In the volatile world of cryptocurrency, Bitcoin (BTC) has recently come under increased scrutiny as analysts and investors closely monitor price movements and potential market repercussions. Notably, Crypto Rover, a prominent crypto analyst, took to X (formerly Twitter) to issue a stark warning. The analyst warned that in the event Bitcoin reached $43,400, $200 million in BTC shorts would be liquidated.

As of the latest update, the current price of Bitcoin stands at $42,884, representing a modest 0.71% increase in the last 24 hours. The 24-hour trading volume for Bitcoin has experienced a 2.39% uptick, reaching $20,946,353,750. However, over the past week, Bitcoin has witnessed a 7.86% decline, leaving traders and investors on edge.

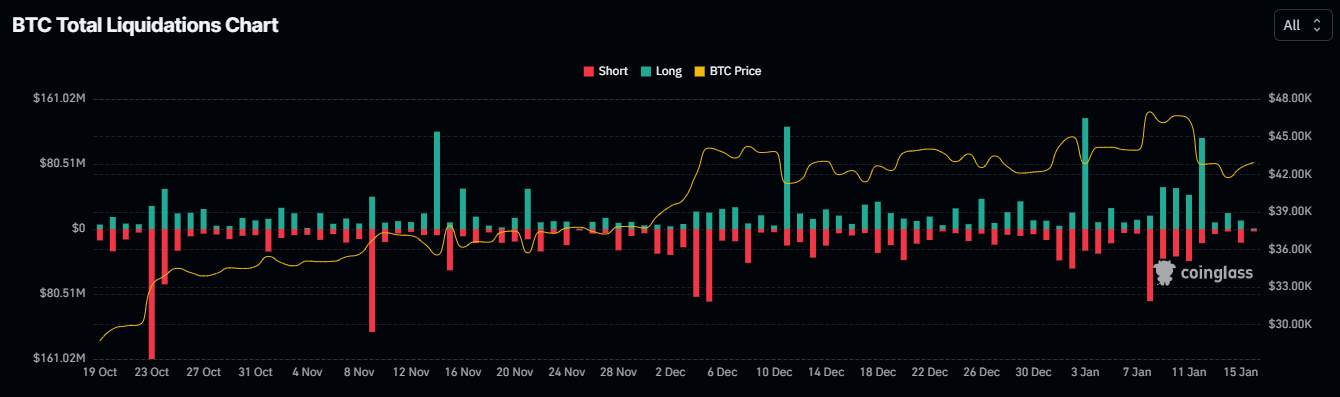

According to data from Coinglass, the last 24 hours saw significant liquidations for Bitcoin, totaling $22.52 million. Of this amount, $9.99 million accounts for long liquidations, while $12.53 million corresponds to short liquidations. This heightened liquidation activity adds an additional layer of uncertainty to an already tense market atmosphere.

Bearish Sentiment Prevails

The recent approval of several spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) last Thursday was anticipated to be a catalyst for a substantial rally in Bitcoin’s value. However, contrary to expectations, Bitcoin briefly surged above $47,000 before experiencing a subsequent dip, ultimately settling at the current levels.

Investors who were hopeful for a sustained bullish trend have expressed disappointment over the market’s response to the spot Bitcoin ETF approvals. The divergence between market expectations and market reality has fueled concerns and discussions within the crypto community.

Renowned crypto analyst Crypto Tony, known for his insightful market predictions, has recently shared a bearish outlook for Bitcoin. He suggests the possibility of a retreat to the $38,000 – $39,000 range in the coming weeks, adding to the growing apprehension among Bitcoin holders.

The crypto market remains unpredictable, with factors such as regulatory developments, market sentiment, and macroeconomic conditions contributing to the ongoing turbulence. Traders and enthusiasts alike will be closely monitoring Bitcoin’s price movements in the days ahead, especially considering the potential liquidation threat highlighted by Crypto Rover.