- 1. Cronos (CRO): A Quick Introduction

- 2. Crypto.com & Cronos: Features

- 3. CRO Price Prediction: Price History

- 4. CRO Price Prediction: Technical Analysis

- 5. CRO Price Prediction By Blockchain Reporter

- 5.0.1. CRO Price Prediction 2023

- 5.0.2. Crypto.com Coin Price Prediction 2024

- 5.0.3. CRO Price Forecast for 2025

- 5.0.4. CRO (CRO) Price Prediction 2026

- 5.0.5. CRO Price Prediction 2027

- 5.0.6. CRO Price Prediction 2028

- 5.0.7. CRO (CRO) Price Prediction 2029

- 5.0.8. Crypto.com Price Forecast 2030

- 5.0.9. CRO (CRO) Price Forecast 2031

- 5.0.10. CRO Price Prediction 2032

- 6. CRO Price Targets: By Experts

- 7. Is CRO A Good Investment? When To Buy?

- 8. Conclusion

- Cronos (CRO): A Quick Introduction

- Crypto.com & Cronos: Features

- Cronos (CRO) Vs. Ethereum (ETH)

- CRO Price Prediction: Price History

- CRO Price Prediction: Technical Analysis

- CRO Price Prediction By Blockchain Reporter

- CRO Price Prediction 2023

- Crypto.com Coin Price Prediction 2024

- CRO Price Forecast for 2025

- CRO (CRO) Price Prediction 2026

- CRO Price Prediction 2027

- CRO Price Prediction 2028

- CRO (CRO) Price Prediction 2029

- Crypto.com Price Forecast 2030

- CRO (CRO) Price Forecast 2031

- CRO Price Prediction 2032

- CRO Price Targets: By Experts

- Is CRO A Good Investment? When To Buy?

- Conclusion

Cronos, originally named CRO, underwent a rebranding in February 2022 but continued to trade under the CRO abbreviation. Since its launch, it has experienced remarkable user adoption, evidenced by over 350,000 unique wallet addresses actively transacting on its blockchain within just three months. Looking ahead, forecasts from ten analysts who follow the company project an annual revenue growth of 19% over the next three years. This outpaces the industry’s expected growth rate of 16% per year, suggesting a potential for stronger revenue performance. Crypto.com (CRO), situated in Singapore, operates as a cryptocurrency exchange, enabling investors to purchase, sell, and swap a range of crypto assets and blockchain-based products. In addition to its decentralized trading platform, the company provides a cryptocurrency wallet, an NFT marketplace, and credit card services. Users who store cryptocurrencies in their wallet can earn interest rates of up to 14.5%. The Cronos ecosystem is designed to support and expand decentralized applications (dApps) in anticipation of a future that is increasingly multichain. It emphasizes applications in areas like non-fungible tokens (NFTs), decentralized finance (DeFi), and digital payments. The platform allows users to transfer cryptocurrencies from Ethereum, Cosmos, and various other chains into Cronos. Additionally, it facilitates the migration of applications and smart contracts from Ethereum and other chains compatible with Ethereum Virtual Machine (EVM). In recent weeks, CRO price made a notable surge but is currently facing bearish pressure near resistance levels. Our CRO price prediction 2025 aims to outline the future market performance of Cronos and in-depth technical analysis of the current CRO price.

Cronos (CRO): A Quick Introduction

The Cronos (CRO) coin serves as the native cryptocurrency for both the Crypto.com blockchain and the Cronos EVM chain, which operate in parallel. The Cronos EVM chain, notable for being the first Ethereum-compatible blockchain built with the Cosmos SDK, is both open-source and permissionless. This design allows any user to participate and enables direct transactions without needing a central authority’s approval. Its main goal is to offer developers the ability to seamlessly transfer applications from other blockchains, taking advantage of lower transaction fees.

Crypto.com, headquartered in Hong Kong, is a comprehensive platform where users can buy, sell, and earn digital assets. Founded in 2016 by Kris Marszalek and his co-founders, Bobby Bao, Gary Or, and Rafael Melo, the platform has grown to over 50 million users. It provides various services including an NFT marketplace and a Visa card offering up to 8% cashback, usable in about 40 countries. Additionally, it features a crypto wallet, token-swap services, daily rewards, interest on holdings, and options for monetizing crypto assets without selling them.

