The cryptocurrency market is showing bearish signs after significant sell-offs near key resistance levels. Consequently, Bitcoin’s value has declined to around $27K, while Ethereum is trading close to $1,550. Notably, multiple on-chain indicators suggest that the market is entering an accumulation period. The number of non-exchange addresses has hit a record high, hinting at a potential bullish period in the upcoming days.

Whales Find Opportunities Amid ETH Price Dip

Recently, Ethereum’s price has been experiencing fluctuations, taking a downward trajectory. While to the casual observer, this might seem like a cause for concern, smart investors, especially the larger players or ‘whales’, see this as an opportunity.

A notable trend accompanying these price dips is the sudden surge in non-exchange Ethereum balances. This indicates that rather than panicking and offloading their holdings on exchanges, these major stakeholders are instead accumulating more of the cryptocurrency.

Santiment’s on-chain data highlights that as Ethereum’s price drops to $1,550, the balances of the top 10 non-exchange and top 10 exchange addresses are on the rise. This paints two potential pictures:

Firstly, several prominent holders seem to be positioning themselves to realize their gains, moving their Ethereum holdings to exchanges, possibly with an intent to sell. As a result of this shift, exchanges now hold approximately 8.51% of Ethereum’s total circulating supply. These whales have amassed 6.9 million ETH in their exchange addresses. Notably, 110K Ethereum has recently been moved back to these exchanges. This movement could imply an increasing intent to sell, potentially exerting downward pressure on Ethereum’s current price.

Secondly, the all-time high increase in the top 10 non-exchange address balances, totalling 39.22 million Ethereum, signals a bullish sentiment. This indicates that the recent decline in Ethereum’s price has prompted a period of accumulation for major holders, who currently possess Ethereum valued at $61.6 billion. This is bullish as whales increasing their holdings in non-exchange wallets during price declines suggests a strong belief in Ethereum’s long-term potential and value. Accumulating more Ethereum at a lower price point allows for greater profit margins should the price rebound.

Ethereum Witnesses $8 Million In Long-Liquidation

In the past 24 hours, Ethereum has seen mixed market reaction as the price tested the support of $1,550. While this led to a noticeable decline in its value, buyers found this a profitable dip to accumulate more ETH. This showcases the continuous back-and-forth between buyers and sellers in the market.

Coinglass data reveals that, after Ethereum’s decline, there was a long liquidation of over $8 million. But this momentum was fleeting as profit-selling quickly altered the market mood. With Ethereum’s price now again meeting buyers’ demand near the dip of $1,550, over $350K worth of positions have been liquidated recently.

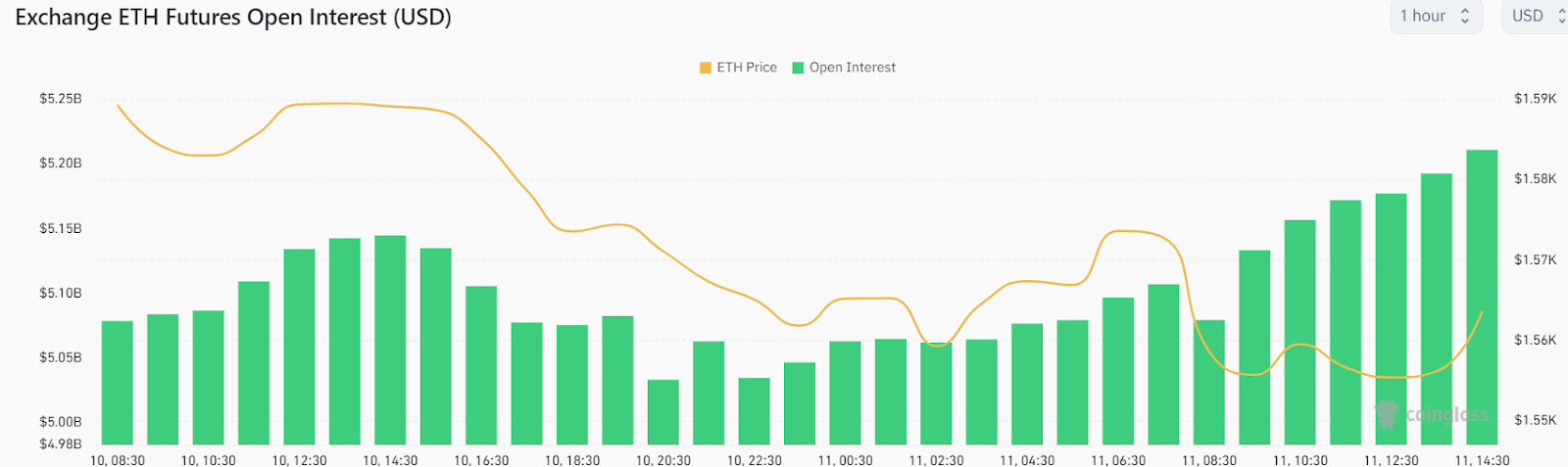

Interestingly, data from Coinglass reveals that in the past 24 hours, the Open Interest (OI) metric has shown a notable increase, jumping from $5.03 billion to $5.21 billion, marking a $198 million growth.

A surge in open interest can indicate strong bullish or bearish inclinations among traders, contingent on the direction of price movement. Typically, simultaneous increases in both prices and open interest suggest a bullish outlook. Moreover, a noticeable uptick in open interest, especially when combined with growing trading volumes, might bring increased volatility. This suggests a new capital influx into the market, potentially bringing upward price fluctuations.

Additionally, the long/short ratio has seen a notable increase, currently standing at 1.2321. The mood appears to be tilting bullish, with traders taking long positions now making up 55% of the market. On the other hand, bears seem to be on the back foot, holding only 45% in short positions.