- Self Mining Updates May 2022

- Marathon Digital

- Monthly Bitcoin Mined For Each 1 EH/s

- Riot Blockchain

- Core Scientific

- Strategic, operational and financial breakdown

- What is riot blockchain?

- Why is riot blockchain going up?

- What does riot blockchain do?

A report on publicly traded cryptocurrency miners shows Core Scientific leading the way with $545 million in revenue in 2021, Riot Blockchain with $215 million, and Hive Blockchain with $195 million. Over the past few days, the three largest publicly traded Bitcoin miners, Core Scientific (CORZ), Marathon Digital (MARA), and Riot Blockchain, have provided data and statistics relating to their May operations. These three companies are considered “monsters” Bitcoin miners in terms of both their present capabilities and their potential for future expansion. “Hashrate” is a measure of a miner’s output, and “above 3.5 EH/s” indicates that the miner’s output exceeds that threshold.

The ability to raise considerable amounts of capital over the course of the previous 18 months has been of great advantage to all three miners. This has made it possible for their planned growth strategy to be implemented on a much greater scale than the majority of their peer miners. Additionally, every miner plays a significant part in the Bitcoin ecosystem by not only ensuring the safety of the network but also keeping or selling the Bitcoin that they have mined. In this article, Blockchainreporter.net examines the recent report on Core Scientific 545M and Riot Blockchain 215M earnings.

Self Mining Updates May 2022

| Marathon Digital | RIOT | Core Scientific | |

| April 30, 2022 Total HR | 3,900 | 4,700 | 8,900 |

| May 31, 2022 Total HR | 3,900 | 4,700 | 9,200 |

| Average HR April 2022 | 3,900 | 4,600 | 9,050 |

| Bitcoin Mined May 2022 | 258 | 466 | 1,138 |

| Bitcoin Mined per 1 EH | 66 | 101 | 126 |

| Bitcoin Mined April/Day | 10.0 | 16.9 | 37.4 |

| Bitcoin Mined May/Day | 8.3 | 15.0 | 36.7 |

| Day On Day Change | -16.5% | -11.2% | -1.8% |

| Future HR | 23,300 | 12,600 | 16,000 |

Marathon Digital

By the beginning of 2023, Marathon anticipates that all 199,000 miners, which will generate roughly 23.3 EH/s, will have been placed and activated. The company is maintaining the expectation that its mining pool activities will be completely free of carbon emissions by the year 2022. Marathon has not sold any Bitcoins and has increased the total number of Bitcoins they own to 9,941. These Bitcoins currently have a market value of $316 million, and Marathon also has additional cash and around $86 million worth of accessible credit facilities.

At this time, Marathon has 19,000 miners, which is equivalent to around 1.9 EH/s, that have been installed and are waiting to be powered on at a variety of Compute North locations. Compute North’s first significant facility is located in West Texas, and it boasts an extra 9,000 units, which are equivalent to 0.9 EH/s. This initial main structure is being constructed in four phases. The first stage is already complete. By the end of the third quarter of 2022, the facility that will house roughly 68,000 Marathon miners will be entirely constructed, and all miners will be installed.

The Las Vegas-based company continues to encounter delays in powering up Compute North’s Texas facilities. In the investor note, Chairman and CEO of Marathon Fred Thiel stated that miners need to begin coming online in the month of June. Marathon continues to collaborate with Compute North to obtain a deeper understanding of the energy provider’s schedule. The location in Hardin, Montana, has also had a negative impact on Marathon’s bitcoin output over the past year. Compared to what would have been anticipated based on the network’s hash rate during the month, the company’s Bitcoin earnings in May were around 47% lower.

Marathon is certain that its production levels will continue to rise over time as they advance its deployment plan and revitalize its miners that have been deployed in Texas. Marathon maintains its expansion to 13.3 EH/s by the end of Q3, with the Compute North 280 MW facility projected to be completed by the end of Q3 2022, holding around 68,000 of Marathon’s miners, or 6.8 EH/s.

