Ether (ETH) options traders are preparing for potential short-term declines in price just one day after the price impressively surged past $4,000, reaching its highest point since late 2021. Following Bitcoin’s recent surge above the $73,000 threshold, ETH has been gaining traction, aiming to maintain its position above the $4,000 mark. Nonetheless, the ongoing Dencun upgrade, a significant development subsequent to the Merge, has ignited worries about a possible retreat in ETH prices. This cautious outlook is further boosted by a variety of on-chain metrics indicating a bearish sentiment.

Ethereum’s Netflow Sparks Bearish Worries

In the past four hours, *ETH* has experienced a significant liquidation event totaling over $5 million, with $3.2 million of this coming from the liquidation of bearish positions by sellers. Notably, with BTC’s price now affecting ETH’s price dynamics, even a slight downturn could trigger a long squeeze in ETH’s market. Moreover, numerous analysts anticipate a market correction for ETH following the completion of the Dencun upgrade, drawing parallels to the correction observed after the Merge.

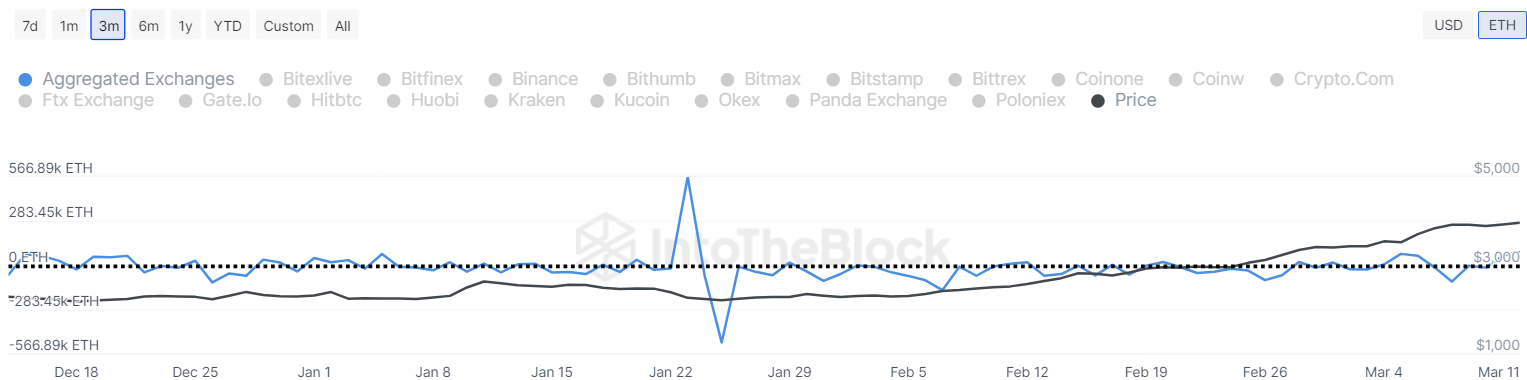

Data from IntoTheBlock reveals a notable increase in the Netflow metric for ETH, with the current trading volume reaching 85.29K ETH. This indicates that the volume of Ethereum entering exchanges has begun to exceed the outflow, leading to an increase in exchange reserves. Such a trend underscores the growing likelihood of an imminent price correction in the near future.

Additionally, the one-month call-put skew for Ether, a key indicator of market sentiment in the options arena, has shifted into negative territory, suggesting a prevailing preference for puts — options that hedge against potential price declines. Similarly, the sentiment for the 60-day period has shown a tilt towards put options. In contrast, the outlook for the 90-day and 180-day periods continues to be optimistic, as per the cryptocurrency options data from Deribit monitored by Amberdata.

Furthermore, alongside the adverse risk reversals, QCP Capital has observed a minor decrease in ETH spot-forward spreads, in stark contrast to the higher spreads seen in Bitcoin (BTC) markets. This disparity indicates that a significant drop in ETH spot prices might trigger an additional tightening of forward spreads as leveraged long positions undergo liquidation.

However, the Dencun upgrade, following last year’s Shapella, introduces significant enhancements to Ethereum, notably with EIP-4844, or “protodanksharding,” drastically reducing Layer 2 fees. It aims to lower transaction costs dramatically, from a dollar to just a cent, enhancing user experience. Additionally, Dencun brings in ephemeral data blobs to reduce storage costs and network congestion, storing data temporarily for about 18 days, thereby boosting Ethereum’s scalability.

Consequently, given the current bullish market outlook, Ethereum may not see any notable price adjustments or declines from its present position. Should any pullbacks occur, they are likely to draw in further buying interest.

What’s Next For ETH Price?

Sellers attempted to drive Ether down to the breakout point of $3,600, yet the pronounced tail on the candlestick indicates robust purchasing at lower prices. As a result, despite facing rejection at $4,100, ETH price quickly rebounded and is now aiming for a retest of that level. Currently, ETH price trades at $4,066, surging over 2.1% from yesterday’s rate.

ETH/USD 4-hour Chart On TradingView

The climb above the key $4,000 mark has set the stage for a potential increase to $4,500, which might present a slight obstacle. However, surpassing this resistance level could send the ETH/USDT pair towards $4,900.

The recent sharp rise has sent the RSI into significantly overbought territory, suggesting a need for caution. Currently, the RSI level trades at 64 level. For sellers to plunge the current bullish trend, they must pull the price beneath the 20-day EMA at $3,989. Doing so could trigger a corrective period for the pair.