Bitcoin (BTC) successfully rebounded above $59,000 as the market steadied following reports that an Israeli strike on Iranian military installations resulted in minimal damage. Bitcoin has launched a strong impulse higher, capturing the attention of traders and investors. The leading cryptocurrency is now focusing on the critical $66,000 resistance level, a pivotal point that could set the stage for a new all-time high if successfully breached. With the Bitcoin halving event now having only 100 blocks remaining, the volatility in the market continues to increase.

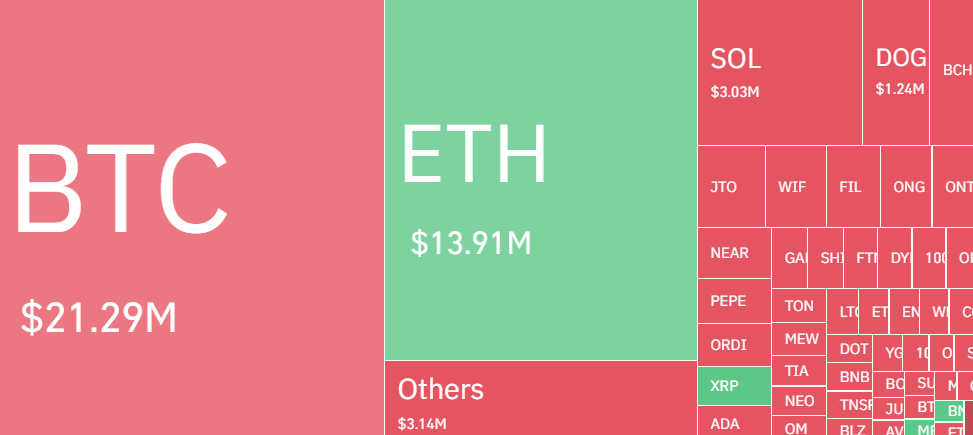

Bitcoin Faces $20 Million Liquidation

Over the last four hours, *BTC* price has been facing intense bullish pressure as buyers continued to accumulate near the $59K-$60K. As a result, the price made a solid rebound, aiming to meet short-term buyers’ goals in the coming hours, triggering $20 million in liquidations.

The increased interest from longs has been instrumental in driving the price up, contributing to the short squeeze that saw many bearish bets liquidated. According to a prominent crypto analyst, the Cumulative Volume Delta (CVD) indicators and delta movements have highlighted a predominantly spot-driven rebound in Bitcoin’s price. The spot market, often considered the backbone of pricing in the crypto market, has seen a robust influx of buying pressure. Simultaneously, the derivatives market has been marked by large deltas and volumes, particularly in perpetual swaps, where the unwinding of short positions has further fueled the rally.

Analysts are closely monitoring the $66K mark which might provide the technical support to Bitcoin in breaching additional resistance lines. Market analysts are closely monitoring the U.S. trading session, which could provide additional momentum to the ongoing trend.

According to Skew, if the price breaks above $66K, we might see another uptrend or even BTC price might head toward new ATH.

Prices are expected to stay higher due to the anticipated approval of future spot ether (ETH) ETFs, expected interest rate cuts from central banks, and regulatory shifts, rather than being significantly influenced by the halving event.

Attention in the market is likely to shift towards ETF performance, as the Bitcoin ETF sector has experienced a change in sentiment, evidenced by a recent drop in investment flows. According to data from a top analytics firm, Bitcoin spot ETFs saw a net outflow of $165 million yesterday alone, with Grayscale’s GBTC losing $133 million and BlackRock’s IBIT gaining approximately $18.09 million.

Despite this downturn, Bloomberg’s senior ETF analyst Eric Balchunas urges caution against making quick judgments about the sector’s future. He notes that such ups and downs are common after periods of rapid growth. This might keep investors and traders engaged, minimizing the impact of halving events.

What’s Next For BTC Price?

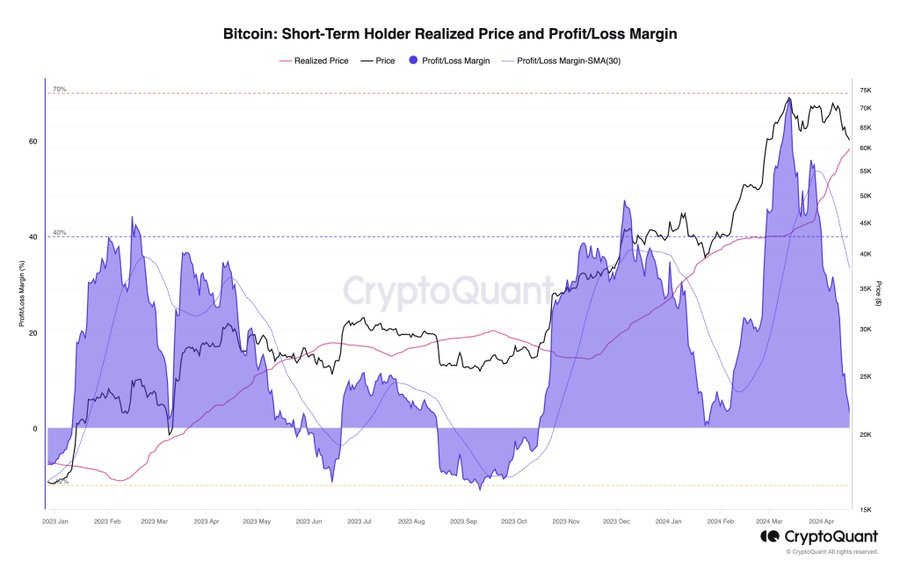

Bitcoin and cryptocurrency traders have had a tough week with multiple drops in Bitcoin’s price, but the recent significant rebound plunged sellers’ confidence. According to CryptoQuant data, traders’ holdings on exchanges have hit a breakeven point at $60,000, indicating lower selling pressure as their unrealized profit margins approach zero. An included chart showed the profit and loss situation for short-term holders (STHs)—those who have held BTC for 155 days or less.

Pullbacks like these are common after setting new all-time highs, and the recent peak before this week’s block subsidy halving heightened expectations for a BTC price correction.

The bears are attempting to push Bitcoin below the $60K support level again; however, buyers are defending strongly and are aiming for a significant push above $72K. If the price continues to charge above and breaks the moving averages, it could trap many aggressive bears, potentially triggering a short squeeze and boosting the chances of a rally to exceed $74K.

However, bears need to strongly protect the $66K mark, and if successful, the BTC/USDT pair could begin a descent to the 50% Fibonacci retracement level at $60K, and potentially further down to the 61.8% retracement level at $59K. While the bulls are expected to defend this zone vigorously, if the bears succeed, the pair could drop sharply to the pattern target of $54,300.