November is historically one of the best months for the cryptocurrency market, and this time it wasn’t an exception. The market continued the trend established in October, with the same expected events driving growth.

Key Takeaways:

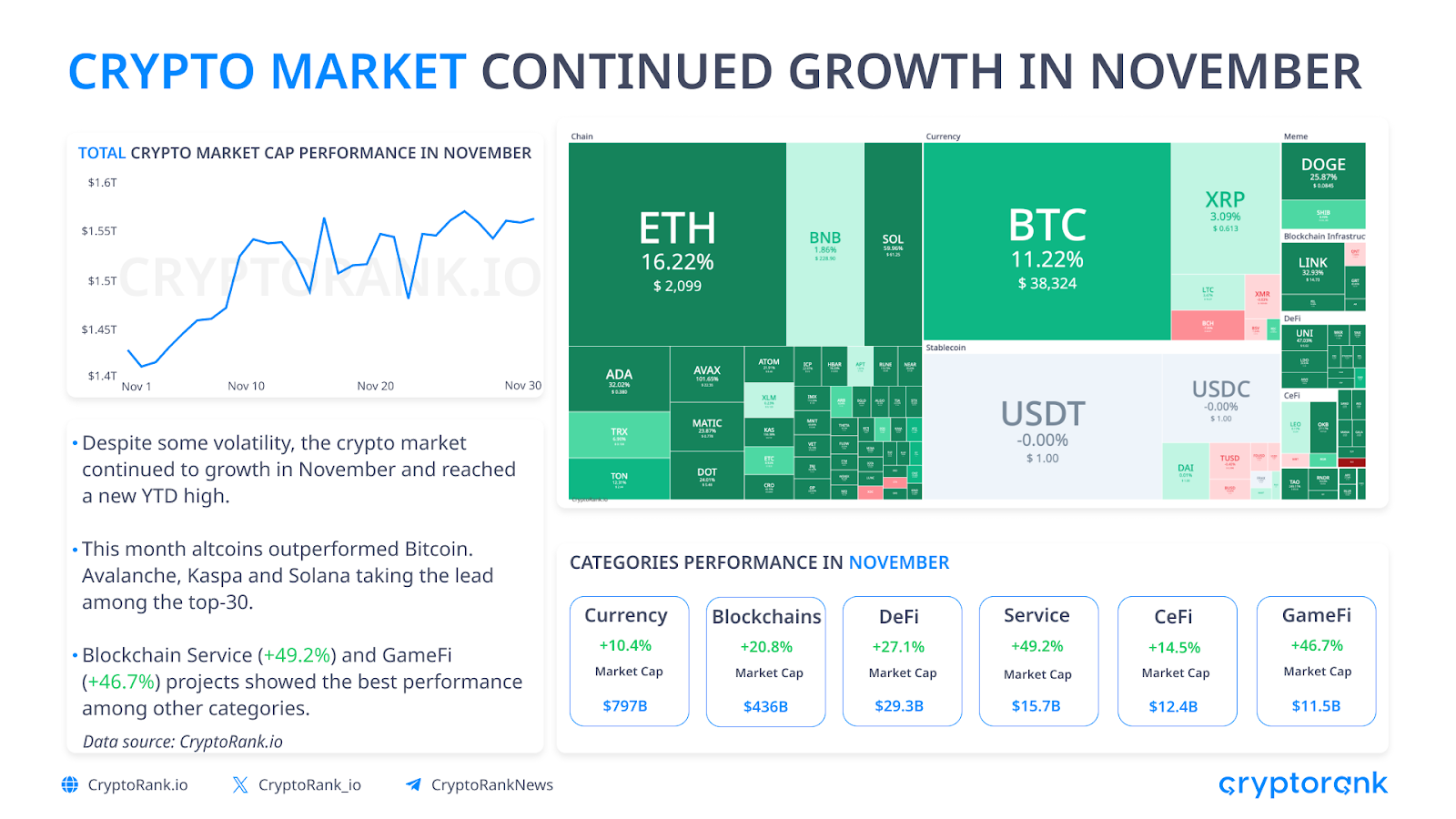

- The crypto market closed November on a positive note, with top altcoins outperforming Bitcoin.

- Binance continues to be the dominant crypto exchange and experienced a 65% increase in trading volume.

- The growth of DeFi is primarily driven by an increase in token prices.

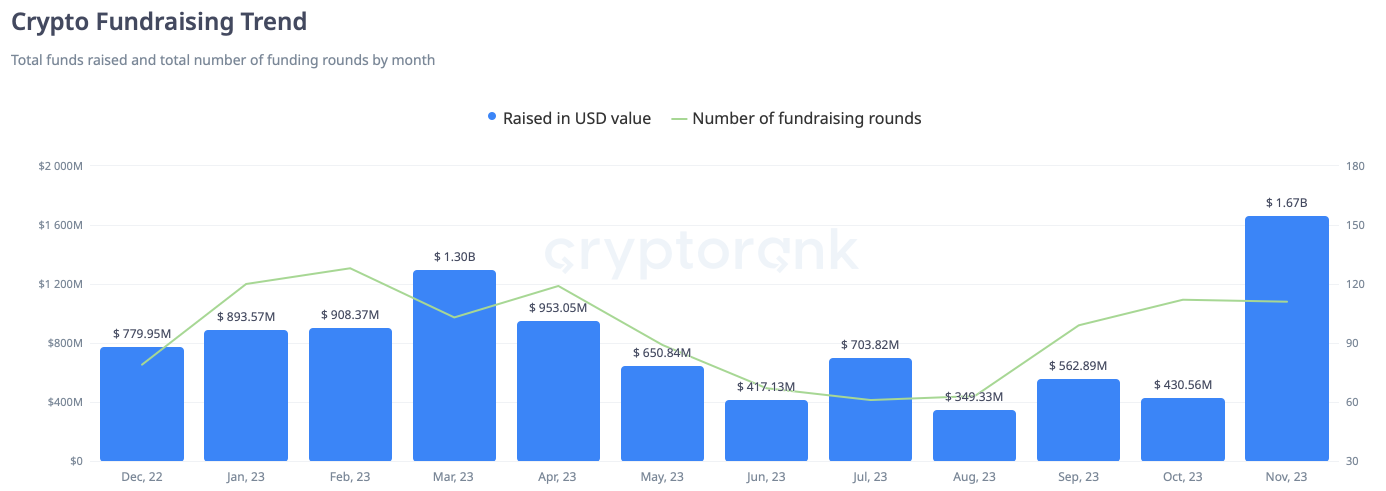

- Crypto venture capital (VC) activity saw a significant surge in November, resulting in a total raise of $1.7 billion.

