In a recent turn of events, Bitcoin, which was supposed to record robust gains and break its monthly consolidation following spot ETF approval from the SEC, faced a stumbling block in its price surge, failing to break past the $47,000 mark. This development comes amid a wave of increased attention and investment in altcoins, including Ethereum, following the landmark decision. However, there are crucial on-chain details that might be the reason for recent consolidation in BTC price and a pump in the altcoin market.

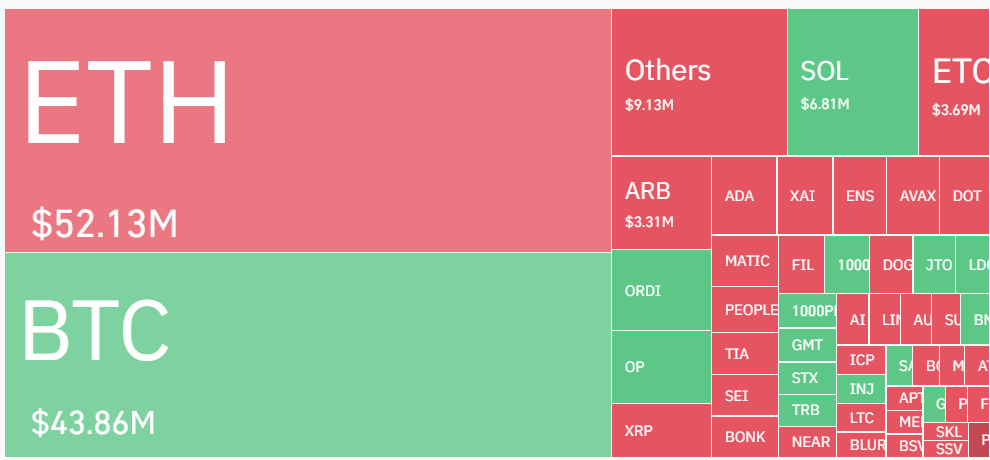

Total Liquidations Surpassed $150 Million

On Wednesday, the U.S. Securities and Exchange Commission marked a significant moment for the cryptocurrency sector by approving the first U.S.-listed exchange-traded funds (ETFs) that will track Bitcoin. This decision represents a major milestone for the leading digital currency and the wider crypto industry.

The SEC greenlit 11 applications from major financial firms, including BlackRock (BLK.N), Ark Investments/21Shares (ABTC.S), Fidelity, Invesco (IVZ.N), and VanEck. This approval comes despite cautions from certain officials and investor advocates regarding the potential risks associated with these products.

Contrary to expectations that Bitcoin’s price would quickly surpass $48K and stabilize around $50K, this surge has not materialized as of yet. Interestingly, the altcoin sector experienced a significant uplift, with top altcoins registering an average increase of 5%-10%. Additionally, Ethereum (ETH) broke through its $2,500 resistance level, pushing up to near $2,650, testing buyers’ patience. This upward movement is occurring amidst growing anticipation among analysts for a similar endorsement from the SEC for a spot Ethereum ETF.

Data from Coinglass indicates that in the past 12 hours, total liquidations exceeded $152 million, with almost $87 million in short positions being liquidated. Notably, while Bitcoin experienced a long-position liquidation of $26 million, Ethereum saw a significant short-position liquidation of nearly $40 million. This trend suggests that the Bitcoin ETF decision had a more pronounced impact on Ethereum’s price rather than on Bitcoin itself.

