Nova Scotia, a beautiful place by the ocean in Canada, is known for its lovely views, friendly people, and tasty seafood. But if you live there or have visited, you might notice something else: the gas prices keep changing. For many people in Nova Scotia, this is a big topic. They often wonder, “Why did the gas price go up today?” or “Will it be cheaper next week?” The cost of gas doesn’t just change on its own. Many things can make it go up or down. Some of these reasons come from events happening in faraway countries. Others are because of decisions made right in Nova Scotia. Plus, the sea, roads, and weather can also play a part. It might sound a bit confusing, but in this article, we’ll break it down and explain everything in simple words. We’ll discuss all the things that can change gas prices. We’ll also discuss how these changes can make life different for people in Nova Scotia. And we’ll take a peek into the future to guess what might happen with gas prices later on in our N.S. gas price prediction.

Nova Scotia: A Quick Introduction

Nova Scotia, located in Canada, is one of thirteen provinces and territories. It’s counted among the three Maritime and four Atlantic provinces. The name “Nova Scotia” translates to “New Scotland” from Latin.

The majority of its residents speak English, and as per the 2021 census, the province has a population of 969,383, making it the most populous among Canada’s Atlantic Provinces. Even though it’s the second-smallest in terms of area, right after Prince Edward Island, it’s the second-most densely populated. Spanning 55,284 square kilometers, Nova Scotia includes Cape Breton Island and thousands of other coastal islands. Connected to mainland North America by the Isthmus of Chignecto, it shares a land border with New Brunswick. It’s surrounded by the Bay of Fundy, the Gulf of Maine, and the Atlantic Ocean and is neighbored by Prince Edward Island and Newfoundland, separated by the Northumberland and Cabot straits.

Before European settlers arrived, the Miꞌkmaq people lived on this land. In 1605, the French established their first New France colony, Acadia, with Port-Royal as its capital. The British and French battled for this territory for over 100 years, with the British finally gaining control in 1713. The British then brought in settlers and moved the French-speaking Acadians out. During the American Revolutionary War, many Loyalists chose to settle in Nova Scotia. By 1848, Nova Scotia achieved responsible government and joined New Brunswick and the Province of Canada in 1867 to create modern-day Canada.

Halifax, Nova Scotia’s capital, houses over 45% of the province’s residents. It’s the twelfth-largest metropolitan area in Canada and the biggest in the Atlantic region. Only Vancouver surpasses Halifax as Canada’s largest coastal city.

Nova Scotia: Economy

Nova Scotia’s economy, which once heavily relied on natural resources, has broadened its horizons over the years. Historically, the abundance of natural resources, especially the rich fish stocks off the Scotian Shelf, played a pivotal role in establishing Nova Scotia’s prominence in North America. Fishing had been a cornerstone of the province’s economy since the 17th century when it was part of New France. But by the late 20th century, overfishing led to a dramatic decline in fish stocks, especially cod. This decline culminated in a loss of roughly 20,000 jobs in 1992 due to the sector’s collapse.

The province faced challenges in other areas as well. Coal mining in Cape Breton and the northern parts of Nova Scotia dwindled, and a major steel mill in Sydney shut down in the 1990s. The forestry industry also took a hit, exacerbated by the high Canadian dollar compared to the US dollar. This led to the closure of a longstanding pulp and paper mill near Liverpool. Nonetheless, mining remains notable, especially for gypsum, salt, silica, peat, and barite. The offshore oil and gas industry, which gained traction post-1991, significantly influenced the economy. Still, its production and profits have seen a decline in recent times. Despite these challenges, agriculture continues to thrive, especially in the Annapolis Valley.

Nova Scotia operates under a parliamentary system within a constitutional monarchy framework. The monarchy in Nova Scotia underpins the executive, legislative, and judicial branches. The current sovereign is King Charles III. He is also the head of state for 14 other Commonwealth countries, all of Canada’s provinces, and the broader Canadian federal domain, though he primarily resides in the UK. In his stead, the Lieutenant Governor of Nova Scotia, currently Arthur Joseph LeBlanc, performs most royal responsibilities in the province.