Market Overview

The crypto market began and ended November on a positive note, despite experiencing some fluctuations in between. Most coins ended the month with a profit, and the total crypto market cap reached a new year-to-date (YTD) high, driven by Bitcoin’s growth.

Upon further analysis of the month’s results, it is evident that Blockchain Service and GameFi projects have emerged as the best performing categories. The concept of Play To Earn is gaining traction once again, especially with the introduction of intriguing new projects. However, the potential of this category remains uncertain, as there have been no substantial developments in the blockchain gaming model.

Bitcoin Is A Key Bull Trigger Of The Month

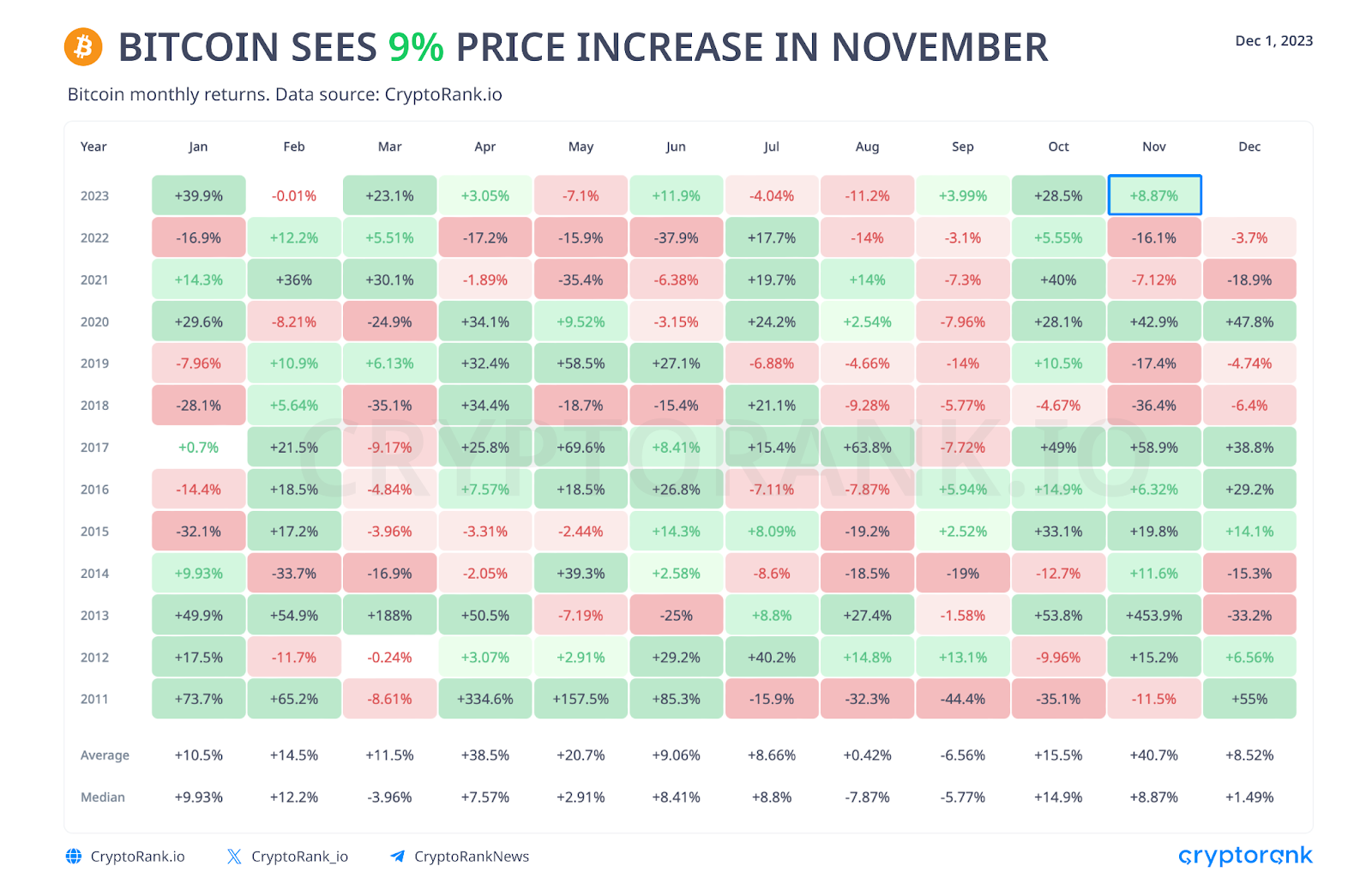

Although Bitcoin’s performance in November did not surpass that of October, it was still a remarkable month for Bitcoin. In November, BTC reached a new yearly high and continued to rise in early December at the time of writing.

Currently, the Bitcoin ETF remains a key driver in the market that pushes prices up. The approval is expected to happen in early January, and the market is already starting to anticipate this event and adjust prices accordingly.

