Introduction

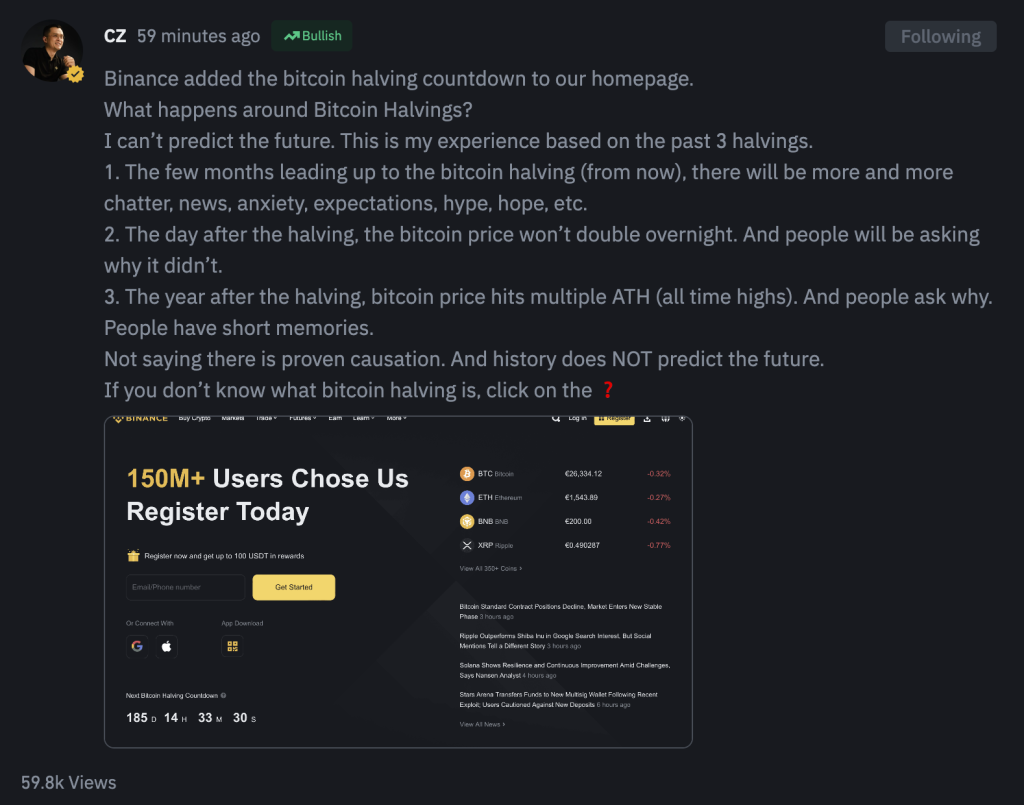

The cryptocurrency market, despite its relative youth, is no stranger to patterns and cyclic behaviors, notably those revolving around Bitcoin halvings. Changpeng Zhao, widely recognized as CZ, the CEO of Binance, recently expressed his thoughts and past experiences regarding the dynamics and sentiment that typically unfold surrounding these anticipated events. Although he stresses an inability to predict the future, CZ shares his observations from the past three Bitcoin halvings.

The Anticipation and Buzz Before Halvings

Heightened Conversations and Expectations

In the months leading up to a Bitcoin halving, the cryptocurrency community and market participants are encapsulated by a diverse range of emotions and speculations. Conversations, debates, and discussions centered around predictions, potentials, and prospects of Bitcoin’s price trajectory pervade both online and offline platforms.

Anxiety and Hope Coexist

The anticipation stirs a concoction of anxiety and hope among investors, traders, and onlookers. While some harbor apprehensions regarding the impact of the halving on Bitcoin’s price and the broader market, others nestle hopes and expectations of lucrative outcomes and possible bullish runs.

The Immediate Aftermath: Questions and Discontent

Why No Instantaneous Surge?

Contrary to the hopes of many, Bitcoin’s price does not double overnight post-halving. The days following witness an influx of puzzled expressions, discontent, and myriad questions, as individuals, especially those new to the space, grapple with the unmet expectations of immediate price surges.

Retrospection: A Year Later

The Journey to All-Time Highs

Surprisingly to some, the year following a Bitcoin halving often paints a different picture – a series of All-Time Highs (ATH) in Bitcoin’s price. The community, still in reminiscence of the immediate post-halving stagnancy, finds itself pondering the catalysts behind such bullish trends. The memory of the once-dissatisfied and questioning community fades, replaced by astonishment and fresh curiosities regarding the factors driving the unforeseen price hikes.

CZ’s Cautious Note

History as a Non-Predictive Tool

While CZ’s experiences and observations provide a fascinating glimpse into the patterns that have historically enveloped Bitcoin halvings, he underscores a pivotal disclaimer: history does not predict the future. In the inherently volatile and uncertain domain of cryptocurrencies, past behaviors are not indicative of future outcomes.

No Proven Causation

The correlation between halvings and eventual price increases does not imply causation. Various factors, such as macroeconomic variables, technological advancements, regulatory frameworks, and overall adoption rates, interact in complex ways to influence Bitcoin’s price.

Conclusion

Exploring the multifaceted dynamics and sentiment surrounding Bitcoin halvings through CZ’s insights offers an intriguing exploration of past market behaviors, yet it simultaneously underlines the principle that the cryptocurrency market remains unpredictably unique. Investors and participants must navigate the thrilling yet uncertain waters of Bitcoin trading with caution, armed with both historical knowledge and an understanding of its limitations.