The province’s primary income sources are personal and corporate taxes. However, it also earns from tobacco and alcohol taxes, its share in the Atlantic Lottery Corporation, and royalties from oil and gas. In the 2006-07 fiscal year, the province approved a budget of $6.9 billion, anticipating a surplus of $72 million. Federal equalization payments contribute $1.385 billion, which is about 20.07% of the province’s income. The province also collaborates with the federal government on the HST, a combined sales tax using the GST tax structure.

On 21 July 2022, Nova Scotia took a significant step by becoming the second Canadian province to regulate online gambling. It launched its online casino via the ALC. This platform is expected to boost the local economy and offer residents a reliable and safe online gambling environment.

Petroleum Pricing In Nova Scotia

In Nova Scotia, the pricing of petroleum is guided by the Petroleum Products Pricing Act. This act determines the wholesale as well as the minimum and maximum prices for gasoline and diesel fuels sold in the province. In 2004, there was concern from both consumers and an organization representing some fuel retailers, known as the Retail Gasoline Dealers Association of Nova Scotia. They voiced their worries about the increasing fuel prices and the shutting down of gas stations in rural areas due to low sales and profit margins.

Responding to these concerns, the Nova Scotia legislature introduced Bill 79, titled The Nova Scotia Petroleum Products Pricing Act. However, it took a year for this to be officially declared as law. In May 2006, Rodney MacDonald, then Premier of Nova Scotia, announced that the prices of petroleum would be regulated starting from 1 July 2006. This decision came shortly after New Brunswick made a similar announcement.

The pricing for gasoline and diesel fuel in Nova Scotia takes its cue from the rates on the New York Mercantile Exchange, converted to Canadian currency. To this base price, a wholesale margin of 6 cents per liter is added. Additionally, there’s a transportation fee ranging from 0.5 to 2 cents per liter and a retail margin between 4 to 5.5 cents per liter. For full-serve gasoline, the retail margin can go up to 7.5 cents per liter.

Interrupter And Price Changes

Starting 13 July 2006, fuel prices in Nova Scotia are scheduled to be reviewed every second Thursday. To decide if a price change is needed, an “interrupter” formula is used. This formula, which began its calculations from 19 July 2006, checks every second Wednesday.

How does it work? It looks at the average NYMEX spot price for fuels over the last five days. If this 5-day average changes by more or less than 4 cents per liter compared to the previous NYMEX average used for the last price setting, then the pump price might be updated. This new 5-day average becomes the reference for future calculations.

If the interrupter doesn’t suggest a price change on its set date, the existing fuel price will remain unchanged until the next scheduled review the following Thursday.

In rare situations, like drastic weather changes or significant global events, a “catastrophic interrupter” might come into play. If global product prices change drastically, for example, by about 15 cents per liter, this special interrupter can be activated. When this happens, the price change might be implemented either on the day of the decision or the following day, aligning with when rack prices in Nova Scotia would typically be updated.

Controversy

Many believe that Nova Scotia’s way of setting petroleum product prices doesn’t benefit the public. Among these critics are the Liberal Party of Nova Scotia, the Nova Scotia Chambers of Commerce, and a significant number of residents, especially from the Halifax Regional Municipality. When this system was introduced, several groups, including the New Democratic Party and the Retail Gasoline Dealers Association of Nova Scotia, hoped for a model similar to that of Prince Edward Island, expecting lower prices.

Those against this idea pointed out that the PEI method might result in higher prices due to reduced competition. The lower fuel costs in PEI come from the absence of a 10% Provincial Sales Tax, whereas Nova Scotia applies a 15% Harmonized Sales Tax (HST). New Brunswick also charges HST but sets a maximum price for fuel across the province without setting a lower limit. To illustrate, on 1 July 2006, when Nova Scotia began its pricing method, the maximum price in New Brunswick was 112.4 cents per liter for regular self-serve. In contrast, Nova Scotia had a minimum price ranging from 113.3 to 115.2 cents per liter, depending on the area.