Excellent Performance for Altcoins In November

November was a great month for many altcoins. We witnessed the rise of tokens from different categories, such as DeFi, Blockchains, and GameFi. With the growth of Bitcoin, we may be witnessing the start of an altcoin bull run.

November’s Key Events

Approval of Spot Bitcoin ETF Is Close?

The month began with speculation that the spot Bitcoin ETF was going be approved, but unfortunately, that has not yet happened. The SEC has postponed making a decision for now. The next opportunity for approval will be from January 5-10. Make sure to read our research on what the Spot Bitcoin ETF is and why it is important.

Blast breaks TVL records.

Blast, the new Layer 2 (L2) solution developed by the Blur team, has recently launched with a $20 million investment from Paradigm and other investors. The launch took place just after the end of the season at Blur. Within just one week, Blast managed to raise $500 million in Total Value Locked (TVL), surpassing Base, zkSync Era, StarkNet, and it keeps growing.

Blast achieved impressive growth through aggressive marketing strategies and a highly engaging gamification approach. Despite its “casino” wrapper, Blast provides users with low-risk returns through partnerships with Lido and Maker.

However, the community has mixed opinions about Blast. The funds invested are locked for a period of three months, and there is currently no product available. Even Paradigm disagrees with this decision. Nevertheless, the situation with Blast indicates a bullish sentiment, as people are willing to invest significant amounts of money based solely on trust and promises.

CZ Leaves, Goodbye Legend!

CZ has resigned as the CEO of Binance, and Richard Teng, former head of regional markets, has became the new CEO. Instead of adhering to CZ’s four principles, Richard has chosen to prioritize three principles in his new role: customer focus, regulatory cooperation, and partnership collaboration. It is worth noting that despite this significant change, BNB has shown strong performance with minimal volatility, indicating a positive outlook.

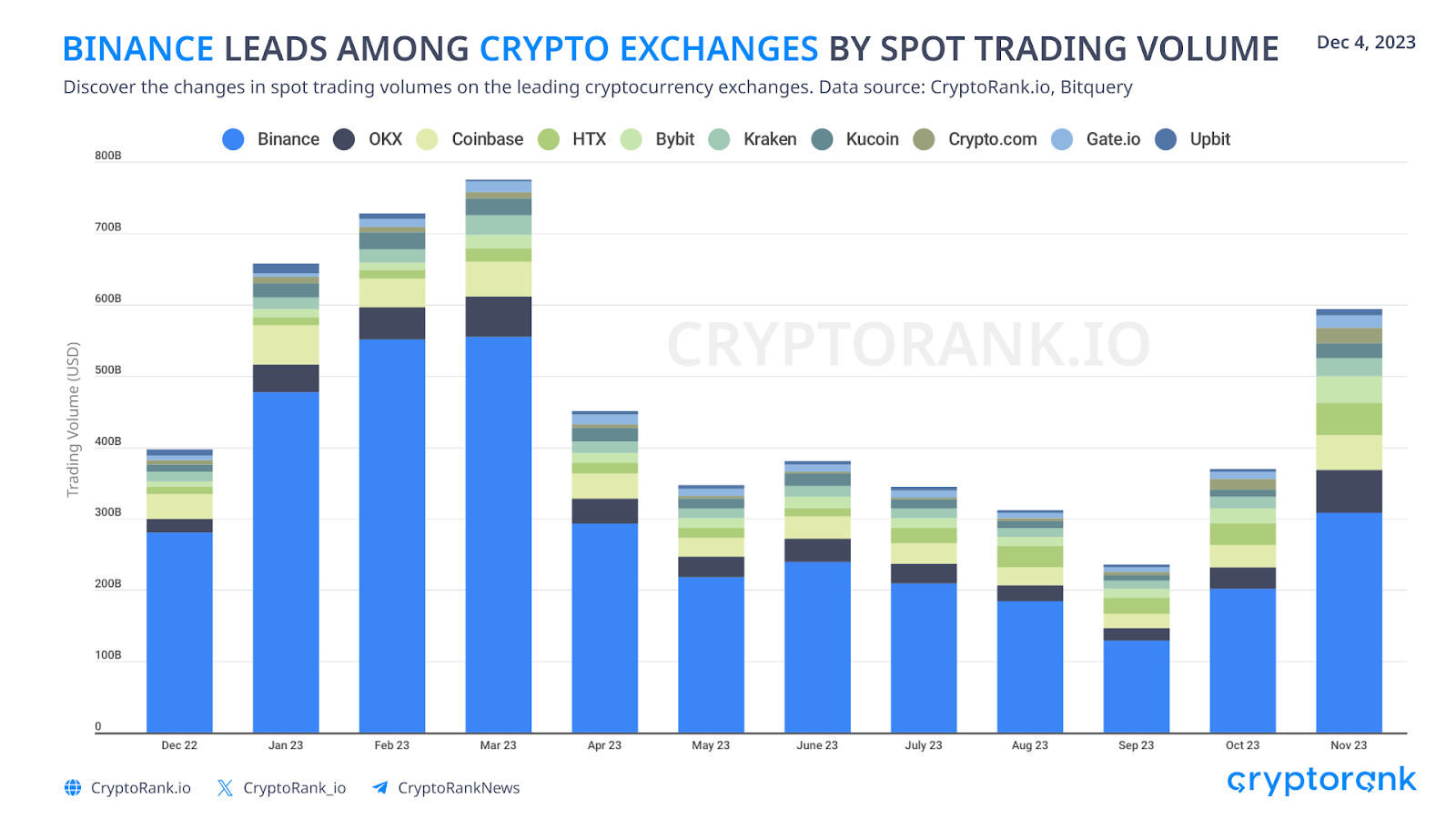

Trading Volumes Spiked, But Not For Every Exchange

In November, centralized exchanges experienced another growth in trading volumes. The bullish market led to increased trading volumes in both spot and futures markets. However, on-chain data indicates that decentralized exchanges had a smaller growth in aggregate trading volume during November.

