As anticipated, the Federal Reserve confirmed today that it would keep its primary policy rate unchanged in its economic projections summary. Following this announcement, Ethereum’s price appeared to respond favorably, sustaining its position above $1,600. However, over the last few hours, ETH price failed to maintain its rally above $1,600, dropping below Fib channels amid declining exchange outflows.

Ethereum Turns Bearish With Increasing Exchange Reserve

Recent market trends have thrown a curveball: Ethereum’s price has slipped below the pivotal $1,600 threshold. This drop, coupled with a decreasing exchange outflow, raises eyebrows and prompts the question: Are the bears starting to dominate the scene?

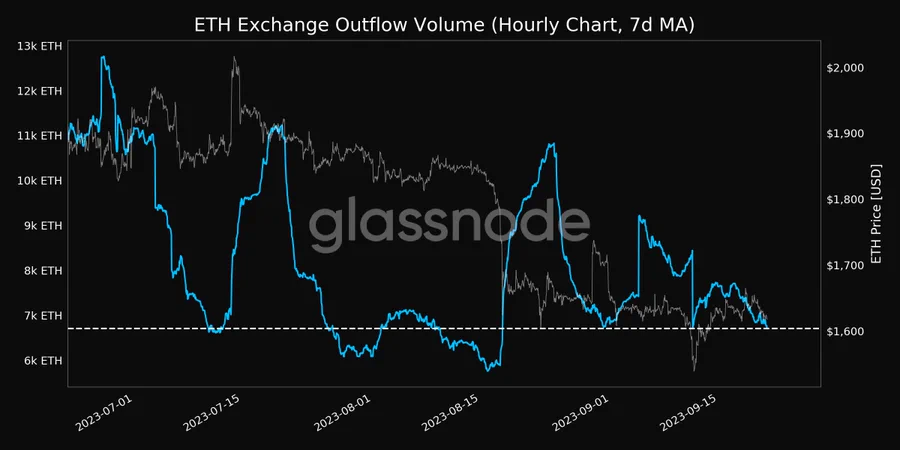

According to Glassnode, the Ethereum exchange outflow has reached a 1-month low of 6709 ETH, which hints at an increasing exchange reserve. A decreasing outflow means that more Ethereum is finding its way back to exchanges as less amount of ETH is now being withdrawn from exchanges. This increase in exchange reserves suggests that there’s more Ethereum available to be sold, which is typically a bearish sign.

On the flip side, increasing outflows indicate lower exchange reserves, which is bullish. It suggests that investors are withdrawing ETH from exchanges to cold wallets for accumulation purposes, possibly in anticipation of a price surge.

The combination of Ethereum’s price drop and the declining exchange outflow paints a concerning picture. It suggests that not only are investors more willing to sell their Ethereum, but there might also be an increasing sentiment of uncertainty or lack of confidence in its short-term price potential.

ETH deposits have witnessed a notable surge recently. As of this moment, exchange deposits have surpassed 161,000, reaching a peak not seen in the past nine months. Before this surge, the chart’s previous high was around 98,000 deposits, recorded back in January. This strengthens short-position holders’ confidence.

