The cryptocurrency market has once again been electrified by a surge in *BTC* activity, with a notable uptick in whale accumulation capturing the attention of investors and analysts alike. According to insights shared by prominent crypto analyst Ali Martinez on social media platform X (formerly Twitter), a staggering 73 new whales have emerged within the Bitcoin ecosystem over the past fortnight, each amassing holdings of 1,000 BTC or more.

This surge in whale accumulation, marking a substantial 3.66% increase within a mere two-week period, underscores a renewed bullish sentiment pervading the crypto landscape. The emergence of these new whales, characterized by large-scale accumulation of Bitcoin holdings, underscores a growing confidence and optimism surrounding the digital asset.

Traditionally, whale activity has been closely monitored within the crypto community as it often serves as a barometer for market sentiment and future price movements. The entry of such a substantial number of new whales into the Bitcoin ecosystem suggests a renewed belief in the long-term value proposition of the leading cryptocurrency, despite ongoing market volatility.

Bitcoin Price Dynamics

At the time of this report, Bitcoin is trading at $42,867, reflecting a modest yet notable uptick of 0.35% over the past 24 hours. However, amidst the apparent stability in price, the market has not been devoid of volatility, as evidenced by Coinglass data indicating total liquidations amounting to $17.64 million for Bitcoin within the same timeframe. Of this sum, long liquidations account for $9.90 million, while short liquidations stand at $7.73 million, emphasizing the dynamic nature of cryptocurrency trading.

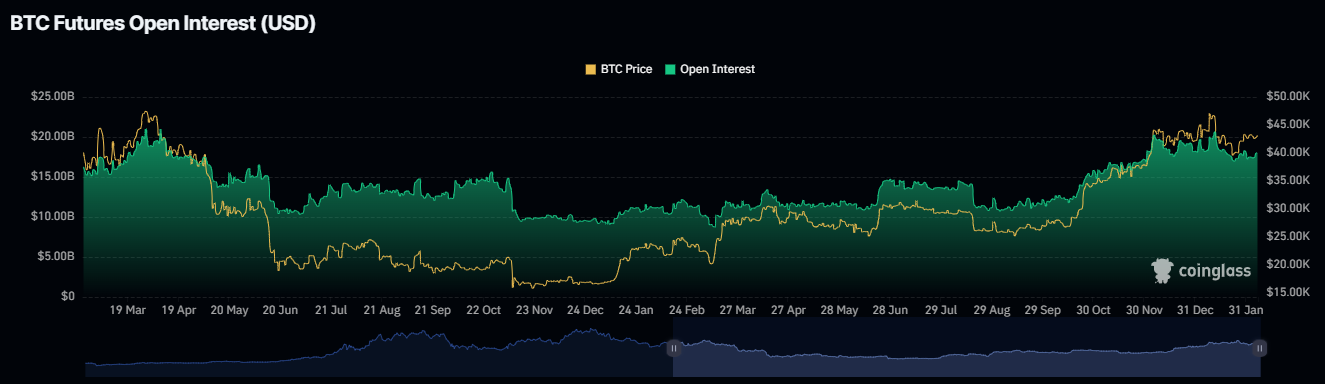

In tandem with the surge in whale accumulation and price fluctuations, Coinglass data reveals a notable increase in Open Interest for Bitcoin derivatives, which currently stands at $17.99 billion, marking a commendable 0.65% uptick. Notable exchanges facilitating this surge in derivatives trading include industry giants such as Binance, boasting an Open Interest of $3.40 billion, followed closely by Bybit with $2.51 billion, and OKX with $1.05 billion, among others.

The influx of new whales accumulating substantial *BTC* holdings, coupled with the growing interest in derivatives trading, reflects a broader trend of increasing institutional and retail adoption of cryptocurrencies as viable investment assets. As the community continues to recognize the intrinsic value and potential of Bitcoin as a hedge against traditional financial systems, the leading cryptocurrency remains poised to redefine the future of finance.

While the crypto market navigates through its characteristic volatility and uncertainty, the surge in whale accumulation and derivatives trading activity serves as a testament to Bitcoin’s enduring resilience as one of the best crypto to buy now. As investors and analysts closely monitor developments within the crypto sphere, the spotlight remains firmly fixed on Bitcoin’s trajectory, as it continues to chart new highs and redefine paradigms within the ever-evolving world of finance.