- Amazon (AMZN): An Introduction

- Amazon Price Stats

- Rise of Amazon.com

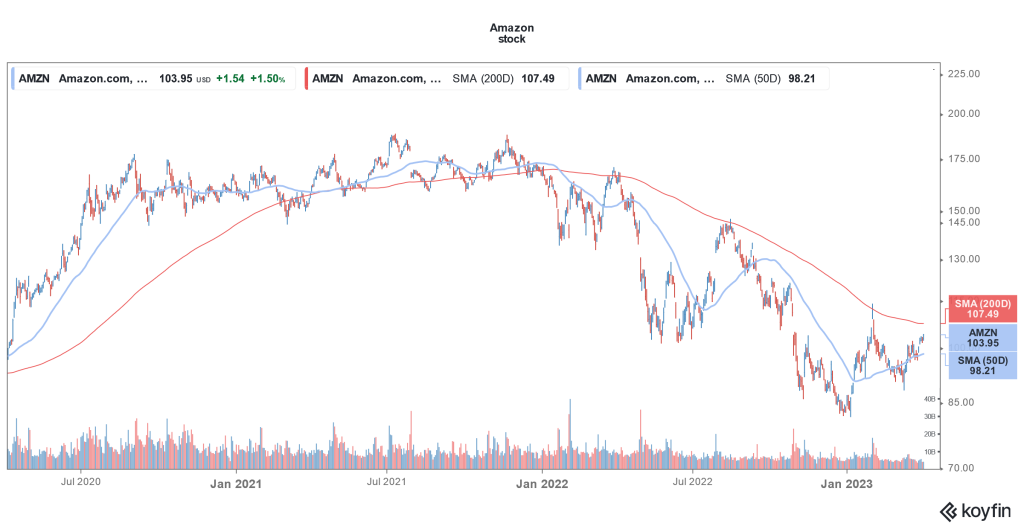

- Amazon Stock Price History

- Amazon Stock Technical Analysis

- Amazon Stock Price Prediction 2030

- AMZN Price Prediction 2023

- AMZN Price Prediction 2024

- AMZN Price Prediction 2025

- AMZN Price Prediction 2026

- AMZN Price Prediction 2027

- AMZN Price Prediction 2028

- AMZN Price Prediction 2029

- AMZN Price Prediction 2030

- FAQ

The retail industry has been continuously evolving since its inception. The advent and further development of the Internet have revolutionized this sector in recent years. When it comes to the top players in this field, Amazon.com Inc. (AMZN) has a strong position. The platform has remained effective in bringing a great number of retail consumers online. At present, cloud computing, AI (artificial intelligence), digital streaming, and e-commerce services of Amazon are getting substantial popularity within the industry.

Amazon (AMZN): An Introduction

Amazon.com is considered to be an online retailer that also provides services related to e-commerce, Web, electronic book reading, and so on. The Washington-headquartered platform has a broad Internet-based enterprise. It sells electronics, housewares, movies, music, books, and several other products either straightly or as a mediator between its numerous consumers and other retailers.

The firm was established back in 1994 in the form of an online bookstore. Following that, in 1997’s May, Amazon started trading shares after an initial public offering (IPO). The Nasdaq Global Select Market is responsible for listing its stock. The platform debuted its initial tablet computer “the Kindle Fire” back in 2011. It additionally began an online Amazon Art marketplace covering fine arts back in 2013. It comprised the original works credited to popular artists like Norman Rockwell and Claude Monet.

In 2015, it launched the famous in-home virtual assistant named Amazon Alexa. This was followed by the release of the Alexa-equipped Echo Dot in the next year. In the world of artificial intelligence, Amazon has made remarkable progress with these and other such products. The platform developed and offered easy-to-use devices with the utilization of deep learning and machine learning technologies along with stimulated or artificial neural networks.

Amazon Price Stats

| Stock | Amazon |

| Ticker Symbol | AMZN |

| Price | $103.95 |

| Trading Volume | $48,662,496 |

| Current High | $104.20 |

| Current Low | $102.11 |

Rise of Amazon.com

The recent COVID-19 pandemic witnessed a rise in the online retail industry. During this time, customers depended on Amazon to a great extent and it seems that the respective trend will keep expanding in the future. By relying on the e-commerce giant, consumers have availed of cost-effective services with great convenience. As a result of this, Amazon turned into the chief retailer for the majority of retail clients, especially during the pandemic.

In February and March last year, a huge spike of 186% took place in the sales of toilet paper on Amazon. In addition to this, the cold and cough medicine were sold at an 862% high rate year over year. Apart from that, online orders witnessed huge increases, taking Amazon sales to record levels in 2022’s 2nd quarter.

During the same year, the US witnessed widespread economic turmoil and unemployment. Even during that phase, the hiring spree of Amazon did not stop. The platform added 36,400 employees in just 3 months which concluded in June. It saw a 34% year-over-year increase in its headcount as the total number of workers reached 876,800.

