In an astonishing week for digital asset investment, the latest report from CoinShares reveals that inflows into digital asset investment products have shattered previous records, amassing a staggering $2.45 billion in a single week. This surge propels the year-to-date inflows to an impressive $5.2 billion, showcasing a robust and growing investor appetite for cryptocurrency and related products.

The inflows have not only underscored the burgeoning interest in digital assets but have also pushed the total assets under management (AuM) to $67 billion, a figure not seen since the heights of December 2021. This remarkable milestone highlights the resilience and expanding appeal of the digital asset market amidst a landscape of financial uncertainties and shifting investment trends.

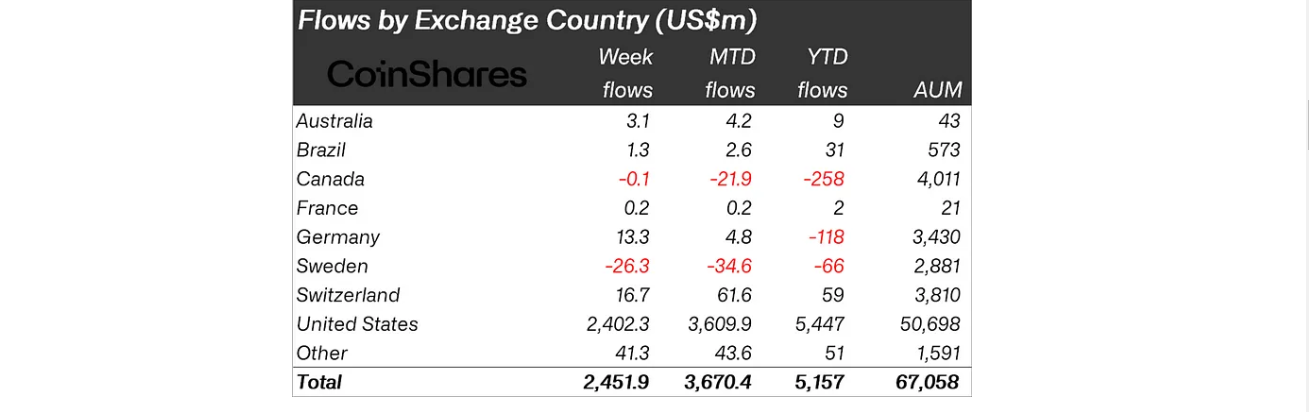

A Closer Look at the Geographic Distribution

The United States emerges as the unequivocal leader in this investment frenzy, commanding 99% of the total inflows, which amounts to approximately $2.4 billion. This overwhelming dominance indicates a significant shift towards spot-based ETFs, suggesting a maturing market with investors seeking more traditional and regulated avenues to enter the crypto space. The wide distribution of inflows among various providers further underscores the diversification and depth of interest across the board.

Conversely, Europe presents a mixed picture with Germany and Switzerland witnessing modest inflows of $13 million and $1 million respectively, while Sweden faced outflows totaling $26 million. This divergence reflects the nuanced regional appetites and regulatory landscapes influencing investment decisions in digital assets across the globe.