In November 2023, the monthly spot trading volume of the top exchanges increased by 61%. Binance continues to hold the leading position with a market share of over 51%. Furthermore, Binance saw a 65.3% increase in trading volume compared to the previous month.

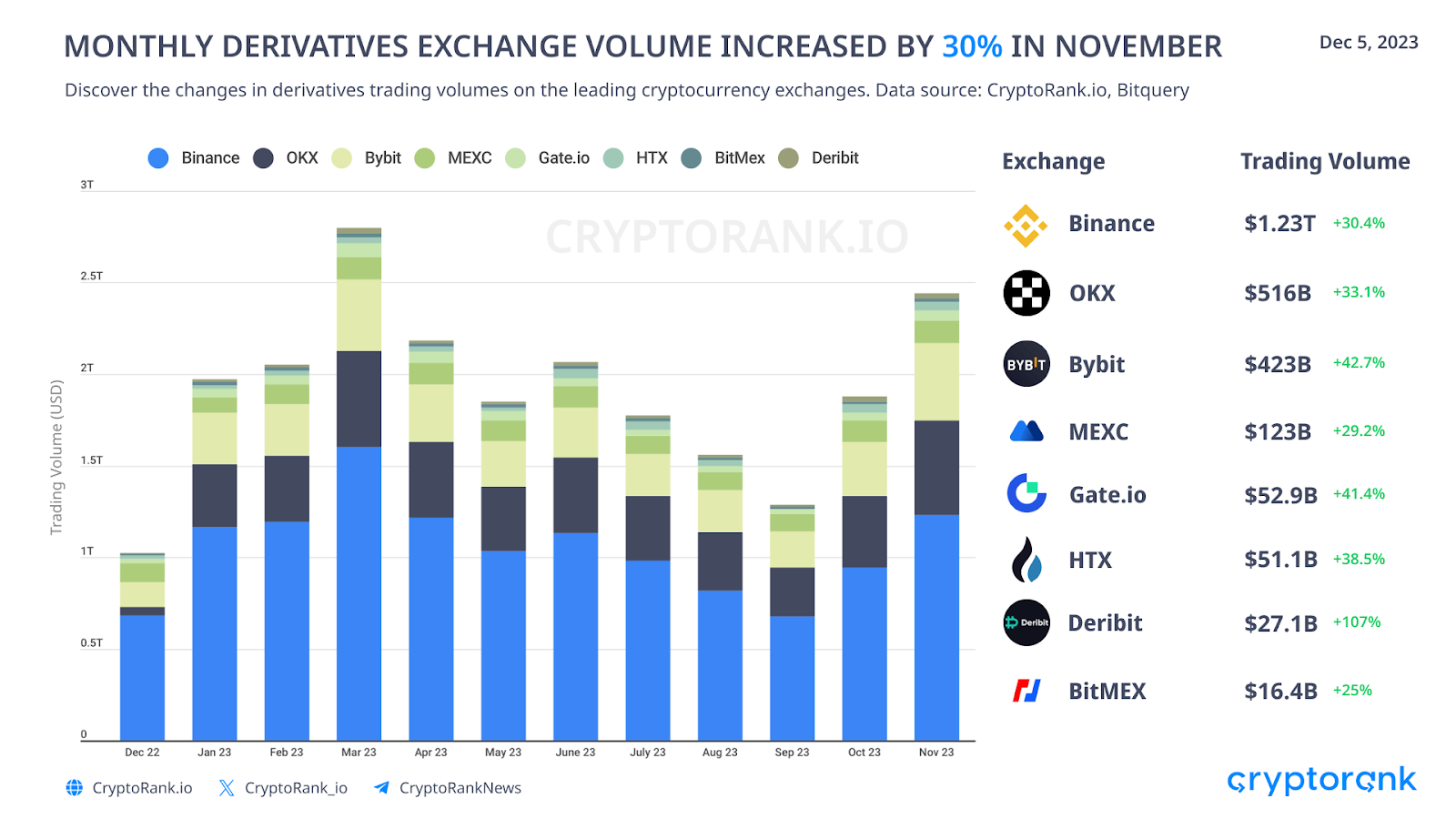

Trading volumes of futures on centralized exchanges displayed significantly less volatility. Derivatives volume on leading centralized exchanges increased by 30.1% in November 2023. While Binance remains the leadership, Deribit and Bybit lead in terms of monthly trading volume change.

