Ethereum has recently witnessed a notable uptick, with its value ascending towards the $2,400 threshold, mirroring Bitcoin’s stable position above $46,000. This surge comes at a crucial time, just as the market anticipates the SEC’s imminent decision today. The anticipation has brought a spike in purchasing interest, sending the ETH price towards a critical test of its resistance level. Despite this momentum, current on-chain data indicate that Ethereum may encounter a downward adjustment at this key resistance point. Additionally, declining interest from large-scale investors, or ‘whales’, could potentially slow down Ethereum’s ability to follow Bitcoin’s upward trajectory.

Heavy Liquidation As Market Volatility Increases

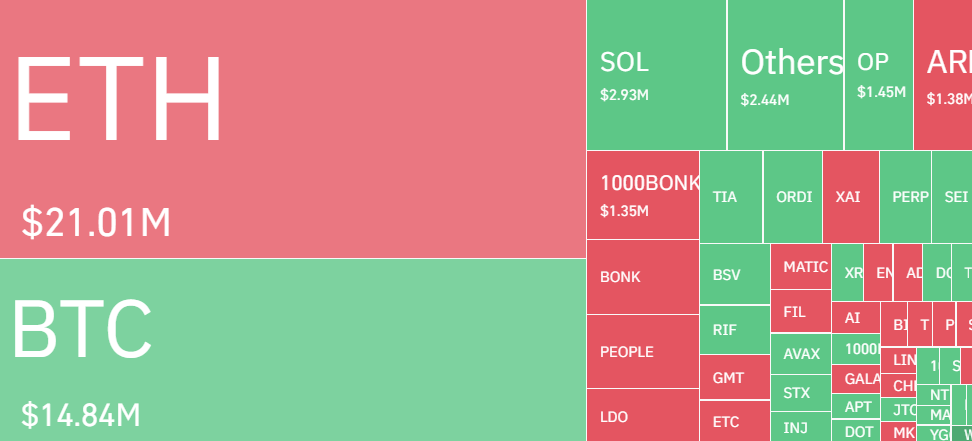

Over the past day, the market experienced significant turbulence, characterized by substantial liquidations. As market prices faltered near key resistance points, an influx of sell-offs ensued. Data from Coinglass reveals that the aggregate value of liquidated assets exceeded $216 million, with a massive $133 million originating from long position liquidations by buyers.

In a more focused 12-hour window, Ethereum (ETH) underwent a $21 million liquidation, while sellers offloaded $16 million in holdings. This activity came after a sharp rise in Ethereum’s value, climbing from its recent bottom of $2,230.

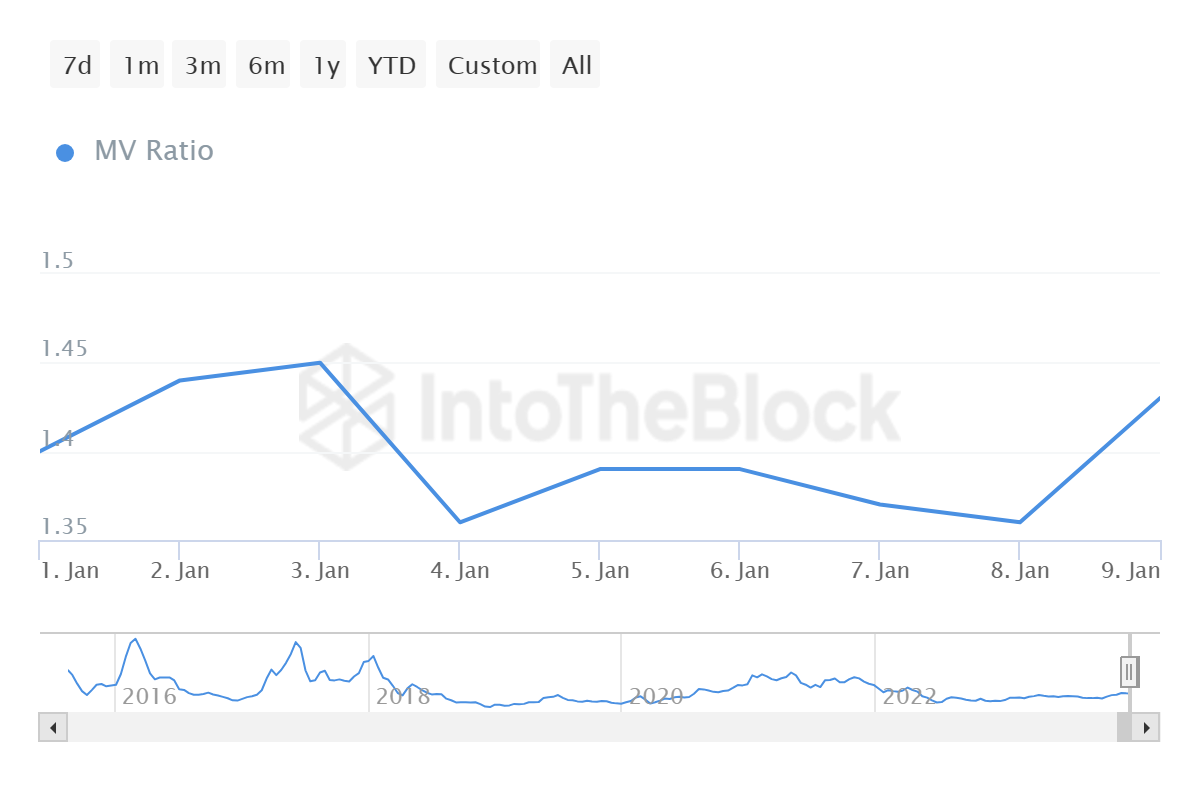

According to insights from IntoTheBlock, Ethereum is facing a challenging trend, with $2,400 emerging as a potential key resistance level. The Market Value to Realized Value (MVRV) ratio, a crucial metric, indicates a significant selling opportunity for Ethereum, especially following its recent climb towards $2,400. Presently, the MVRV ratio stands at 1.43, indicating that Ethereum’s market value has exceeded its realized value. This difference could tempt traders to capitalize on their investments by selling their holdings for a profit.