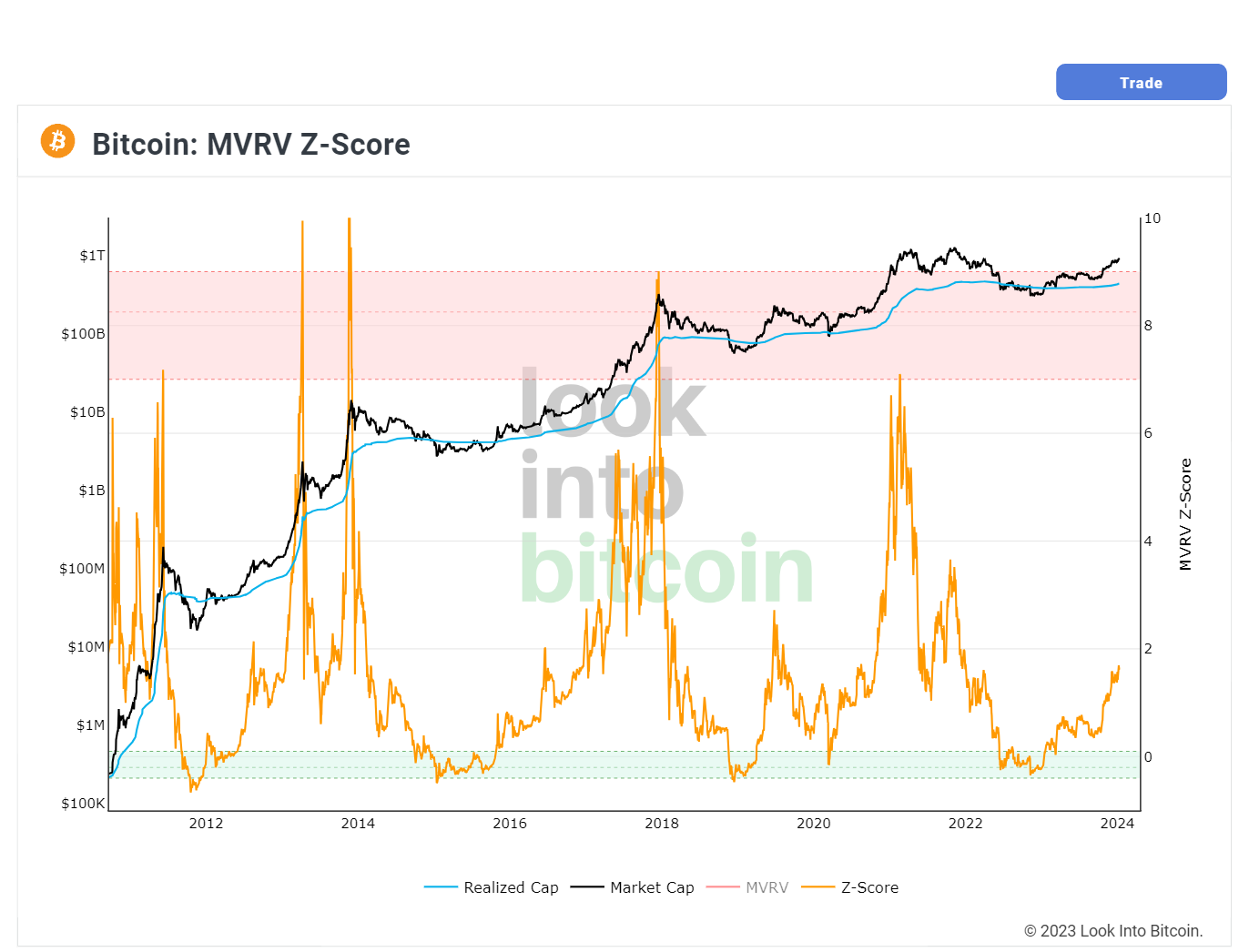

Interestingly, Bitcoin’s Market Value to Realized Value (MVRV) ratio has climbed to a near 2-year high, currently standing at 1.65. This indicates that the market value of Bitcoin has surpassed its realized price, putting traders in a profitable position. This scenario suggests a potentially lucrative opportunity for selling the coins.

