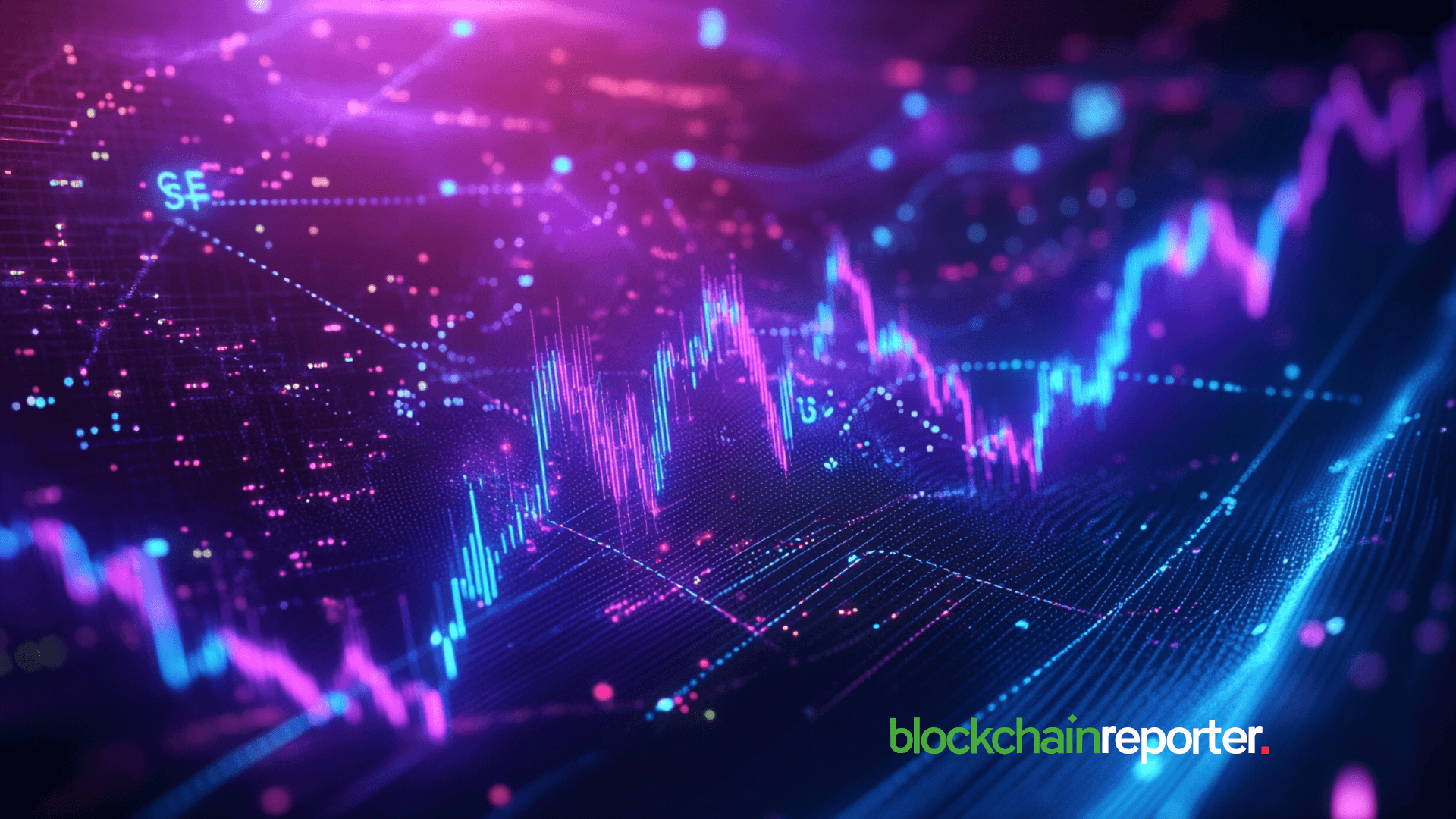

Amazon’s stock, $AMZN, has been experiencing considerable fluctuations recently, with its price testing a crucial support level. According to a recent analysis by @ali_charts, the movement of Amazon’s stock price is at a critical juncture. If buyers can step in and uphold this level of support, it could pave the way for a potential rally, with price targets reaching up to $220 in the coming sessions.

In technical analysis, support levels are points where the price tends to find stability before moving upward again. Amazon’s stock has dropped to a level that is considered a significant support zone. As shown in the chart, the price is currently near the lower boundary of its ascending channel, with several Fibonacci retracement levels highlighting areas of potential support.

This support is particularly important for investors and traders as it represents a psychological price point where market sentiment may shift. Suppose the stock maintains its position above this critical level. In that case, it suggests that buyers are willing to step in and accumulate shares at these lower levels, which could lead to upward momentum.

Amazon’s Price Action, Fibonacci, and Risks

The chart illustrates an upward trend channel, with the stock finding support at various key Fibonacci retracement levels along the way. These retracement levels are used to predict potential areas where the price might reverse or consolidate.

Currently, Amazon is testing the 0.382 Fibonacci retracement level, which has historically been a strong level of support. If the stock fails to break below this level and begins to recover, it would signal that the support is holding firm. Should this occur, the next logical target would be the 0.236 Fibonacci level near $220, where sellers may face resistance, marking a potential point of upward rally.

If buyers step in and the support level holds, there is a strong possibility that Amazon’s stock could begin a rally toward the $220 mark. This price target is significant for a number of reasons, as it coincides with a major resistance level within the current upward channel. A move toward $220 would represent a continuation of the prevailing bullish trend, reinforcing investor sentiment and confidence in Amazon’s prospects.

The trajectory towards $220 would likely depend on several factors. Firstly, broader market conditions, including investor sentiment and macroeconomic factors, could play a role in determining whether the rally takes place. Secondly, any positive news surrounding Amazon, such as new product launches or strong earnings reports, could act as a catalyst, pushing the stock toward this key resistance level.

While the outlook is generally optimistic, there are inherent risks in trading stocks, especially when they are testing significant technical levels like this one. If the support fails to hold and Amazon’s stock drops below this level, it could signal a bearish reversal. In such a scenario, the stock may continue its decline, potentially testing lower support levels, such as the 0.618 Fibonacci retracement at $122.68. Traders should be cautious of potential volatility and consider their risk tolerance before entering positions in Amazon. However, for those with a bullish outlook, the potential rally towards $220 provides an attractive opportunity if the support holds.