As the crypto market prepares for a day of significant volatility, anticipation rises over the upcoming interest rate decision and Jerome Powell’s speech at today’s FOMC meeting. Despite this uncertainty, the market commenced the week on a bullish trajectory, with Bitcoin and Ethereum notably surpassing their monthly resistance levels. This positive momentum has triggered investors to intensify their accumulation of these leading assets, in anticipation of a potential upswing as the ‘sell the news’ phenomenon fades. On-chain data further boosts this sentiment, indicating a probable bullish trend in the coming days.

Netflow For BTC And ETH Becomes Negative

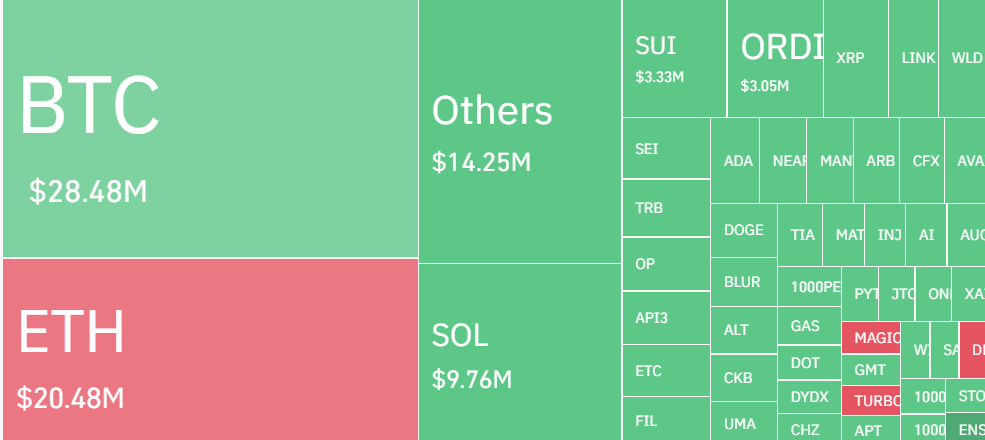

In the past 24 hours, Bitcoin and Ethereum have experienced a surge, pushing their prices near critical resistance levels of $44,000 and $2,400, respectively. Despite this upward movement, strong resistance from bearish traders has presented an opportunity for short-term profit-taking, resulting in significant liquidations. According to Coinglass, Bitcoin saw liquidations amounting to $28.5 million, while Ethereum experienced liquidations close to $20.5 million. Notably, this liquidation event impacted both short and long position traders.