The Cronos ecosystem, as described in the Crypto.com whitepaper, is seen as a pivotal step in the widespread adoption and use of Web 3.0 by millions.

Cronos coin isn’t just a currency; it’s integral to the ecosystem. It’s used for staking, offering users perks like free Netflix and Spotify subscriptions, cashback rewards, favorable interest rates, and additional benefits on the Crypto.com exchange. Staking CRO also allows users to become liquidity providers. Furthermore, the Cronos cryptocurrency is utilized for settling transaction fees on the Crypto.com chain.

Crypto.com & Cronos: Features

Crypto.com’s core mission is to advance the integration of open-source blockchain technology within the crypto world, promoting digital currencies as viable payment options akin to traditional fiat money. Cronos, initially known as CRO, was rebranded in February 2022 but continues to be traded under its original ticker, CRO.

The platform offers a suite of business tools, including an Invoice/Pay Checkout feature. This allows customers to use cryptocurrency to pay for goods and services through Crypto.com’s wallet infrastructure. Payments on Crypto.com can be made using CRO, fiat currencies, or stablecoins like USDT. On the Crypto.com exchange, users have the flexibility to trade CRO, engage in DeFi Swap, stake it for rewards, or act as liquidity providers.

Crypto.com provides a wide range of services encompassing a payment system, VISA-linked cards, fiat-to-crypto trading, staking, DeFi services, crypto loans, and options for withdrawals and deposits. Additionally, the platform offers a unique opportunity for users to earn rewards by completing various “missions” within its mobile app, encouraging exploration and engagement with its features.

Crypto.com’s mission and vision emphasize hastening the global shift to cryptocurrency. They aim to achieve this by offering a variety of digital financial services, meeting the growing demand for cryptocurrency and blockchain technologies.

Cronos (CRO) Vs. Ethereum (ETH)

Both Ethereum and Crypto.com share a fundamental feature: they each have a native token integral to their respective ecosystems. Beyond this, their differences become more pronounced.

Crypto.com, as a company, has developed its own proprietary, closed-source blockchain. This blockchain is engineered to deliver a variety of decentralized financial services via a single platform. In contrast, Ethereum is an open-source platform that invites universal participation. Its transparent and modifiable nature allows anyone to inspect, propose modifications, or develop independent projects on it.

The core objectives of Crypto.com and Ethereum also diverge. Crypto.com, as a business entity, focuses on delivering financial services, thus centralizing an aspect of the digital economy initially conceived to be decentralized. Ethereum, on the other hand, operates as a globally accessible virtual machine, embodying complete decentralization. Notably, the Crypto.org blockchain and its associated Cronos chain are built to function on the Ethereum Virtual Machine.

Crypto.com serves the convenience of enthusiasts and users who prefer consolidating their digital transactions and assets in one location. Although this represents a centralized approach, it isn’t necessarily negative. Many individuals are not at ease using multiple exchanges for their cryptocurrency transactions or managing various wallets to transfer assets.

