The bears are in control of today’s session, as seen from the decrease in the global market cap. The total cap stood at $3.35T as of press time, representing a 0.74% decrease over the last 24 hours, while the trading volume dropped by 2.28% over the same period to stand at $198.38B as of press time.

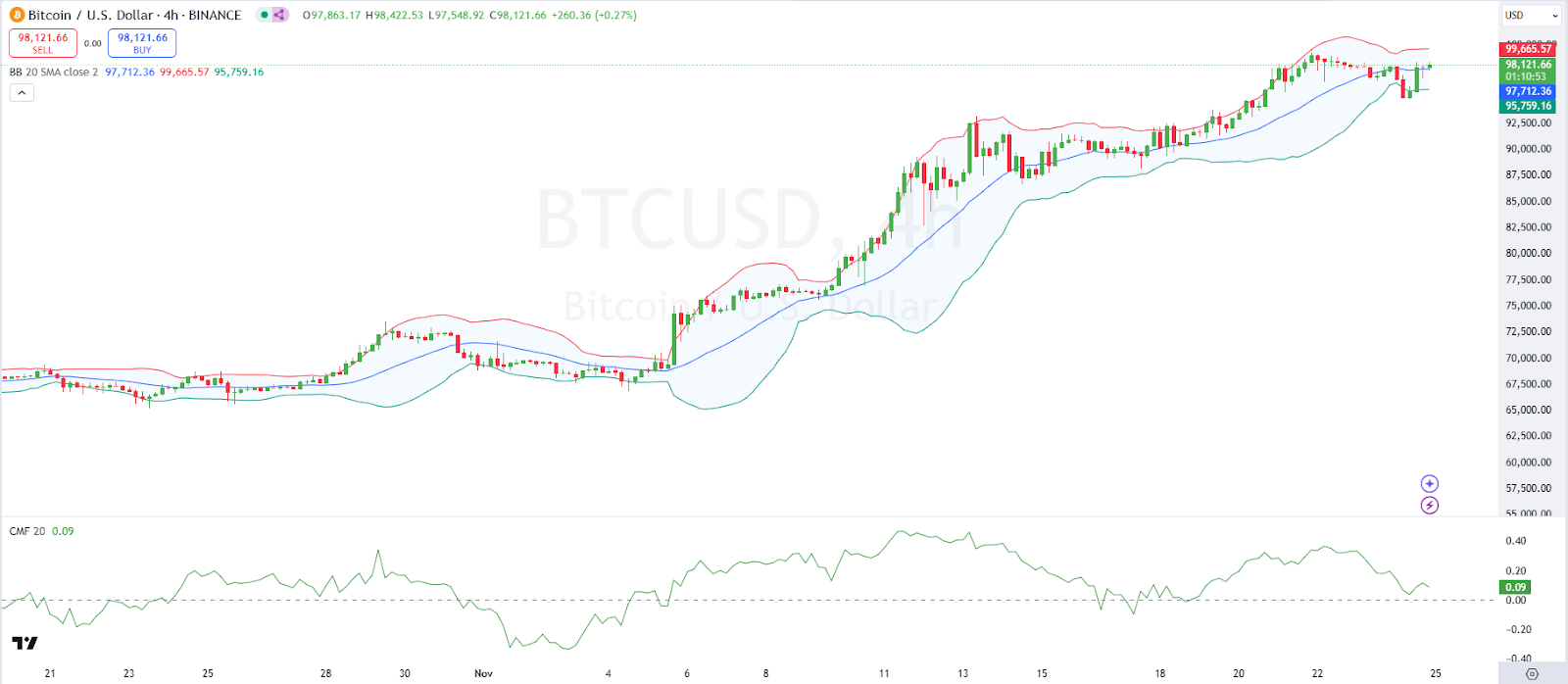

Bitcoin Price Review

Bitcoin, $BTC, has failed to post gains in today’s session, as seen from its price movements. Looking at an in-depth analysis, we see that the Bollinger Bands are moderately wide, suggesting a decent level of volatility. The bands have begun to contract slightly, indicating potential stabilization or decrease in volatility.

The Chaikin Money Flow (CMF) has had fluctuations above and below the zero line, suggesting mixed signals on buying vs. selling pressure. The recent readings near the zero line imply a balance between buying and selling forces. Bitcoin traded at $98,206 as of press time, representing a 0.26% decrease over the last 24 hours.