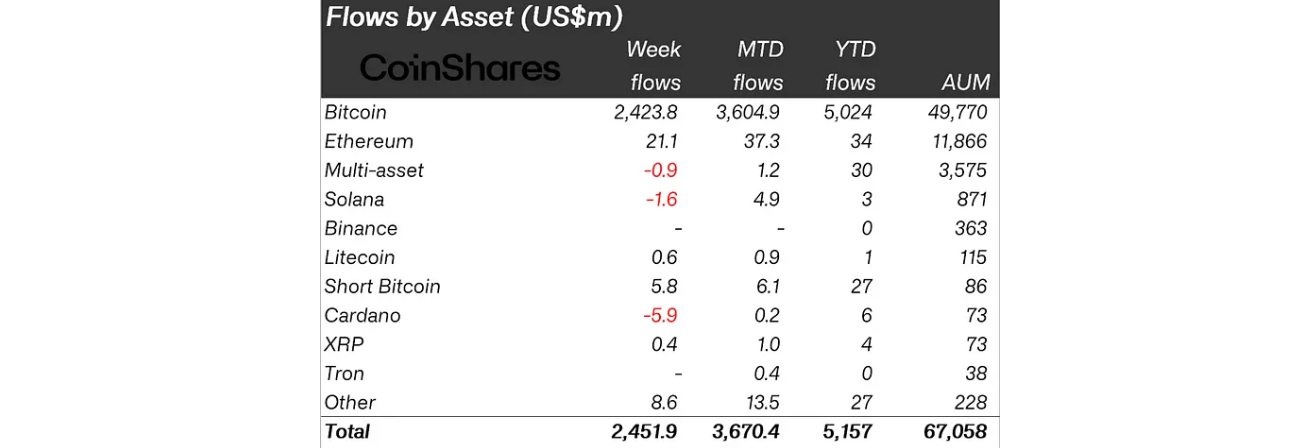

Bitcoin and Ethereum Lead the Charge

The investment inflow has been predominantly concentrated in *BTC*, capturing over 99% of the total influx. This demonstrates unwavering confidence in Bitcoin as the flagship digital currency, despite some investors exploring short positions, which themselves attracted $5.8 million. *ETH* also enjoyed positive momentum, with $21 million in inflows, signifying its continued relevance and potential within the digital asset ecosystem.

Notably, other cryptocurrencies such as Avalanche (AVAX), Chainlink (LINK), and Polygon (MATIC) have consistently attracted weekly inflows, signaling a broader interest beyond the leading coins. These inflows reflect investors’ search for diversification within their digital asset portfolios, exploring potential growth opportunities beyond the established giants.

Crypto Market Gets Bullish Momentum

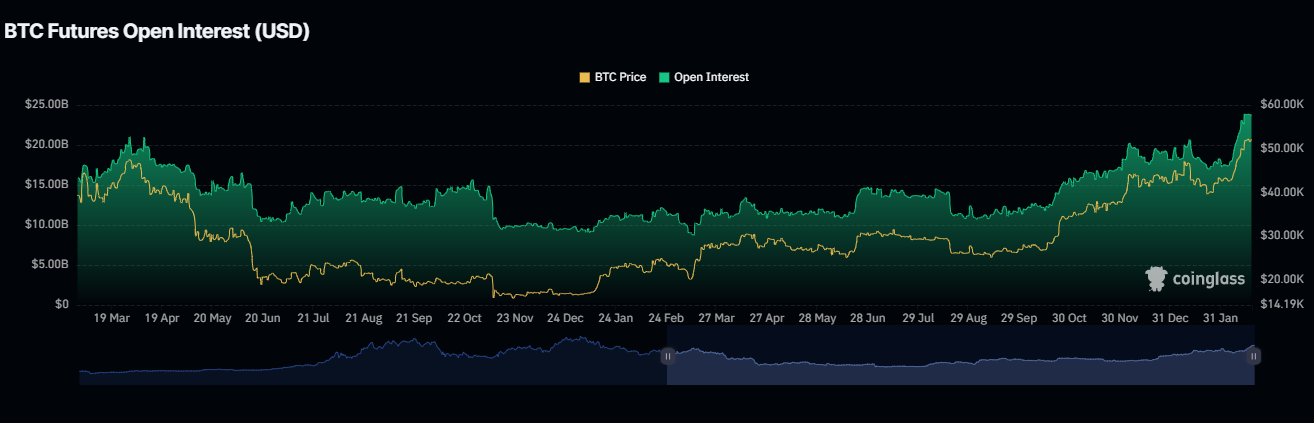

The crypto market has responded to these developments with palpable optimism. Bitcoin’s price has surged to $52,152, marking a 0.42% increase over the last 24 hours and an impressive 27.11% uplift over the past month. This bullish trend is further supported by a 1.26% increase in Open Interest for Bitcoin futures, indicating a healthy and dynamic market environment.

The concentration of Open Interest on platforms like Binance, Bybit, and OKX illustrates the global nature of Bitcoin trading and the diverse ecosystems supporting its growth. This dynamic interplay between investment inflows and market performance underscores the vibrant and evolving landscape of the digital asset sector.

As the digital asset market continues to mature, the unprecedented inflows into Bitcoin spot ETFs and the broader crypto space reflect a significant shift in investor sentiment and strategy. With regulatory clarity and institutional adoption on the horizon, the digital asset market stands at the cusp of a new era of growth and innovation.