The Binance Coin is one of the oldest and most reliable networks around, but like many others, the BNB price trajectory is facing a slowdown as investors focus on more solid returns as well as capital security. The BNB price is expected to remain within a projected price range of $765 and $790 over the medium term, as the rising strength of utility-driven projects proves to be a challenge for its dominance.

Investors, especially from the retail side, are increasingly opting for low-cost tokens offering real-world functionality, as new projects outclass existing players like Binance Coin in real-world utility and innovation.

Among these, utility and AI-based platforms still in their early stages, like Unilabs, are gaining attention by targeting inefficiencies in the global DeFi asset investment market, an area Binance Coin is not directly concerned with. Here’s why this matters.

BNB Price Outlook: Losing Momentum Over Uncertainty

Binance coin has proven to be one of the most effective major crypto project currencies, and is comparatively low profile, with less hyped performance compared to its peers. This has helped BNB’s price performance to retain some stability in bearish markets.

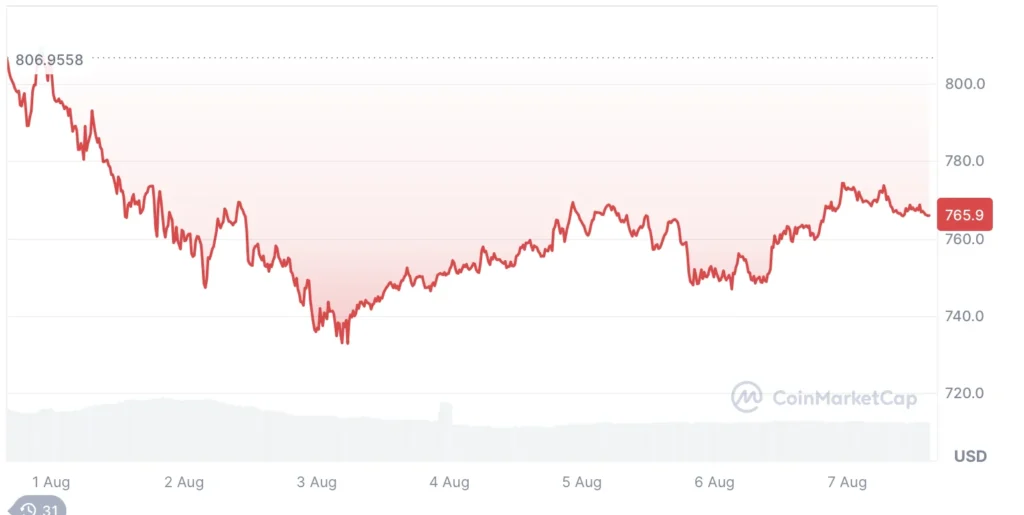

However, now that the markets are in a bull cycle, it seems that the BNB price is getting sticky. The network has rolled out upgrades that improve network performance and usage, which should be boosting Binance coin’s price performance; however, it is lagging behind the market trends. Rising concerns about execution risks exist, especially as delays by the SEC to approve ETFs are placing a damper on bullish sentiment.

Source: CoinMarketCap

Regulatory approvals will probably increase institutional inflows, but the prolonged delays in ETF approvals is probably going to cap gains. However, the technical strength of the Binance coin is likely to help it pull through, although without as high a gain trajectory as expected from the BNB price.

With no question about its utility, BNB’s momentum seems to be currently dependent on the macroeconomic elements, and this explains why investors are moving to look for viral gain potential in other projects.

Unilabs: The DeFi Asset Investment Game Changer

Step into the future of crypto investing with Unilabs Finance (UNIL), the game-changing DeFi project set to transform how the world invests money in crypto. It offers users a unique investing experience, with next-level transparency, high returns, and unmatched access to ventures that were once reserved for institutional players.

The project promises to help investors unlock cutting-edge crypto opportunities with its blend of institutional-grade AI tools, applied to investment brackets with the innovation expected from DeFi principles. Its investing tools system tracks thousands of emerging projects, helping people to invest early and with confidence.

Why Unilabs Will Be A Market Disruptor

To accommodate diverse investor profiles and investing strategies, Unilabs presents four distinct fund options, all of which leverage top-tier expertise and AI-driven insights.

These four investment funds are:

- BTC Fund: Bitcoin-related strategic investments and partnerships.

- AI Fund: Projects working on and implementing AI tools and products within the crypto ecosystem.

- Mining Fund: This allows traders to earn by mining coins.

- RWA Fund: This fund tokenizes real-world assets to bring practical utility to Web3.

Early Entry Advantage: 50% Bonus UNIL Rewards Program Is Live

To reward the UNIL community, 30% of the total fees generated on the platform are redistributed to token holders via a five-tier system. For those looking to buy Unilabs tokens before it rises on its listing on CoinMarketCap, there is a time-bound 50% bonus offer on right now.

As crypto investors turn toward regulated, utility-driven ecosystems, Unilabs represents the kind of innovation the market increasingly rewards, and analysts believe UNIL may very well outpace traditional exchange tokens in the next growth cycle. The UNIL is currently available for just $0.009.

For more information about Unilab Finance, visit the links below:

Website: https://www.unilabs.finance

Social: Unilabs Telegram

This article is not intended as financial advice. Educational purposes only.