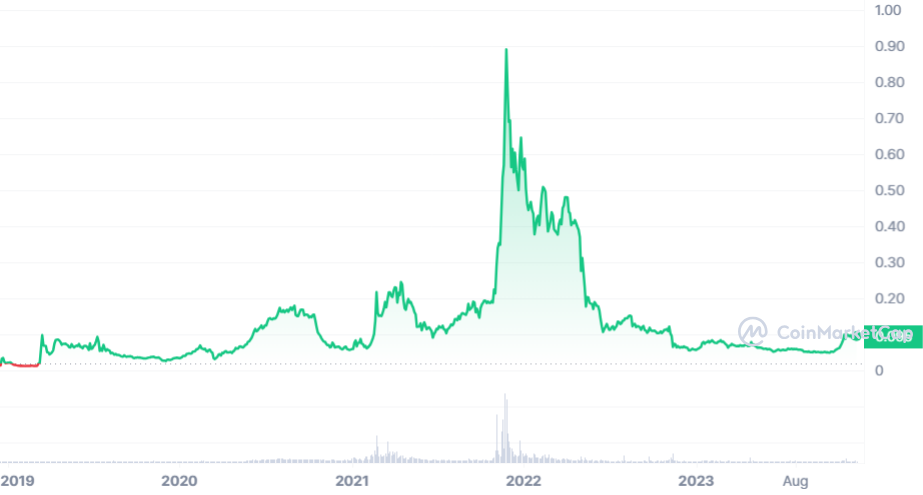

CRO Price Prediction: Price History

Analyzing the price history of CRO, we should remember that past performance is not a reliable indicator of future outcomes, yet it provides valuable context for understanding predictions or making our own.

CRO debuted in mid-December 2018, priced around $0.0153. It witnessed a significant rise to $0.103 by March 15, 2019, followed by a period of relative stability until late spring 2020. During this time, its value began a steady ascent.

From March 14, 2020, when CRO was valued at $0.03187, to August 31, 2020, the token’s value increased over five times, reaching $0.1785. This surge might be linked to the launch of the Crypto.com wallet in late March 2020. Another significant increase occurred in early 2021, responding to a bullish market. CRO’s price soared approximately 285%, from $0.06362 on February 4, 2021, to $0.2452 on April 15, 2021. The cryptocurrency reached its peak at $0.9005 on November 23, 2021, but experienced a decline, closing the year at $0.5575.

Crypto.com prominently highlighted its rapid growth and achievements, including being the first global crypto exchange to launch its own NFT platform and securing the endorsement of renowned actor and writer Matt Damon for its global brand campaign.

However, 2022 was less favorable for CRO. The price initially fell, managing a brief surge to over $0.50 on February 9, 2022. Despite rebranding from crypto.com to cronos to symbolize “the decentralization of the coin and the substantial expansion of the Cronos ecosystem,” the positive sentiment was short-lived. CRO’s decline was further influenced by Crypto.com’s decision to reduce some staking rewards and terminate key partnerships.

In May 12, 2022, amid market upheaval following the UST stablecoin’s depegging and LUNA cryptocurrency’s collapse, CRO’s value had dropped to $0.1694. The situation worsened in June when the suspension of withdrawals on Celsius (CEL) crypto lending platform signaled a bear market, leading cronos to fall to $0.09902 by June 18.

In other developments, Crypto.com introduced a Google Pay in-app feature on July 25, 2022, enabling users to purchase crypto swiftly and securely. Shortly before, on July 23, 2022, the platform had announced updates to its Crypto.com Visa cards.

By September 5, 2022, the value of cronos stood at approximately $0.1185. Despite unveiling a roadmap for enhanced scalability on October 13, the price fell to $0.09653. However, a brief recovery saw it climb to $0.1183 on November 6, before experiencing a severe downturn.

This decline was exacerbated by a mishap where Cronos mistakenly sent ether (ETH) worth about $400 million to an incorrect account. Following closely after the FTX crypto exchange collapse, CRO’s value plummeted nearly 30% in hours, reaching a low of $0.05629 on November 14, a stark contrast to its previous day’s trading above $0.08.

A further drop to $0.06156 occurred on November 28, but a slight recovery to $0.06572 was seen by December 6, before falling back to $0.05629 on December 20, 2022.

Post-FTX collapse, Cronos disclosed its holdings. Initially, on November 11, its assets exceeded $2 billion, but by November 16, 2022, this amount had reduced to just over $600 million. However, it bounced back to $3.3 billion as of December 1. Notably, the platform reported having no debts. Despite starting 2023 on a bearish note, CRO price is now gaining attention and it almost doubled during the ‘Uptober’ trend, touching a high of $0.12.

CRO Price Prediction: Technical Analysis

Recently, the CRO coin price experienced intense bullish sentiment, which has triggered buyers near the immediate resistance levels. The price has made a breakout momentum above $0.1 as the BTC price touched a high of $44K. However, after surging above the $0.12-mark, CRO’s price sparked a minor selling momentum and declined. The price has been facing minor rejections recently as it lost buyers’ confidence. A thorough technical analysis of the CRO coin price reveals bullish indicators, which may soon send the price to new highs.

