The period of *BTC* inactivity appears to have come to an end, at least momentarily, with the cryptocurrency marking significant increases twice within the last 48 hours. Bitcoin has surged by over three thousand dollars during this period, while daily liquidations have rocketed to over $125 million. This surge comes after a significant drop following the U.S. SEC’s approval of nearly a dozen spot Exchange-Traded Funds (ETFs) on January 10, and particularly after these ETFs became available for trading the following day. The recent recovery in the market hints at a pre-halving bullish rally and BTC price might aim for $50K in the coming days, significantly plunging market interest on altcoins.

Bitcoin’s Market Dominance Skyrockets

Bitcoin began its surge yesterday, reaching $45,000 for the first time in a month since the ETF approvals. The next 12 hours have also shown a promising trend, with the cryptocurrency soaring to another monthly peak of over $46,000.

The sharp rise in Bitcoin’s value led to an abrupt and widespread liquidation of positions, totaling nearly $125 million. These liquidations primarily affected leveraged traders who were betting on different market movements, triggering an intense volatility in the market. Coinglass data reveals that the total crypto market liquidation surpassed $123 million, with short-positions worth of $90 million were closed. This has resulted in a surging buying confidence, with BTC price triggering nearly $50 million in total liquidation.

Significantly, Bitcoin’s increasing market dominance has eclipsed that of top altcoins such as *ETH*, DOGE, and XMR, as reported by Santiment. With Bitcoin’s market share climbing to over 53.5% accompanied by a spike in social media discussions, there’s been a noticeable decline in altcoin dominance, leading to a declined interest in the altcoin sector.

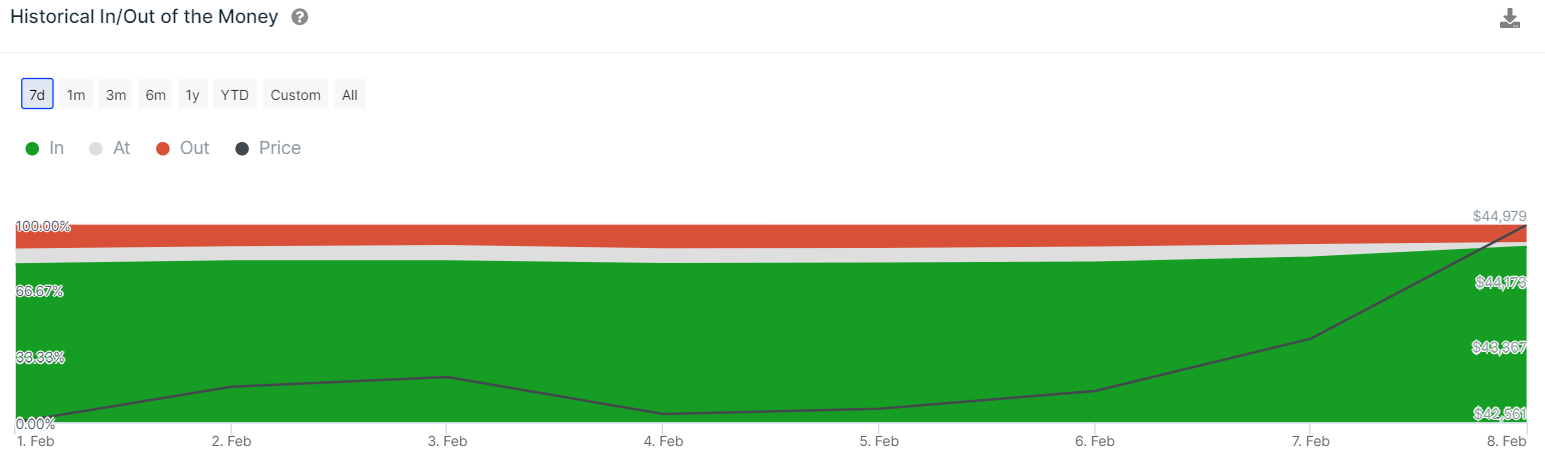

The recent rally in Bitcoin has elevated the proportion of profitable addresses to 88.7%, which translates to approximately 46 million addresses. This development is likely to boost investor confidence, prompting more individuals to acquire Bitcoin at its current price levels and thereby softening the resistance levels it faces. Notably, with the uptick in Bitcoin’s value, there’s been a trend of investors pulling their funds from exchanges.

