Over the past day, the price of Hedera (HBAR) has significantly dropped. It failed to stay above $0.37 and plummeted to $0.32. Alongside this price drop, Hedera’s trading volume also decreased by 32.6%, amounting to $1.03 billion.

Looking at a longer timeline, Hedera’s price fell below $0.39 on December 3 and has been on a downward trend since. However, after stabilizing between $0.23 and $0.25 for some time, Hedera has started to show signs of recovery, managing to avoid sharp declines. In the last 24 hours, its market capitalization has decreased by 7.8%, totaling $12.9 billion.

Bulls Liquidated Worth class="wp-block-heading".4 Million Positions

In the past day, trading activity for Hedera (HBAR) has increased, resulting in a significant amount of liquidations. Coinglass reports that about $1.63 million worth of Hedera trades were liquidated, with the majority, $1.4 million, coming from traders closing their long positions where they had anticipated a price increase.

Following the recent price decline, there has also been a decrease in trading interest for Hedera. The open interest, which measures the total unsettled trading contracts, has dropped by over 13% to $423 million.

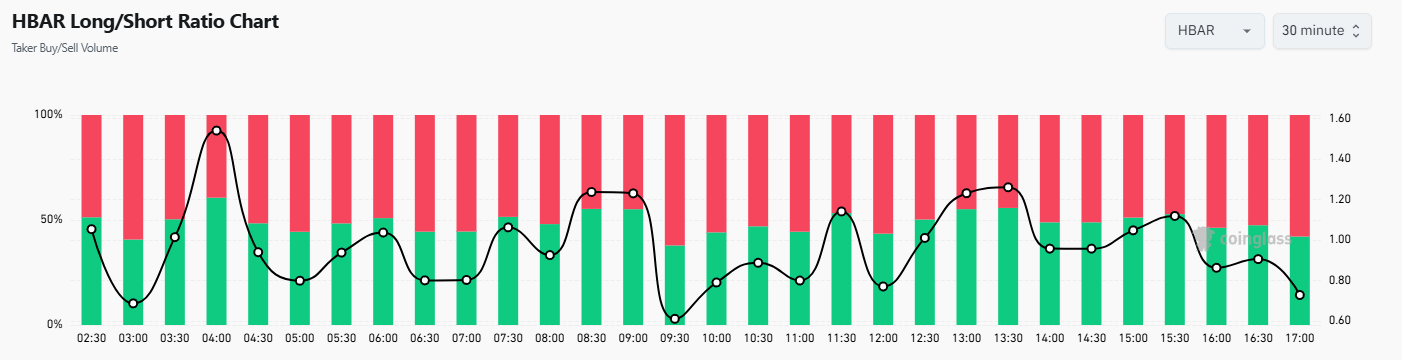

Furthermore, the price drop has pushed the long/short ratio below 1, currently standing at 0.7277. This indicates that most traders are now expecting the HBAR price to continue falling. Currently, 42% of traders believe Hedera’s price will rise, while 58% anticipate a decline.

Hedera Price Prediction: Technical Analysis

After facing rejection around $0.37, the price of HBAR faced intense selloff. This pushed the price toward the low of $0.32. However, buyers are trying to send the price above 23.6% Fib channel to retest the resistance channel. As of writing, HBAR price trades at $0.334, declining over 8.9% in the last 24 hours.

The HBAR/USDT trading pair continues to hover below $0.34 and is aiming to consolidate around that zone. If the price falls below the trend line, the sellers will likely try to push it back down to $0.25-$0.3.

However, as the RSI level continues to trade just below the midline at level 46, it might trigger a retest of the resistance channel. If the price manages to hold above $0.35, it would favour the buyers. The trading pair could then increase to $0.37.

Hedera Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, Hbar price might continue to struggle around $0.32-$0.34. If the price moves above that level, we might see a trade around $0.35. On the other hand, $0.3 is the lower range.

Long-term: According to Coincodex’s current Hedera Hashgraph price prediction, the price of Hedera Hashgraph is expected to increase by 17.66% and reach $0.389778 by February 20, 2025. Coincodex’s technical indicators indicate that the current market sentiment is bullish, with the Fear & Greed Index at 76, signaling extreme greed. Over the past 30 days, Hedera Hashgraph has had 14 green days, accounting for 47% of the time, with a price volatility of 9.69%. Based on this forecast, Coincodex suggests that now is a good time to buy Hedera Hashgraph.

How much is Hedera price today?

HBAR price is trading at $0.334 at the time of writing. The HBAR price has dropped by over 8.9 % in the last 24 hours.

What is the Hedera price prediction for January 21?

Throughout the day, the Hbar price might continue to struggle around $0.32-$0.34. If the price moves above that level, we might see a trade around $0.35. On the other hand, $0.3 is the lower range.

Is Hedera a Good Buy Now?

According to long-term forecasts, the HBAR price might reach $0.389 by February 20. This makes HBAR price a good investment considering its monthly yield.

Investment Risks for HBAR

Investing in Hedera can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.