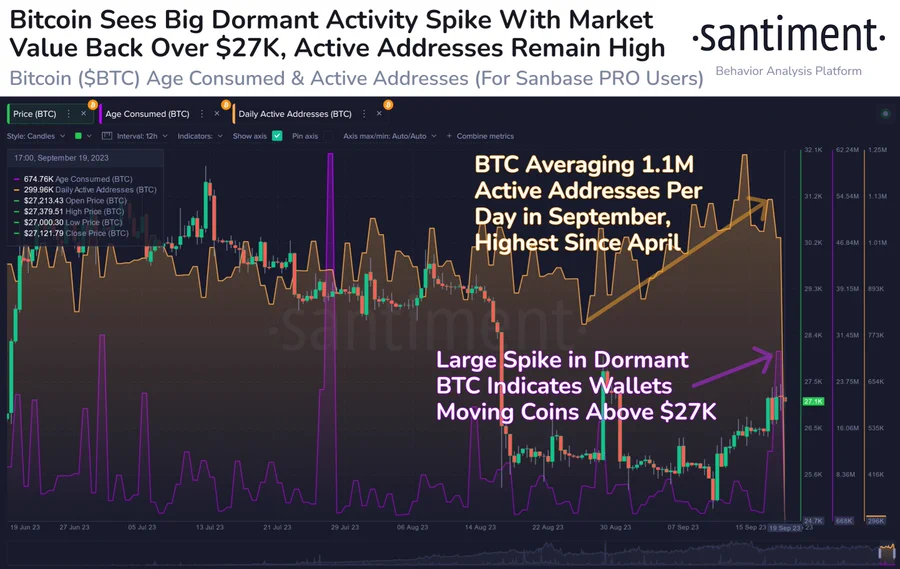

In recent weeks, Bitcoin has been making headlines with its wild and unpredictable price swings that have ignited passionate debates within the crypto market. As the price of BTC approaches the crucial threshold of $27,000, on-chain data from Santiment has unveiled a noteworthy surge in the dormant Bitcoin movement. Additionally, during this period, the number of active addresses has remained notably high, indicating the potential for significant market movements on the horizon.

On-chain Activity Meets Acceleration Amid Fed’s Rate Decision

Volatility, which measures the extent of price fluctuations in Bitcoin (BTC), continues to stay subdued, mirroring the tranquility observed in the U.S. stock and bond markets. Several cryptocurrency traders anticipate that this period of low volatility will persist even after the Federal Reserve (Fed) rate decision scheduled for Wednesday.

The recent movements in Bitcoin’s price have brought a sense of hope among traders as the asset makes its way towards the $27,000 mark. This positive trend comes after a bearish performance throughout the month of August and the initial two weeks of September. The renewed buying demand was generated following yesterday’s announcement of the Bitcoin adoption fund by Japanese banking giant Nomura.

Santiment’s data reveals that Bitcoin’s on-chain activity has been steadily increasing since April, indicating a surge in network engagement, even amidst price fluctuations in the range of $25,000 to $28,000. Additionally, Bitcoin’s daily active addresses have been on an upward trajectory since April, currently averaging approximately 1.1 million daily addresses.

Bitcoin’s price is fundamentally influenced by the interaction of supply and demand. More daily active addresses can indicate increased demand for Bitcoin, especially if it outpaces the rate at which new coins are being created (through mining). This demand-supply imbalance can drive prices higher.

Bitcoin’s Dormant Activity Jumps

Data reveals a spike in dormant BTC movement, which is the third largest in three months. Dormant Bitcoin movement can affect market liquidity. When previously inactive coins start to move, they become available for trading, potentially increasing the supply of Bitcoin in the market. If there is a sudden influx of previously dormant coins, it could temporarily affect the supply-demand balance, which can influence price movements.

The movement of dormant Bitcoin can shed light on the behavior of long-term holders (HODLers). If they are choosing to move their coins, it may signal a shift in their investment strategy or outlook on the market. This change in behavior can create selling pressure on the BTC price.

The difference between Bitcoin’s price movement and the level of daily active addresses, which continues to indicate substantial activity, suggests that despite significant accumulation by large investors (whales), their actions have had a limited impact on the price. This phenomenon strongly suggests that they are discreetly acquiring Bitcoin through over-the-counter (OTC) channels rather than executing large buy orders directly on exchanges.

Regarding today’s Fed’s decision, no interest rate hikes could potentially increase the Bitcoin price recovery momentum, providing it with more momentum. Conversely, an actual interest rate hike might catch Bitcoin holders off guard, increasing selling pressure on the cryptocurrency.

Furthermore, if there is a hawkish tone in the central bank’s statements, it could increase the likelihood of a future rate hike, potentially triggering a sell-off in crypto assets. Historically, the immediate response to interest rate hikes by the US central bank has been a negative shock to Bitcoin’s price. Market participants tend to withdraw capital from riskier assets such as cryptocurrencies, resulting in downward pressure on BTC’s value.