N.S. Gas Prices Become Cheap

Gas prices in Nova Scotia dropped by several cents on Friday due to the interrupter clause. This clause allows the Nova Scotia Utility and Review Board to change prices outside the regular Friday adjustments.

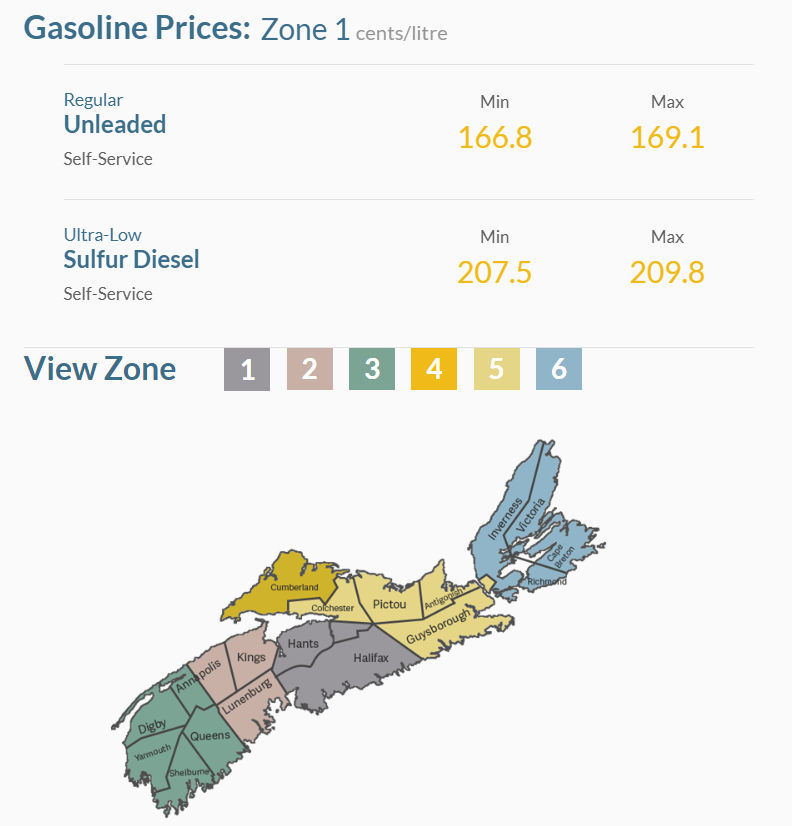

Now, in the Halifax and Hants area, the minimum price for regular self-serve gasoline is 166.8 cents per liter. At the same time, the maximum gas price is 169.1 cents. The ultra-low sulfur diesel’s maximum price is 209.8 cents, and the minimum price is 207.5 cents.

For those in eastern Annapolis Valley, as well as Kings and Lunenburg Counties, the minimum price for regular unleaded is 167.4 cents per liter, and the maximum is 169.7 cents per liter. The minimum price for sulfur diesel is 208 cents, and the maximum price is 210.3 cents per liter. In locations like Digby, Yarmouth, Shelburne, Queens, and the western part of Annapolis Valley, the minimum rate of regular unleaded is 167.8 cents per liter, and the maximum rate is 170.1. The maximum price for sulfur diesel is 210.8 cents per liter, and the minimum rate is 208.5 cents per liter.

For residents in Colchester, Pictou, Antigonish, and Guysborough, the minimum price for regular unleaded stands at 168 cents per liter, and the maximum rate is 170.3 cents per liter. The minimum price for sulfur diesel is 208.6 cents per liter, and the maximum price is 210.9 cents per liter. Meanwhile, Cape Breton has the highest rate, with regular unleaded gasoline priced at 168.8 cents per liter, and the maximum price goes up to 171.1 cents per liter. The minimum rate of sulfur diesel is 209.4 cents per liter, and the maximum rate is 211.7 cents per liter. The minimum price for regular unleaded is 168 cents per liter, and the maximum is 170.3 cents per liter in Cumberland. The minimum price for Sulfur diesel is 208.6 cents per liter, and the maximum rate is 210.9 cents per liter.