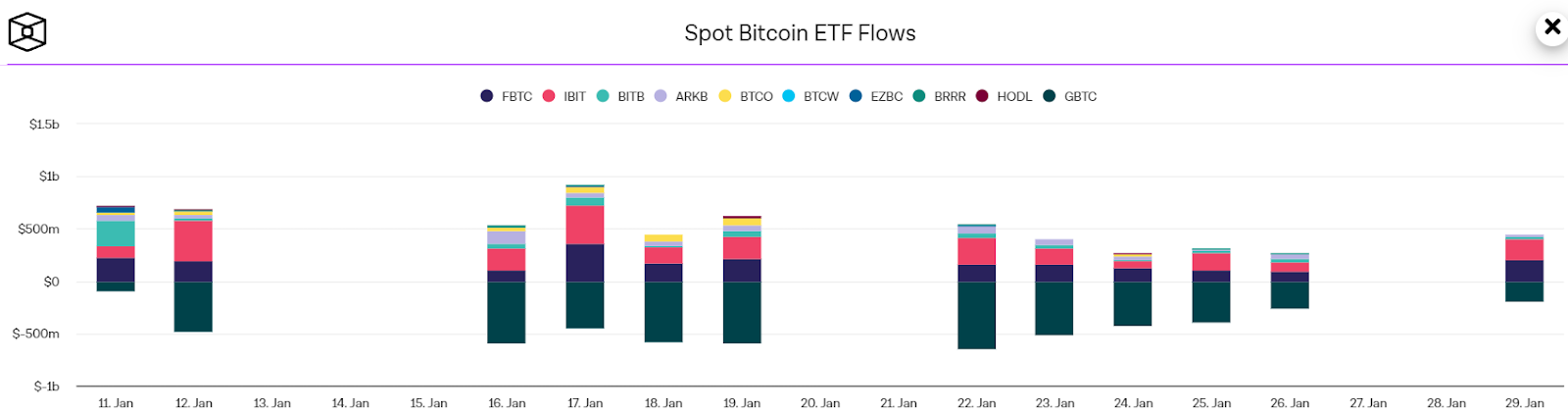

Bitcoin’s price surpassed $43,000 on Monday, a peak not seen in two weeks, amid speculation of a potential rate halt at the upcoming Federal Open Market Committee meeting. Additionally, there’s evidence that withdrawals from Grayscale Investments’ bitcoin ETF are decreasing. Bloomberg Intelligence ETF analyst James Seyffart noted that early trading volumes of IBIT surpassed those of GBTC, indicating a possible shift in trading dominance among new ETFs.

On Monday, the ten spot bitcoin ETFs saw their first net inflows in a week, contributing to bitcoin’s rise to its highest price since these funds started trading. Despite ongoing but reduced outflows from the Grayscale Bitcoin Trust (GBTC), the total ETF holdings increased by over 4,200 bitcoins, valued at about $183 million. In contrast, the previous week witnessed consistent daily outflows, with around 20,000 bitcoins withdrawn from January 23 to January 26.

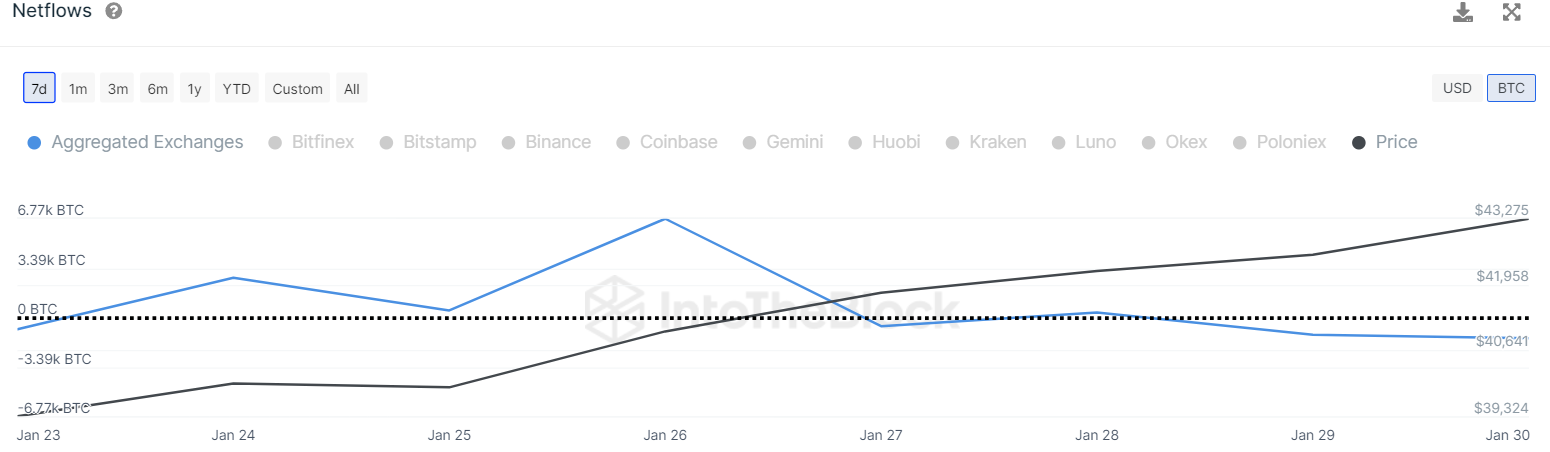

Bitcoin’s recent surge has positively influenced the crypto market, with Ethereum approaching the $2,400 mark. This uptrend has attracted investors to buy more during the dip. According to IntoTheBlock data, Bitcoin’s Netflow remains negative at -1.43K BTC, indicating that outflows are exceeding inflows. Similarly, Ethereum’s Netflow is at -1.65K ETH, suggesting that traders are actively accumulating it.