4-hour BTC|USD Chart | Source: TradingView

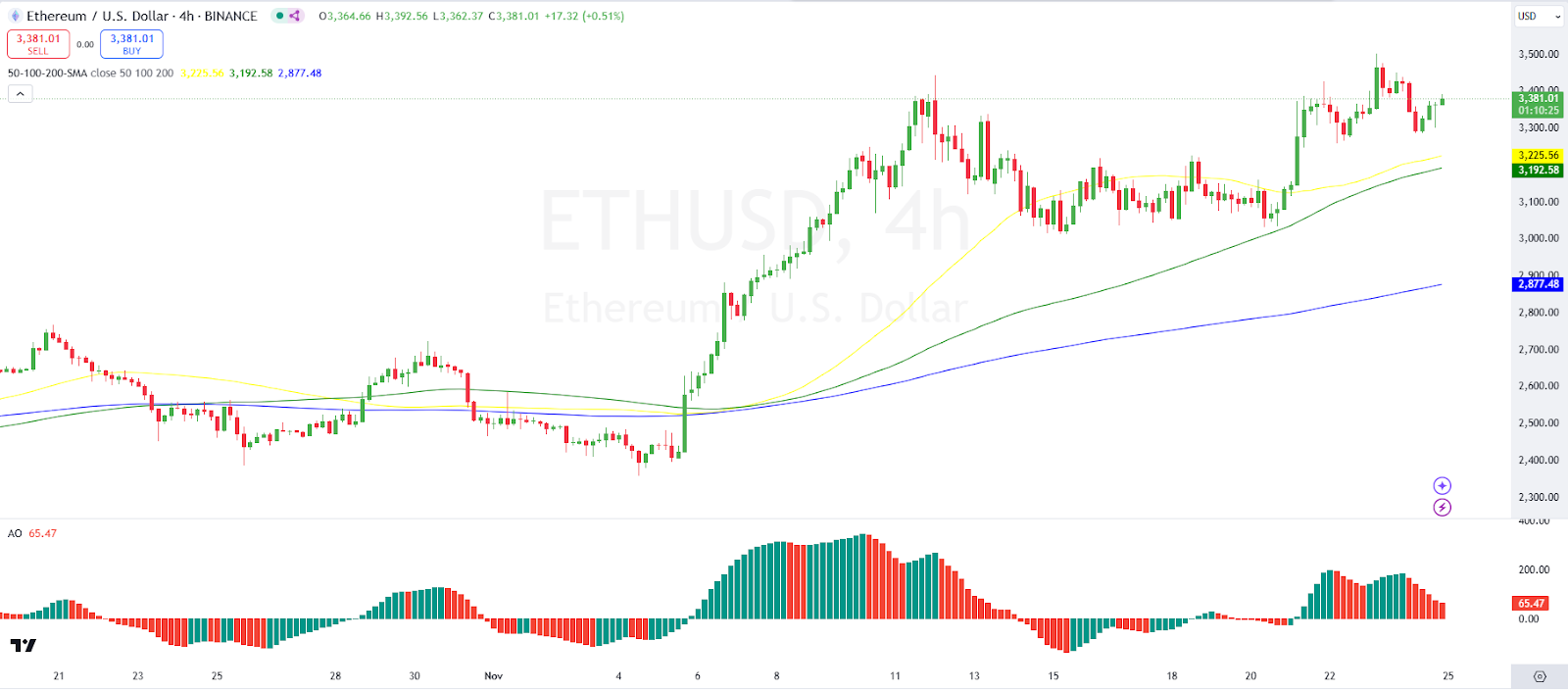

Ethereum Price Review

Ethereum, $ETH, has also failed to post gains in today’s session as seen from its price movements. Looking at an in-depth analysis, we see that the recent increase in price is not accompanied by a widening of the Bollinger Bands, suggesting the move is within expected volatility levels.

On the other hand, we see that the Awesome Oscillator shows strong green bars, indicating growing bullish momentum. However, the decreasing size of the bars suggests that momentum might be tapering off. Ethereum traded at $3,383 as of press time, representing a 1.29% decrease over the last 24 hours.