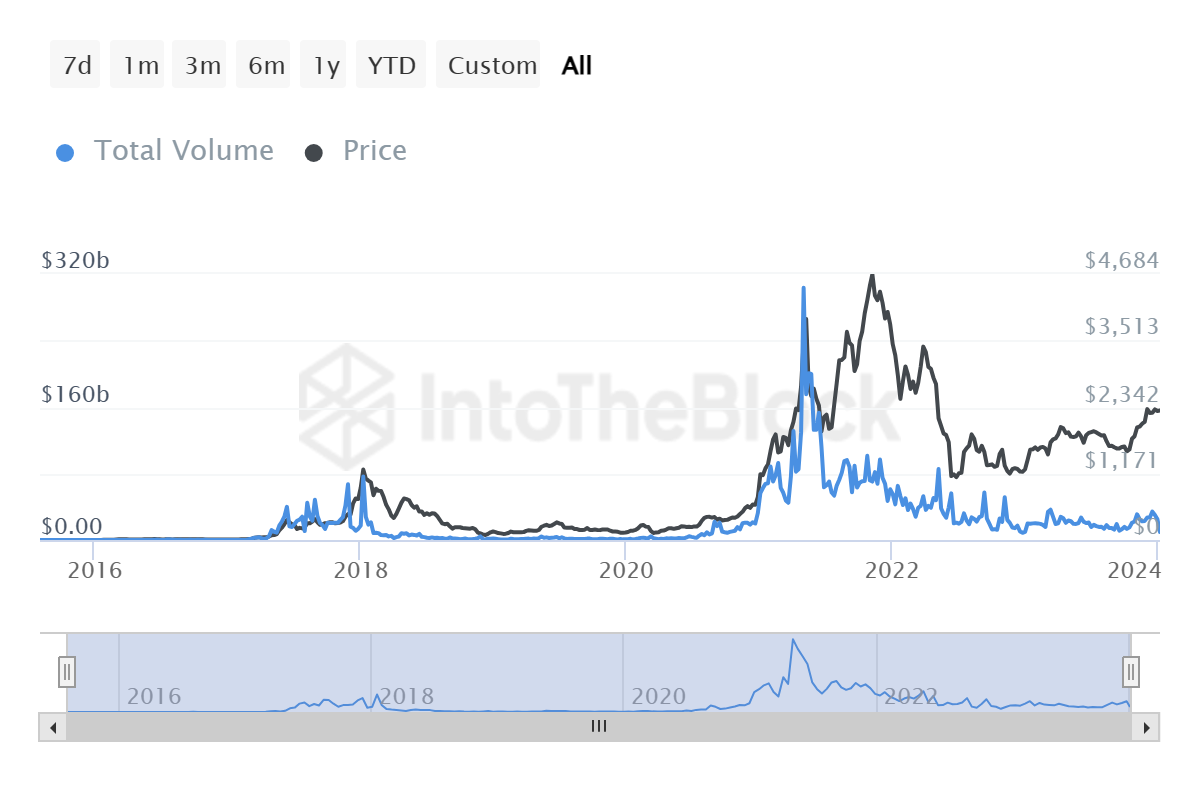

Additionally, there’s a steep decline in the weekly whale transactions for the ETH price. Ethereum’s failure to keep pace with the current bullish uptrend in the market, along with the remarkable growth of other rising altcoins, has resulted in decline interest among key investors, commonly known as ‘whales’. Latest figures from IntoTheBlock show a significant drop in high-value transaction activity.

From December onwards, a steep decline in this metric has been observed, plummeting from a weekly peak of $34 billion on December 18 to a mere $9.5 billion by January 8, marking a drastic 70% decrease. This pattern indicates a declining chance of any substantial price move for Ethereum in the coming hours.

What’s Next For ETH Price?

Ethereum price is currently testing buyers’ patience at $2,400 level as buying demand surged near the dips. However, there’s a strong battle between the buyers and sellers as ETH price faces extreme volatility near that resistance level. As of writing, ETH price trades at $2,420, surging over 5.4% from yesterday’s rate.

The $2,400 level is a key short-term resistance level that the bulls need to conquer. If the price continues to trade above this level and head toward immediate Fib channels, we might see further surges in the ETH price. If the price breaks above the crucial resistance zone of $2,500-$2,700, it could aim for a push toward $3,000. However, this resistance level might bring a surge in bearish domination. In the short term, ETH price might skyrocket above $2,700 quickly if the SEC comes up with positive news regarding ETF approval.

On the flip side, should the price decline from current level and drop below the 20-day Exponential Moving Average (EMA), sellers might attempt to push the ETH price down to the crucial support level at $2,230. This level is particularly important to monitor in the short term, as breaching it could lead to a further decline to $2,100.