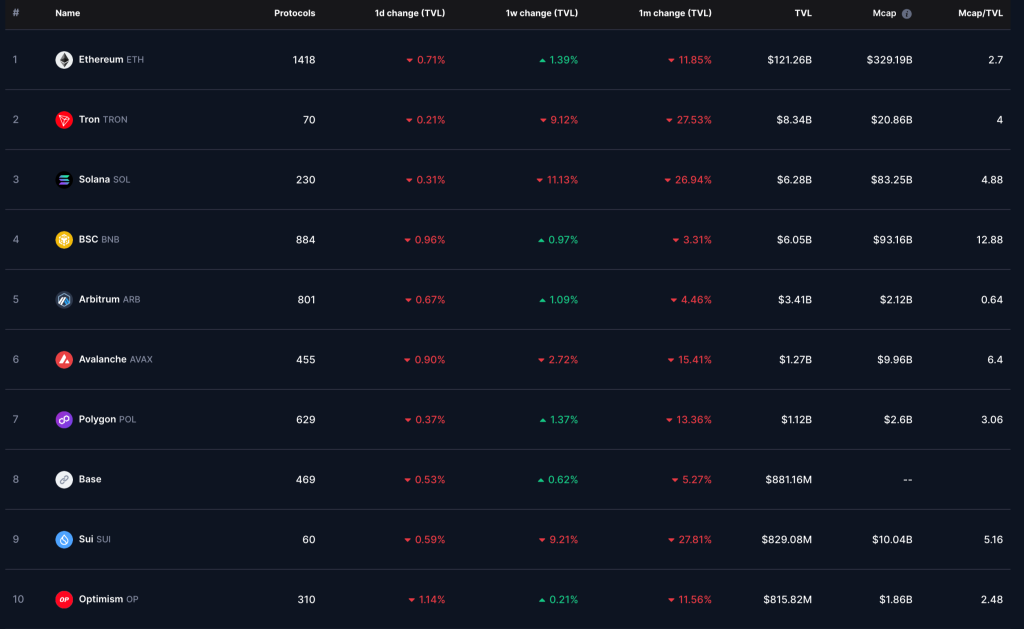

Ethereum remains the dominant blockchain network with the highest total value locked (TVL) of $121.26 billion, despite a 0.71% daily decline and a 11.85% drop over the past month. The network supports 1,418 protocols, significantly more than its competitors, and maintains a market capitalization of $329.19 billion, resulting in a market cap-to-TVL ratio of 2.7.

Tron (TRX) continues to hold the second-highest TVL at $8.34 billion, showing relative stability with only a 0.21% daily decrease. However, the network has witnessed a 9.12% drop over the past week and a 27.53% decline in the last month, marking a significant downward trend. Tron’s market capitalization stands at $20.86 billion, giving it a market cap-to-TVL ratio of 4.0.

Solana, BSC Fluctuate as Arbitrum, Avalanche Diverge

Solana (SOL) has a TVL of $6.28 billion, making it the third-largest blockchain by this metric. The network saw a 0.31% daily drop and an 11.13% weekly decline, with a 26.94% decrease over the past month. Solana’s market capitalization is $83.25 billion, yielding a market cap-to-TVL ratio of 4.88.

Binance Smart Chain (BSC) follows closely, recording a TVL of $6.05 billion. While BSC suffered a 0.96% daily decrease, it showed a 0.97% increase over the past week but still faced a 3.31% monthly decline. The network boasts a market capitalization of $93.16 billion, with a market cap-to-TVL ratio of 12.88, reflecting its strong valuation relative to locked assets.

Among Layer-2 solutions, Arbitrum (ARB) recorded a TVL of $3.41 billion, with a 0.67% daily decrease but a 1.09% weekly gain. Over the past month, it experienced a 4.46% decline. Arbitrum’s market capitalization is $2.12 billion, resulting in a market cap-to-TVL ratio of 0.64, indicating its valuation is relatively low compared to its locked assets.

Avalanche (AVAX), on the other hand, saw a 0.90% daily drop, a 2.72% weekly decline, and a 15.41% monthly decrease in TVL, bringing its total to $1.27 billion. The network’s market capitalization is $9.96 billion, with a market cap-to-TVL ratio of 6.4.

Polygon, Base, Sui, Optimism See TVL Declines

Polygon (POL) holds a TVL of $1.12 billion, with a 0.37% daily drop but a 1.37% weekly increase. Despite short-term recovery, it remains down 13.36% over the past month. Polygon’s market capitalization stands at $2.6 billion, with a market cap-to-TVL ratio of 3.06. Base, Coinbase’s Layer-2 network, currently has a TVL of $881.16 million, with a 0.53% daily decline and a 0.62% weekly increase. The platform continues to show gradual adoption but lacks a reported market capitalization.

Sui (SUI) has seen one of the steepest TVL declines, dropping 9.21% over the past week and 27.81% over the past month to $829.08 million. Sui’s market capitalization stands at $10.04 billion, leading to a market cap-to-TVL ratio of 5.16. Optimism (OP) saw a 1.14% daily decline, a 0.21% weekly increase, and an 11.56% monthly drop in TVL, bringing its total to $815.82 million. Its market capitalization stands at $1.86 billion, resulting in a market cap-to-TVL ratio of 2.48.

The market remains in a state of flux, with Ethereum maintaining dominance while Layer-1 and Layer-2 networks experience varying levels of capital inflows and outflows. Market cap-to-TVL ratios suggest valuation disparities across networks, with some blockchains appearing overvalued relative to locked assets, while others, such as Arbitrum, have lower valuations compared to TVL. Investors and analysts will closely monitor liquidity trends, protocol developments, and macroeconomic conditions to gauge the future trajectory of these blockchain ecosystems.