November seems set to extend October’s bullish momentum, with Bitcoin’s price initiating the month on a strong upward trajectory. Recently, Bitcoin took a confident jump to test the $35K threshold and even soared past it, touching a high at just over $36K. But even as open interest climbs and the market becomes stable, there’s an increasing concern about the possibility of a liquidation.

A Significant Liquidation Is Yet To Take Place

Since Bitcoin’s price jumped to $35,000, things in the market have been quite calm, with trading sentiment not making any dramatic changes. Right now, Bitcoin’s price is hovering in a narrow zone between $35K-$36K, and it’s not clear what it will do next. Traders are looking for some signs to figure out where things are headed. According to CryptoQuant, more and more people are getting into Bitcoin futures and options as the Open Interest metric shows no sign of slowing down.

Open Interest shows how many future and option contracts are opened in the market. It shows that traders are taking risks, and hoping they’ll make some good money. Also, a lot of traders seem to think prices will keep going up because they’re willing to pay a little extra to keep their trades open, which is what those positive funding rates are all about.

Even though the market is getting ready for prices to move a lot, there has not been any big sell-offs or buy-ins just yet. The market isn’t bouncing around too much at the moment. However, this quiet can’t last forever. If things start moving fast again, we might see a lot of sudden buying or selling, which could shake things up for everyone who’s invested.

BTC Price Prepares For A $40K Breakout

Historically, the market has seen an uptick in the final quarter of the year. November, in particular, tends to follow October’s lead, generally sustaining the pace, with the notable exception of last year’s FTX crash that bucked the trend. On the whole, it wouldn’t be surprising to see Bitcoin’s value climb by an additional 10% in November, pushing it in the direction of $37,500. Such a move might even set the stage for Bitcoin to cross the $40,000 threshold within the month.

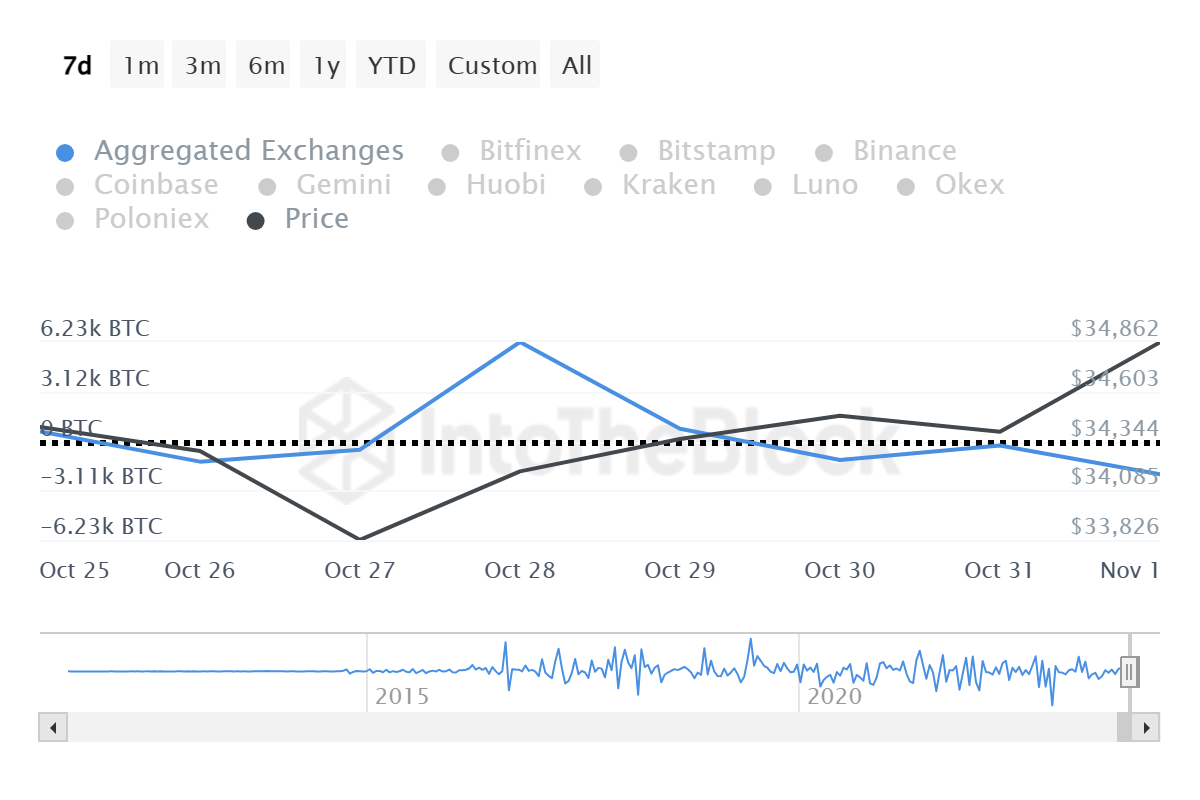

Information sourced from IntoTheBlock indicates that Bitcoin has been seeing more outflows than inflows over the past week, with reserves on exchanges dropping. This pattern typically hints at a bright future for the market since a decrease in exchange reserves often means that more investors are holding onto their Bitcoin rather than selling it.

This kind of movement is usually read as a sign that investors are in a phase of accumulating more Bitcoin, which often precedes an increase in its price. Therefore, the current scenario may be painting a ‘bullish’ picture for Bitcoin’s trend in November. Currently, the netflow stands at a substantial 2100 BTC, underscoring a rising interest from investors.

Federal Reserve Chair Jerome Powell’s recent comments suggested a softening stance on rate hikes, acknowledging the already significant tightening of monetary policy. Markets interpreted this as a potential pause in rate hikes, with chances of cuts by mid-2024.

In response, traders are moving away from the dollar and into riskier assets, which has given a boost to cryptocurrencies.

As a result, Bitcoin has surged past the $35,000 mark, a notable recovery from its previous dip to $15,000 late last year, following a series of collapses within the crypto space, including the notable FTX bankruptcy.