Over $5.7 Million Long-Positions Liquidated

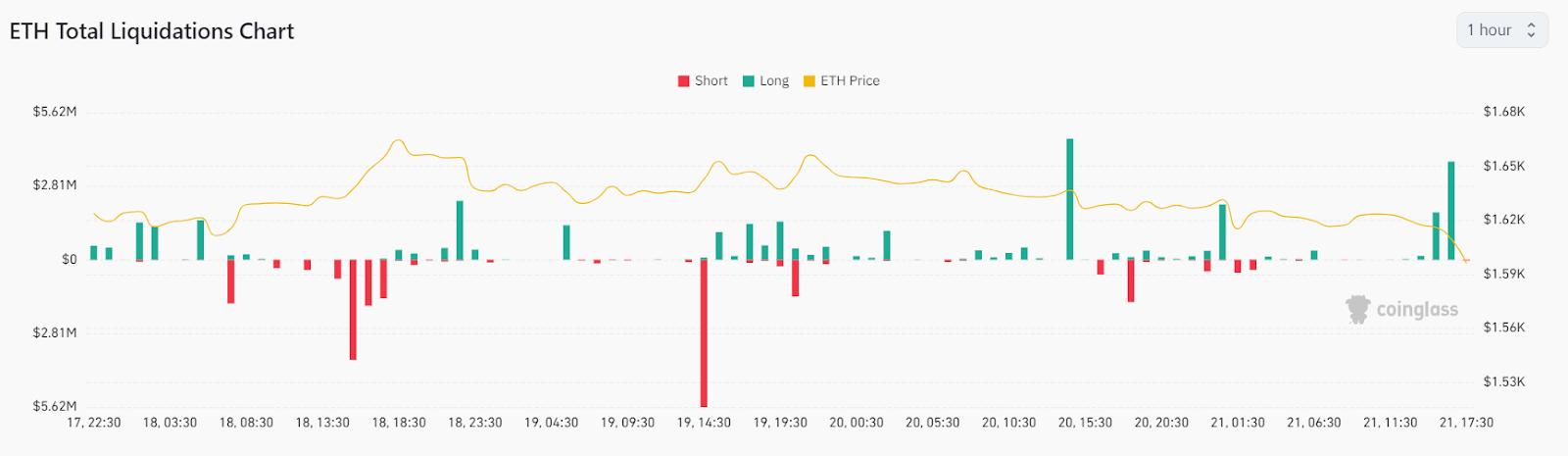

After reaching a high of $1,617, ETH’s price took a downturn, and this decline was accompanied by a significant bearish indicator: a surge in long-liquidations. According to data sourced from Coinglass, a staggering $5.7 million worth of long positions were liquidated in a short span of a few hours.

This rapid liquidation is a clear sign of increased selling pressure, particularly as ETH approaches its resistance levels near $1,620. For those unfamiliar with the term, long-liquidation essentially means that traders who bet on the price increase had to exit their positions, often at a loss, due to the price moving against their predictions.

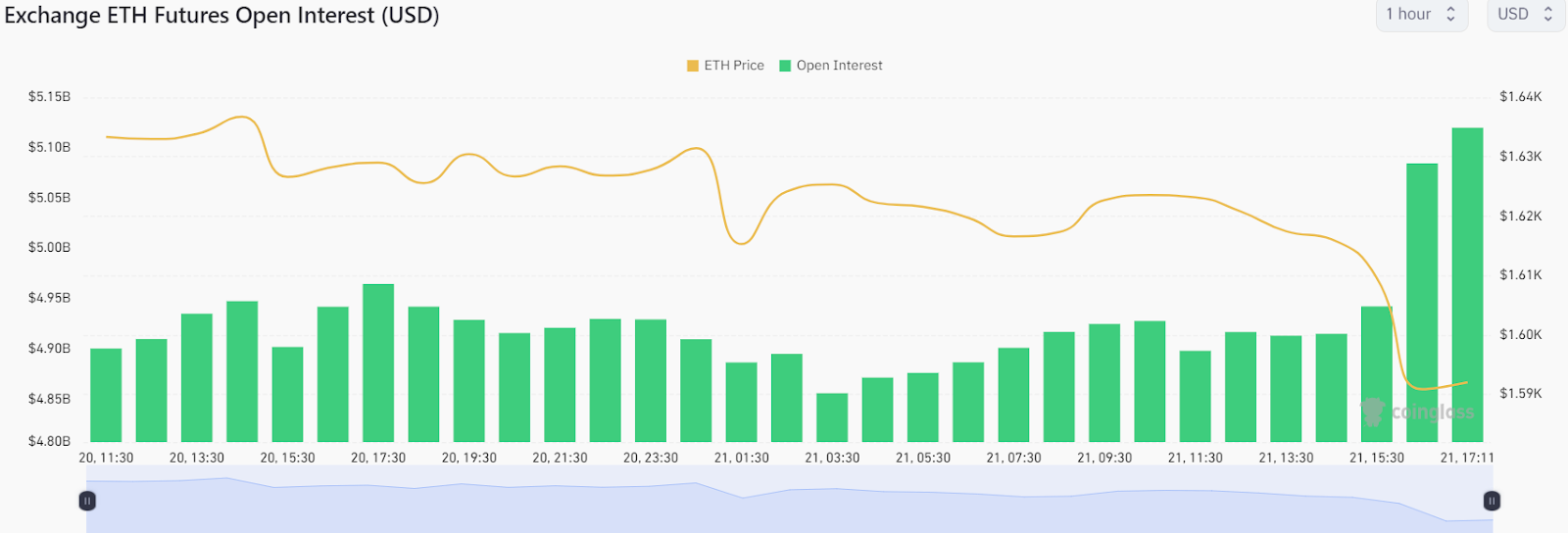

The open interest (OI) for ETH, which represents the total number of outstanding derivative contracts (like futures and options) that have not been settled, has also seen a significant spike. After the ETH price dropped below the $1,610 mark, Coinglass reported a sharp increase in OI by $200 million. An increase in open interest, especially during a price decline, can be interpreted as more traders entering the market, expecting further price drops or hedging against them.

After ETH’s price dipped to a low near $1,590, a notable development caught the attention of traders: a positive funding rate for ETH. The funding rate is a crucial metric for derivatives, particularly for perpetual futures contracts. In simple terms, it represents the fee paid by one side of the contract to the other. A positive funding rate means that long traders (those betting on the price to go up) are paying short traders (those betting on the price to go down).

A positive funding rate often indicates that the majority of traders are bullish on the asset, expecting its price to rise. While a positive sentiment is a good sign, it’s essential to note that a persistently high positive funding rate can make it expensive for traders to hold long positions.

In the short term, a positive funding rate can act as a counterbalance to bearish trends, suggesting that there’s still significant confidence in ETH’s potential to rebound. As of writing, ETH price trades at $1,594, declining over 2.2% from yesterday’s rate.