- 1. AMP Crypto: Quick Introduction

- 2. AMP: Uniqueness And Benefits

- 3. AMP Crypto Price Prediction: Price History

- 4. AMP Price: Technical Analysis

- 5. AMP Crypto Price Prediction By Blockchain Reporter

- 5.1. Amp Price Prediction 2023

- 5.2. Amp Price Prediction 2024

- 5.3. AMP Price Forecast for 2025

- 5.4. Amp (AMP) Price Prediction 2026

- 5.5. Amp Price Prediction 2027

- 5.6. Amp Price Prediction 2028

- 5.7. Amp (AMP) Price Prediction 2029

- 5.8. Amp Price Forecast 2030

- 5.9. Amp (AMP) Price Prediction 2031

- 5.10. Amp Price Prediction 2032

- 6. AMP Price Forecast: Experts’ Opinions

- 7. Is AMP A Good Investment?

- 8. Conclusion

- AMP Crypto: Quick Introduction

- AMP: Uniqueness And Benefits

- Real-World Applications of AMP Cryptocurrency

- AMP Crypto Price Prediction: Price History

- AMP Price: Technical Analysis

- AMP Crypto Price Prediction By Blockchain Reporter

- Amp Price Prediction 2023

- Amp Price Prediction 2024

- AMP Price Forecast for 2025

- Amp (AMP) Price Prediction 2026

- Amp Price Prediction 2027

- Amp Price Prediction 2028

- Amp (AMP) Price Prediction 2029

- Amp Price Forecast 2030

- Amp (AMP) Price Prediction 2031

- Amp Price Prediction 2032

- AMP Price Forecast: Experts’ Opinions

- Is AMP A Good Investment?

- Conclusion

Amp (AMP) cryptocurrency offers a fresh take on how we handle digital transactions. It’s all about making the process of “staking” tokens easier and more versatile. Staking is like putting digital coins to work, allowing them to secure different kinds of transactions. With Amp, one doesn’t need to go through the hassle of moving tokens to a separate digital contract each time for staking. Imagine you’re using Amp for various types of exchanges, whether it’s paying for something online, swapping currencies, distributing loans, or even dealing in real estate. Amp’s system is designed to handle all these scenarios smoothly. The more people and businesses that use Amp for their transactions, the better it gets. This is because Amp’s usefulness grows with every new user and every new transaction that happens on the network. The main goal of AMP is to actively drive growth in the network’s economy. By making transactions easier and more secure, Amp aims to attract more users and increase the volume of transactions happening on its platform. This, in turn, boosts the overall productivity and output of the network. Flexa incorporates Amp within its payment solution on the Flexa network. However, this system is versatile and can be adopted by other parties who are not directly related to Flexa. However, due to the SEC labeling the altcoin unregistered security, AMP token has lost its momentum and investors are still waiting for a bullish comeback. In this article, we’ll explore AMP crypto price prediction, its current market status with in-depth technical analysis and opportunity for a profitable investment option.

AMP Crypto: Quick Introduction

Traditional payment systems often face challenges like slow transaction speeds and security risks, mainly because they depend on middlemen. Blockchain technology emerged as a potential solution, offering to improve these aspects. However, it has found it challenging to simultaneously provide high speed and strong security. Typically, improving one aspect means compromising the other. Amp cryptocurrency seeks to overcome this challenge by introducing a decentralized approach that doesn’t sacrifice speed for security or vice versa.

Amp’s primary aim is to ensure that transactions and their related data are both swift and secure. Built on the Ethereum blockchain and adhering to the ERC20 token standard, Amp allows users the choice to transact in either traditional fiat currency or various digital assets.

To fully grasp Amp’s role, it’s essential to understand its background with the Flexa Network, co-founded in 2018 by Daniel C. McCabe, Machary Kilgore, Trevor Filter, and Tyler Spalding. Flexa operates as an open platform facilitating real-time cryptocurrency payments in both online and physical retail spaces.

Flexa launched an app named SPEDN, which enables payments in multiple cryptocurrencies, including Bitcoin (BTC), Litecoin (LTC), and Ether (ETH). This app is accepted by tens of thousands of merchants across the USA and Canada. Initially, FlexaCoin (FXC) was the native token for these transactions. However, to boost merchant security, Flexa switched from FlexaCoin to Amp, a more advanced and secure token.