4-hour ETH/USD Chart | Source: TradingView

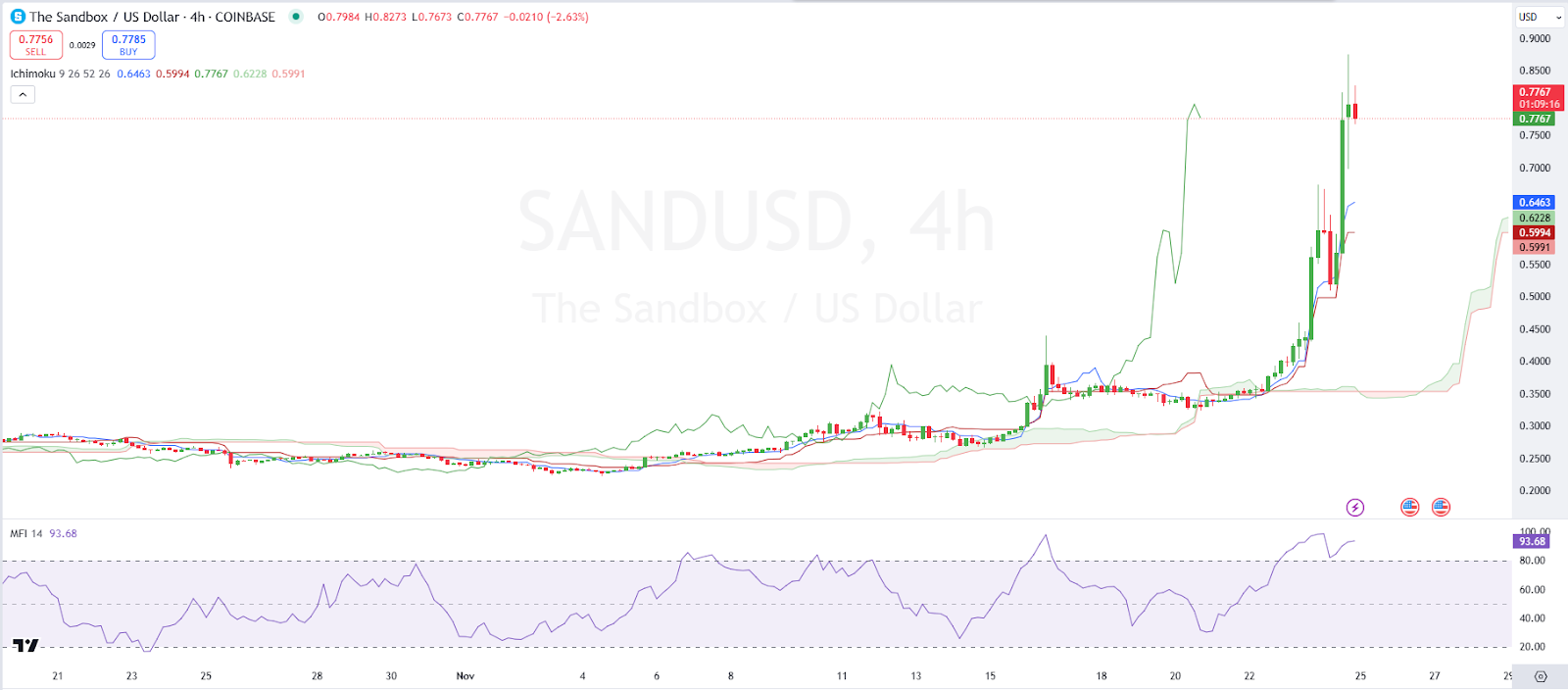

The Sandbox Price Review

The Sandbox, $SAND, is among the top gainers in today’s session as also seen from its price movements. Looking at an in-depth analysis, we see that the extreme spike and subsequent red candles indicate high volatility. The Ichimoku Cloud, expanding during the price spike, further confirms increased market volatility.

On the other hand, we see that the Money Flow Index (MFI) is extremely high, which typically suggests overbought conditions that could precede a price pullback. The Sandbox traded at $0.7599 as of press time, representing a 27.29% increase over the last 24 hours.

