In a noteworthy development within the dynamic realm of cryptocurrency, Bitcoin (BTC) whales—large holders of the digital asset—appear to be adopting a risk-averse stance, a strategic move that coincides with the heightened anticipation surrounding the U.S. Securities and Exchange Commission’s (SEC) impending decision on Bitcoin spot exchange-traded funds (ETFs).

The discerning eye of Ki Young Ju, the founder and CEO of CryptoQuant, shed light on this shift in behavior, a trend that has captured the attention of the crypto community. Ki Young Ju took to X (formerly Twitter) to share his insights, succinctly stating that Bitcoin whales were shifting to risk-off mode and avoiding sending BTC to derivative exchanges.

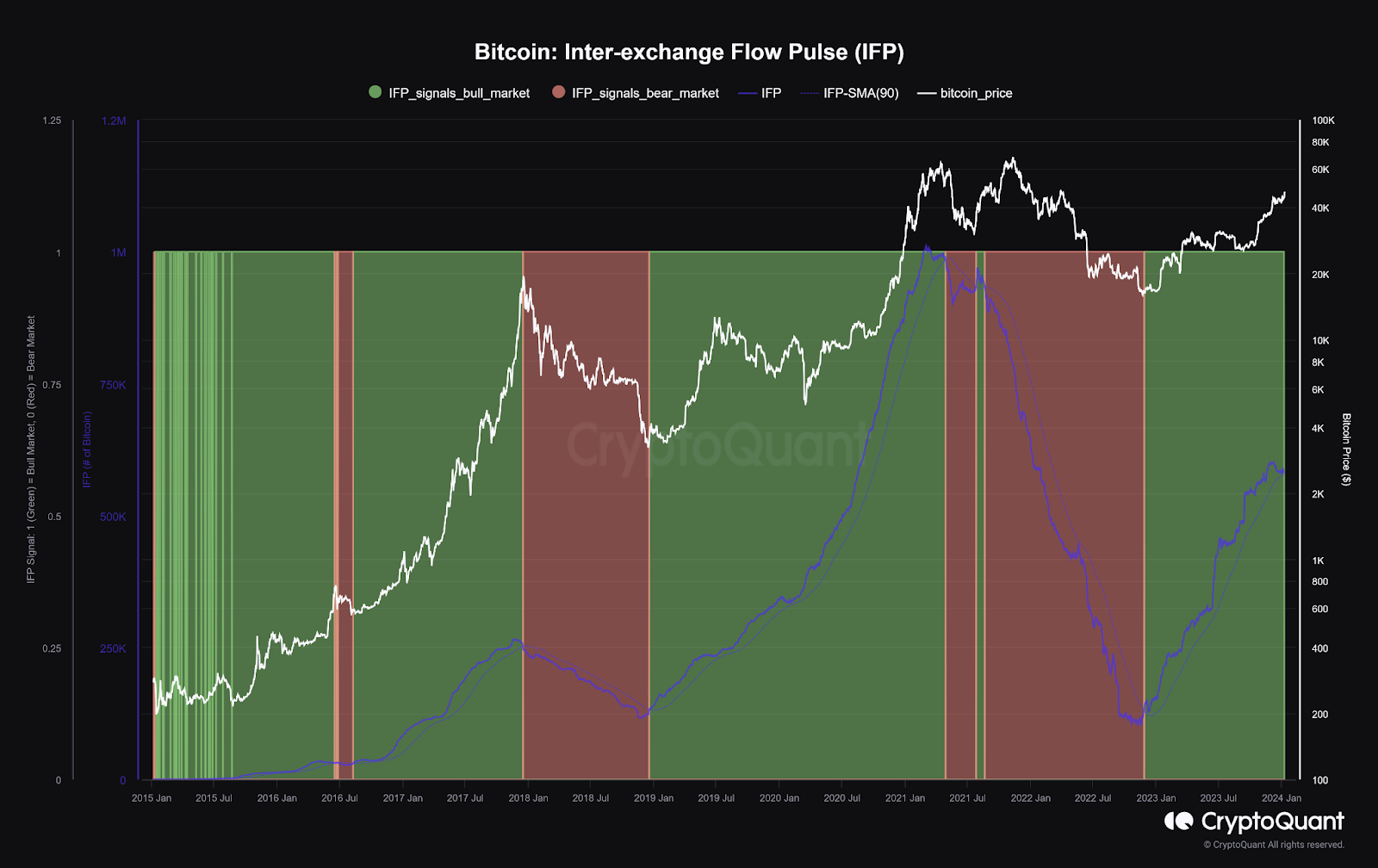

Accompanying this proclamation was The Inter-exchange Flow Pulse (IFP) chart—a powerful analytical tool that measures Bitcoin flows between spot and derivative exchanges. Leveraging CryptoQuant’s rich exchange flows data, the IFP chart serves as a valuable indicator of market sentiment. Specifically, it gauges the ebb and flow of Bitcoin between spot and derivative exchanges, with an increasing or decreasing trend often aligning with bullish or bearish market conditions.

The strategy adopted by astute market participants involves seeking exposure to Bitcoin during periods when the IFP exhibits an upward trend. The historical analysis of Bitcoin flows, particularly when the IFP crosses its 90-day moving average, has proven to be a reliable signal for identifying the onset of bull and bear markets.

As of the latest market update, Bitcoin (BTC) is trading at $46,717, showcasing a noteworthy 6.37% increase over the last 24 hours. Notably, Bitcoin briefly touched the $47,000 mark on Monday before dipping to the current level. In addition, the 24-hour trading volume for Bitcoin has experienced a significant surge, catapulting by 71.57% and currently standing at an impressive $41,285,178,072.

Bitcoin Spot ETFs Decision

Adding fuel to the speculative fire, reports are circulating that the SEC might be on the cusp of approving Bitcoin spot ETFs—a potential watershed moment in the broader acceptance of this digital asset class. Recent applications from financial heavyweights like BlackRock and Fidelity have only served to amplify these speculations, signaling an increasing interest from institutional players seeking exposure to the burgeoning crypto market.

In a tweet that added an extra layer of intrigue, Nate Geraci, President at The ETF Store, suggested that BlackRock seemed to believe that Wednesday (January 10) would be the day for the approval of a spot Bitcoin ETF. If proven accurate, this Bitcoin spot ETF speculation could herald a new era for cryptocurrency investments, attracting a wave of institutional capital.

As traders and investors eagerly await the SEC’s decision, the market finds itself on tenterhooks, recognizing the potential implications of an ETF approval. Bitcoin whales, ever the strategic players in this ecosystem, are positioning themselves in a risk-averse mode, anticipating and preparing for potential market dynamics that may unfold in the aftermath of this pivotal regulatory decision.

The imminent SEC verdict carries profound significance for the broader cryptocurrency landscape, with the potential to reshape market dynamics and fuel renewed interest from institutional players. As the crypto community holds its collective breath, eyes remain firmly fixed on the SEC, awaiting the decision that could potentially propel Bitcoin into a new phase of acceptance and legitimacy.