After reaching this milestone, an essential safety protocol called the Staking Rate Limit was activated to ensure the safety and integrity of the protocol.

Understanding Lido Finance’s Staking Rate Limit Mechanism for Protocol Safety

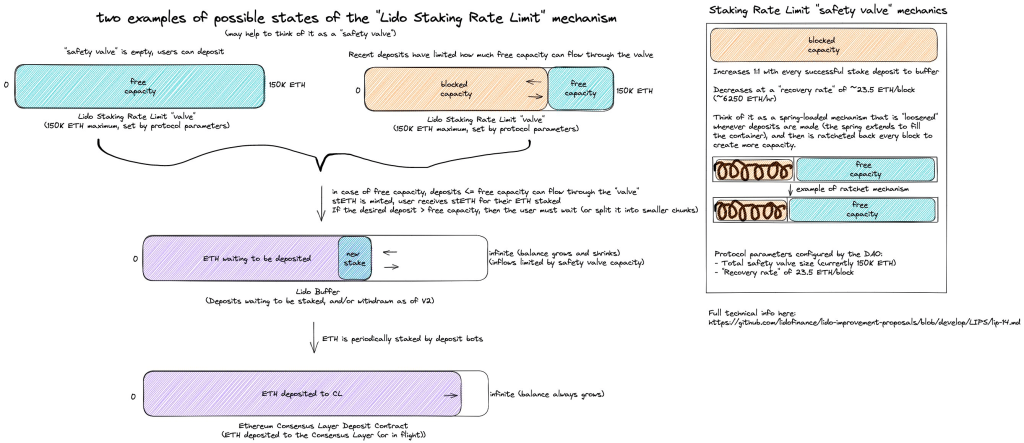

The Staking Rate Limit is a dynamic safety mechanism designed to respond to large inflows of stake and prevent potential side effects such as rewards dilution, without the need to halt stake deposits explicitly. This mechanism works by adjusting the total amount of stETH that can be minted at any given time based on recent deposits within a sliding 24-hour window. This limit is then replenished on a block-by-block basis. The recovery rate is approximately 6.2K ETH/hr, which is fast enough to ensure that most users are unlikely to be affected.

The Staking Rate Limit applies to all parties attempting to mint stETH, regardless of their approach, such as a frontend, direct contract call, or integration. If users encounter an error message stating that “stETH cannot be minted at this time,” they should either attempt to mint a smaller amount or wait for the capacity to replenish.

To learn more about this mechanism, kindly refer to https://docs.lido.fi/guides/steth-integration-guide/ or https://github.com/lidofinance/lido-improvement-proposals/blob/develop/LIPS/lip-14.md

Justin Sun’s Stake

As reported by the Twitter account Lookonchain, Dragonfly Capital’s data scientist, hildobby, stated that Tron founder Justin Sun had staked the 150,000 Ethereum.

Lido Finance has recently finalized the design of the second version of its protocol, which will enable support for Ethereum staking withdrawals post-Shanghai. The proposal is expected to be put up for a vote on Lido’s governance platform by the end of this month.