According to Coinmarketcap, the CRO price is currently trading at $0.095, reflecting an increase of 2.2% in the last 24 hours. Our technical evaluation of the CRO price indicates that the current bullish momentum may soon fade as bears are attempting to reverse the trend from the upcoming resistance at $0.12; however, bulls are trying to prevent the price from dropping below the immediate support level of $0.08. Examining the daily price chart, the CRO coin price has found support near the 23.6% Fib level, from which the price gained bullish momentum and attempted to break above multiple Fib channels. As CRO price continues to trade above the EMA20 trend line, buyers are gaining confidence to open further long positions and send the price to test its upcoming resistance. The Balance of Power (BoP) indicator is currently trading in a positive region at 0.3 as buyers are increasing their domination on the price chart.

To thoroughly analyze the price of a CRO token, it is crucial to take a look at the RSI-14 indicator. The RSI indicator recently experienced a surge as the CRO price holds buyers’ demand near resistance channels. The trend line is currently hovering above the midline as it trades at level 51, hinting that further upward correction is on the horizon. It is anticipated that the Cronos price will soon attempt to break above its immediate Fibonacci level to achieve its short-term bullish goals of around $0.124. If bears fail to plunge below the current 0.038 Fibonacci region, an upward trend might be on the horizon.

As the SMA-14 continues its swing by trading at 50, it trades slightly below the RSI line, potentially holding promises about the coin’s upward movement on the price chart. If CRO’s price makes a bullish reversal above $0.124, it can pave the way to resistance at $0.16. A breakout above will drive the coin’s price toward the upper limit of the Bollinger band at $0.2 and then to $0.31.

Conversely, if CRO fails to hold above the critical support region of $0.08, a sudden collapse may occur, resulting in further price declines and causing the coin’s price to trade near the Bollinger Band’s lower limit of $0.05. If the price fails to continue a trade above, it may trigger a more significant bearish downtrend to $0.02.

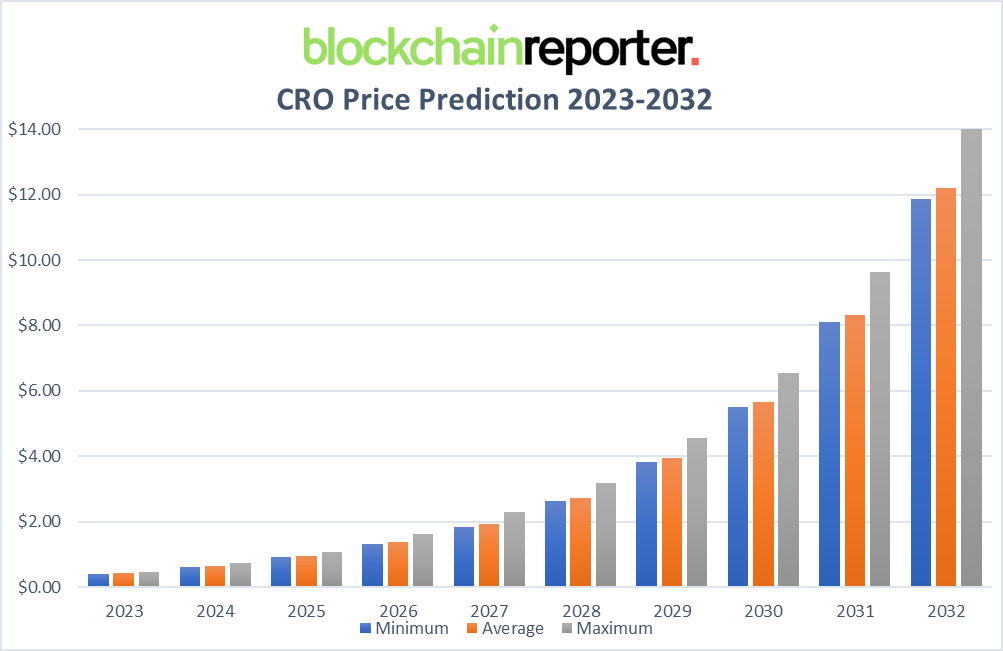

CRO Price Prediction By Blockchain Reporter

CRO Price Prediction 2023

The CRO price is anticipated to achieve a minimum price of $0.3980 in 2023. Its maximum price may rise to $0.4478, with an average of $0.4353 expected throughout the year.