4-hour STX/USDT Chart | Source: TradingView

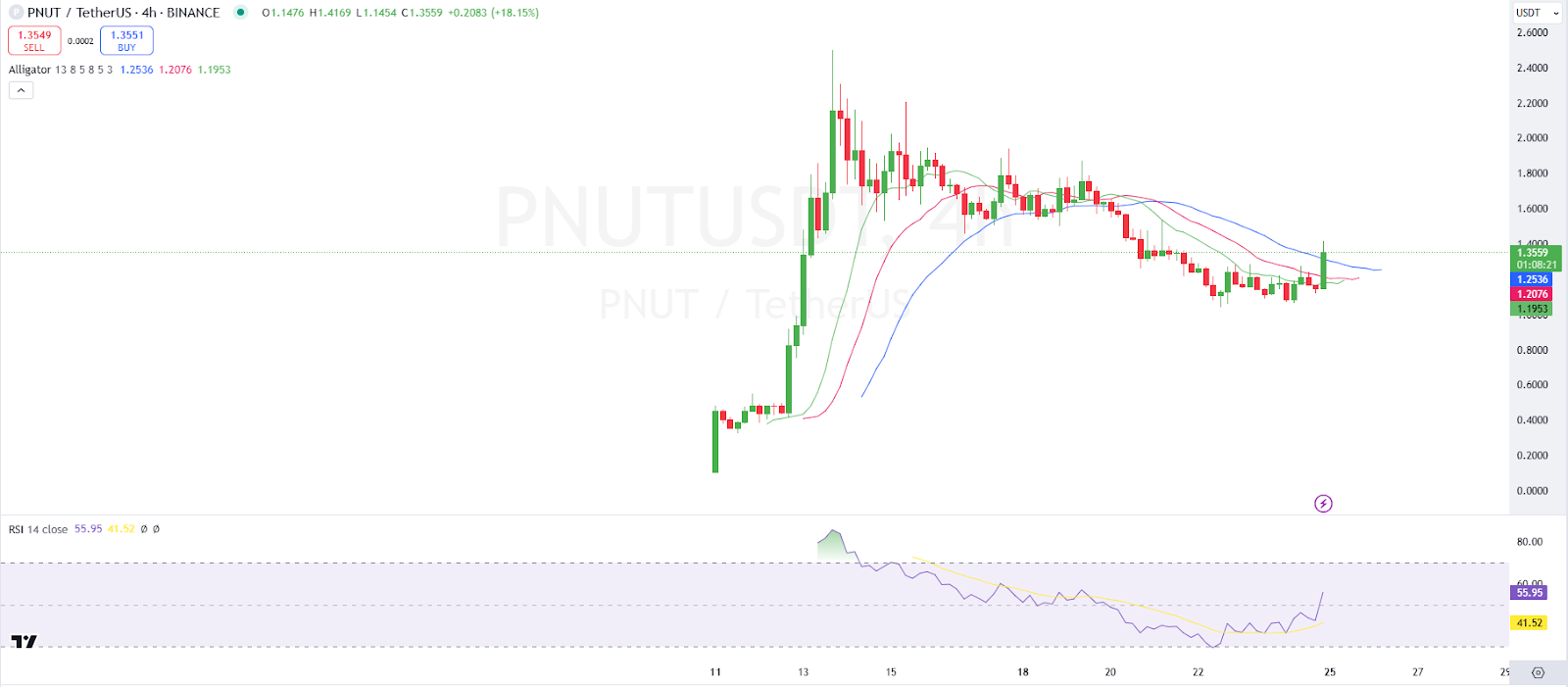

Peanut the Squirrel Price Review

Peanut the Squirrel, $PNUT, is also among the gainers in today’s session. Looking at an in-depth analysis, we see that After a substantial price increase, the trend shows the price stabilizing and possibly starting a consolidation phase, moving closer to the moving averages.

On the other hand, we see that, the Relative Strength Index (RSI) is trending downwards from an overbought condition, signaling weakening bullish momentum and potential for a downturn or consolidation. Peanut the Squirrel traded at $1.36 as of press time, representing a 13.24% increase over the last 24 hours.

4-hour PNUT/USDT Chart | Source: TradingView

Sei Price Review

Sei, $SEI, is also among the gainers in today’s session. Looking at an in-depth analysis, the price is in a short-term uptrend, indicated by its recent push above the moving averages. The Bollinger Bands show an increase in volatility with the price spike but are beginning to narrow, suggesting potential stabilization.

On the other hand, we see that the ADX is rising, indicating strengthening of the current trend, although the recent red candles may suggest a cooling-off or potential pullback. Sei the Squirrel traded at $0.649 as of press time, representing a 12.95% increase over the last 24 hours.