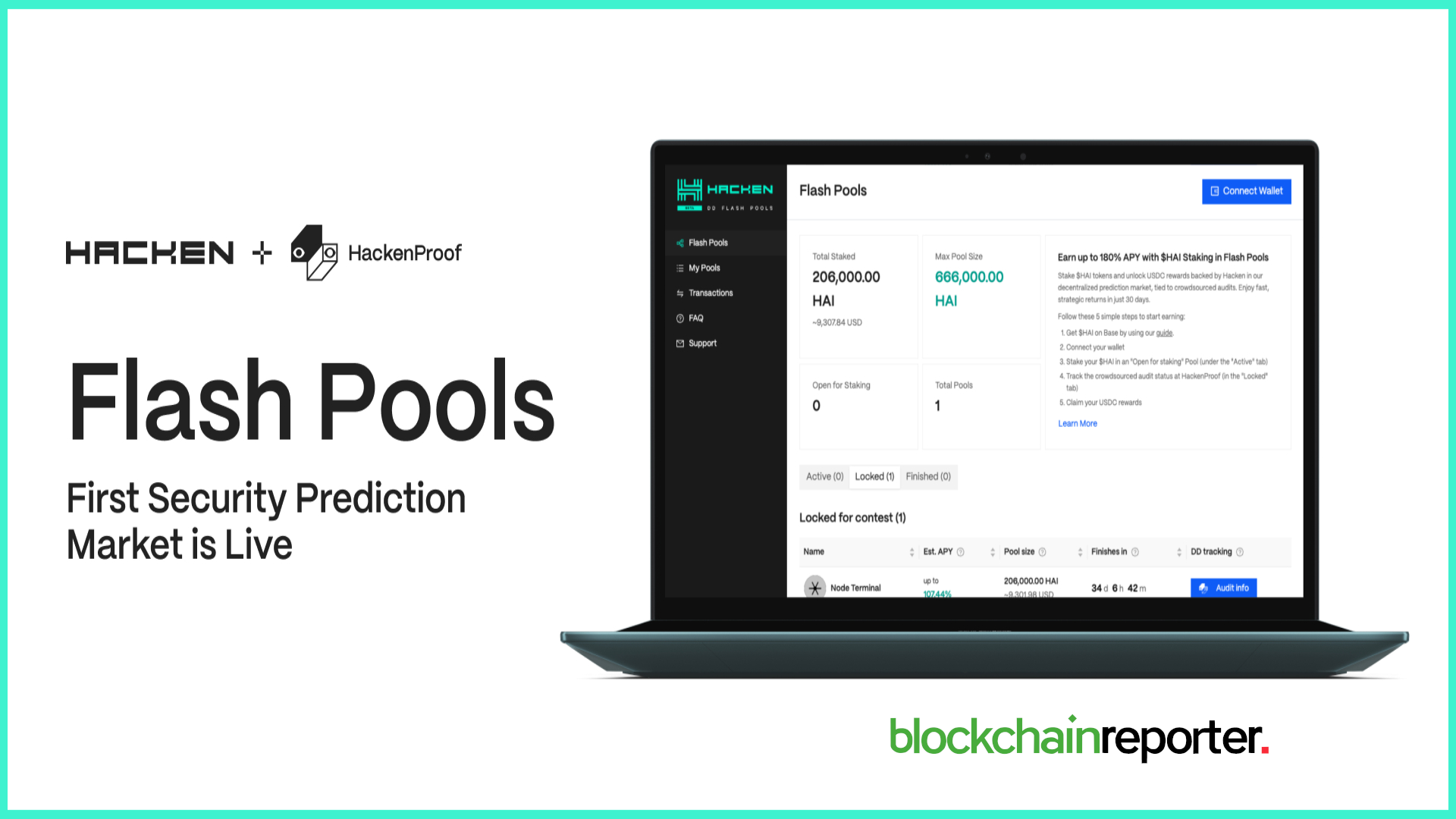

Hacken, a well-known security company in the blockchain industry, has recently launched the DualDefense Flash Pools. DualDefense Flash Pools is a platform designed to enhance security and sustainability in decentralized finance (DeFi). This new platform integrates real yield prospects with community-based security improvements and presents a win-win model for investors and developers.

Hacken’s Successful Launch and Pool Sell-Out

During their offering, the first batch of 206,000 $HAI tokens with a high 115% annual percentage yield (APY) was sold in under 11 minutes. These funds are allocated to support the community audit of Node Terminal, a client benefiting from the new security model. Hacken’s website indicates that more pools will be available soon.

A large number of clients have requested Hacken to conduct a thorough audit of their DeFi projects. Once Hacken completes the security assessment, a 35-day DualDefense Flash Pool opens, allowing HAI token holders to stake their tokens. Hacken provides USDC to the pool, and independent security researchers analyze the code.

The researchers receive a payout based on the staked pool funds regarding potential vulnerabilities. This approach makes sure that gains in the financial domain correspond to customer outcomes rather than the inflationary emission of tokens.

New Prediction Market for Audit Verification

Hacken’s new initiative also includes an industry-first prediction market tied to audit verification. Stakers essentially bet on the quality of Hacken’s audit, and the size of the pool motivates researchers to participate in code reviews.

Based on actual market actions, the Flash Pools generate substantial returns of up to 180% APY for the participants. This approach generates sustainable returns besides boosting the security of the DeFi projects free of charge for the clients. Hacken’s initiative is taking the sides of developers, investors, and the general public, which is a better economic solution for the DeFi world.

Hacken has also developed a special prediction market related to audit verification. $HAI token holders bet on how well Hacken can conduct the audit and the white-hat hackers who verify the project. This approach encourages more crypto community participants and enhances blockchain security through the supply of incentives likely to be used to identify mistakes within the blockchain system.