Bitcoin’s recent ascent to new heights after BTC ETF approval has captured the attention of investors worldwide. However, the master cryptocurrency is now facing a notable correction since the last week. Analysts at CryptoQuant have delved into the intricacies of this downturn. They have identified three pivotal factors that are currently influencing Bitcoin’s trajectory. Bitcoin has lost 6% of its value this week in two days so far.

Moreover, the factors are reverberating throughout the whole crypto market. Almost all altcoins are feeling the pinch of the correction. 14% drop in $WIF and 5% drop in $FET price suggests that almost all narratives are affected by *BTC* correction despite the fact that meme coins and AI coins were dominating the market in the last week.

Three Key Factors Behind Bitcoin’s Downturn Unveiled by CryptoQuant

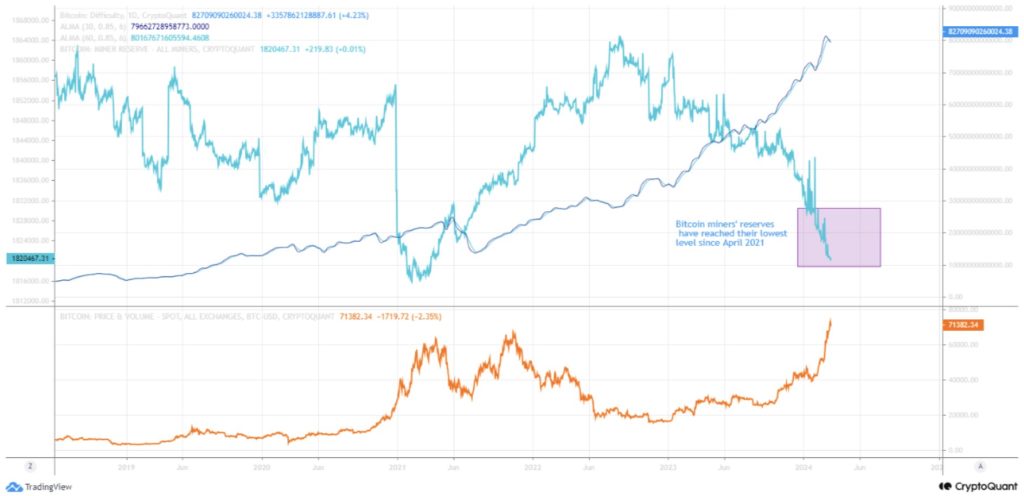

According to insights from CryptoQuant author @CryptoOnchain, Bitcoin miners’ reserves have seen a significant decline. The BTC miner reserves are currently at their lowest level since April 2021. This decline in reserves has continued since November 2023. This change is common before Bitcoin halvings and underscores a crucial shift in market dynamics. This change suggests heightened selling pressure on the cryptocurrency.