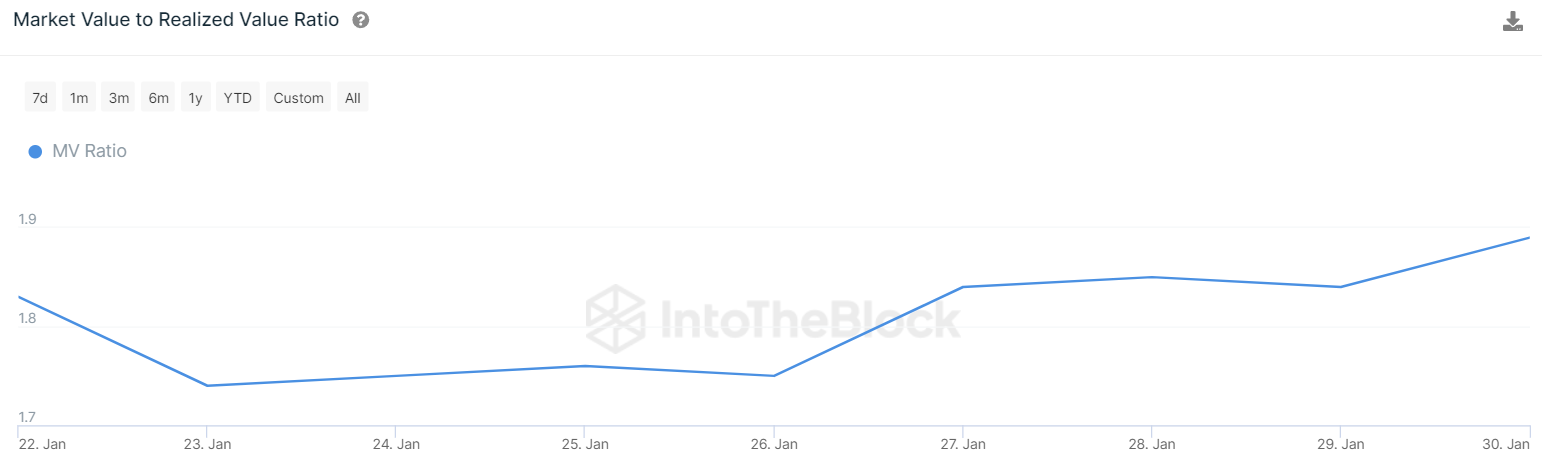

The rising MVRV ratio of Bitcoin, now at 1.9, hints at a potential correction for the asset. In contrast, Ethereum’s MVRV ratio stands at 1.4, indicating the likelihood of further price increases in the coming hours.

Bitcoin (BTC) Price Analysis

Attempts to push Bitcoin over the $44K level were resisted by bears. As a result, BTC price is now facing a correction and is aiming to drop below the moving averages. However, buyers are strongly defending a decline. As of writing, BTC price trades at $42,609, declining over 2.1% from yesterday’s rate.

Should bulls succeed in lifting the price above $44K, the BTC/USDT pair might reach $47,500, a level expected to face strong bearish selling. A reversal from $44K and a fall below the moving averages would suggest a continuation of range-bound trading for some more days.

If the price drops and stays below the 20-day EMA, the pair could slowly decline towards $40,000 and then to $38,000. A significant trend shift could occur if the price is pushed toward $35K.

Ethereum (ETH) Price Analysis

The long wick on Ether’s candlestick indicates that bears are selling around the $2,400 level. As a result, ETH price struggles in breaking above the resistance channel. Currently, ETH price trades at $2,300, declining over 0.9% from yesterday’s rate.

The 20-day EMA ($2,306) is beginning to decline, and with the RSI approaching the midline, it suggests a slight advantage for the bears. They may attempt to lower the price to $2,270, and then to a key support level at $2,180. A robust rebound from this point could trap the ETH/USDT pair within the $2,100 to $2,400 range for some time.

A break and close above the moving averages would signal strength. Following this, the pair could rise to $2,400, a critical resistance level to watch. Overcoming this level could lead the price to test $2,700.