Cryptocurrency investors brace for possible turbulence in the

Bitcoin$98,835.00

Bitcoin Faces Critical Juncture: Key Levels and Technical Indicators in Focus

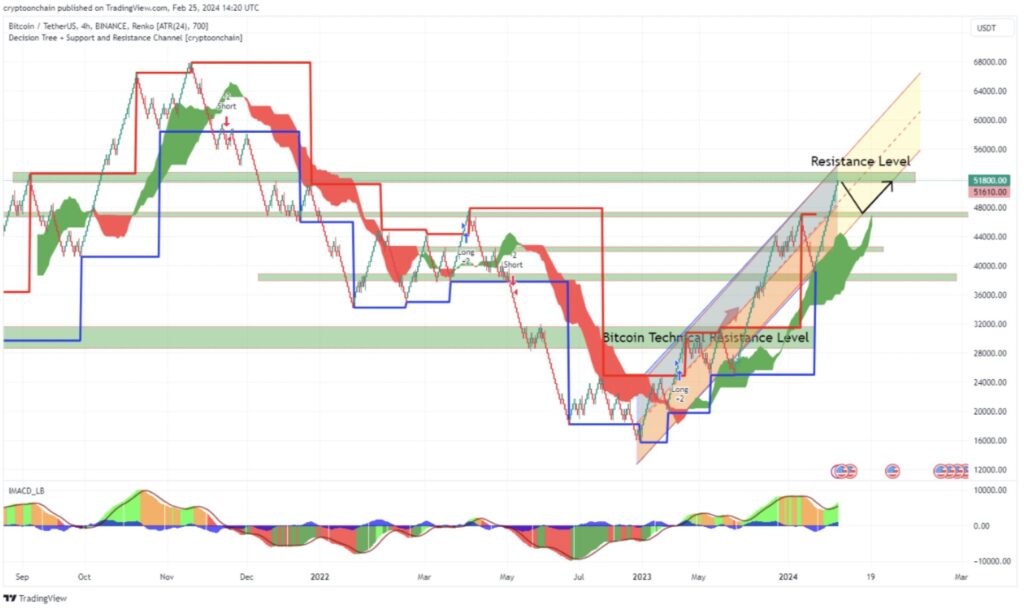

Bitcoin, which has been trading above the 50-day and 200-day Exponential Moving Averages (EMAs), providing bullish signals, now faces a critical juncture. Analysts highlight that a breakthrough above the $52,500 level could propel Bitcoin towards the $53,000 resistance level and potentially surpass last week’s high of $53,026. However, a downward shift below the $50,500 support level could pave the way for bears to target the $48,178 support level.

The analysis further points to the 14-Daily Relative Strength Index (RSI) reading, currently at 66.47, indicating that Bitcoin might test the $53,000 resistance level before entering overbought territory. This assessment underscores the potential for short-term price fluctuations in the market.

One of the key metrics driving this prediction is the 30-day moving average of short-term Holder Spent Output Profit Ratio (SORP), which suggests that Bitcoin is nearing the selling zone for short-term investors. This observation aligns with technical chart analysis, indicating that Bitcoin is currently situated below resistance levels.

Factors Influencing Bitcoin’s Near-Term Trajectory

Additionally, market data from this week reveals that Digital Asset Fund flows amounted to $598 million, a decline from the previous week’s inflows of $2.45 billion. This diminishing trend in fund flows lends support to CryptoQuant’s forecast of a potential Bitcoin price correction.

While Bitcoin’s recent bullish momentum has buoyed investor sentiment, analysts caution that the market could experience increased volatility in the near term. Traders and investors are advised to closely monitor key support and resistance levels, as well as on-chain data, for insights into potential market movements.

As Bitcoin navigates this critical phase, market participants, including institutional investors, retail traders, and cryptocurrency enthusiasts, are closely monitoring its movements and preparing for a range of potential scenarios. With increasing mainstream adoption and regulatory developments shaping the industry, stakeholders are keenly aware of the need to stay informed and adaptable to changing market dynamics. This heightened vigilance underscores the importance of staying abreast of market trends and technical indicators to make informed decisions.