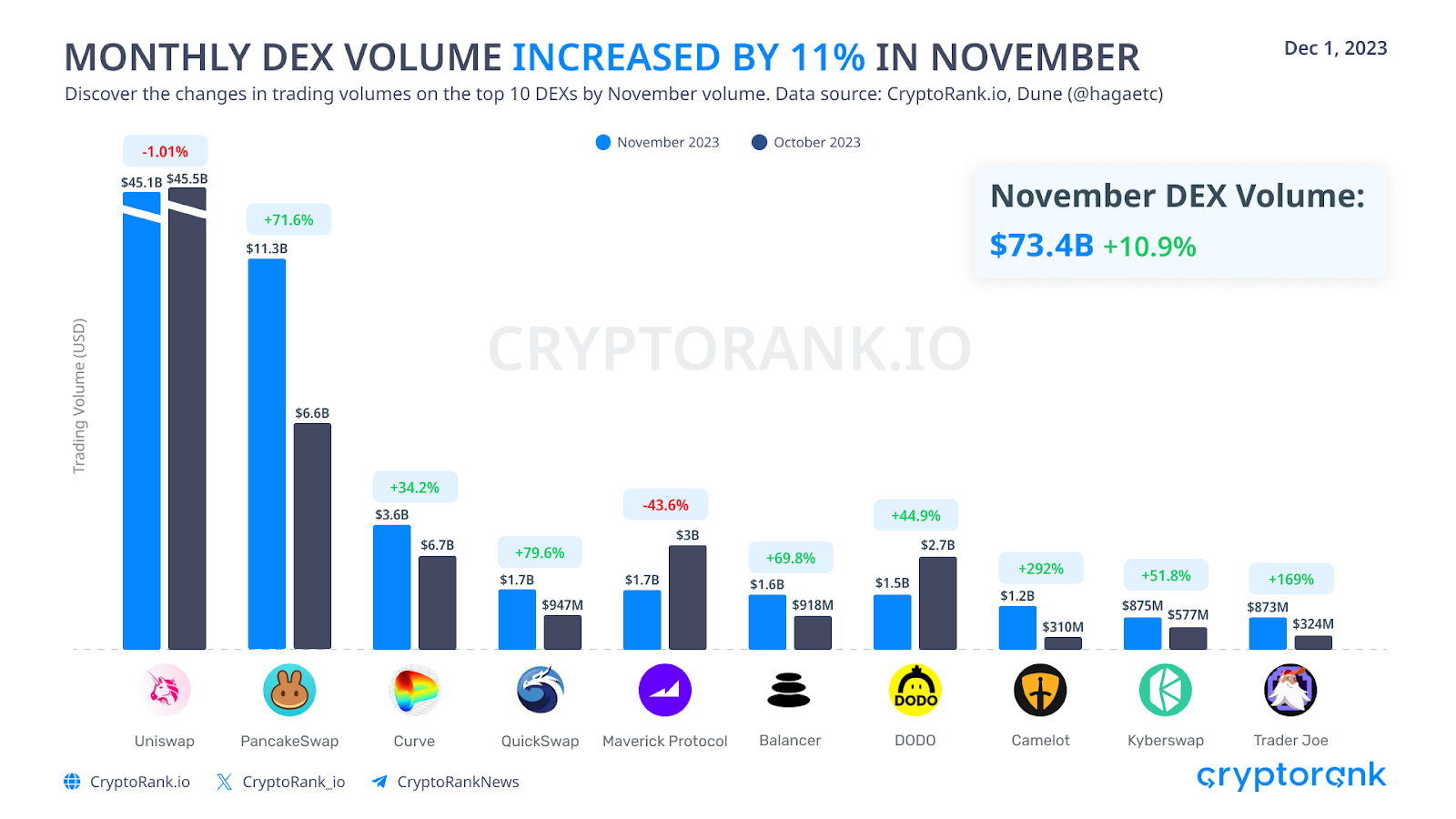

When it comes to decentralized exchanges, the situation is somewhat different. In November, the total trading volume only grew by 10%, primarily because of a 1% decrease in volumes on Uniswap. Despite the impressive growth in trading volumes on other exchanges, Uniswap still holds the largest share of the DEX market.

Private Fundraising Is Up, Token Sales Are Flat

Crypto VC activity saw a significant increase in November, resulting in a total raise of $1.7B. This is the highest point since October 2022. For more detailed information, please refer to our fundraising report.

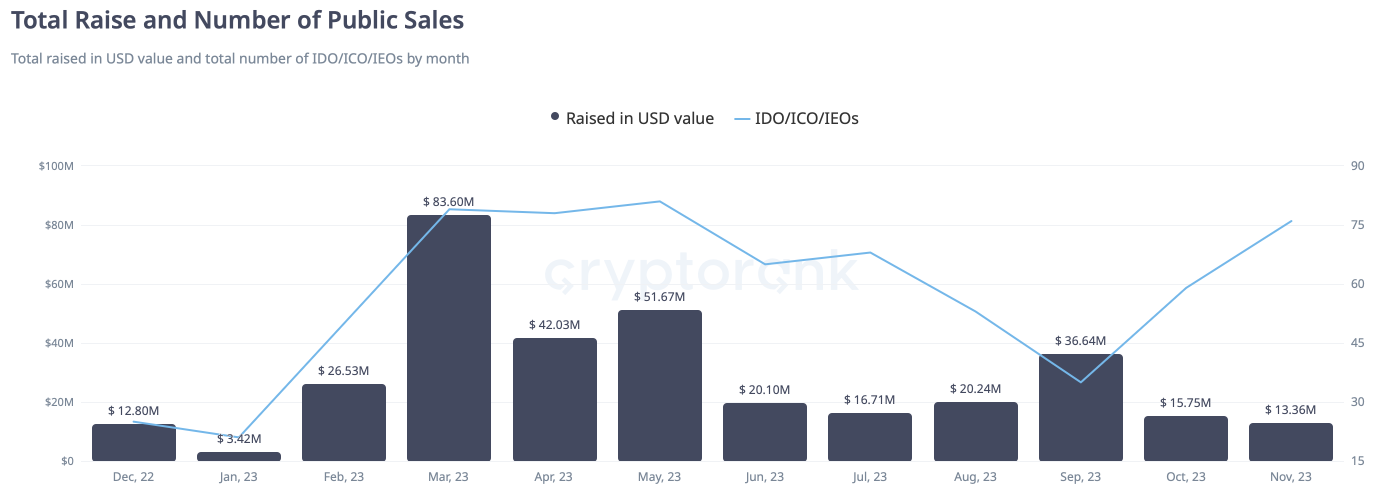

Regarding token sales, the situation remains disheartening. Despite an increase in the number of token sales, the amount of funds raised remains low. While it is possible that the ongoing positive market trend will result in the growth of IDOs, IEOs, and ICOs, there is currently no guarantee that we will witness the same level of excitement in token sales as we did in 2021.

The flow of investments into cryptocurrency has begun to recover, primarily through private investment rounds and direct investments by trading funds. Currently, most of the funds are held in Bitcoin (BTC), but we may witness a significant increase in interest in alternative cryptocurrencies once the Bitcoin ETF gains momentum.