AMP: Uniqueness And Benefits

The native token of the Flexa network, AMP, has revolutionized the transaction process by enabling instant payment authorizations, significantly speeding up transactions. Users benefit greatly from this, as they can stake and secure various types of value exchanges, including digital payments, fiat currency exchanges, loan distributions, property sales, and more. Amp is the product of a collaborative effort between Flexa network and ConsenSys, backed by a team of dedicated consultants and investors. This concept evolved into a groundbreaking ERC20 token, making a significant impact on the AMP crypto exchange and influencing similar technologies in the field.

One of the key advantages of AMP is its ability to facilitate transaction rates that scale with the network’s growth, leading to a significant increase in miner participation. AMP operates on a strong, high-capacity public blockchain, addressing issues like accessibility and the detection of fraudulent or invalid transactions. It achieves this by ensuring that each confirmed block can be traced back to its predecessor. As an Ethereum-based token, AMP serves as collateral for payments made on the Flexa Network and other similar platforms.

AMP’s foundation lies in the mathematical reliability of blockchain-enabled transactions. It verifies transactions without disclosing any information about the involved parties, thereby enhancing security.

A standout feature of AMP is its provision of liquidity combined with rapid transaction speeds. This distinct quality sets it apart from other Ethereum-based Decentralized Finance protocols and opens up a wide range of opportunities for mining.

Therefore, it’s fair to say that AMP tokens act as a catalyst in the execution of smart contracts and the transfer of funds.

Real-World Applications of AMP Cryptocurrency

- As Collateral in Payment Networks: Flexa utilizes AMP to facilitate instant, fraud-proof transactions across its digital payment network. By integrating AMP, apps can ensure real-time settlement of payments, regardless of the asset or protocol involved.

- For Individual Users: Individuals can leverage AMP as collateral by assigning it to a collateral manager. This allows them to transfer another asset without incurring high transaction fees. The counterpart in the exchange can immediately utilize the underlying asset, as AMP is securely held in escrow, matching the transaction’s value.

- In Decentralized Finance (DeFi) Platforms: AMP’s involvement in DeFi platforms is expanding its range of applications and enhancing its quality as collateral. Various DeFi platforms have already integrated AMP, showcasing its growing significance and versatility in the DeFi ecosystem. This integration not only diversifies AMP’s applications but also strengthens its position in the market.

AMP Crypto Price Prediction: Price History

The AMP ecosystem’s initial idea was formed in early 2019, and the token made its debut on September 11, 2020, starting at $0.009. However, its early journey wasn’t smooth, as it saw a decline in value, reaching an all-time low of approximately $0.0007 on November 17, 2020.

Despite this rocky start, AMP’s fortunes began to turn around in 2021 as the overall crypto market triggered a bull run. It rebounded, surpassing its initial offering price and achieving a significant high of around $0.036 on February 16, 2021. This upward trend didn’t stop there as the price continued to break above crucial resistance lines in the coming weeks; by April 18, AMP’s value had escalated to $0.064. The token continued to set new benchmarks, hitting highs of $0.077 on May 7 and then soaring to $0.12 on June 16, buoyed by its listing on the renowned cryptocurrency exchange, Coinbase. However, this was the last time that the AMP token achieved this high as it soon triggered a bearish decline, breaking below multiple support channels.

By September 2021, AMP’s value had dipped below $0.05, and it continued to decline, reaching $0.02 by January 2022. The bear market presented significant challenges, and by May 2022, AMP’s value had dropped below its original launch price. The price has been a severe bearish trend since then. However, in recent weeks, AMP price made a minor recovery, touching a high of $0.0025.

AMP Price: Technical Analysis

Recently, the AMP coin price experienced intense bullish sentiment, which has triggered buyers near the immediate resistance levels. The price has been on a steady upward trajectory over the last few weeks due to the market’s ‘Uptober’ trend revival. After surging above the $0.002-mark, AMP’s price sparked an intense buying momentum and surged exponentially. The price has been facing intense buying pressure recently, and it managed to break above multiple resistance levels following Bitcoin’s surge toward $38K. A thorough technical analysis of the AMP token price reveals mixed indicators, which may soon send the price either to new lows or highs.

