BitBuy and Newton imposed rules to limit users in Ontario from buying more than $30K CAD worth of altcoins in a given year.

The crypto world’s graph is moving upwards at a fast pace. Crypto giants and regulators across the world are becoming aware of the protection of crypto enthusiasts. Keeping that in mind, various impositions and regulations are enforced in the crypto space. Canada-based crypto exchanges, Bitbuy and Newton, enforced a 30,000 Canadian dollars annual purchase limit for restricted altcoins for the users based in certain provinces in order to protect them amid tightened regulations.

In recent developments, Newton and BitBuy are imposing the said purchase restriction for certain altcoins for customers based in Ontario to protect them.

Bitcoin And Ethereum Are Unrestricted

Newton, a Toronto-based popular crypto exchange, announced the new rules after working on getting registered with the Ontario Securities Commission and the securities regulatory authorities in other provinces and territories of Canada, meaning that Newton is bound to honour the rules set by the Ontario Securities Commission. Newton elaborated on this imposition, “These changes are to protect cryptocurrency investors, like yourself, and to make sure investors are aware of the risks associated with investing in crypto assets.”

Ontario-based crypto traders and investors will be subject to an annual 30,000 CAD net buy limit on all cryptocurrency coins on the Newton and other Canadian crypto platforms, including BitBuy. Under this rule, four cryptocurrencies are unrestricted, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH), which means users can trade however much crypto they want, and it will not count towards the limit.

BitBuy Is On A Mission To Protect Crypto

Canadian crypto exchange BitBuy also confirmed similar crypto buy restrictions earlier this year. It is to be noted that similar restrictions also apply to users in the territories of Manitoba, Prince Edward Island, New Brunswick, Newfoundland, Labrador, Ontario, Nova Scotia, Northwest, and Nunavut and Yukon.

BitBuy requires traders to fill out a form to determine whether the investor qualifies as a Retail Investor, Eligible Investor or Sophisticated Investor. However, Retail Investors are limited to the 30,000 CAD buy limit, Eligible Investors’ buy limit is increased to 100,000 CAD, and there is no purchase limit for Accredited Investors.

The Buy-Sell Mechanism

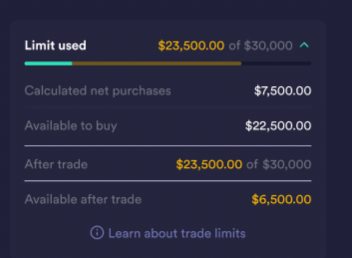

Regarding the buy-sell mechanism, Newton said, “When you buy restricted cryptocurrencies, you use some of your limit. Selling restricted cryptocurrencies will add space back to your limit (to a maximum of $30,000).”

For example, if a user buys $25,000 worth of Solana, a restricted crypto, the user would have used $25,000 of his $30,000 annual limit. So, if he wants to buy more crypto, he is limited to buying a maximum of $5,000. But then, if he sells $10,000 worth of SOL, it will increase the net buy limit to $15,000.

Alongside, if someone buys $40,000 of Bitcoin and sells $10,000 of Ethereum, his limit will remain unchanged because the said coins are listed as unrestricted cryptos.

The $30,000 limit will be reset every year, and the limits have been imposed by the Ontario Securities Commission (OSC) and the Canadian Securities Administrators (CSA).

Conclusion

The Ontario province alone accounts for nearly 40% of the Canadian population, and Toronto is the major metropolitan hub. The ban is expected to reduce uncontrolled crypto transactions and risks in Canada. Consumer protection is the main focus of Canadian regulators. In April 2021, the Canadian federal government announced that it would undergo a legislative review on the financial sector of Canada, focusing on improving the stability and security of digital currencies by establishing a central bank digital currency (CBDC).