Monthly Bitcoin Mined For Each 1 EH/s

| Jan 22 | Feb 22 | Mar 22 | Apr 22 | May 22 | Performance % | |

| Iris Energy | 157 | 130 | 142 | 132 | 130 | 100.00% |

| Core Scientific | 153 | 125 | 139 | 130 | 126 | 97.31% |

| RIOT | 141 | 119 | 125 | 113 | 101 | 86.67% |

| Marathon Digital | 130 | 97 | 113 | 77 | 66 | 69.91% |

Riot Blockchain

The report on Core Scientific 545m and Riot Blockchain 215m revenue states that Riot forecasts a total self-mining hash rate capacity of roughly 12.6 EH/s by the end of January 2023, under the assumption that the company will have fully deployed around 116,150 Antminer ASICs by that time. This hashrate does not take into account any of the possible benefits that could be gained from the infrastructure that uses immersion cooling technology, which totals 200 megawatts (MW). The company presently offers 200 MW of Bitcoin mining hosting facilities to institutional clients.

Riot controls roughly 6,536 Bitcoin, all of which were generated through their own mining efforts. In May, Riot sold 250 Bitcoin, or roughly $7.5 million. In the month of May, a number of miners also sold some of their Bitcoin in order to assist them in meeting their operating and capital requirements. Riot has revealed that their immersion building is currently filled with about 23,000 S19 series miners, 7,000 of which are staged in the immersion-cooling tanks and are projected to be deployed pending installation of the last needed components, delivering an increase in hashrate to 5.4 EH/s.

Riot has continued to make work on the ongoing construction of their Whinstone Facility in Rockdale, Texas. Riot further verified that they are now improving their overall hash rate and efficiency by upgrading their fleet of S17-Pro Antminers. As a result, these miners have been temporarily deactivated, and the hashrate of 225 PH/s is no longer considered towards their hashrate capacity number. The company anticipates deploying 51,313 miners with an approximate hashrate capacity of 5.4 EH/s.

Core Scientific

Core Scientific presently manages over 170,000 owned and colocated ASICs servers in the Company’s five data centers. During the previous month, Core Scientific produced 1,138 self-mined Bitcoin, which was more than any other public company in North America produced. In addition to boosting the hashrate of their own self-mining operations by 300 PH/s to 9.2 EH/s, the company offers data center colocation services, as well as technological and operational assistance, to a growing customer base that collectively accounts for 7.9 EH/s.

The miner reduced its 2022 hashrate forecast from 40-42 EH/s to 30-32 EH/s and now anticipates total power of approximately 1 gigawatt, as opposed to its previous forecast of between 1.2 and 1.3 gigawatts (GW). During the course of the month, the company with headquarters in Austin shut down 13 separate sections of its data center activities in the state of Texas, thereby conserving a total of 1,218-megawatt hours of power. This is a frequent event for all miners, who continue to collaborate with the towns and energy providers in which they function to enable and maintain the stability of the electrical grid.

Core Scientific Chief Executive Officer Mike Levitt stated earlier in the month of May that the company is not interested in releasing equity at this time because of the current market conditions and that the company may sell some of its mined coins during the course of this year. At the end of the month of May, the corporation had 8,058 Bitcoins generated by its operations, having sold 2,698 Bitcoins.

Strategic, operational and financial breakdown

Hash rate and revenue are just two of the many metrics that may be used to differentiate between organizations; however, these metrics do not provide a complete picture because some companies generate revenue in ways that are unrelated to their primary mining operations. The research dissects these critical statistics and provides a comparative analysis that includes the strategic, operational, and financial performance of each organization. This report on Core Scientific 545m and Riot Blockchain 215m precisely discusses these things.