According to Coinmarketcap, the AMP price is currently trading at $0.0024, reflecting a decrease of 2.5% in the last 24 hours. Our technical evaluation of AMP price indicates that the current bullish momentum may soon fade as bears are attempting to reverse the trend from the upcoming resistance at $0.003; however, bulls are trying to prevent the price from dropping below the support level of $0.0021. Examining the daily price chart, AMP coin price has found support near the $0.002 level, from which the price gained bullish momentum and was attempting to break above multiple Fib channels. As AMP price continues to trade above the EMA200, buyers are gaining confidence to open further long positions and send the price to test its upcoming resistance. The Balance of Power (BoP) indicator is currently trading in a negative region zone at 0.28 as sellers are increasing their domination on the price chart.

To thoroughly analyze the price of an AMP coin, it is crucial to take a look at the RSI-14 indicator. The RSI indicator recently experienced a surge as the AMP price failed to hold sellers’ demand near $0.0023. The trend line is currently hovering above the midline as it trades at level 51, hinting that further upward correction is on the horizon. It is anticipated that the AMP price will soon attempt to break above its 23.6% Fibonacci level to achieve its short-term bullish goals of around $0.003. If bears fail to plunge below the current 0.038 Fibonacci region, an upward trend might be on the horizon.

As the SMA-14 continues its swing by trading at 51, it trades slightly below the RSI line, potentially holding concerns about the coin’s downward movement on the price chart. If AMP’s price makes a bullish reversal, it can pave the way to resistance at $0.0041. A breakout above will drive the coin’s price toward the upper limit of the Bollinger band at $0.0052.

Conversely, if AMP fails to hold above the critical support region of $0.002, a sudden collapse may occur, resulting in further price declines and causing the coin’s price to trade near the Bollinger Band’s lower limit of $0.00184. If the price fails to continue a trade above, it may trigger a more significant bearish downtrend to $0.0014.

AMP Crypto Price Prediction By Blockchain Reporter

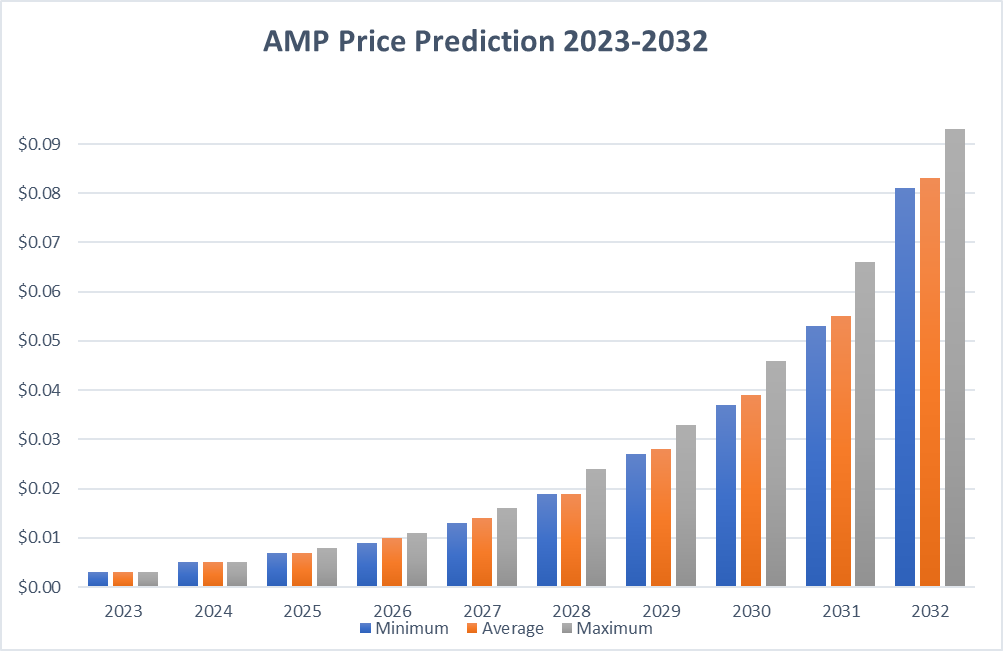

Amp Price Prediction 2023

According to our deep technical analysis on past price data of AMP, in 2023, the price of Amp is forecasted to be at around a minimum value of $0.0025. The Amp price value can reach a maximum of $0.0028 with the average trading value of $0.0027.

Amp Price Prediction 2024

The price of Amp is predicted to reach a minimum value of $0.0038 in 2024. The Amp price could reach a maximum value of $0.0045 with the average trading price of $0.0039 throughout 2024.

