Although Bitcoin’s price recently climbed toward $106K, it failed to sustain this level and soon dropped to $98K. Over the past 24 hours, Bitcoin’s trading volume has decreased by more than 22.6%, totaling $41.8 billion.

In a broader perspective, Bitcoin fell below $100,000 on January 7 and showed a downward trend. It reached a low of approximately $89,397 on January 13 but has started to recover. However, it still threatens to drop below $100K. Over the last 24 hours, its total market capitalization decreased by 1.28%, settling at $2.02 trillion.

Bitcoin Faces Million in Liquidation

Despite President Trump signing several executive orders supporting the cryptocurrency market, the price of Bitcoin is seeing mixed reactions. It’s having a tough time gaining momentum, frequently being pushed down at the $106,000 level as short-term investors sell off to capitalize on any significant price jumps.

Over the past week, Bitcoin’s value dropped by 2.03%, though it has risen 11.4% over the last month. Right now, Bitcoin is struggling to rise above its current resistance levels. According to data from Coinglass, the Bitcoin market has seen over $59.8 million in total liquidations recently, with $47.7 million from buyers and $12 million from sellers, showing a lot of ups and downs in buying and selling.

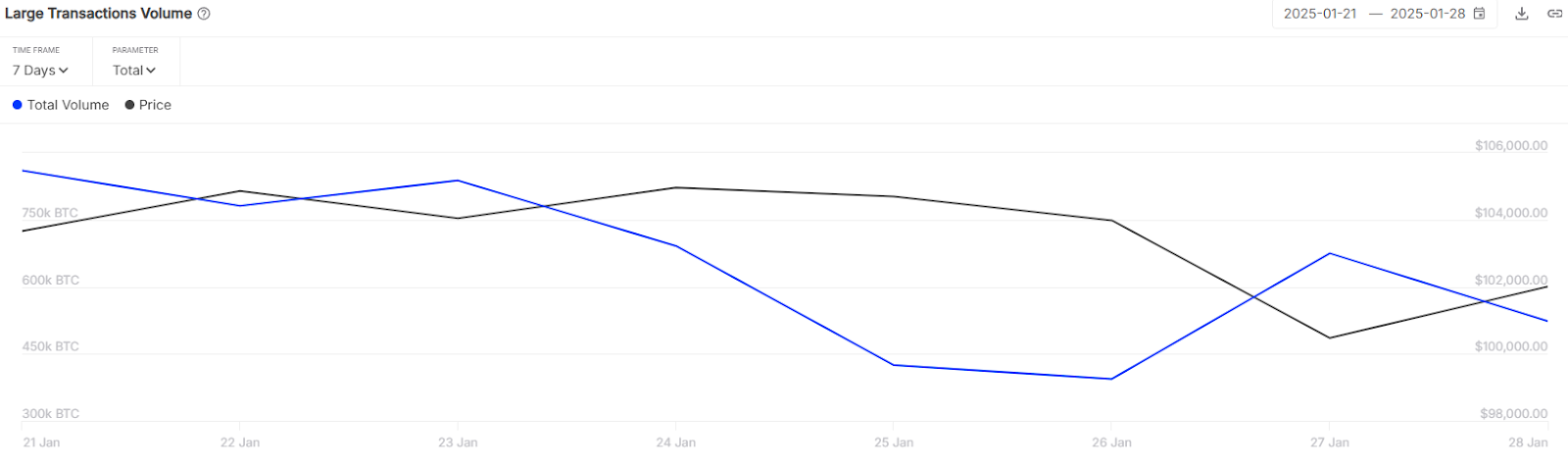

In the last 48 hours, the volume of large Bitcoin transactions has decreased, with data from IntoTheBlock indicating a drop from 860K BTC at its highest to 523K BTC at its lowest, pointing to reduced trading interest among major investors, or “whales.” This lack of interest from whales could lead to a price correction. Additionally, the increasing US debt could pose a downside risk to Bitcoin’s price, potentially triggering more selling if Bitcoin can’t break through resistance levels.

Despite these challenges, Bitcoin’s funding rate is still positive at 0.0081%, suggesting that buyers might still manage to push the price above $106,000.

Bitcoin Price Prediction: Technical Analysis

Bitcoin’s price recently found it challenging to maintain its momentum at around $103,000, leading to a sharp drop towards $100K. However, the BTC price is now facing minor buying demand above $102K. Currently, Bitcoin is trading at $101,930, after a decline of 0.86% in the past 24 hours.

The Bitcoin to USDT trading pair is facing difficulties at the $106,000 mark, which could be a slight hurdle. Staying above this level would be beneficial for buyers, potentially allowing the price to test higher levels at $108,256 and perhaps even reach $111,000.

Conversely, if the price remains below the EMA20 trend line on the 1-hour chart, there might be a push from sellers driving it down towards $100K. Nonetheless, with the RSI at around 46, there is still a possibility for the price to rise.

Bitcoin Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, BTC price might continue to struggle below $103K. On the other hand, $100K is the lower range.

Long-term: According to the Bitcoin price prediction provided by Coincodex, the price of Bitcoin is expected to increase by 27.61% and reach $131,221 by February 28, 2025. Coincodex’s technical indicators suggest that the current market sentiment is bullish, while the Fear & Greed Index indicates a score of 72, signifying greed. Over the past 30 days, Bitcoin has experienced 17 green days, which is 57% of the time, with a price volatility of 4.30%. Based on this forecast from Coincodex, it is currently considered a good time to buy Bitcoin.

How much is Bitcoin price today?

Bitcoin price is trading at $101,930, at the time of writing. The BTC price has dropped by over 0.86% in the last 24 hours.

What is the BTC price prediction for January 29?

Throughout the day, BTC price might continue to struggle below $103K. On the other hand, $100K is the lower range.

Is Bitcoin a Good Buy Now?

According to long-term forecasts, Bitcoin price might reach $131,221 by February 28. This makes BTC price a good investment considering its monthly yield.

Investment Risks for Bitcoin

Investing in Bitcoin can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.