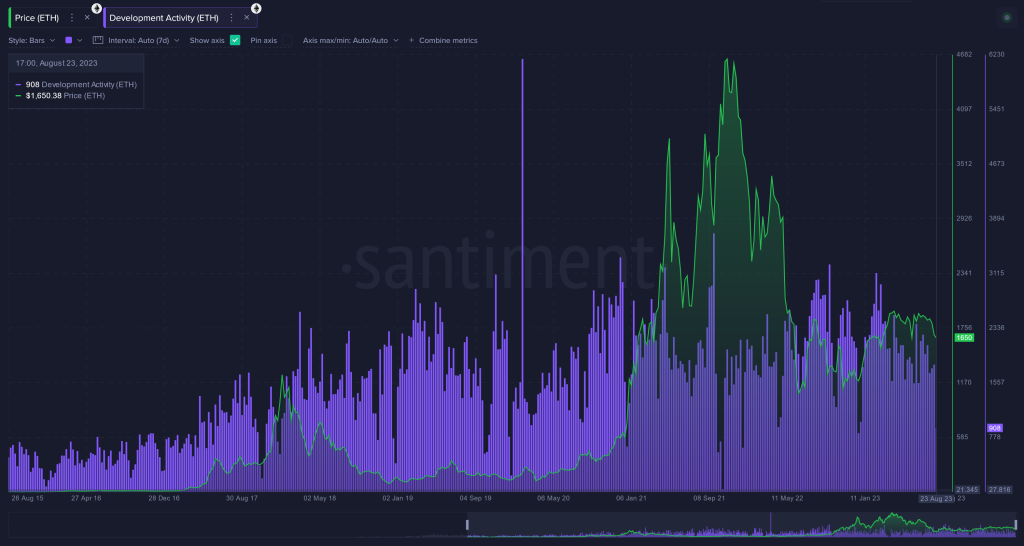

Ethereum (ETH) has fluctuated in value like many other cryptocurrencies. Recent Santimant statistics indicate that Ethereum is still developing and promising despite its ups and downs. Ethereum was once in the news for its market value surpassing $4,000. On November 10, 2021, the second-largest cryptocurrency by market value and several other projects hit a record $489.17 billion.

Ethereum Struggles against Competing Cryptocurrencies

Today, Ethereum’s price is just one-third of what it was 22 months ago. While Ethereum attracted huge interest in the crypto world, especially during the much-anticipated Ethereum 2.0 update to improve scalability and energy efficiency, it has struggled to compete with other large-cap cryptocurrencies in the previous year.

Santimant, a blockchain analytics tool, says Ethereum’s principle is valid despite price volatility. Santimant’s native coin, SAN, is an Ethereum-based ERC-20 token.

When assessing Ethereum’s present status, consider more than its market price. From early November last year, on-chain transaction activity and trading volume have dropped significantly. This loss in utility reflects traders’ confusion about whether Ethereum is overpriced or undervalued, with a psychological support level of around $1,500 if utility drops significantly.

Ethereum Whales Shed Holdings amidst High Accumulation

Whales and huge address activity are crucial to evaluating Ethereum’s health. Over the past four months, addresses with 10,000 ETH or more have been selling their holdings, despite huge accumulation towards the close of the year. This profit-taking coincides with the cryptocurrency’s one-year high of $2,120.

However, whales and major holdings don’t guarantee a speedy rebound to $2,000 and higher prices. There are many factors that affect bitcoin prices, not just significant holders.

Positively, Ethereum’s development team keeps enhancing the network. Ethereum has grown in development and innovation over the past eight years. The project’s continued Github activity proves its authenticity and devotion to advancement, despite allegations about Ethereum teams that may not care about investors.

Ethereum has persevered and grown despite its ups and downs. As the crypto market changes and Ethereum’s utility persists, investors should stay educated and consider more than price swings when assessing its future potential.