In recent years, decentralized finance (DeFi) has shown remarkable growth, with its total value locked (TVL) soaring from $600M in early 2020 to about $50B by the end of 2023. Despite facing controversies, DeFi is reshaping global financial transactions.

This rise is revolutionizing global financial transactions from payments to loans, especially in regions with limited banking access. However, the inherent volatility of DeFi poses a barrier to mainstream adoption.

On the other hand, Cardano’s DeFi has also shown an unprecedented growth, with the total value locked in Cardano protocols sitting at around $375 million according to Defilama as at the time of writing this article.

The key barrier to DeFi’s mass adoption in the financial mainstream is its inherent volatility. While some crypto enthusiasts are comfortable with daily price fluctuations, this high-risk environment deters traditional institutions from participating.

Real-World Assets (RWAs) on the blockchain have the potential to create a positive impact and stabilize this space, attracting traditional financial institutions as RWAs like real estate or commodities offer familiarity and reduce risk.

What Are Real World Assets (RWAs)?

Real World Assets (RWAs) in the context of blockchain technology refer to tangible, physical assets like real estate, commodities, or even art, that are tokenized into digital assets.

On the Cardano blockchain, the value proposition of RWAs lies in their ability to offer a stable and familiar investment option, bridging the gap between traditional finance and the digital world.

Their tokenization on Cardano’s secure and scalable platform could enhance liquidity, transparency, and broaden investor appeal, potentially bridging traditional finance and the evolving DeFi sector.

Real World Assets tokenization will play a hugely important role in Cardano’s roadmap for 2024 as the Cardano blockchain has the capacity to accept rich metadata unlike other L1 blockchains like Bitcoin & Ethereum.

Furthermore, RWAs in DeFi can yield stable, cryptocurrency market-independent returns, paving the way for a new era of economic stability and broadened financial inclusion.

Real World Asset Tokenization Platforms On Cardano?

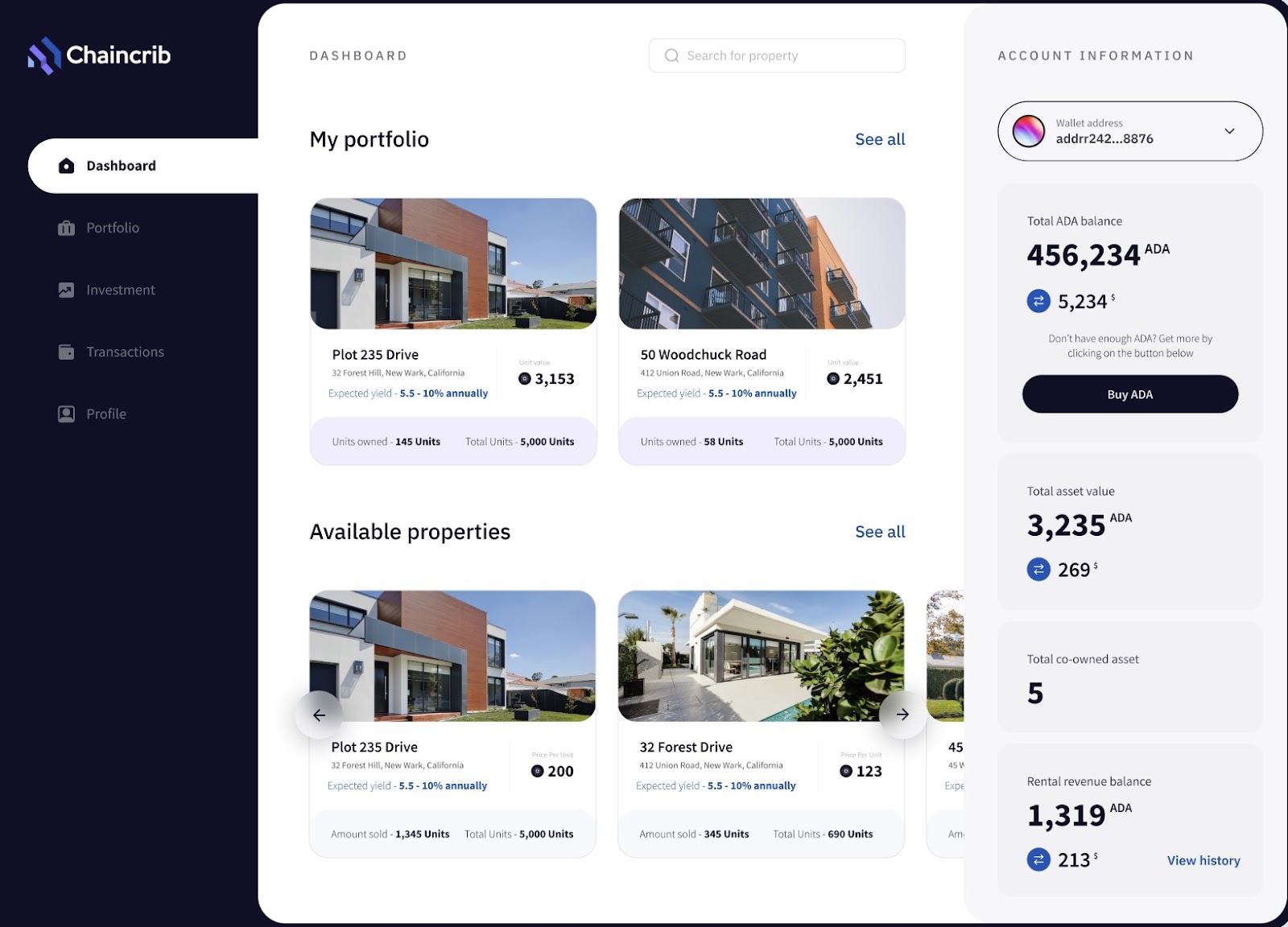

There are currently a couple of real world asset tokenization platforms currently on Cardano but none stands out like Chaincrib, first announced couple of months ago with a mention from Cardanocube, a prominent Cardano ecosystem explorer which further cements the unique value proposition Chaincrib brings to the Cardano ecosystem.

According to their first medium blog post, ChainCrib aims to simplify investment in real estate property assets utilizing the Cardano blockchain to offer a secure, efficient way to tokenize real estate, providing investors with stable income streams, independent of crypto volatility.

The Future Of The DeFi RWA / Tokenization

As we witness the dynamic growth of the DeFi market, it’s clear that the integration of RWAs could mark a turning point. As traditional financial institutions join this digital evolution, the future seems ripe with possibilities.

For those looking to be part of this transformation, ChainCrib offers a unique opportunity. You can learn more about Chaincrib by Visiting the website chaincrib.com or joining the Telegram community.