The pandemic-powered growth of Amazon has been continuously advancing afterwards. At first, the extreme demand rate was not expected for Amazon. Nonetheless, the company struggled to manage its operations according to the needs. Jeff Bezos, the chief executive officer of the platform, admitted that the firm witnessed a hard time at the beginning of the Covid-19 crisis. This was the time when Amazon’s supply chain was considerably damaged. Nevertheless, it maintained its status within the retail market and kept on evolving with time.

Amazon Stock Price History

It is crucial to comprehend the historical price movements of Amazon (AMZN) to get a clear picture of the future trends as well as the technical analysis. The historical data points out that AMZN’s price performance in the previous month has seen a +9.05% growth. In addition to this, the recent 3 months saw Amazon reaching to +18.81 increase in its performance. On a broader canvas, the statistics indicate that Amazon’s recent 6-month price witnessed a decrease of nearly -17.14.

However, the year-to-date price performance of AMZN has been positive with an increase of almost +19.95. Its 52-week high has been quite promising at $168.11 (13,782.50 INR). On the other hand, $81.43 was AMZN’s 52-week low price level. During the current year, the stock price of Amazon remained between $83.03 and $110.245, which was witnessed on the 2nd of February 2023. The most frequent price levels of AMZN ranged from $87.46 to $101.155.

Amazon Stock Technical Analysis

The technical analysis of AMZN signifies that most of the time its stock price has been within the positive sphere. Keeping in view the statistical data, the moving average of AMZN in the recent 50 days has been around $98.21 with an increase of +6.59% in its price. Moreover, its 100-day moving average has been nearly $94.66 with an elevation of almost +15.53%. While moving further, the 200-day moving average stands at $107.49 with a relatively less increase of up to +0.28%.

Amazon Stock Price Prediction 2030

In line with the former price performance as well as the economic indicators, it seems that AMZN has an optimistic scenario for the future. With the use of predictive modelling and econometrics, it is anticipated that the next years up till 2030 are very crucial for AMZN. The qualitative analysis brings to the front that the recent developments made by Amazon can help increase its stock price although it could also witness some regression in its way forward. Additionally, the quantitative analysis is also somehow favourable, signifying some promising outcomes in the upcoming years within the time series till 2030.

AMZN Price Prediction 2023

In the current year, the maximum price level of Amazon stocks can reach $181.76. On the other hand, $136.32 is anticipated to be the minimum stock price of AMZN in 2023.

AMZN Price Prediction 2024

The year 2024 will see Amazon’s price reaching $225.89 at minimum. On the contrary, AMZN’s stock price can touch the $301.19 spot at the maximum in the same year.

AMZN Price Prediction 2025

For 2025, our financial predictions disclose that the maximum stock price of Amazon can be approximately $342.74. The AI-based future price forecasts indicate that $257.06 will be the minimum price to be seen by AMZN in 2025.

AMZN Price Prediction 2026

In the next year, Amazon’s price can touch the maximum price spot of $519.3, according to the AI-based price prediction. Keeping in view the volatility in the long-term price forecasts, it is predicted that $389.48 can be the minimum stock price of Amazon in the same year.

AMZN Price Prediction 2027

Corresponding to the projected growth and enhanced stock valuation of Amazon in the year 2027, AMZN’s stock price can reach $830.88 at the maximum. As opposed to this, due to some economic indicators that might influence the price, Amazon’s price can also drop to $623.16.

AMZN Price Prediction 2028

The positive developments and good investor sentiment about Amazon can elevate AMZN’s stock price to $1028.21 in 2028. Nonetheless, global events might cause volatility in its price. As a result, Amazon’s stock price can even decline to $771.16 in that year.

AMZN Price Prediction 2029

In general, the stock performance and the stock valuation of Amazon will increase in the next years and 2029 will also see this momentum. The maximum and minimum stock prices of AMZN in 2029 can be $1350.18 and $1012.64 respectively in that year, based on the technical and fundamental analysis of Amazon’s stocks.

AMZN Price Prediction 2030

The year 2030 will be significant for Amazon in terms of its price, as indicated by the historical stock performance and financial projections. In 2030, AMZN can reach $1751.08 as its maximum stock price. On the opposite end, $1313.31 can also be seen by Amazon as the minimum price level in that year.

FAQ

What Is Amazon.com?

Amazon.com is categorized among the prominent online retail platforms. It offers a diversity of products and services including cloud computing, artificial intelligence, electronic devices, e-commerce, and so on. Since its inception, Amazon has been continuously expanding its business although it started as an online bookstore. Afterward, it started selling stocks in 1997.

Does Amazon Offer a Good Investment Opportunity?

Based on the existing and projected trends related to Amazon stocks, long-term investors can leverage them. Nevertheless, investors should be aware of their business requirements before moving toward an investment plan. Getting adequate knowledge about suitable investment strategies is also significant in this respect. Above all, investors are advised to regularly check price forecasts and do their research before any investment.

Who are the Well-Known Competitors of Amazon?

Being a top tech retailer, Amazon has the well-known platforms as its competitors. Google, Microsoft, as well as Apple, are considered to be among the companies that are currently competing with Amazon in diverse fields including cloud computing, manufacturing tech devices, and offering AI-based services.

READ MORE:

Ava Labs and Amazon Web Services to Accelerate Enterprise and Government Adoption of Blockchain