Crypto.com Coin Price Prediction 2024

In 2024, CRO is expected to have a minimum price of $0.6213. It could reach a peak of $0.7308, averaging around $0.6387 for the year.

CRO Price Forecast for 2025

Based on technical analysis of past CRO data, the 2025 prediction for CRO suggests a minimum price of $0.9236. It might peak at $1.07, with an average price of $0.9555.

CRO (CRO) Price Prediction 2026

For 2026, the predicted minimum price of CRO is $1.33. The coin could reach a high of $1.63, with an average price of $1.38 throughout the year.

CRO Price Prediction 2027

In 2027, the forecasted minimum price for CRO is $1.85. The maximum price could be $2.31, with an average value of $1.92 anticipated.

CRO Price Prediction 2028

The 2028 forecast suggests a minimum price of $2.63 for CRO. A maximum price of $3.18 is possible, with an average trading price around $2.71.

CRO (CRO) Price Prediction 2029

In 2029, CRO is expected to have a minimum price of $3.83. The maximum price could reach $4.56, averaging around $3.94.

Crypto.com Price Forecast 2030

For 2030, the lowest projected price for CRO is $5.51. The highest price could be $6.54, with an average forecast price of $5.67.

CRO (CRO) Price Forecast 2031

Based on in-depth technical analysis, the 2031 prediction for CRO is a minimum price of $8.09. A maximum price of $9.63 is possible, with an average trading price around $8.32.

CRO Price Prediction 2032

In 2032, the price of one CRO is expected to reach a minimum of $11.87. The maximum price could be $14.07, with an average price of $12.21 throughout the year.

CRO Price Targets: By Experts

According to the forecast data analysis provided by Digital Coin Price, the price of CRO (Cronos) is anticipated to surpass the $0.22 mark in 2024. By the conclusion of 2024, it is projected that Cronos will achieve a minimum value of $0.20. Furthermore, there is potential for the CRO price to attain a maximum of $0.24. Looking ahead to 2032, the same analysis predicts that the price of CRO will exceed $1.78. By the end of 2032, Cronos is expected to maintain a minimum value of $1.78, with the capability of reaching a peak price of $1.83.

According to Coincodex’s current Cronos price prediction, the value of Cronos is expected to increase by 4.45%, reaching $0.099127 by December 13, 2023. Coincodex’s technical indicators suggest a Neutral sentiment at present, while the Fear & Greed Index indicates a level of 72, signaling Greed. In the past 30 days, Cronos has experienced 16/30 (53%) green days, with a price volatility of 5.78%.

Coincodex’s forecast suggests that it is currently an opportune time to purchase Cronos. Taking into account the historical price trends of Cronos and the BTC halving cycles, Coincodex estimates the lowest Cronos price for 2024 to be around $0.079046. Moreover, they predict that the price of Cronos could climb to a high of $0.153635 in the next year.

Is CRO A Good Investment? When To Buy?

Determining the future trajectory of CRO is challenging. Recently, there has been an uptick in its value, but the factors driving this increase remain unclear. The sustainability of this upward trend is uncertain, and much will depend on the market’s stability.

Currently, it’s impossible to predict with certainty. Although many forecasts for Cronos’s price are positive, it’s important to acknowledge that price predictions often prove inaccurate. It’s also crucial to remember that market prices are volatile and can decrease as readily as they can increase. However, as Bitcoin prepares for new ATH amid the 2024’s halving event and spot ETF approval, CRO price might turn profitable if invested at a price of $0.08.

Conclusion

Cronos’s price analysis is mixed, so investors should review multiple forecasts and understand market trends before investing. Cronos has grown significantly, supported by Crypto.com, and is considered a good long-term investment due to its practical applications. Its demand is fueled by modern financial services, including DeFi.

Despite market challenges, Cronos remains resilient, with expectations for growth as cryptocurrencies gain legitimacy. Purchasing CRO is possible through Crypto.com and other major exchanges. However, take price predictions as guides, not certainties, and combine them with market understanding for wise investing.