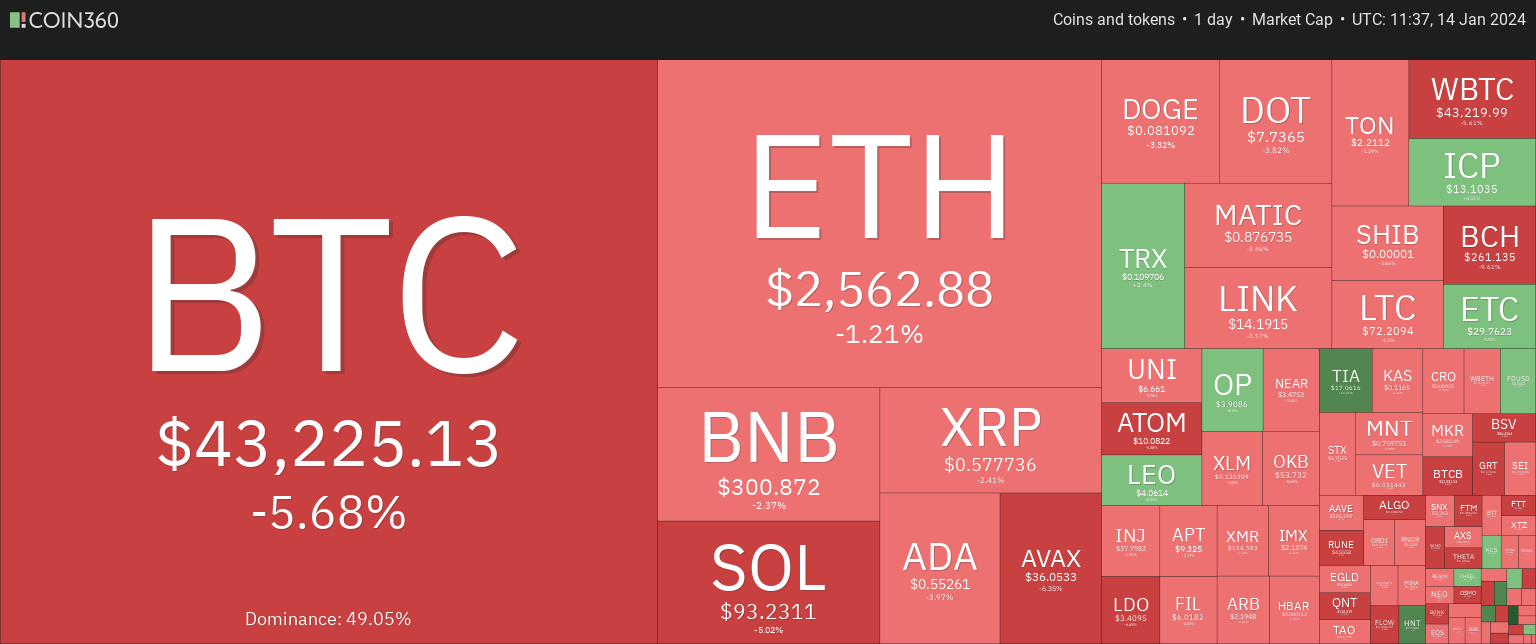

Last week, there was strong anticipation that Bitcoin’s value would surpass $48,000 and settle close to $50,000 by the weekend. However, defying these forecasts, Bitcoin underwent a notable downturn, sliding towards $41,000, even following the SEC’s approval of a spot BTC ETF. In spite of this downturn, Bitcoin has seen some rebound, presently hovering around the $43,000 mark. Current analysis indicates that a further decrease might happen, with $38,000 being a pivotal level for a possible strong recovery.

Despite lacking a strong upward market trend, the Bitcoin ETFs still attracted significant attention from traders. Records indicate that the total trading volume for these newly introduced Bitcoin ETFs surged above $5 billion. Following this initial adjustment, it’s anticipated that Bitcoin will stabilize within a certain range in the short term, as traders anticipate the start of institutional investments into these ETFs.

Over the longer term, the combination of Bitcoin ETFs and the upcoming Bitcoin halving in April 2024 is expected to lead to a reduction in supply, potentially driving prices upwards.

Which support levels could potentially trigger buying interest in Bitcoin and altcoins? We’ll examine the chart patterns of today’s top 5 cryptocurrencies to discover this.

Bitcoin (BTC) Price Analysis

Bitcoin price has been fluctuating a lot recently, as bears continue to defend the EMA200 trend line aggressively. However, buyers remain active near the dips. This indicates buying activity at lower price points and selling during price rises. As of writing, BTC price trades at $42,896, declining over 0.3% from yesterday’s rate.

The price continues to face rejections above $43,500, suggesting that the market is not sustaining higher levels. The RSI level below the midline at level 36 suggests a rising bearish dominance among traders.

Bears will soon attempt to send the price toward $40K to test buyers’ patience. However, this level might trigger accumulation and should there be a rebound, the bulls might send the price above the EMA20 trend line at $44,000.

Ethereum (ETH) Price Analysis

Though ETH price rejected the overhead resistance at $2,700, it currently holds buying confidence above $2,500. Interestingly, there was a robust accumulation near the dip of $2,450. Currently, Ethereum price trades at $2,548, surging over 0.2% from yesterday’s rate.

The initial resistance is set at the ascending line near $2,700, a level which may prompt short-term traders to take profits. However, if ETH maintains its position close to this level, it will imply that traders are buying on every small dip. This behavior could enhance the likelihood of Ether reaching the key psychological mark of $3,000.

On the downside, the first notable support is at $2,400. Should this level be breached, the price could potentially decline to $2,200.

BONK Price Analysis

Buyers are defending the Bonk price above moving averages on the 4-hour chart. However, the descending resistance line creates a hurdle for the meme coin. As of writing, Bonk price trades at $0.0000148, surging over 10% in a single day.

Bears are working hard to drag BONK/USDT below the 20-day EMA; however, there’s a solid accumulation near the dips. The leveling EMA lines and the RSI hovering just above the midpoint offer no distinct advantage to either bulls or bears.

If BONK breaks above the resistance line, we might see a quick surge toward the $0.000023. However, to defend this surge, bears need to pull the price toward $0.00001.

Chainlink (LINK) Price Analysis

Chainlink price has been pumping hard in the last few hours as it gained solid buying pressure with a jump in 24-hour trading volume toward $495 million. As of writing, LINK price trades at $15.2, surging over 8.1% from yesterday’s rate.

The 20-day Exponential Moving Average (EMA) at $14.5 is beginning to rise, suggesting a bullish advantage. However, with the Relative Strength Index (RSI) heading toward its overbought region, there’s a small edge for the sellers as a correction is around the corner. However, a break above the resistance line at $16 might strengthen buying pressure.

Solana (SOL) Price Analysis

Solana’s price has been fluctuating within the confines of an uptrend and a downtrend line for several days now. The nearly flat 20-day Exponential Moving Average (EMA) at $96, combined with the Relative Strength Index (RSI) hovering around the midpoint, fails to provide an edge to either buyers or sellers.

If the price remains below the 20-day EMA, there’s a potential for the SOL/USDT pair to drop towards the $89 level. Should this support level break, the decline could extend to the support at $80.3.

Conversely, if the bulls successfully push and maintain the price above the moving averages, they could gain control. This could lead to a breakout above the resistance channel at $103, sending SOL price above $120.