In a continuation of bullish trends in digital asset investment, the latest report from CoinShares Research unveils another week of substantial inflows, further solidifying investor confidence in the cryptocurrency market. The report sheds light on the dynamics shaping the digital asset landscape. The crypto market continued to record inflows however the inflows were significantly lower than the previous week. The reduction of inflows has caused *BTC* to fluctuate in a narrow zone between $50,500 to $52,200.

Regional Investment Patterns

Digital asset investment products witnessed robust weekly inflows totalling US$598 million, marking the fourth consecutive week of positive inflows. Year-to-date inflows have now surpassed the US$5.7 billion mark, showcasing sustained investor interest and contributing to a cumulative total that accounts for 55% of the record inflows witnessed in 2021.

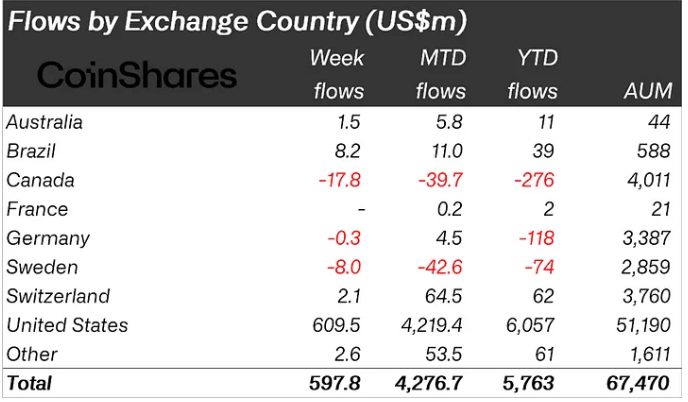

The United States remains a focal point, experiencing the majority of inflows at US$610 million. However, these figures were impacted by notable outflows from incumbent issuer Grayscale, totalling US$436 million. Brazil and Switzerland saw minor inflows at US$8.2 million and US$2.1 million respectively. Conversely, both Canada and Sweden witnessed outflows totalling US$18 million and US$8 million respectively.

Leading Cryptocurrencies

Bitcoin continues to lead the charge with significant inflows of US$570 million last week, bringing year-to-date inflows to US$5.6 billion. Despite recent price increases prompting minor inflows into short-bitcoin positions totalling US$3.9 million, investor confidence in Bitcoin price remains strong. Ethereum saw inflows of US$17 million, while Chainlink and *XRP* saw inflows of US$1.8 million and US$1.1 million respectively. However, recent outages for *SOL* likely impacted sentiment, resulting in outflows of US$3 million.

Blockchain equities continued to see outflows totalling US$81 million last week, indicating a cautious approach among equity investors amidst current market conditions.

Digital Asset Market Outlook

While total assets under management (AuM) peaked at US$68.3 billion earlier in the week, representing the highest point since December 2021, the digital asset market still has ground to cover to reach the all-time high of US$87 billion seen in November 2021. However, the consistent inflows and growing investor confidence signal a promising outlook for the sector.

As the digital asset market continues to evolve and attract significant inflows, investors are navigating an increasingly dynamic landscape marked by regulatory developments and technological advancements. The sustained interest in digital assets underscores their growing importance in the global financial ecosystem.