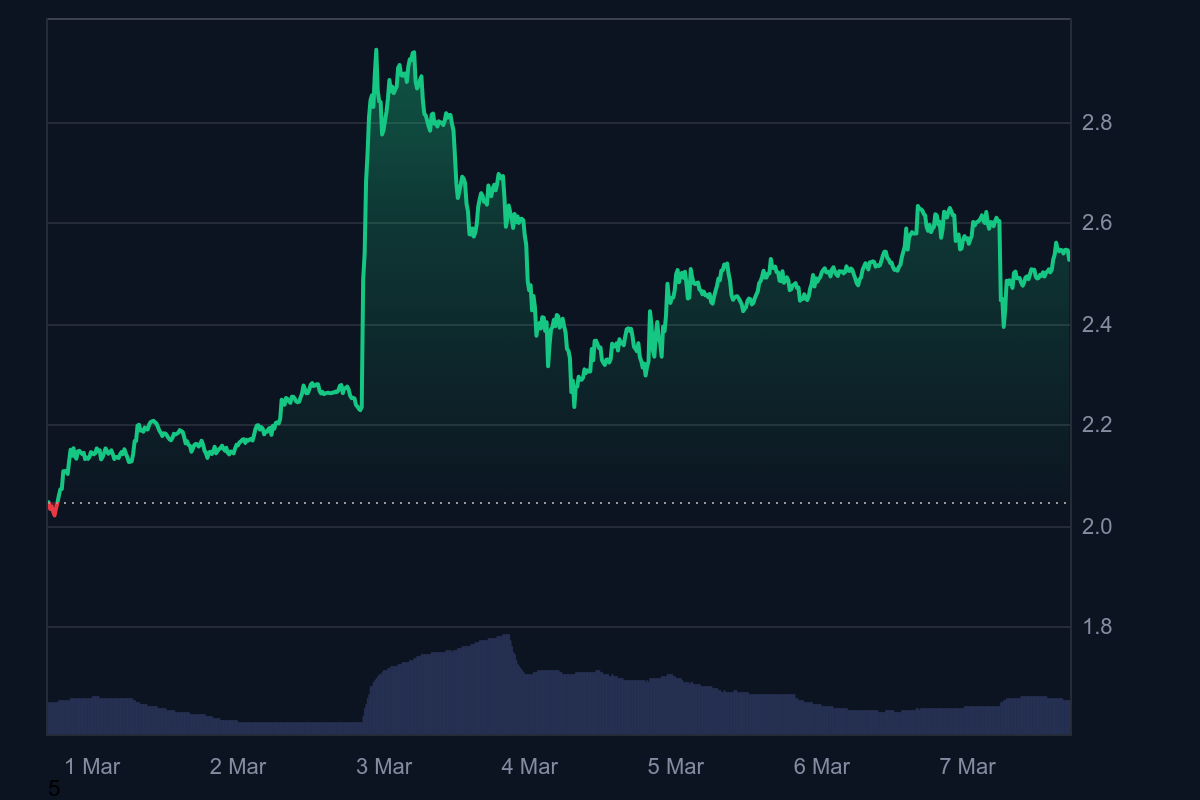

XRP’s recent performance shows a short-term rebound that has lifted its price to $2.52. Over the past 24 hours, XRP experienced a 3.31% increase, which can be attributed to a surge in buying activity. This uptick indicates that short-term traders are capitalizing on perceived oversold conditions and are stepping in to push the price higher. The 7-day performance, with a robust increase of 23.66%, suggests that there is a growing wave of positive sentiment in the market despite any lingering bearish undertones.

XRP Price Analysis

XRP has shown consistent buying interest around the $2.45–$2.50 range. This level acts as a safety net where buyers are expected to step in during minor pullbacks. Should the price fall further, the next key support is likely around $2.40. A sustained drop below this level could indicate a shift in market sentiment. The first hurdle for XRP is between $2.60 and $2.65. A breakout above this zone would signal a bullish reversal and could trigger further gains.

Beyond this, the next resistance level appears near $2.70, which may act as a psychological barrier for traders. Meanwhile, XRP is trading close to its short-term moving averages, such as the 50-day SMA, which provides an indication of medium-term trend direction. The 200-day SMA offers a view of the longer-term trend. Currently, XRP is sitting above these key averages, which is a positive sign for the short-term rally. A bullish crossover (i.e., the 50-day SMA crossing above the 200-day SMA) would further support a bullish outlook.

On the other hand, recent charts have shown bullish candlestick formations, including bullish engulfing patterns near support levels. These formations suggest that buyers are starting to take control, although the overall market sentiment must be confirmed by sustained volume and momentum. A decisive breakout above the immediate resistance between $2.60 and $2.65 would be a strong bullish signal.

XRP Price Prediction

If buying pressure continues and XRP successfully defends its support levels near $2.45–$2.50, there is a strong likelihood that the price will break through the primary resistance in the $2.60–$2.65 range. In this optimistic scenario, XRP could rally to a target range between $2.70 and $2.80. This breakout would be supported by increasing trading volume and technical indicators like an improving RSI and a bullish MACD crossover.

Conversely, if selling pressure intensifies or if the support levels fail to hold, XRP might experience a pullback. A breach below $2.45 could force the price down toward $2.40 or even lower. In this scenario, the technical picture would indicate that the bullish momentum is short-lived, and traders may need to re-evaluate their positions.

Given the current trading price of $2.52 and the overall positive short-term momentum indicated by a 3.31% gain over the past 24 hours, the balanced near-term prediction for March 7, 2025, is that XRP could trade between $2.70 and $2.80 if bullish conditions persist. However, it is essential to remain cautious, as a reversal in sentiment could see the price fall back toward $2.40.

Frequently Asked Questions (FAQs)

What are the short-term price predictions for XRP?

In the short term, technical analysis suggests that XRP may continue its modest rally, moving from its current level of $2.52 to between $2.70 and $2.80, provided that buying pressure persists and key support holds.

Where can I buy XRP?

XRP is widely available on major cryptocurrency exchanges such as Binance, Coinbase, Kraken, and Bitstamp. These exchanges offer high liquidity, robust security, and user-friendly interfaces for both new and experienced traders.

What is the forecast price for XRP today?

Based on current market data, the short-term forecast for XRP is near its current price of $2.52. However, if buying pressure continues, the price could potentially edge up to around $2.70–$2.80 by the end of the trading day.

Investment Risk Consideration

Investing in XRP, as with any cryptocurrency, involves a high degree of risk due to its inherent volatility and sensitivity to market sentiment and regulatory news. It is crucial to only invest what you can afford to lose and consider seeking advice from a financial professional if you are new to cryptocurrency trading. Staying updated with the latest technical indicators and broader market trends will help you make informed decisions and navigate the volatile crypto landscape more effectively.