DeFi TVL Finds Growth, But Relatively Slowly

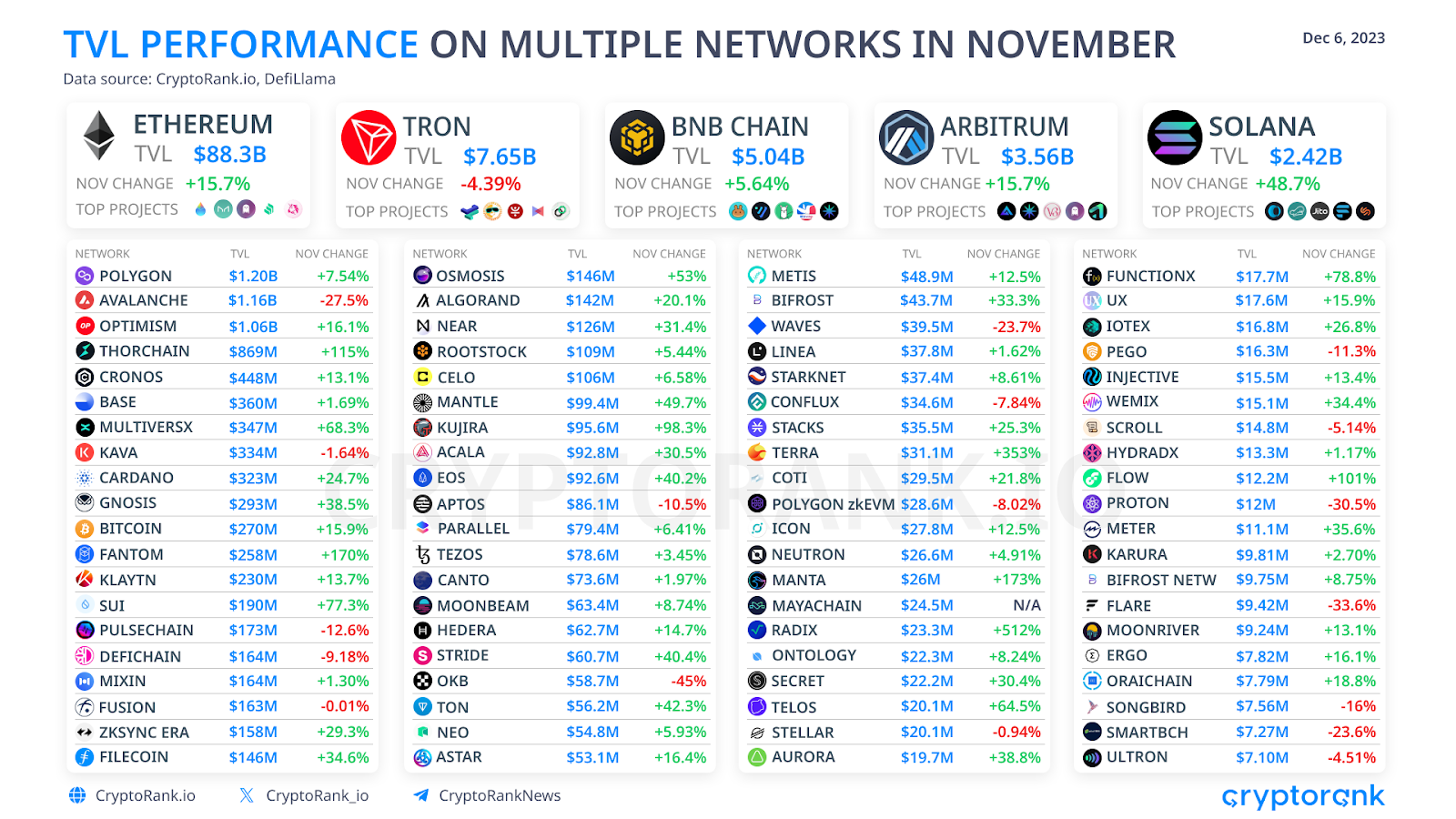

As mentioned earlier, if crypto investments do happen, they are typically settled in coins, primarily Bitcoin. This poses a major challenge for Decentralized Finance (DeFi), hindering the growth of Total Value Locked (TVL).

Despite the rise in coin value, the increase in the number of locked coins and tokens is minimal. Most of the notable changes occur when funds move from one project to another.