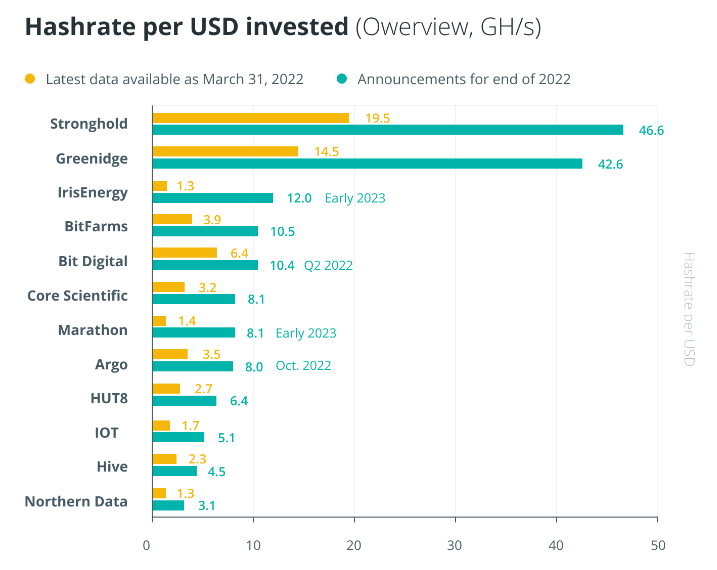

For instance, the report evaluates the activities of each organization based on the current hash rate per dollar invested. This makes it easy to determine which company delivers the greatest investment value to investors; in this case, Stronghold Digital Mining leads the field with 46.56 gigahashes per second (GH/s). In addition to this, the study offers a concise summary of the activities of each company, detailing each organization’s operational key performance indicators (KPIs), business model, data center locations, BTC holdings, and other relevant information.

To be more specific, large players like Marathon have streamlined operations and are wholly dependent on being hosted by third-party providers, whilst other major players, like Stronghold, own their assets together with the full value chain, which includes the electrical infrastructure. Instead of relying exclusively on financial data and public remarks, Crypto Oxygen has furthermore undertaken a poll to collect direct feedback from the assessed companies.

What is riot blockchain?

Riot Blockchain is one of the largest publicly traded Bitcoin miners in North America that is situated in the United States and is continually aiming to increase its efficiency and output. Riot Blockchain is dedicated to supporting the Bitcoin ecosystem via mining proof-of-work (PoW). It is a Bitcoin believer, and its efforts to expand its mining operation indicate its dedication to the Bitcoin network.

The Company operates a data center for Bitcoin mining in central Texas, Bitcoin mining activities in central Texas, and electrical switchgear engineering and construction in Denver, Colorado. Whinstone U.S. is a wholly-owned subsidiary of Riot Blockchain, and its 750 MW built capacity makes it the largest Bitcoin mining and hosting facility in North America. Currently, Riot has a deployed hash rate capacity of 4.6 exahash per second (EH/s), requiring roughly 136 megawatts (MW) of electricity.

Why is riot blockchain going up?

The nine analysts providing 12-month price projections for Riot Blockchain Inc have a consensus price target of 15, with a high estimate of $42 and a low estimate of $12. The median estimate reflects a rise of 80.07 percent from the previous price of $8.33. Nonetheless, Riot’s stock could beat Bitcoin’s price if this occurs, as the company will mine more Bitcoins on its own. In other words, Riot is risky, but it is still worth purchasing at these rock-bottom prices if you trust in Bitcoin’s long-term potential.

What does riot blockchain do?

Riot Blockchain, Inc. is a Bitcoin mining startup that supports the Bitcoin blockchain by rapidly establishing large-scale Bitcoin mining operations in the United States. Riot Blockchain is focused on extending its operations by boosting the hash rate and infrastructure capacity of its Bitcoin mining business. Riot anticipates a total self-mining hash rate capacity of approximately 12.6 EH/s by January 2023, guessing full deployment of roughly 116,150 Antminer ASICs and excluding any prospective value-based gains in productivity from the Company’s utilization of 200 MW of immersion-cooling facilities, which is approximately 50% complete. Approximately 100% of the Company’s self-mining fleet will consist of the latest generation S19 series miner.