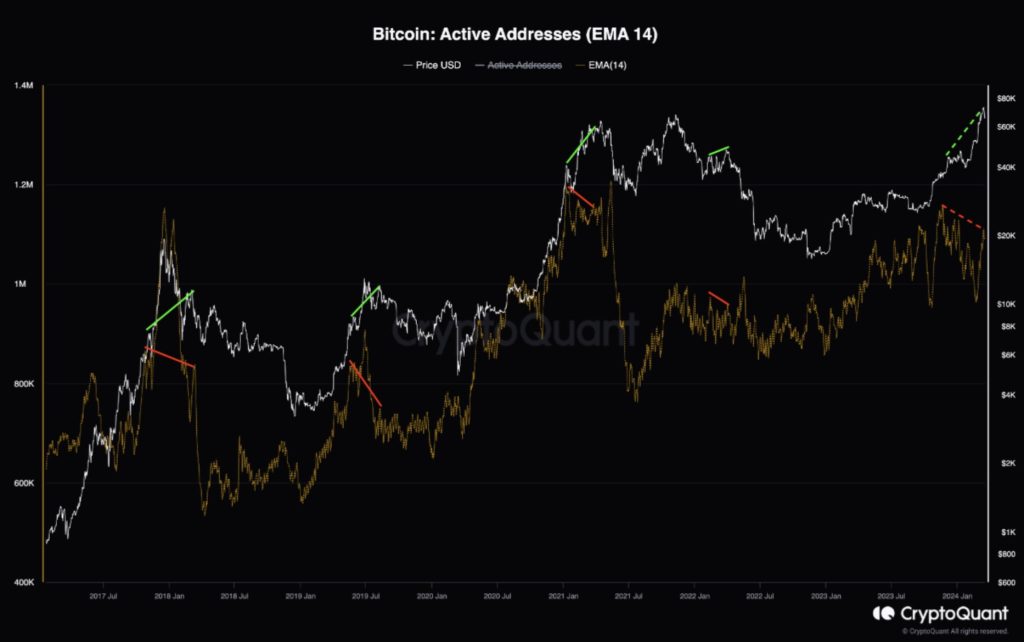

Moreover, concerns have been raised by @phi_deltalytics regarding the disparity between Bitcoin’s surging price and the sluggish growth in active addresses. Despite the impressive climb in Bitcoin’s value, the growth in active addresses has failed to keep pace. This point hints at a potential disconnect between market sentiment and actual usage.

The discrepancy between Bitcoin’s rising price and stagnant active addresses suggests that the price increase may be driven by speculation rather than genuine network usage, potentially leading to a correction.

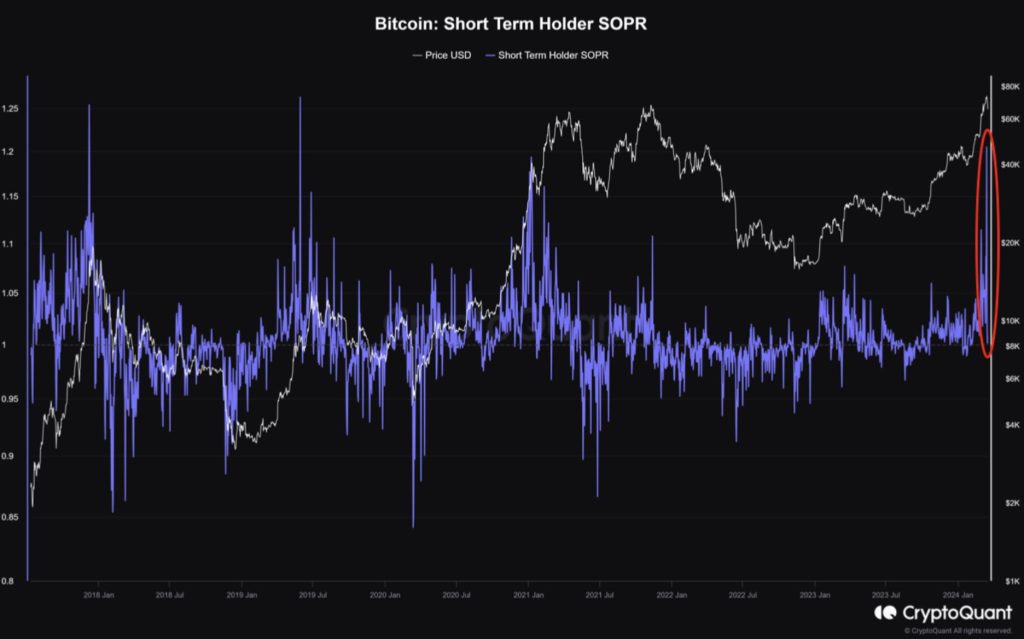

Adding to the mix, on-chain data scrutinized by @DanCoinInvestor points to a surge in profit-taking by short-term Bitcoin holders. This pattern, reminiscent of previous market peaks, implies that investors are seizing the opportunity to cash in on their gains, potentially signaling a critical turning point in Bitcoin’s price trajectory.

Understanding Bitcoin’s Path Forward Amid Market Volatility

As Bitcoin grapples with this correction, investors are closely monitoring these key indicators for insights into the cryptocurrency’s future direction. The convergence of declining miners’ reserves, lagging active addresses, and a surge in profit-taking underscores the multifaceted nature of factors shaping Bitcoin’s market dynamics. Moreover, this highlights the complexity of navigating the cryptocurrency landscape during these turbulent times.