Bitcoin bulls have taken over the crypto market after weeks of consolidation surging about 20 per cent this week. The leading cryptocurrency broke past $20,000 some hours ago, marking a new all-time high past the critical technical level.

The cryptocurrency managed to trade above $23,000 after pushing even higher. Bitcoin is currently rallying parabolically, with its price correcting lower at $22,625 with the bulls expecting more.

The rise in Bitcoin price comes amid positive fundamental trends for Bitcoin.

Bitcoin Price is Still Surging

Yesterday there was a significant drop in the price of Bitcoin above the resistance levels of $19,500 and $19,800. As a result, BTC broke the $ 20,000 mark to initiate a strong bullish run.

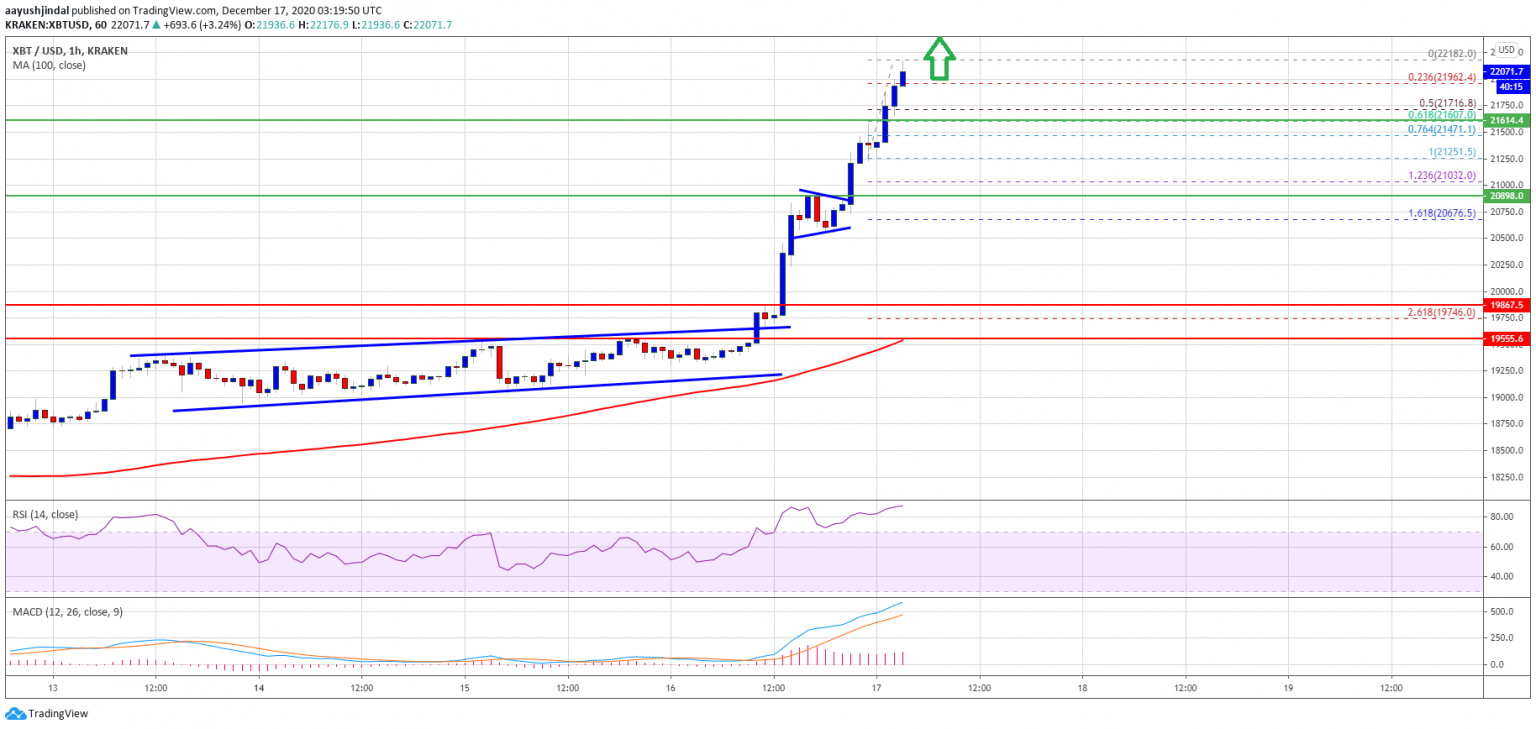

Bitcoin hit new records, setting a simple moving average above the 100 hours. The bulls were in on the action as they managed to pump the prices over $21,000 and $22,000, respectively. There was a break above the bullish continuation pattern near $19,754 and $20,900 on the hourly chart of the BTC / USD pair.

The pair is gaining momentum and recently traded as high as $23,256.92. Currently consolidating revenue and selling above $23,000. The downside is that initial support is nearing the $21,700 level. It is close to the 50% Fib correction level of its recent jump from the low of $21,251 to $22,182.

Source: BTCUSD on TradingView.com

On the downside, Bitcoin prices could be around $22,200 and $22,450. Further fixes could take the price to $23,500 in the near term.

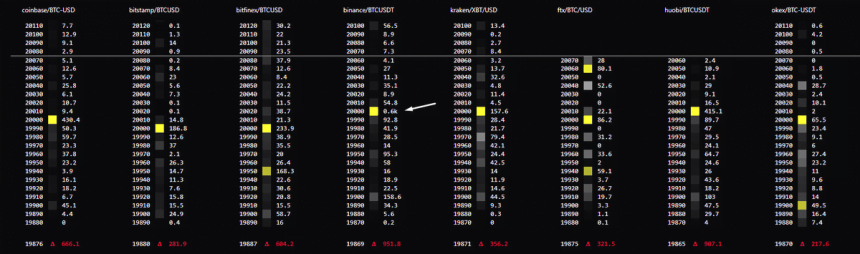

BTC Likely to Be Bolstered by Short Liquidations

One trader stated before the morning break above $20,000 that a hard pass above that level would create a sales liquidation flow which would result in a higher price for the cryptocurrency.

He stated that Binance is eager to save its underwater shorts. It is going to be a severe battle, but if $20,000 breaks, then the squeeze will be epic.

Image Courtesy of Byzantine General.

We already see the effect as this latest foray by Bitcoin could mark the start of the next parabolic uptrend in cryptocurrency.