N.S. Gas Price Prediction By Blockchain Reporter

NS Gas Price Prediction 2023

In 2023, the average gas price in Nova Scotia is expected to stabilize around 165 cents per liter. Prices might dip to a minimum of 155 cents or escalate to a peak of 180 cents. Several factors, including global market dynamics, regional demand, and state regulations, are contributing to this projection. The province’s efforts to diversify its energy sources and the global push towards sustainable alternatives also play a role in shaping these numbers.

NS Gas Price Prediction 2024

Entering 2024, the gas prices in Nova Scotia are forecasted to see an upward trend. The average price could lie in the vicinity of 192 cents, with a potential low of 180 cents and a high reaching up to 208 cents. This surge is anticipated based on the increasing global demand, potential geopolitical influences, and regional infrastructure developments.

NS Gas Price Prediction 2025

By 2025, the upward trajectory is expected to continue, pushing the average price to around 220 cents. Prices might fluctuate between a minimum of 206 cents and a maximum of 238 cents. Factors such as inflation, global production rates, and provincial consumption patterns significantly influence these predictions.

NS Gas Price Prediction 2026

In 2026, Nova Scotia’s gas prices are predicted to hover around an average of 248 cents, with potential lows and highs at 233 cents and 267 cents, respectively. The province’s trading structure with global market shifts, will play a crucial role in bringing these numbers.

NS Gas Price Prediction 2027

Moving forward to 2027, the average gas price could settle around 277 cents. The year might witness prices dipping to a minimum of 263 cents or peaking at 299 cents. As Nova Scotia explores alternative energy avenues and global oil reserves face challenges, these factors will influence the price points.

NS Gas Price Prediction 2028

By 2028, the average gas price in Nova Scotia might escalate to 305 cents. Prices could vary, with a potential low of 291 cents and a ceiling of 329 cents. Global economic conditions, paired with provincial consumption rates and energy policies, will shape these figures.

NS Gas Price Prediction 2029

Approaching 2029, the province could see gas prices averaging around 335 cents. The price spectrum for this year is anticipated to range between a minimum of 319 cents and a high of 355 cents. Strategic energy partnerships and global market trends will be pivotal in determining these values.

NS Gas Price Prediction 2030

Rounding off the decade in 2030, Nova Scotia’s gas prices are projected to reach an average of 365 cents. The expected price fluctuations might span between 348 cents at the lowest and 386 cents at the peak.

Provincial Regulations

Nova Scotia has a unique gas price regulation system. The Utility and Review Board sets prices weekly based on a predetermined formula that considers global oil prices, exchange rates, and other factors. This system aims to provide stability and predictability for consumers, though it has its critics who argue it doesn’t always reflect the real-time fluctuations of the global market.

Consumer Impact And Behavior

Gas prices significantly impact daily life in Nova Scotia, influencing decisions ranging from daily commutes to long-term vehicle purchases. When prices rise:

- Public Transport: There’s often an uptick in public transport usage as residents look for more economical travel alternatives.

- Vehicle Purchases: Consumers might lean towards more fuel-efficient vehicles or even explore electric options.

- Local Tourism: High gas prices can sometimes deter locals from long road trips, impacting local tourism sectors in more remote parts of the province.

Conclusion

The trajectory of gas prices in Nova Scotia over the years reflects a combination of global market dynamics, regional consumption patterns, and provincial policies. As the world shifts towards sustainable energy solutions and as Nova Scotia adapts to these changes, the province’s residents will inevitably feel the impact at the pump.

While predicting exact numbers in the future is always a challenge, it’s clear that factors like global demand, geopolitical influences, and regional infrastructure developments will continue to determine the future of gas prices in Nova Scotia.