After experiencing a period of bearish consolidation, the price of Bitcoin has seen an upturn in buying demand. This shift is due to a decrease in the ‘sell the news’ event, along with the fact that numerous ETF providers have begun to accumulate BTC. As a result, there’s a noticeable increase in buyer confidence, suggesting that Bitcoin may soon breach a significant resistance channel. Despite this bullishness, on-chain data indicates potential risks, hinting at the possibility of a sudden reversal and a potential false breakout.

BTC Price Sets Its Bullish Targets

The week started with a bullish momentum, successfully strengthening the existing bullish pattern as Bitcoin’s price surged past the crucial $43,000 mark, aiming for $44K-$45K. This rise has paved the way towards higher resistance levels. Consequently, the pressing question now is whether the anticipation for a 2024 bear market is increasing, or if this signifies yet another opportunity for traders to sell at higher, resulting in a market correction.

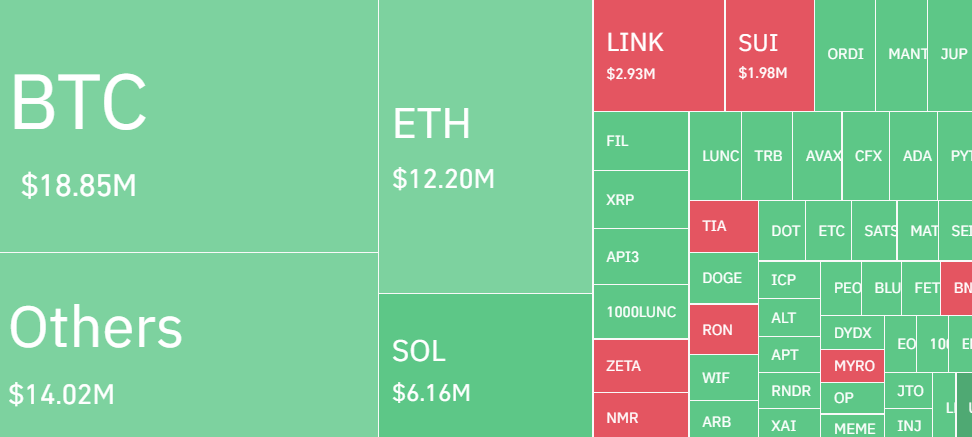

According to Coinglass data, in the past 24 hours, the Bitcoin market experienced a total liquidation of approximately $18.8 million. This included the liquidation of about $10.6 million in long positions by buyers and over $8.2 million in short positions by sellers. This activity shows a strong contest between buyers and sellers in the $42K to $44K price range.

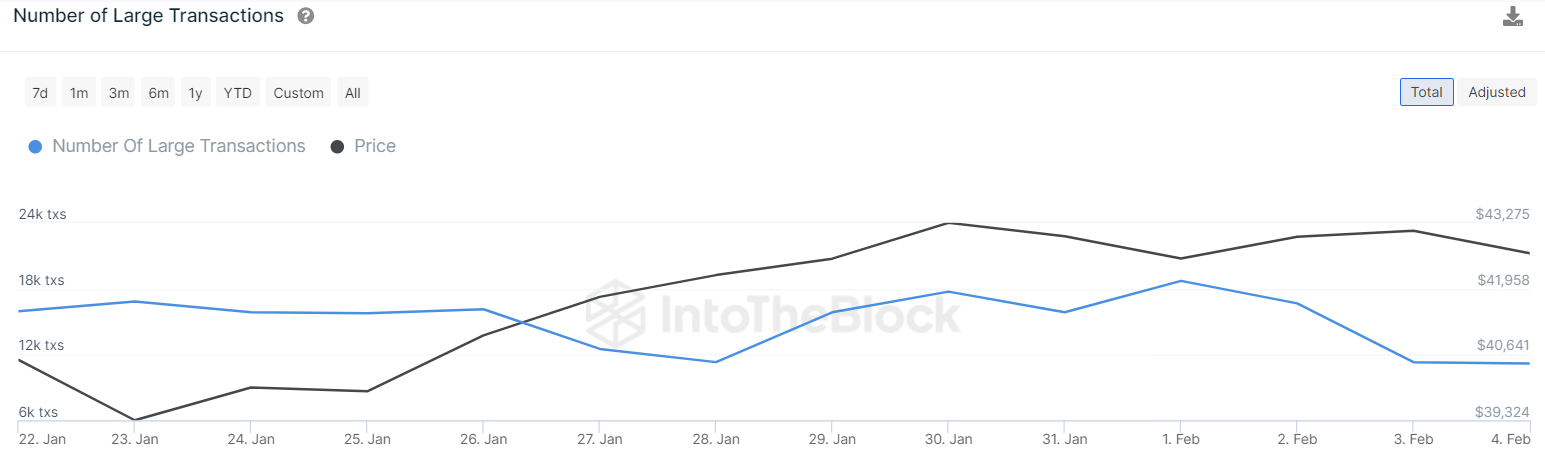

Santiment, an on-chain analytics platform, reports that the count of Bitcoin addresses with holdings ranging from 1,000 to 10,000 BTC has risen by 47 wallets, marking a 2.5% increase over a span of six days. As a result, the total number of addresses in this category climbed to 1,958, reaching its peak since November 2022. However, the number of large transactions witnessed a decline in the last three days as it dropped from 18.7K to 11.1K, signaling a minor drop in whale interest.

However, as the Netflow remains in the negative region, we might see accumulation by whales as the BTC price is set to break the $43K channel. This might also trigger the loss-making addresses to liquidate their holdings wherever the concentration is high, leading to a rejection and false breakout.

The accumulation by numerous large-scale holders indicates ongoing confidence in Bitcoin amidst its present consolidation phase. However, it’s important to remember that whale accumulation is just one among various factors impacting the price. While Bitcoin’s current price trend may appear blurry, the on-chain suggests a bullish shift fundamentally. This is supported by the recent influx of $1.7 billion into Bitcoin spot ETFs over the last 14 days.

What’s Next For BTC Price?

Bitcoin has managed to remain above its 20-day exponential moving average ($42,932) recently, yet the bulls haven’t been able to overcome the key resistance level at $44K. As of writing, BTC price trades at $43,150, increasing over 0.56% from yesterday’s rate.

The slow recovery from the 20-day EMA hints at a reduced buying interest at higher levels. Currently, buyers are attempting to hold above the resistance line at $43.8K to trigger a wave of short-liquidation. In such a case, BTC price might aim for a retest of $45K region.

The resistance at $44,700 is a critical level to monitor for an upward move. A decisive break and closure above this threshold would indicate that the bulls have regained dominance, potentially paving the way for a rally towards long-term bullish goals.

On the 4-hour chart, both moving averages have leveled off, and the RSI hovers around the midpoint, reflecting a balance between buyers and sellers. A drop below the 20-day EMA would give the sellers an edge. In this scenario, the price could drop to $41,500.

For the bulls to take charge, they need to push the price beyond the $44,000 to $44,700 resistance zone. Should they achieve this, the price might ascend to $47,000. However, this level could pose a strong challenge, possibly leading to a retraction back to $44,000. Should the bulls turn this level into a support, the BTC price might then continue its upward trend and aim for the $50,000 mark.