March 2024 has cemented itself as a monumental period in the annals of cryptocurrency history, with Santiment’s detailed market recap offering a data-rich overview of the month’s frenetic activity. The collective market saw numerous digital assets achieving all-time highs, with social sentiment and trading volumes showcasing an exuberant atmosphere among investors.

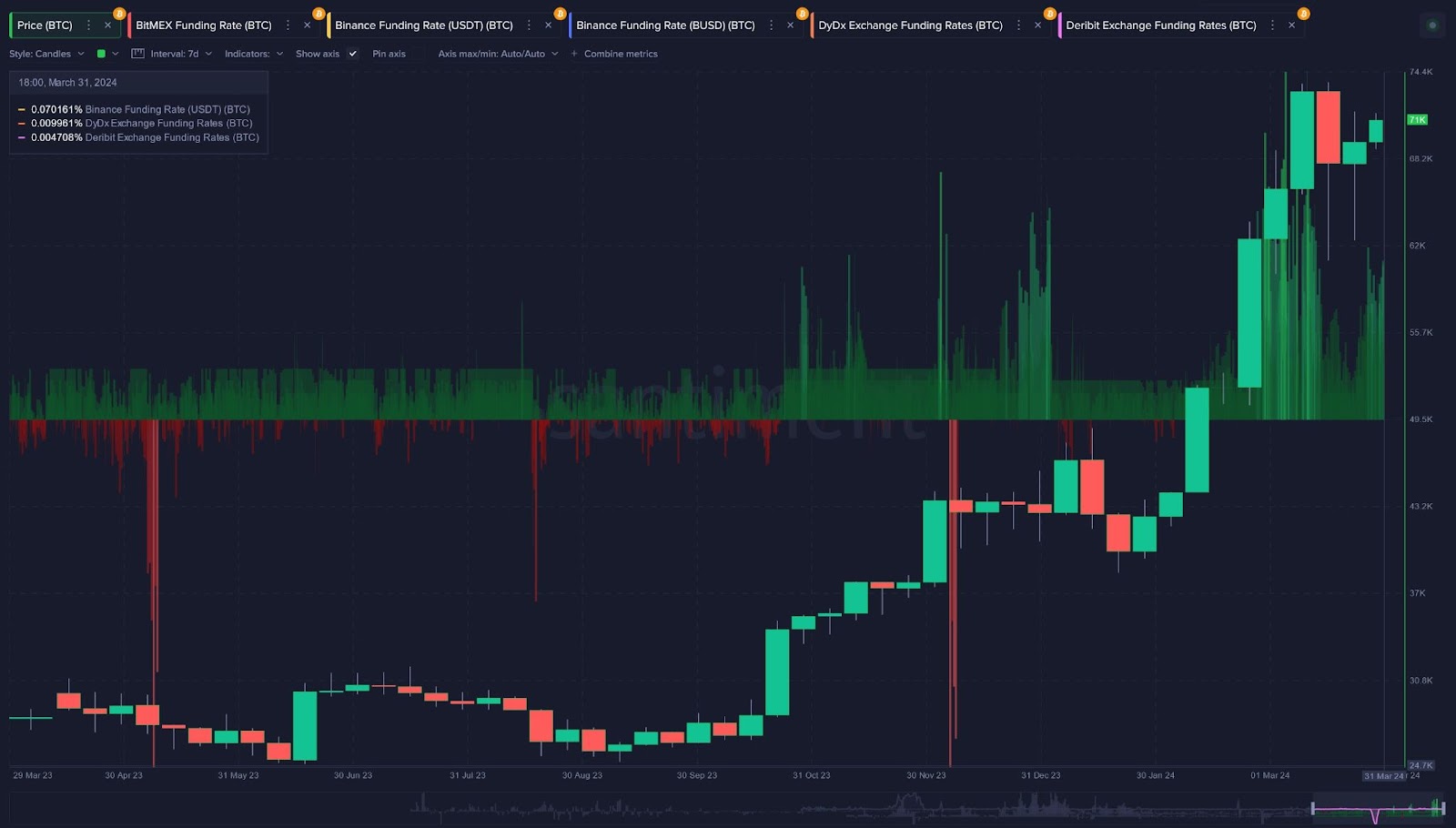

Bitcoin (BTC), the market leader, once again captured headlines as it scaled new heights, surpassing the $71,000 mark. The *BTC* halving anticipation played a significant role in bolstering investor optimism. This quadrennial event, expected to occur in 2024, typically sparks a bullish momentum by halving the reward for mining new blocks, thus reducing the rate at which new coins are introduced to the market.

Santiment’s analysis revealed notable whale accumulation patterns, with large cryptocurrency holders actively increasing their stakes. The report’s metrics showed that despite periodic dips, there was a sustained and considerable increase in the volume of Bitcoin held by these whales, signifying a strong confidence in the asset’s long-term value.

In the arena of alternative cryptocurrencies, memecoins and AI-themed tokens surged in popularity, largely propelled by viral social media discussions. Dogecoin (DOGE), a perennial favorite in memecoin conversations, was subject to significant volatility, with its sentiment scores oscillating between bullish and bearish extremes. Despite skepticism from some quarters, its social volume remained high, indicating a persistent community interest.