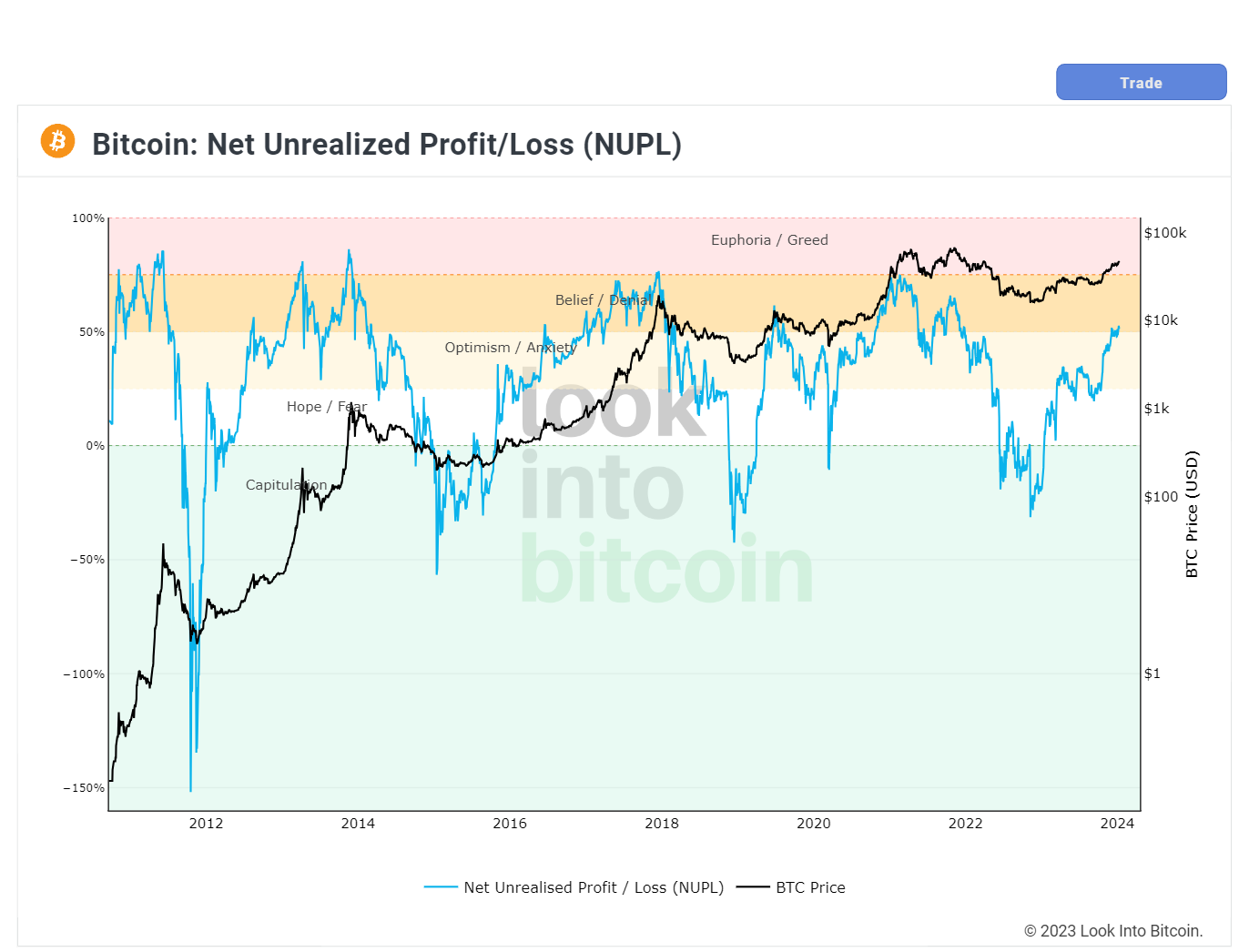

Many analysts had anticipated that Bitcoin’s price might initially face difficulty in its upward trajectory following ETF approval, as short-term holders are positioned at a high profit margin. As a result, the Net Unreleased Profit stands at 52%, the highest in 2.5 years.

In the upcoming hours, Bitcoin’s price is expected to face challenges in its upward movement, as short-term investors are likely to continue exiting, thereby creating selling pressure near resistance levels. Following this period, a gradual surge towards the $50K mark might be observed.

What’s Next For BTC Price?

Bitcoin successfully concluded its trading above the ascending resistance pattern following ETF approval, signaling the commencement of the next upward phase. However, the bullish pattern was soon rejected by increasing selling pressure from STHs near $48,000. As of writing, BTC price trades at $46,284, surging over 1.3% from yesterday’s rate.

Currently, bears are attempting to push the price below the breakout level of $45,500, aiming to catch the aggressive bulls off-guard. Should they succeed, the BTC price might experience a significant sell-off, potentially leading to a retest of the EMA100 trend line. However, such a dip might cause robust purchasing power, triggering a rebound.

If the price manages to rebound from $45,500, it would indicate that bulls are actively working to establish this level as a new support. This scenario would enhance the likelihood of a surge towards $48,100, and possibly extend the rally beyond $50K in the coming days.