AMP Price Forecast for 2025

As per the forecast and technical analysis, in 2025, the price of Amp is expected to reach a minimum price value of $0.0054. The AMP price can reach a maximum price value of $0.0066 with the average value of $0.0056.

Amp (AMP) Price Prediction 2026

Amp price is forecast to reach a lowest possible level of $0.0080 in 2026. As per our findings, the AMP price could reach a maximum possible level of $0.0096 with the average forecast price of $0.0082.

Amp Price Prediction 2027

The price of Amp is predicted to reach a minimum value of $0.0112 in 2027. The Amp price could reach a maximum value of $0.0136 with the average trading price of $0.0116 throughout 2027.

Amp Price Prediction 2028

The price of 1 Amp is expected to reach a minimum level of $0.0167 in 2028. The AMP price can reach a maximum level of $0.0198 with the average price of $0.0173 throughout 2028.

Amp (AMP) Price Prediction 2029

As per the forecast price and technical analysis, in 2029, the price of Amp is predicted to reach at a minimum level of $0.0241. The AMP price can reach a maximum level of $0.0295 with the average trading price of $0.0248.

Amp Price Forecast 2030

The price of Amp is predicted to reach a minimum level of $0.0340 in 2030. The Amp price can reach a maximum level of $0.0414 with the average price of $0.0350 throughout 2030.

Amp (AMP) Price Prediction 2031

According to our deep technical analysis on past price data of AMP, in 2031, the price of Amp is predicted to reach at a minimum level of $0.0487. The AMP price can reach a maximum level of $0.0586 with the average trading price of $0.0504.

Amp Price Prediction 2032

Amp price is forecast to reach a lowest possible level of $0.0712 in 2032. As per our findings, the AMP price could reach a maximum possible level of $0.0858 with the average forecast price of $0.0733.

AMP Price Forecast: Experts’ Opinions

Digitalcoinprice forecasts a steady upward trend in the price of Amp (AMP) over the upcoming years. Their analysis suggests that Amp might attain a price of $0.00426 by the close of 2023. It’s projected that the price will escalate to $0.00707 by 2025, and increase further to $0.00887 by 2026. For 2028, they estimate the average price of Amp to be around $0.0101. In 2029, the price of AMP is anticipated to vary between $0.0130 and $0.0144. By the year 2032, they predict a significant rise in Amp’s price, potentially surpassing $0.0364 and reaching up to $0.0377.

Coincodex’s current price prediction for Amp indicates a forecasted decrease of -7.41%, with the price expected to fall to $0.002259 by November 28, 2023. Their analysis, based on technical indicators, suggests a Neutral market sentiment at present, while the Fear & Greed Index shows a reading of 66, indicating Greed. Over the past 30 days, Amp has experienced 53% green days, with a price volatility of 15.93%.

According to Coincodex’s forecast, this might be an opportune time to invest in Amp. Furthermore, considering the historical price trends of Amp and the Bitcoin halving cycles, Coincodex estimates the lowest price for Amp in 2024 to be around $0.002116. Additionally, they predict that in the coming year, the price of Amp could soar to a high of $0.005675.

Is AMP A Good Investment?

Considering recent SEC’s action on AMP and its multiple delisting, it is wise not to invest in the project as the liquidity continues to decline. Moreover, with the volatility on a declining path, investors are putting their investments to emerging altcoins with greater ROI.

Conclusion

The AMP ecosystem has been attracting investors keen on leveraging its diverse offerings, including Defi, the broader cryptocurrency market, and NFTs. The network’s smart contracts feature various built-in incentive models such as continuous compounding and micro-distributions, enhancing its appeal.

Amp’s unique capabilities position it as a potentially preferred network for transactions. The platform’s value is further boosted by partnerships with entities like Poliniex, Bittrex, Crypto.com, and Yield, allowing users to collateralize both digital and physical assets.

Beyond the blockchain market, the Amp network extends its utility to real-world assets. The AMP token is available on leading cryptocurrency exchanges like Binance, Coinbase, and Gemini. Forecasts for AMP suggest a promising outlook, with expectations of significant growth by 2032, indicating its potential as a viable long-term investment.

However, it’s important to note that factors such as adverse news or market crashes could negatively impact AMP’s performance in the volatile cryptocurrency market. This analysis should not be taken as investment advice, and thorough personal research is advised before investing in any crypto assets.