Market Sentiment and Social Trends

Santiment’s sentiment analysis tools shed light on the mood of the market, showing a prevailing positive sentiment toward Bitcoin, despite a few concerns about its financial and environmental implications. The sentiment balance for Bitcoin displayed a greater leaning towards the bullish side, underpinning the strong market performance.

Social platforms played a pivotal role in shaping market dynamics, with social volume and dominance metrics reaching their zenith in March. For instance, social volume for Bitcoin experienced a substantial uptick, correlating with its price movements. The social dominance indicator, which tracks the share of voice for each cryptocurrency, signaled Bitcoin’s commanding presence in social media discussions, a testament to its unshaken status in the public eye.

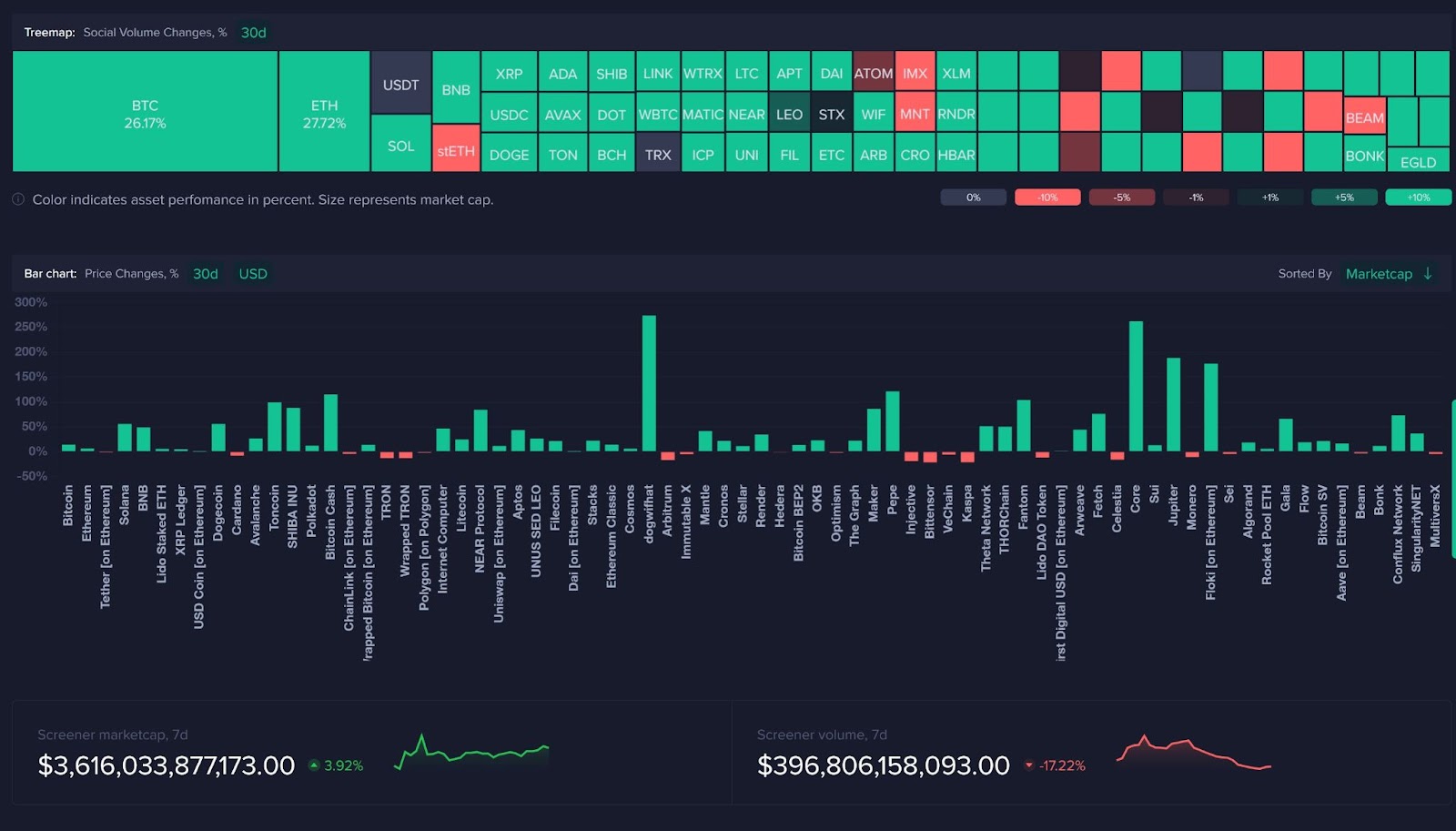

Furthermore, the treemap of social volume changes over the past 30 days highlighted Bitcoin’s commanding 26.17% increase, outshined only marginally by Ethereum (ETH) 27.72% surge. This visual representation underscored the market’s heightened responsiveness to social media stimuli, with social discourse often serving as a leading indicator of market trends.

The price performance metrics painted an equally telling picture, with a mix of green and red bars indicating a diverse range of outcomes for different cryptocurrencies. While some, like Bitcoin, showed significant gains, others faced downward pressure, reflecting the heterogeneous nature of the market.

To encapsulate, March was a testament to the crypto market’s vibrancy and its susceptibility to social sentiment, technological milestones, and large-scale investment behaviors. Santiment’s comprehensive market recap, enriched with data and trend analysis, provides a clear lens through which to view the intricate tapestry of the cryptocurrency landscape—a landscape that is as varied in its participants as it is in its potential for unprecedented growth.