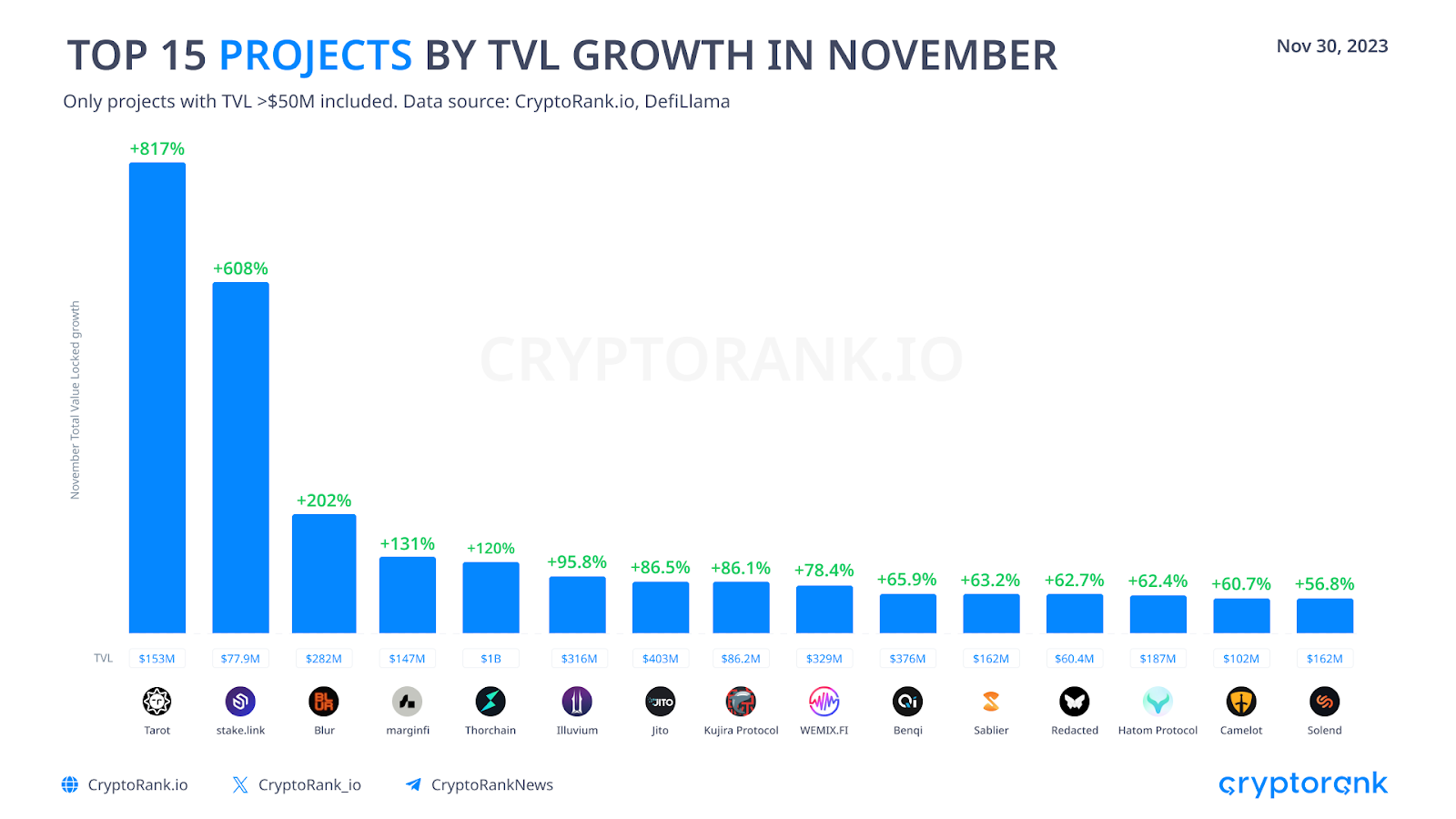

Solana, ThorChain, Fantom, and Sui experienced significant changes this month. Among the projects with low total value locked (TVL), Terra and Manta showed substantial growth.

This month proved to be highly successful for many DeFi protocols. The growth leaders included protocols from various categories such as lending, liquid staking, NFT, GameFi, and DEX.

