During the European morning hours on Wednesday, the price of Bitcoin (BTC) surged past $51,000, reaching a $1 trillion market capitalization for the first time since December 2021, according to available data. This increase was fueled by a positive outlook on the future expansion of the leading cryptocurrency, with options traders hoping that prices could soar to as high as $75,000 in the upcoming months. Additionally, the recent surge has triggered whales to take big risks ahead of the halving event and they have reentered the market, boosting the market confidence.

New Traders Target ATH In The Coming Weeks

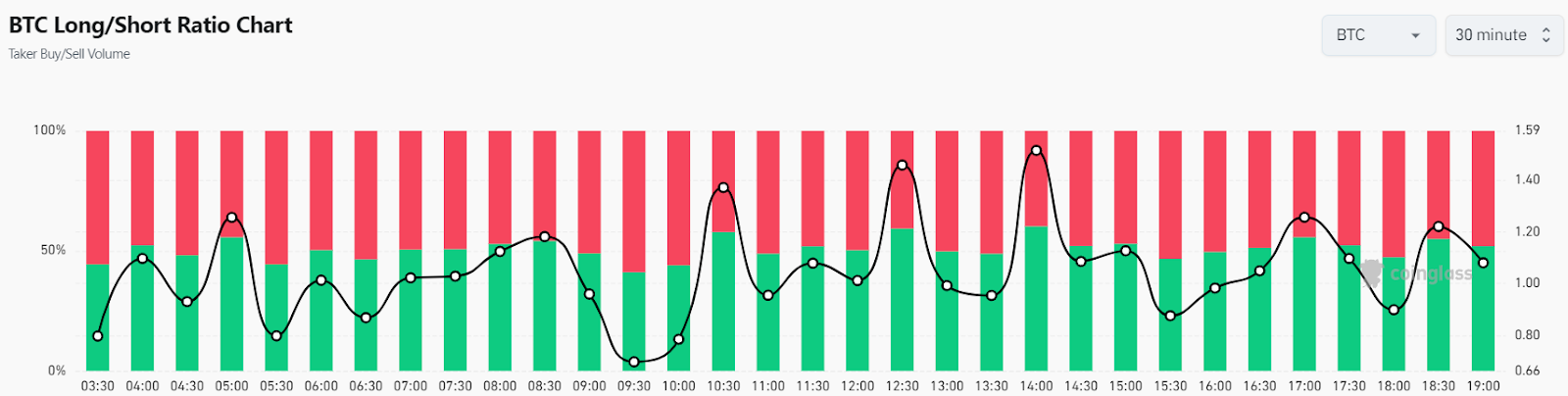

Over the last 12 hours, the crypto market witnessed a surge in total liquidation as the market trapped bearish with a significant surge in prices. According to Coinglass data, the total crypto market liquidations surpassed $113 million, out of which sellers liquidated around $102 million worth of short positions.

Interestingly, Bitcoin has done it again, reaching a market value of $1 trillion for the first time since December 2021. This big achievement puts Bitcoin ahead of huge companies like Walmart, Tesla, and Berkshire Hathaway, showing just how important it has become in the world of money and technology.

When we talk about how much Bitcoin is worth, we usually look at its market value, but that doesn’t tell us everything. There’s a lot going on behind the scenes that affects how much money is actually going into Bitcoin and how it’s being traded. That’s where a robust indicator called Realized Cap comes in. It looks at the last price each Bitcoin was traded at, which helps us understand its true value better than just the current price, according to Glassnode.

Bitcoin staying above $1 trillion isn’t just good news for its reputation; it also shows that big investors, or ‘whales,’ are getting ready to dive back in. There’s a surge in Bitcoin moving to derivatives, suggesting these big players are feeling confident and ready to make moves that could shake things up.

It is to be noted that the recent surge in Bitcoin, Ethereum, and other cryptocurrencies follows the disclosure that PayPal’s billionaire co-founder, Peter Thiel, has invested $200 million in Bitcoin and *ETH*.

Some traders are setting their sights on reaching the $64,000 mark in the next few weeks, fueled by increasing interest in spot Bitcoin exchange-traded fund (ETF) products. On Tuesday, BlackRock’s IBIT experienced close to $500 million in net inflows, signaling strong purchasing demand.

What’s Next For BTC Price?

Bitcoin surged past its $50K milestone but failed to defend increasing selling pressure triggered by bearish CPI news. As a result, BTC price declined toward $48,500, which triggered accumulation among traders. As of writing, BTC price trades at $51,606, surging over 3.3% from yesterday’s rate.

Bitcoin has recently seen its price rising above the $50K mark again and knocked the $52,000 resistance, aiming to continue its uptrend in the coming weeks. If Bitcoin maintains a value above $50,000, it will confirm the upward movement and pave the way for a potential increase beyond $52,000. This could send the BTC price above $59.2K.

The $50,000 mark might become a crucial support, and it might determine future BTC price trends. With strong volatility, a drop below the $50K mark will strengthen bearish positions resulting in a minor correction. As a result, we might see the BTC price hovering within $48K.

In recent minutes, the *BTC* has seen an increase in its long/short ratio, surging above 1 to stand at 1.0803. This indicates that buying volume is surpassing selling activity, as a greater number of traders are initiating long positions in anticipation of a big move above $52K. At present, 52% of all positions are betting on a price increase, whereas 48% are forecasting a decline in price.