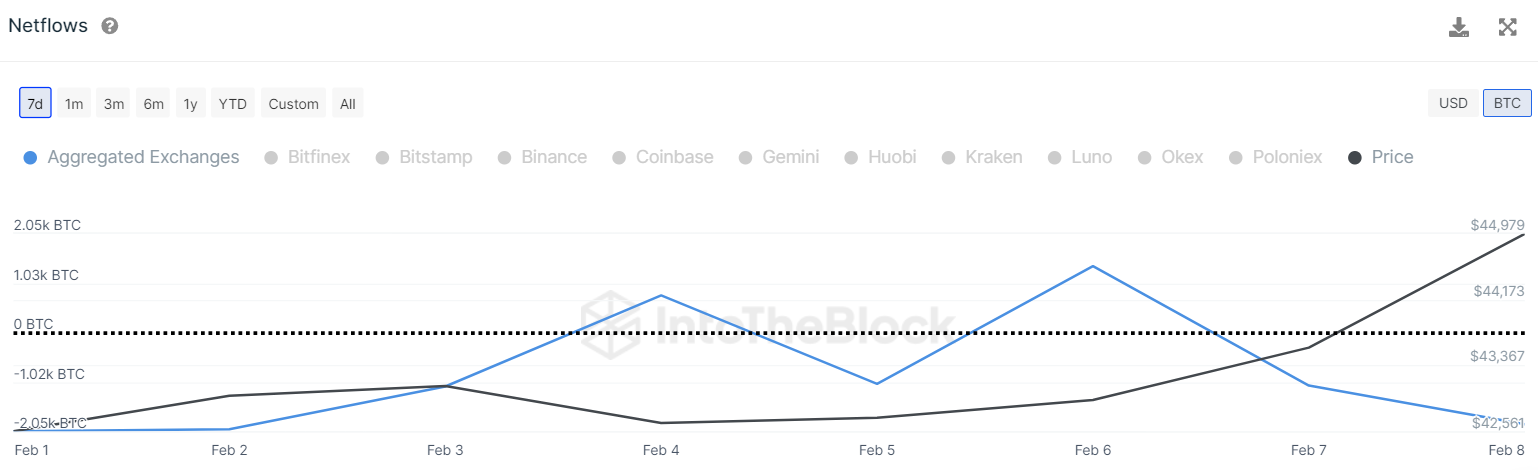

Data from IntoTheBlock indicates that Bitcoin’s Netflow has seen a decrease over the past 48 hours, hitting its lowest negative point at -1.91K BTC. This trend of net outflows exceeding inflows, even amidst rising prices, suggests that investors are increasingly inclined to hold onto their Bitcoin rather than sell it for immediate gains. Such behavior is reinforcing Bitcoin’s momentum, setting the stage for a potential surge beyond the $50K threshold.

Bitcoin’s Short-Term Target Of $48K

Bitcoin (BTC) is on its way to reaching $48,000 in the near term, triggered by a consistent pattern of gains observed around the Chinese New Year, as per Markus Thielen, head of research at Matrixport and founder of 10x Research.

Thielen highlighted in a report published on Thursday the critical statistical significance of the upcoming days, noting that Bitcoin typically experiences an 11% rally around the Chinese New Year, which begins on February 10 (Saturday). “Over the past nine years, Bitcoin has consistently seen an uptick whenever traders purchased it three days before and sold it ten days after the commencement of the Chinese New Year,” Thielen explained.

Peering into the future, Thielen predicts more gains for Bitcoin, drawing on the Elliott Wave theory—a technical analysis method that suggests price movements follow predictable wave patterns. According to this theory, price trends unfold in five phases, with waves 1, 3, and 5 categorized as “impulse waves” that denote the primary trend direction.

Conversely, waves 2 and 4 act as retracements or minor pullbacks within the broader impulsive movement. Thielen points out that Bitcoin has navigated through its wave 4 retracement, dropping to $38,500, and is now on its fifth and final impulse wave of the current uptrend, aiming for a target of $52,000 by mid-March.