maturity on one end, retail-powered momentum on the other.

Follow BZIL on X (Formerly Twitter)

Frequently Asked Questions About XRP’s Institutional Growth and BullZilla’s Presale

What is BlackRock’s BUIDL fund?

It’s a $2 billion tokenized money market fund that now integrates with RLUSD for on-chain liquidity.

How does RLUSD strengthen XRP’s ecosystem?

It enables 24/7 liquidity, compliance-backed stability, and direct integration with institutional funds.

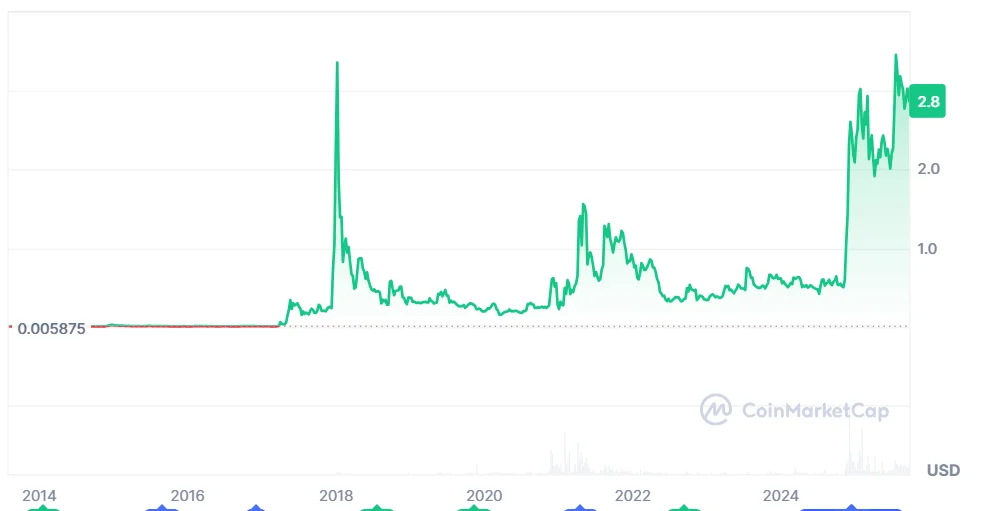

What is the current outlook for the XRP price?

Analysts expect XRP to benefit from growing RWA adoption, with stronger support levels forming.

What stage is BullZilla’s presale in?

Stage 4 (Red Candle Buffet), with 28B+ tokens sold and $630K+ raised.

How much ROI can BullZilla investors expect?

At current pricing, over 6,000% upside to the confirmed listing price of $0.00527.

How do XRP and BullZilla differ?

XRP is institutional-grade infrastructure, while BullZilla is a meme-driven retail growth play.

How can investors join the BullZilla presale?

Through how to buy BullZilla tokens or whitelist entry channels for 2025.

Glossary of Key Terms

- XRP: Native token of the XRP Ledger, used for payments and liquidity.

- XRP Ledger (XRPL): Blockchain supporting payments and real-world asset tokenization.

- BUIDL: BlackRock’s $2B USD Institutional Digital Liquidity Fund.

- RLUSD: Ripple’s enterprise stablecoin, backed 1:1 with liquid assets.

- Tokenization: Converting real-world assets into digital blockchain tokens.

- Presale: An early fundraising stage for crypto tokens before their public listing.

- ROI (Return on Investment): Profit percentage relative to entry price.

- Whitelist Entry: An early access mechanism for purchasing presale tokens.

- DeFi: Decentralized finance applications built on blockchain.

- RWA (Real-World Assets): Traditional assets represented on-chain.

Article Summary

Ripple has expanded its institutional footprint by connecting BlackRock’s $2B BUIDL fund to the XRP Ledger through RLUSD integration. Investors can now redeem tokenized fund shares into RLUSD 24/7, enhancing liquidity and on-chain exposure. With Guggenheim, VERT, and Dubai Land Registry also active on XRPL, the ledger is becoming a leader in real-world asset tokenization. This momentum reinforces optimism for XRP’s price outlook in 2025. At the same time, meme-inspired presales like BullZilla ($BZIL) are thriving on the retail side, with Stage 4 already raising $630K+ and projecting over 6,000% ROI to listing. Together, XRP and BullZilla represent the institutional and retail engines driving the crypto market.

Disclaimer

The article is informational in nature and is not a financial advice. The risk associated with cryptocurrency and tokenized investments in the assets is also high, as far as it can lead to the loss of the principle. Always do your own research and use the services of a licensed financial advisor when making investment decisions. The author and publisher do not bear monetary losses on the basis of dependency on this content.