On-Chain Picture Remains Positive

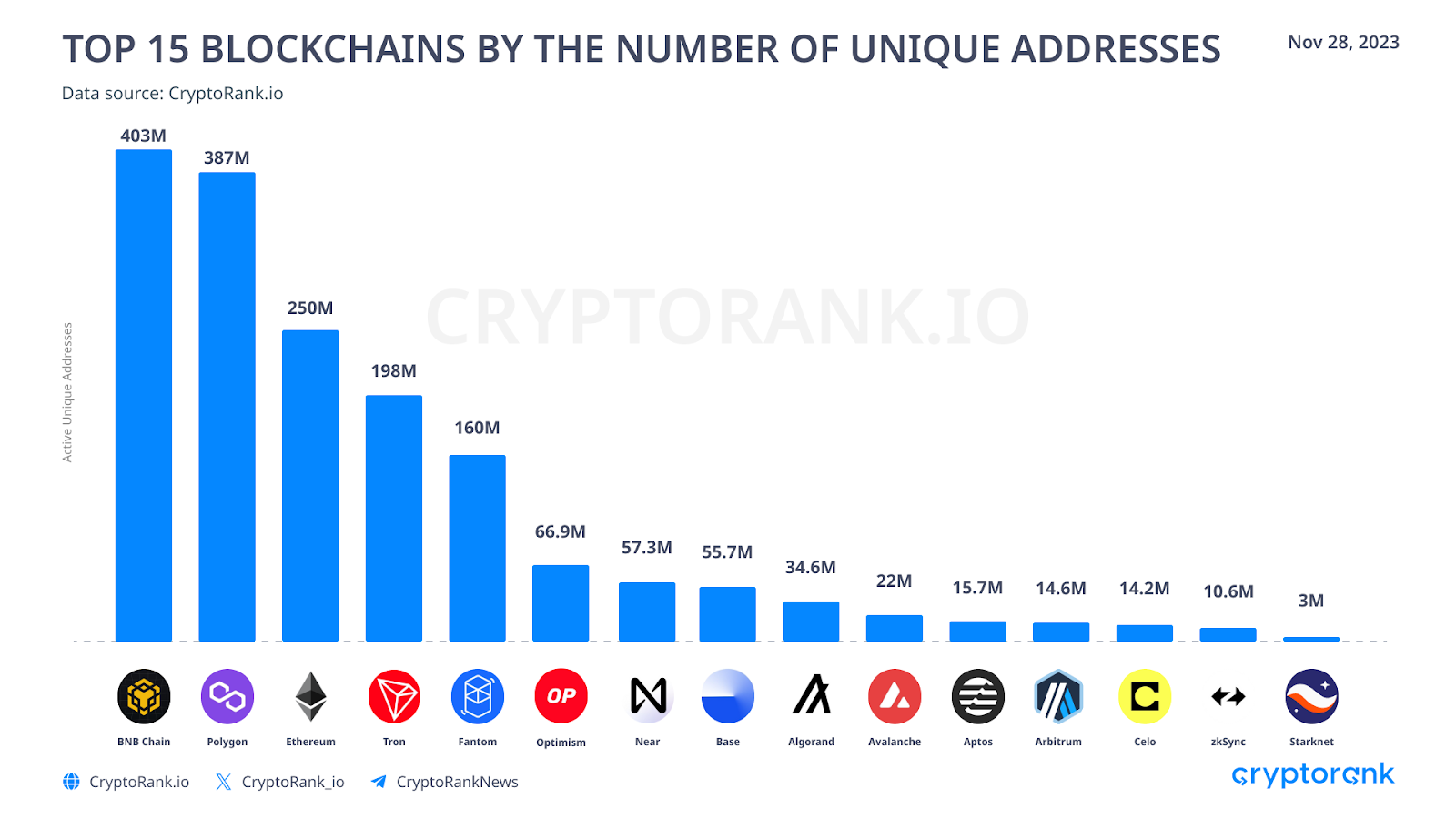

Data on on-chain utilization of blockchains continues to show growth. BNB Chain maintains its leadership position and in November surpassed the milestone of 400 million unique addresses.

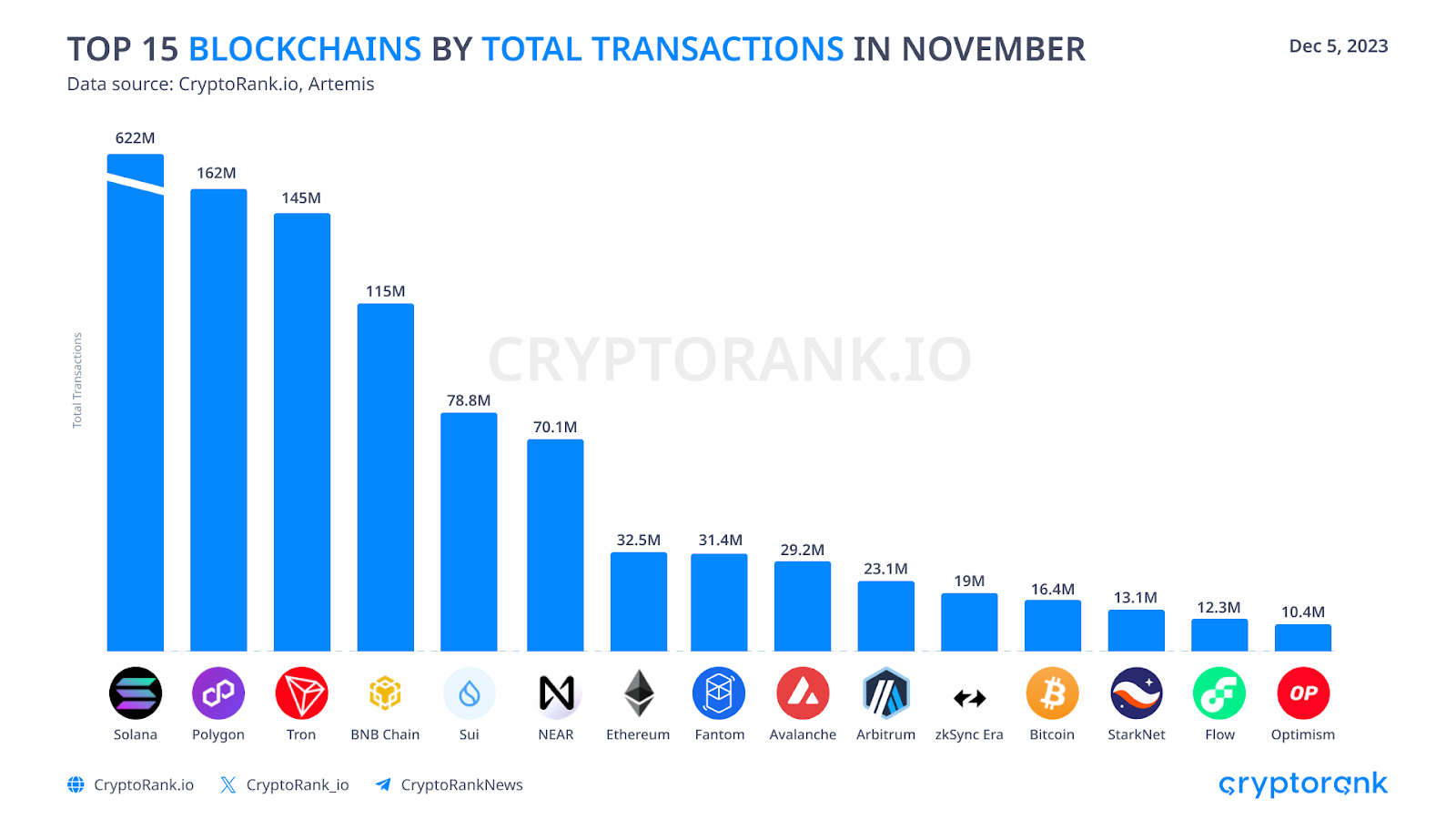

Solana leads in the number of transactions in November, followed by Polygon, TRON, and BNB Chain. Sui rounds out the top five most popular blockchains.

The coming months have the potential to be a great time for blockchains to grow their network statistics. This is because there will be increased interest from the crowd in altcoins and on-chain activity following the Bitcoin rally.

The Bottom Line

November proved to be an exceptionally successful month for the crypto market, bolstering participants’ confidence in the impending bull market. The same events that drove growth before continue to serve as key catalysts, and the belief in their occurrence is steadily increasing.

The possibility of a Bitcoin ETF is no longer a mere fantasy, but rather a tangible reality on the horizon. In light of this, not only Bitcoin but also numerous other coins are experiencing growth, while projects are intensifying their development efforts. However, it remains uncertain whether the bull run has commenced or is on the verge of starting, and what lies ahead once the ETF is approved.